TIDMORM

RNS Number : 5156K

Ormonde Mining PLC

25 August 2023

25 August 2023

Ormonde Mining plc

("Ormonde" or the "Company")

Results of EGM & AGM

Further to the Company's announcement dated 31 July 2023,

Ormonde announces that all resolutions proposed at the

Extraordinary General Meeting ("EGM") and the Annual General

Meeting ("AGM") of the Company, both held today, were duly passed.

The results of the voting follow in the appendix below.

Accordingly, Ormonde is pleased to announce that, following

shareholder approval at the EGM, the Company's investment in

Toronto-listed exploration company TRU Precious Metals Corp

("TRU"), which is exploring for gold and copper in the highly

prospective Central Newfoundland Gold Belt in Canada, is expected

to complete after the Cancellation (as defined below) on or around

5 September 2023 ("Completion").

Upon Completion, Ormonde will own an initial 36.2% controlling

interest (under TSXV Rules) in TRU's share capital following a

total investment of CAD $3,000,000. Ormonde's funding will be used

to fast-track the advancement of TRU's Golden Rose Project as well

as the evaluation of other mineral property transaction

opportunities.

The cancellation of the admission of the Company's ordinary

shares ("Ordinary Shares") to trading on AIM and Euronext Growth

(the "Cancellation") was also approved by shareholders at the EGM.

Accordingly, the expected time and date of Cancellation is 7.00

a.m. on 5 September 2023.

An application has been made for the Company's shares to be

admitted to trading on the Access segment of the AQSE Growth Market

("AQSE"), a Multi-lateral Trading Facility (MTF) and a Recognised

Stock Exchange under S1005 (1)(b) United Kingdom Income Tax Act

2007 ("Admission"). It is expected that Admission will become

effective and that dealings will commence on AQSE on 4 September

2023. Following Admission, the Company will be subject to the

regulations and corporate governance requirements of the AQSE

Growth Market Access Rulebook.

Brendan McMorrow, Chief Executive Officer, commented:

"Following Completion, Ormonde will have a controlling interest

(under TSXV Rules) in what the Board believes is a well-funded

listed entity, with an exciting gold exploration asset and a highly

capable management team with complementary and diverse skillsets.

We intend to capitalise on this by advancing the Golden Rose

Project with a view to generating significant capital growth and

leveraging the complementary skillsets of the management teams to

achieve the identification of further mineral asset

opportunities.

Ormonde is also committed to retaining its 20% interest in Peak

Nickel Limited which is advancing exploration on a potentially

significant battery metals project.

The deferred consideration receivable from the sale of Ormonde's

La Zarza assets (EUR 1.5 million, over three years) will be

utilised for further investment and working capital purposes.

Ormonde's investments will now expose the Company's shareholders

to diverse and highly prospective assets. The Cancellation of the

AIM and Euronext Growth listings will deliver further cost savings

while the AQSE listing will provide an ongoing and cost-effective

platform for facilitating dealing in the Company's shares.

We look forward to continuing to report to shareholders on the

progress of our investments in the months ahead."

The Directors of the Company are responsible for the release of

this announcement.

Investor enquiries:

Ormonde Mining plc

Brian Timmons, Chairman

Tel: +353 (0)1 801 4184

Vigo Consulting (Investor Relations)

Ben Simons

Tel: 44 (0)20 7390 0230

Davy (Nomad, Euronext Growth Listing

Sponsor and Broker)

Anthony Farrell

Tel: +353 (0)1 679 6363

Company website: www.ormondemining.com

Appendix - Results of Voting

EGM

RESOLUTION VOTES FOR % VOTES % VOTES TOTAL** % of VOTES

AGAINST ISC* WITHELD

To authorise

cancellation

1(S) of AIM listing 122,983,121 95.76% 5,441,048 4.24% 128,424,169 27.18% 53

----------------- ----------- ------ --------- ----- ------------- ------ --------

To authorise

cancellation

of Euronext

2(S) listing 122,983,121 95.76% 5,441,048 4.24% 128,424,169 27.18% 53

----------------- ----------- ------ --------- ----- ------------- ------ --------

To authorise

completion of

3(O) TRU investment 122,983,121 95.76% 5,441,048 4.24% 128,424,169 27.18% 53

----------------- ----------- ------ --------- ----- ------------- ------ --------

AGM

RESOLUTION VOTES % VOTES % VOTES % of VOTES

FOR AGAINST TOTAL** ISC* WITHELD

To receive and

consider the

accounts for

the year ended

1(O) 31 December 2022 123,554,006 99.55% 564,293 0.45% 124,118,299 26.27% 4,259,138

-------------------------- ----------- ------ --------- ----- ----------- ------ ---------

To re-elect Mr.

Keith O'Donnell

2(O) as a director 122,694,848 99.25% 923,451 0.75% 123,618,299 26.16% 4,759,138

-------------------------- ----------- ------ --------- ----- ----------- ------ ---------

To authorise

the directors

to fix the remuneration

3(O) of the auditors 123,524,397 99.52% 593,902 0.48% 124,118,299 26.27% 4,259,138

-------------------------- ----------- ------ --------- ----- ----------- ------ ---------

To authorise

the directors

to allot relevant

4(O) securities 122,629,848 98.80% 1,488,451 1.20% 124,118,299 26.27% 4,259,138

-------------------------- ----------- ------ --------- ----- ----------- ------ ---------

To authorise

the directors

to allot equity

5(S) securities 122,629,848 98.80% 1,488,451 1.20% 124,118,299 26.27% 4,259,138

-------------------------- ----------- ------ --------- ----- ----------- ------ ---------

Notes

* ISC - Issued Share Capital

** Excludes votes withheld

(S) Special resolution

(O) Ordinary resolution

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMFZGZRDKMGFZM

(END) Dow Jones Newswires

August 25, 2023 10:33 ET (14:33 GMT)

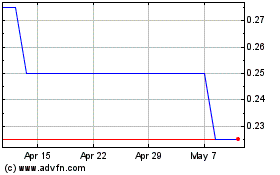

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Mar 2024 to Apr 2024

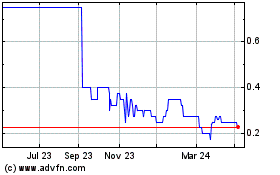

Ormonde Mining (AQSE:ORM)

Historical Stock Chart

From Apr 2023 to Apr 2024