TIDMOMI

RNS Number : 1782O

Orosur Mining Inc

30 January 2023

Orosur Mining Inc.

Second Quarter Results for 2022/23

London, January 30th, 2023 . Orosur Mining Inc. ("Orosur" or

"the Company") (TSXV/AIM: OMI ), a South American-focused minerals

explorer and developer, is pleased to announce its results for the

second quarter ended November 30, 2022 ("Q2 23" or the "Quarter").

All dollar figures are stated in US$ unless otherwise noted. The

unaudited condensed interim financial statements of the Company for

the quarter ended November 30, 2022 and the related management's

discussion and analysis have been filed and are available for

review on the SEDAR website at www.sedar.com. They are also

available on the Company's website at www.orosur.ca.

Highlights of the Second Quarter Results for 2022/23

Colombia

-- On 6th September 2022, the Company announced assay results

from the Pepas prospect to the north of Anza, including assay

results from PEP001 which returned a substantial, high-grade

intersection of 150.9m @ 3.00g/t Au (from surface). Also announced

on that day, that Monte Aguila had informed the Company that it had

met its expenditure of US$4m for the year.

-- On 9(th) September 2022, the Company announced that its JV

partner, Monte Águila provided the Company with a Phase 1 Earn-In

Notice, having completed all of the Phase 1 obligations, including

investing US$10 million in the Anza Project. The Company and Monte

Aguila will begin the process of forming a new mining company

("Mining Company") that will hold title to the Anza Project's

concessions and applications. The Company was also notified by

Monte Aguila that in accordance with the Exploration Agreement, it

will enter Phase 2 following negotiation and execution of a joint

venture agreement to govern the operations of the Mining Company.

Once the Mining Company is formed, which is expected to take

several months, Orosur will initially have 49% ownership and Monte

Aguila, 51% ownership in the Mining Company, which will be managed

by Monte Aguila.

-- On 21(st) October 2022, the Company announced assay results

from four additional diamond drill holes at Pepas and Pupino. Both

the Pepas and Pupino prospects are located in the northern region

of the Anzá Prospect, roughly 12km and 8km respectively north

northeast from the central APTA prospect that had seen most

drilling at Anzá up until early 2022. At PEPAS, holes PEP005 and

PEP007 were drilled from the same pad as PEP001 but in different

directions. Both holes returned substantial gold intersections,

with the best at PEP007 being 80.55m @ 3.05g/t Au from surface

(including 41.75m @ 5.24g/t).Two additional holes are currently

underway from new pads in an attempt to better define the geometry

of the mineralised body at Pepas.

-- On 2(nd) December 2022, after the period end, the Company

announced assay results from another 4 holes at Pepas, holes

PEP002,006,008 and 009. Holes PEP002 and 006 did not yield

significant results. Two new drill pads were constructed to drill

holes PEP008 and PEP009. Both holes intersected mineralised

structures, largely as expected, but with lower levels of gold

mineralisation than intersected in previous drilling. Near term

focus will now shift away from drilling to focus on field mapping,

sampling and trenching activities will continue across the Project

to define further drilling targets, including additional surface

works specifically in the Pepas prospect area.

-- On 17 January 2023, the Company announced that negotiations

to complete the Mining Company Constituent Documents with Minera

Monte Aguila are progressing and that the US$2 million Phase 2

Payment will be paid soon. The formation of the new Mining Company,

which will take several months, is underway. Once formed, the

Mining Company will be owned 49% by Orosur and 51% by Minera Monte

Aguila who will also be the manager. MMA may earn an additional 14%

ownership in the Mining Company if it has spent US$20 million in

qualifying exploration expenditures on the Project on or prior to

the fourth anniversary of the parties entering into the Mining

Company Constituent Documents. If the Phase 2 earn-in is completed,

MMA would own 65% of the Mining Company and the Company would own

the remaining 35%.

Uruguay

-- In Uruguay, the Company's wholly owned subsidiary, Loryser,

continues to focus its activities on the implementation of the

Creditors Agreement and the sale of its Uruguayan assets. Loryser

has successfully finalised the reclamation and remediation works on

the tailings dam and has now started a one-year post-closure

control phase.

-- During the course of the year, Loryser agreed and paid for

the settlements with all of its former employees, with the proceeds

received from the sale of certain of its assets.

-- Good progress is being made on the sale of Loryser's other

assets including plant and equipment. The proceeds from all of

these sales will be used to pay liabilities in Uruguay in

connection with the aforementioned Creditors Agreement.

Financial and Corporate

-- The unaudited consolidated financial statements have been

prepared on a going concern basis under the historical cost method

except for certain financial assets and liabilities which are

accounted for as Assets and Liabilities held for sale (at the lower

of book value or fair value) and Profit and Loss from discontinuing

operations. This accounting treatment has been applied to the

activities in Uruguay and Chile.

-- On 30(th) November 2022, the Company had a cash balance of

US$2,906k (31(st) May 2022, US$4,221k). As at the date of this

announcement the Company had a cash balance of US$3,549k.

-- Post the period end, on 7(th) December 2022, all of the

outstanding 10,897,058 warrants expired and so the fully diluted

share capital of the Company as at the date of this announcement is

199,885,299.

For further information, visit www.orosur.ca , follow on twitter

@orosurm or contact :

Orosur Mining Inc

Louis Castro, Chairman,

Brad George, CEO

info@orosur.ca

Tel: +1 (778) 373-0100

SP Angel Corporate Finance LLP - Nomad & Joint Broker

Jeff Keating / Kasia Brzozowska

Tel: +44 (0) 20 3 470 0470

Turner Pope Investments (TPI) Ltd - Joint Broker

Andy Thacker

James Pope

Tel: +44 (0)20 3657 0050

Flagstaff Strategic and Investor Communications

Tim Thompson

Mark Edwards

Fergus Mellon

Tel: +44 (0) 207 129 1474

orosur@flagstaffcomms.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

About Orosur Mining Inc.

Orosur Mining Inc. (TSX-V: OMI; AIM: OMI) is a minerals explorer

and developer focused on identifying and advancing projects in

South America. The Company currently operates in Colombia, Brazil

and has discontinued operations in Uruguay.

Forward Looking Statements

All statements, other than statements of historical fact,

contained in this news release constitute "forward looking

statements" within the meaning of applicable securities laws,

including but not limited to the "safe harbour" provisions of the

United States Private Securities Litigation Reform Act of 1995 and

are based on expectations estimates and projections as of the date

of this news release. Forward-looking statements include, without

limitation, the exploration plans in Colombia and Brazil and the

funding from Newmont/Agnico of those plans, Newmont/Agnico's

decision to continue with the Exploration and Option agreement, the

ability for Loryser to continue and finalize with the remediation

in Uruguay, the ability to implement the Creditors' Agreement

successfully as well as continuation of the business of the Company

as a going concern and other events or conditions that may occur in

the future. The Company's continuance as a going concern is

dependent upon its ability to obtain adequate financing, to reach

profitable levels of operations and to reach a satisfactory

implementation of the Creditor's Agreement in Uruguay. These

material uncertainties may cast significant doubt upon the

Company's ability to realize its assets and discharge its

liabilities in the normal course of business and accordingly the

appropriateness of the use of accounting principles applicable to a

going concern. There can be no assurance that such statements will

prove to be accurate. Actual results and future events could differ

materially from those anticipated in such forward-looking

statements. Such statements are subject to significant risks and

uncertainties including, but not limited, those as described in

Section "Risks Factors" of the Company's MDA. The Company disclaims

any intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events

and such forward-looking statements, except to the extent required

by applicable law.

Qualified Persons Statement

The information in this news release was compiled, reviewed and

verified by Mr. Brad George, BSc Hons (Geology and Geophysics),

MBA, Member of the Australian Institute of Geoscientists (MAIG),

CEO of Orosur Mining Ltd and a qualified person as defined by

National Instrument 43-101. Orosur Mining staff follow standard

operating and quality assurance procedures to ensure that sampling

techniques and sample results meet international reporting

standards.

Drill core is split in half over widths that vary between 0.3m

and 2m, depending upon the geological domain. One half is kept on

site in the Minera Anzá core storage facility, with the other sent

for assay. Industry standard QAQC protocols are put in place with

approximately 20% of total submitted samples being blanks, repeats

or Certified Reference Materials (CRMs).

Samples are sent to the Medellin preparation facility of ALS

Colombia Ltd, and then to the ISO 9001 certified ALS Chemex

laboratory in Lima, Peru. 30 gram nominal weight samples are then

subject to fire assay and AAS analysis for gold with gravimetric

re-finish for overlimit assays of >10g/t. ICP-MS Ultra-Trace

level multi-element four-acid digest analyses is also undertaken

for such elements as silver, copper, lead and zinc, etc.Gold

intersections are reported using a lower cut-off of 0.3g/t Au over

3m.

Orosur Mining Inc.

Condensed Interim Consolidated Statements

of Financial Position (Expressed in thousands

of United States dollars)

Unaudited As at As at

November 30, May 31,

2022 2022

------------------------------------------------ ------------------------------------ -------------------

ASSETS

Current assets

Cash and cash equivalents $ 2,906 $ 4,221

Restricted cash 83 353

Accounts receivable and other assets 155 186

Assets held for sale in Uruguay 2,390 1,160

------------------------------------------------ ------------------------------------ -------------------

Total current assets 5,534 5,920

Non-current assets

Property, plant and equipment 92 113

Exploration and evaluation assets Colombia 4,602 5,441

------------------------------------------------ ------------------------------------ -------------------

Total assets $ 10,228 $ 11,474

------------------------------------------------ ------------------------------------ -------------------

LIABILITIES AND (DEFICIT)

Current liabilities

Accounts payable and accrued liabilities $ 258 $ 389

Liabilities of Chile discontinued operation 2,102 2,058

Warrant liability - 168

Liabilities held for sale in Uruguay 12,998 13,134

------------------------------------------------ ------------------------------------ -------------------

Total current liabilities 15,358 15,749

------------------------------------------------ ------------------------------------ -------------------

Deficit

Share capital 69,341 69,339

Contributed surplus 10,539 10,540

Currency translation reserve (3,060) (2,125)

Deficit (81,950) (82,029)

------------------------------------------------ ------------------------------------ -------------------

Total deficit (5,130) (4,275)

------------------------------------------------ ------------------------------------ -------------------

Total liabilities and deficit $ 10,165 $ 11,474

------------------------------------------------ ------------------------------------ -------------------

Orosur Mining Inc.

Condensed Interim Consolidated Statements of Loss and

Comprehensive Income and Loss (Expressed in thousands of United

States dollars)

Unaudited

Three Months Three Months Six Months Six Months

Ended Ended Ended Ended

November 30, November November November

30, 30, 30,

2022 2021 2022 2021

------------------------------------------------------------------------------------------ ----------------------- ----------------------- ------------------------

Operating expenses

Corporate and administrative expenses $

(436) $ (565) $ (843) $ (885)

Exploration expenses (185) (10) (247) (10)

Share-based compensation - (147) - (315)

Other income 2 1 8 2

Net finance cost (3) (2) (5) (3)

Gain on fair value of warrants 92 501 168 873

Foreign exchange (loss) gain net (13) (33) (52) (102)

------------------------------------------------------------------------------------------ ----------------------- ----------------------- ------------------------

Net (loss) for the period for continued

operations $ (543) Other comprehensive (loss) $ (255) $ (971) $ (440)

income:

Cumulative translation adjustment $ (430) $ 7 $ (935) $ (194)

------------------------------------------------------------------------------------------ ----------------------- ----------------------- ------------------------

Total comprehensive (loss) for

the period from continued

operations (973) (248) (1,906) (634)

Income (loss) from discontinued

operations 979 1,601 1,050 58

-------------------------------- -------------------------------------------------------- ----------------------- ----------------------- ------------------------

Total comprehensive income

(loss)

for the period 6 1,353 (856) (576)

Basic and diluted net (loss)

income

per share for continued

operations $ (0.00) $ (0.00) $ (0.01) $ (0.00)

Basic and diluted net (loss)

income

per share for discontinued

operations $ 0.01 $ 0.01 $ 0.01 $ 0.00

-------------------------------- ---------------------- -------------------------------- ------- -------------- ------- -------------- -------- --------------

Weighted average number of

common

shares outstanding 188,552 188,420 188,536 188,420

-------------------------------- ---------------------- -------------------------------- ------- -------------- ------- -------------- -------- --------------

Orosur Mining Inc.

Consolidated Statements of Cash Flows (Expressed

in thousands of United States dollars)

Three Months Three Months

Ended Ended

November 30, November 31,

2022 2021

Operating activities

Net loss for the year for continued and discontinued

operations $ 79 $ (382)

Adjustments for:

Share-based payments - 315

Labour provision adjustments - (1,499)

Obsolescence provision (3,107) (300)

Fair value of warrants (168) (873)

Gain on sale of property, plant and equipment (1,396) (111)

Foreign exchange and other (163) (201)

Changes in non-cash working capital items:

Accounts receivable and other assets (101) (86)

Inventories 3,419 716

Accounts payable and accrued liabilities (37) 981

----------------------------------------------------- ------------------------- -------------------

Net cash used in operating activities (1,474) (1,234)

Investing activities

Increase (decrease) in the restricted cash 270 (719)

Proceeds received for sale of property, plant

and equipment 545 111

Environmental rehabilitation provision - (477)

Proceeds received from exploration and option

agreement 85 1,077

Exploration and evaluation expenditures (138) (1,619)

----------------------------------------------------- ------------------------- -------------------

Net cash provided by investing activities 761 (2,048)

Financing activities

Proceeds from the sale of treasury shares - 1,140

2 -

Net cash provided by financing activities 2 1,140

----------------------------------------------------- ------------------------- -------------------

Net Change in cash and cash equivalents (711) (2,176)

Net change in cash classified within assets

held for sale (604) 547

Cash and cash equivalents, beginning of year 4,221 6,958

----------------------------------------------------- ------------------------- -------------------

Cash and cash equivalents, end of year $ 2,906 $ 5,329

----------------------------------------------------- ------------------------- -------------------

Operating activities

- continued operations (1,533) (1,087)

- discontinued operations 59 (181)

Investing activities

- continued operations 216 (1,682)

- discontinued operations 545 (366)

Financing activities

- continued operations 2 1,140

----------------------------------------------------- ------------------------- -------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEUEFUEDSEEF

(END) Dow Jones Newswires

January 30, 2023 02:00 ET (07:00 GMT)

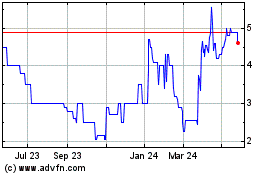

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

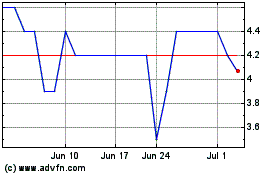

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024