TIDMORM

RNS Number : 9025A

Ormonde Mining PLC

28 September 2022

28 September 2022

Ormonde Mi n i ng p lc

("Or m onde" or "the C o m pany ")

Interim Results for the Six Months Ended 30 June 2022

Ormonde announces its unaudited interim results for the six

months ended 30 June 2022.

Key points:

-- Ongoing review of acquisition and investment opportunities across a number of jurisdictions

-- Conditional sale of La Zarza assets (the "Sale") provides

opportunity to further strengthen the Company's balance sheet in

order to create shareholder value through acquisitions

-- Following shareholder approval of the Sale, Company to become

a cash shell - required to undertake a reverse takeover within six

months

Operational Review:

New Projects

During the first six months of the year, the Board of Directors

(the "Board") and its advisory team evaluated a range of projects

located in a number of countries covering, inter alia, precious

metal, precious stones, base metals and battery metals

opportunities. While there are numerous early-stage exploration

opportunities available in the mining sector currently, such

investments carry a range of risk profiles, particularly those that

may require significant upfront investment with little visibility

over near or medium-term upside. With shareholder value in mind,

the Board is looking to identify opportunities in which Ormonde's

investment will have the ability to advance the project in a timely

manner and enhance its profitability potential without taking on

excessive risk.

La Zarza

On 29 July 2022, the Company announced that it had entered into

a conditional agreement for the sale of its interests in the La

Zarza Copper-Gold Project in Spain ("La Zarza") for a cash

consideration of EUR2.3 million, payable as EUR800,000 on closing

and three further payments of EUR500,000 each on the first, second

and third anniversary of closing. The Sale is conditional on

approval by Ormonde shareholders at an Extraordinary General

Meeting ("EGM") to be held later today. The Company has received

irrevocable undertakings from the Company's largest shareholder,

Thomas Anderson, holding 24.41% of the Company's shares, to vote in

favour of the resolutions in relation to the Sale.

Salamanca and Zamora Gold Projects

The three investigation permits that make up these gold

exploration projects came up for renewal during July and September

2021. Applications to extend each permit for a further three years

have been submitted to the mining authorities where they are

currently being processed. The renewal of the permits will require

further exploration commitments. This process can take a

considerable length of time and carries no guarantee that the

permits will be renewed. Ormonde's interest in the Salamanca and

Zamora Projects on 30 June 2022 was 50.9% and 46.6%

respectively.

Financial Review:

Interim Results

The Company reports a significantly reduced loss after tax for

the six months ended 30 June 2022 of EUR363,000 (2021: EUR630,000

Loss). The reduction of EUR267,000 in the reported loss was

primarily driven by the significant reductions in director and

senior management salaries and the elective non-payment of director

fees during the period.

As at 30 June 2022, the Company held EUR3.4 million of cash

(EUR3.7 million at 31 Dec 2021), with a further EUR800,000 due on

closing of the Sale and three further payments of EUR500,000 each

on the first, second and third anniversary of closing.

EGM Recommendation and AIM Rule 15

Following shareholder approval of the disposal of the La Zarza

assets, the Company would become a cash shell pursuant to AIM Rule

15 and the Euronext Growth Market rules, and as such will, within a

period of six months and twelve months respectively from the date

of the disposal, be required to make an acquisition or acquisitions

which constitute a reverse takeover under AIM Rule 14 and the

Euronext Growth Market rules. If no such acquisition or

acquisitions are made, the Company's shares would be suspended from

trading pursuant to AIM Rule 40 and the Euronext Growth Market

rules.

The Board unanimously recommended that shareholders voted in

favour of the resolutions relating to the Sale.

Brendan McMorrow, Chief Executive Officer, commented:

"The sale of our assets at La Zarza will be an important

milestone for the Company and, following the approval by Ormonde's

shareholders, would place the Company on an even stronger financial

footing from which to execute on new opportunities. To release

value from the assets at a premium to book value is a very

satisfactory outcome for the Company and its shareholders.

Although we have not yet identified the optimal project for our

next phase, I am encouraged by the quality and volume of the

opportunities that we have reviewed and the strength of the newly

constructed Board and its advisory team. Our balance sheet strength

allows us the benefit of selectivity, ensuring that when we do move

forward with a transaction, we expect it to be a highly attractive

one."

For further information, please contact :

Ormonde Mining plc

Brian Timmons, Non-Executive Chairman

Tel: +353 (0)1 801 4184

Vigo Consulting (Investor Relations)

Ben Simons / Charlie Neish

Tel: 44 (0)20 7390 0230

Davy (Nomad, Euronext Growth Listing Sponsor and Joint

Broker)

Barry Murphy

Tel: +353 (0)1 679 6363

Company website: www.ormondemining.com

Ormonde Mining plc

Consolidated Statement of Comprehensive Income

Six months ended 30 June 2022

unaudited unaudited audited

6 Months ended 6 Months ended Year ended

30-Jun-22 30-Jun-21 31-Dec-21

EUR000s EUR000s EUR000s

Turnover - - -

Administration expenses (350) (617) (1,194)

Impairment of Asset classified

as held for sale - - (400)

______ ______ ______

Loss on ordinary activities (350) (617) (1,594)

Finance costs (13) (13) (24)

______ ______ ______

Loss for the period from continuing

activities (363) (630) (1,618)

Taxation on (loss) - - -

______ ______ ______

Loss for the period after

tax (363) (630) (1,618)

______ ______ ______

Loss for the period (363) (630) (1,618)

______ ______ ______

Total comprehensive (loss)

for the period (363) (630) (1,618)

______ ______ ______

Earnings per share

from continuing operations

Basic & diluted (loss) per

share (in cent) (0.08) (0.13) (0.34)

Total earnings per share

Basic & diluted gain (loss)

per share (in cent) (0.08) (0.13) (0.34)

Ormonde Mining plc

Consolidated Statement of Financial Position

As at 30 June 2022

unaudited unaudited audited

30-Jun-22 30-Jun-21 31-Dec-21

EUR000s EUR000s EUR000s

Assets

Non-current assets

Intangible assets 315 305 309

_______ _______ _______

Total Non-Current Assets 315 305 309

Current assets

Trade & other receivables 49 31 93

Cash & cash equivalents 3,385 4,315 3,746

Asset classified as held

for sale 2,000 2,400 2,000

_______ _______ _______

Total current assets 5,434 6,746 5,839

_______ _______ _______

Total assets 5,749 7,051 6,148

_______ _______ _______

Equity & liabilities

Equity

Issued share capital 4,725 4,725 4,725

Share premium account 29,932 29,932 29,932

Share based payment reserve 281 283 281

Capital conversion reserve

fund 29 29 29

Capital redemption reserve

fund 7 7 7

Retained losses (29,376) (28,099) (29,013)

_______ _______ _______

Total equity - attributable

to the owners of the Company 5,598 6,877 5,961

Current liabilities

Trade & other payables 151 174 187

_______ _______ _______

Total liabilities 151 174 187

_______ _______ _______

Total equity & liabilities 5,749 7,051 6,148

_______ _______ _______

Ormonde Mining plc

Consolidated Statement of Cashflows

Six months ended 30 June 2022

unaudited unaudited audited

6 Months ended 6 Months ended Year ended

30-Jun-22 30-Jun-21 31-Dec-21

EUR000s EUR000s EUR000s

Cashflows from operating activities

(Loss) for period before taxation

Continuing operations (363) (630) (1,618)

________ ________ ________

(363) (630) (1,618)

Adjustments for:

Impairment of Asset classified

as held for sale - - 400

Share option expense - - 72

________ ________ ________

(363) (630) (1,146)

Movement in Working Capital

Movement in receivables 44 27 (35)

Movement in liabilities (36) (37) (24)

________ ________ ________

Net Cash used in operations (355) (640) (1,205)

________ ________ ________

Cashflow from financing activities (355) (640) (1,205)

Investing activities

Expenditure on intangible assets (6) (10) (14)

________ ________ ________

Net cash (used in) investing activities (6) (10) (14)

Net (decrease) in cash and cash

equivalents (361) (650) (1,219)

Cash and cash equivalents at beginning

of period 3,746 4,965 4,965

______ ______ ______

Cash and cash equivalents at end

of period 3,385 4,315 3,746

________ ________ ________

Ormonde Mining plc

Consolidated Statement of Changes in Equity

Six months ended 30 June 2022

Share

based

Consolidated Statement payment

of Changes in Equity reserve

Share Share Other Retained Total

Capital Premium Reserves Losses

EUR000s EUR000s EUR000s EUR000s EUR000s EUR000s

At 1 January 2021 4,725 29,932 283 36 (27,469) 7,507

Loss for the period - - - - (630) (630)

______ ______ ______ ______ ______ ______

Total comprehensive loss

for the period 0 0 0 0 (630) (630)

______ ______ ______ ______ ______ ______

At 30 June 2021 4,725 29,932 283 36 (28,099) 6,877

Loss for the period - - - - (988) (988)

______ ______ ______ ______ ______ ______

Total comprehensive loss

for the period 0 0 0 0 (988) (988)

Release relating to expired

share options - - (74) - 74 0

Employee share-based compensation - - 72 - 72

______ ______ ______ ______ ______ ______

At 31 December 2021 4,725 29,932 281 36 (29,013) 5,961

Loss for the period - - - - (363) (363)

______ ______ ______ ______ ______ ______

Total comprehensive loss

for the period 0 0 0 0 (363) (363)

______ ______ ______ ______ ______ ______

At 30 June 2022 4,725 29,932 281 36 (29,376) 5,598

______ ______ ______ ______ ______ ______

Notes to the Interim Consolidated Financial Statements

1. Accounting policies and basis of preparation

Ormonde Mining plc ( the "Company") is a company incorporated

and domiciled in the Republic of Ireland. The Unaudited

Consolidated Interim Financial Statements ("the Interim

Consolidated Financial Statements") of the Company, as at and for

the six months ended 30 June 2022, comprise the Company and its

subsidiaries (together referred to as the "Group").

The comparative information provided in the Interim Consolidated

Financial Statements relating to the year ended 31 December 2021

does not comprise statutory financial statements. The audit opinion

on the statutory financial statements for the year ended 31

December 2021 was unqualified. However, the auditors drew attention

by way of an emphasis of matter paragraph to the material

uncertainty relating to the carrying value of the La Zarza

exploration and evaluation assets, which are classified as assets

held for sale. These assets held for sale are as set out in the

opening page to these Interim Consolidated Financial Statements now

the subject of a conditional agreement for their sale.

The Interim Consolidated Financial Statements do not include all

of the information required for full annual financial statements

and should be read in conjunction with the audited consolidated

financial statements of the Group as at and for the year ended 31

December 2021, which are available on the Company's website,

www.ormondemining.com.

The financial information in this report has been prepared using

accounting policies consistent with International Financial

Reporting Standards (" IFRS") as adopted by the European Union.

IFRS is subject to amendment and interpretation by the

International Accounting Standards Board ("IASB") and the IFRS

Interpretations Committee and there is an ongoing process of review

and endorsement by the European Commission. These policies are

consistent with those to be adopted in the Group's consolidated

financial statements for the year ending 31 December 2022. The

accounting policies applied by the Group in the Interim

Consolidated Financial Statements are the same as those applied by

the Group in the consolidated financial statements for the year

ended 31 December 2021.

The Directors have prepared the Interim Consolidated Financial

Statements on the going concern basis which assumes that the Group

and Company will have sufficient resources to continue in operation

for the foreseeable future, being a period of not less than 12

months from the date of signing of these statements. The Directors

have prepared cashflow forecasts for the twelve month period to

September 2023 and on that basis consider it appropriate to prepare

the Interim Consolidated Financial Statements on the going concern

basis. These statements do not include any adjustments that would

result from the going concern basis of preparation not being

adopted.

.

The unaudited Interim Consolidated Financial Statements were

approved by the Board of Directors on 27 September 2022.

Notes to the Interim Consolidated Financial Statements

2. Segmental analysis

An analysis by geographical segments is presented below. The

Group has geographical segments in Ireland and Spain.

The segment results for the period ended 30 June 2022 are as

follows:

Ireland Spain Total

Total comprehensive loss for 6 months

to 30 June 2022 EUR000s EUR000s EUR000s

Segment (loss) for period (207) (156) (363)

______ ______ ______

(207) (156) (363)

______ ______ ______

Total comprehensive loss for year to

31 December 2021 EUR000s EUR000s EUR000s

Segment (loss) for period (1,038) (580) (1,618)

______ ______ ______

(1,038) (580) (1,618)

______ ______ ______

Total comprehensive loss for 6 months

to 30 June 2021 EUR000s EUR000s EUR000s

Segment (loss) for period (532) (97) (630)

______ ______ ______

(532) (97) (630)

______ ______ ______

Notes to the Interim Consolidated Financial Statements

(continued)

3. Basic earnings per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share are as follows:

Earnings per share 30-Jun-22 30-Jun-21 31-Dec-21

EUR000s EUR000s EUR000s

Profit/(loss) for the period attributable to equity

holders of the parent:

From continuing business (363) (630) (1,618)

______ ______ ______

Total (Loss) for period (363) (630) (1,618)

Weighted average number of ordinary shares

for the purpose of basic earnings per share 472,507,482 472,507,482 472,507,482

______ ______ ______

Basic loss per ordinary shares (in cent)

from continuing operations (0.08) (0.13) (0.34)

______ ______ ______

Basic loss per ordinary shares (in cent)

Total (0.08) (0.13) (0.34)

______ ______ ______

Diluted earnings per share

For the six months to 30 June 2022, the share options are

anti-dilutive and therefore diluted earnings per share is the same

as the basic earnings per share.

For the six months to 30 June 2021 and the year ended 31

December 2021 the basic and diluted earnings per share are the

same.

Notes to the Interim Consolidated Financial Statements

(continued)

4. Share capital

30-Jun-22 30-Jun-21 31-Dec-21

EUR000s EUR000s EUR000s

Authorised Equity

650,000,000 ordinary shares of

EUR0.01 each 6,500 6,500 6,500

______ ______ ______

6,500 6,500 6,500

______ ______ ______

Issued Capital

Share Capital 4,725 4,725 4,725

Share Premium 29,932 29,932 29,932

______ ______ ______

34,657 34,657 34,657

______ ______ ______

Issued Capital comprises

472,507,483 ordinary shares of

EUR0.01 each 4,725 4,725 4,725

______ ______ ______

4,725 4,725 4,725

______ ______ ______

5. Dividends

No dividends were paid or proposed in respect of the six months

ended 30 June 2022.

6. Post balance sheet events

On 30 August 2022 the Company notified shareholders that is was

posting a circular calling an extraordinary general meeting for the

28 September 2022 in relation to the approval of the sale of the La

Zarza assets to La Zarza Mineria Metalica S.L.U..

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSRALIDFIF

(END) Dow Jones Newswires

September 28, 2022 02:00 ET (06:00 GMT)

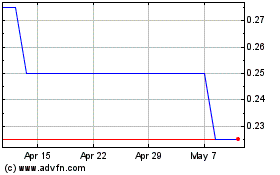

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From May 2024 to Jun 2024

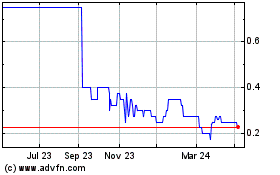

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Jun 2023 to Jun 2024