TIDMOMI

RNS Number : 9817E

Orosur Mining Inc

05 July 2023

Orosur Mining Inc - Operational Update, Brazil

-- Sampling and mapping program commenced at Ariquemes.

-- Alluvial program to test effectiveness of regional work.

-- Mapping north of Bom Futuro identifies mineralised granites - samples submitted for assay.

London, July 5(th) 2023 . Orosur Mining Inc. ("Orosur" or the

"Company") (TSXV/AIM:OMI) , is pleased to provide an update on the

progress of exploration activities at its Ariquemes Tin Project

("Ariquemes Project" or the "Project") in Brazil.

The Ariquemes Project is a large-scale tin (and associated

metals) exploration project in Rondonia State, Brazil, entirely

within the world class Ariquemes Tin Field. The Project comprises a

large number of granted licences and applications that in total

cover more than 3,000km(2) , representing the largest land holding

in this key mining district.

Ariquemes Project is a joint venture with Canadian listed

Meridian Mining UK (TSXV: MNO) ("JV"), whereby Orosur has the right

to earn a 75% stake in the Project by investing US$4m in

exploration over a four-year period in two stages.

As announced on May 4(th) , 2023, a regional stream sediment

program was recently completed across the entire licence area. The

rationale for this program was to cover the area as quickly and as

efficiently as possible and identify key higher priority zones for

follow-up. This objective was successful with large areas of tin

and niobium anomalism being mapped. As a result, the Company has

now decided to move to the next phase.

As part of the next phase, two prospects were targeted for small

work programs designed to address several key geological questions.

The work programs include:

1. carrying out more detailed work in one key licence area to

assess the effectiveness of the regional sampling program;

2. if successful, identifying as quickly as possible, a body of

mineralisation that demonstrates the economic potential of the

region and underpins further work; and

3. exploring the northeast of the large Bom Futuro mine for possible extensions or repetitions.

Oriente Novo

The Oriente Novo licence is to the far east of the main lease

package.

This licence was chosen as the most attractive site for the next

phase of work for several reasons:

-- the area returned several stream sediment samples, highly anomalous in both tin and niobium;

-- being recently granted (unlike many other licences which

remain unpublished or awaiting renewal), ground disturbing

activities such as drilling are permitted;

-- there was substantial historical mining both north and south

of the lease (stopping at the boundary), both from primary hard

rock and secondary alluvial sources;

-- these two historical mining areas are connected by a long

drainage system, over 6km of which is within the licence area, that

contained the anomalous stream sediment samples; and

-- the licence contains over 15km of additional drainages that

have shown anomalous results and may be the target of additional

work in the future.

A small, handheld, mechanised auger drill will be used to take

samples down to 5m (with a sample collected at every metre) to test

the presence of surface mineralisation along the length of this

drainage system (Figure 2). In addition, at regular intervals, the

auger will be pushed down to its capacity of 20m to test the depth

potential of the drainage system.

This program is expected to take approximately six weeks, but as

samples will be assayed using a local XRF unit rather than being

sent to a laboratory, results should be forthcoming as the survey

progresses, allowing the program to be modified as it

progresses.

Figure 2. Orient Novo - survey plan

Should the results of this work be positive in defining a

substantial area of tin and niobium mineralisation near surface,

the Company may then consider expanding the program both in terms

of area, depth and infill exploration and drilling, potentially

with a view to considering early-stage, pilot-scale production as

allowed by the Brazilian mining code.

Paraiso - north of Bom Futuro

The Bom Futuro tin mine is the largest mine in the region and,

at its peak, was one of the largest in the world.

It was discovered accidently by local woodcutters in 1987 and

then subsequently developed and mined continuously by a local

cooperative which exploited both the primary hard rock

mineralisation and surrounding associated alluvial sources.

The operating cooperative has generally focussed on exploitation

of visible mineralisation and has done little work to develop a

full understanding of the genesis of the deposit or to explore

beyond the immediate mining area.

Freely available government aeromagnetic data (Figure 3) shows

that the Bom Futuro mine is situated at the southern end of a

roughly 25km long cigar-shaped structural feature, interpreted to

be a fault bounded block of basement and granite. These SW to NE

trending bounding structures were possibly the primary conduits for

altering fluids that created the pegmatite and greisen tin

mineralisation.

The northern half of this structural feature sits within the JV

area but has never been explored.

Figure 4 - preliminary samples from Pariaso

Company geological teams recently visited the area for the first

time - a delay driven largely by the fact the licence has yet to be

published as a granted lease, limiting what work can be done.

Most of the area is now totally cleared for cattle farming with

no outcrop, other than several small granite hills with residual

forest. Geological teams entered these areas and located extensive

areas of altered granites and pegmatites, rich in tourmaline,

somewhat similar in character to what is seen at Bom Futuro.

Tourmaline (a boron silicate mineral) is a positive indicator as

boron can be enriched in fractionated felsic melts and shows close

association with tin and lithium mineralisation.

Panning of a stream adjacent to one of these granites also

returned high grade cassiterite, suggesting proximity to a primary

source.

Samples have been submitted to a local geochemical laboratory

for assay, with results expected in several weeks.

Orosur CEO Brad George commented:

"Work at Ariquemes Project has progressed as per the planned

timetable, to allow us to gradually develop our understanding of

the region and the local controls on mineralisation. This work is

now bearing fruit, and this current phase, if successful could mark

a major milestone in identifying areas of economic mineralisation.

At a time of encouraging tin and niobium prices, this may provide

the Company with valuable optionality."

F or further information, visit www.orosur.ca , follow on

twitter @orosurm or contact :

Orosur Mining Inc.

Louis Castro, Chairman,

Brad George, CEO

info@orosur.ca

Tel: +1 (778) 373-0100

SP Angel Corporate Finance LLP - Nomad & Joint Broker

Jeff Keating / Kasia Brzozowska

Tel: +44 (0) 20 3 470 0470

Turner Pope Investments (TPI) Ltd - Joint Broker

Andy Thacker/James Pope

Tel: +44 (0)20 3657 0050

Flagstaff Communications and Investor Communications

Tim Thompson

Mark Edwards

Fergus Mellon

orosur@flagstaffcomms.com

Tel: +44 (0)207 129 1474

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

About Orosur Mining Inc.

Orosur Mining Inc. (TSX: OMI; AIM: OMI) is a minerals explorer

and developer focused on identifying and advancing projects in

South America. The Company operates in Colombia, Argentina and

Brazil. The Company has discontinued operations in Uruguay.

Qualified Persons Statement

The information in this news release was compiled, reviewed and

verified by Mr. Brad George, BSc Hons (Geology and Geophysics),

MBA, Member of the Australian Institute of Geoscientists (MAIG),

CEO of Orosur Mining Inc. and a qualified person as defined by

National Instrument 43-101.

Orosur Mining staff follow standard operating and quality

assurance procedures to ensure that sampling techniques and sample

results meet international reporting standards.

Anzá

Drill core is split in half over widths that vary between 0.3m

and 2m, depending upon the geological domain. One half is kept on

site in the Minera Anzá core storage facility, with the other sent

for assay.

Industry standard QAQC protocols are put in place with

approximately 20% of total submitted samples being blanks, repeats

or Certified Reference Materials (CRMs).

Samples are sent to the Medellin preparation facility of ALS

Colombia Ltd, and then to the ISO 9001 certified ALS Chemex

laboratory in Lima, Peru.

30-gram nominal weight samples are then subject to fire assay

and AAS analysis for gold with gravimetric re-finish for overlimit

assays of >10g/t. ICP-MS Ultra-Trace level multi-element

four-acid digest analyses is also undertaken for such elements as

silver, copper, lead and zinc, etc.

Gold intersections are reported using a lower cut-off of 0.3g/t

Au over 3m.

El Pantano

Initial soil sample lines at El Pantano varied from 500m to 1km

spacing with infill lines located at 120m spacing in areas of

anomalism. Samples were taken at 20m intervals along these

lines.

Samples were taken at depths of 30 cm to 60 cm below the

surface, corresponding to the local equivalent of the B Horizon.

This layer of silt-clay is thought to contain the highest

accumulation of metals commonly used in mineral prospecting.

Shallow material such as ashes and rock fragments were removed

from the area before collecting samples. Manual tools were used to

reach the silt-clay level, with sample weights varying from 1.5 to

2.0 kg. Samples were then sent to an ALS Chemex preparation

facility in Santa Cruz province for preparation and thence to the

ISO 9001 certified ALS Chemex laboratory in Lima Peru for assay by

In ductively Coupled Plasma - Atomic Emission Spectroscopy

(ICP-AES) and Inductively Coupled Plasma - Mass Spectrometry

(ICP-MS)

Ariquemes

Stream sediment samples were taken at specific locations where

drainages intersected local roads, on roughly a 10km x 5km spacing.

Samples of approximately 20 litres were gathered at a depth of

around 70cm to 1 m. To avoid anthropogenic contamination, the

sampling points were located at a distance from the roads. The

collection process was carried out using a post-hole digger, and

samples were then packaged in plastic bags, sealed, and labelled

accordingly. Collected samples underwent a concentration process by

panning to produce a concentrate of heavy minerals.

Samples were then sent to the SGS laboratory in Belo Horizonte,

Minas Gerias State for assay by Inductively Coupled Plasma -

Optical Emission Spectroscopy (ICP OES) and Inductively Coupled

Plasma - Mass Spectrometry (ICP-MS).

Forward Looking Statements

All statements, other than statements of historical fact,

contained in this news release constitute "forward looking

statements" within the meaning of applicable securities laws,

including but not limited to the "safe harbour" provisions of the

United States Private Securities Litigation Reform Act of 1995 and

are based on expectations estimates and projections as of the date

of this news release.

Forward-looking statements include, without limitation, the

exploration plans in Colombia and the funding from Monte Águila of

those plans, Monte Águila's decision to continue with the

Exploration Agreement, the formation of a new mining company or

mining venture to hold the project, the ability for Loryser to

implement the Creditor's Agreement successfully in Uruguay and

other events or conditions that may occur in the future. The

Company's continuance as a going concern is dependent upon its

ability to obtain adequate financing, to reach profitable levels of

operations and to reach a satisfactory implementation of the

Creditor's Agreement in Uruguay. These material uncertainties may

cast significant doubt upon the Company's ability to realize its

assets and discharge its liabilities in the normal course of

business and accordingly the appropriateness of the use of

accounting principles applicable to a going concern. There can be

no assurance that such statements will prove to be accurate. Actual

results and future events could differ materially from those

anticipated in such forward-looking statements. Such statements are

subject to significant risks and uncertainties including, but not

limited, those as described in Section "Risks Factors" of the MDA

and the Annual Information Form. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements whether as a result of new information, future events

and such forward-looking statements, except to the extent required

by applicable law.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSSAEFLEDSELW

(END) Dow Jones Newswires

July 05, 2023 02:00 ET (06:00 GMT)

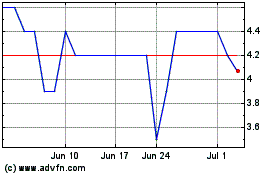

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Orosur Mining (AQSE:OMI.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024