TIDMRLE

RNS Number : 3701U

Real Estate Investors PLC

28 March 2023

Real Estate Investors Plc

("REI" or the "Company" or the "Group")

Final Results

For the year ended 31 December 2022

Robust Portfolio Performance, Disposals & Debt Reduction

Real Estate Investors Plc (AIM: RLE), the UK's only

Midlands-focused Real Estate Investment Trust (REIT) with a

portfolio of 1.37 million sq ft of investment property, is pleased

to report its final results for the year ended 31 December

2022:

Growing NTA in a challenging market

-- Revenue* of GBP13.3 million (FY 2021: GBP14.7 million)

(decrease in the main due to loss of income associated with

sales)

-- Profit before tax of GBP10.9 million (FY 2021: GBP13.9

million), including a revaluation gain of GBP3.2 million on

investment properties (FY 2021: gain of GBP4.9 million), a gain of

GBP948,000 on the sale of investment property (FY 2021: gain of

GBP1.2 million) and a gain in the market value of our interest rate

hedging instruments of GBP2.2 million (FY 2021: gain of GBP1.4

million)

-- Underlying profit before tax** of GBP4.6 million (FY 2021: GBP6.4 million)

-- EPRA*** Net Tangible Assets ("NTA") per share of 62.2p (FY 2021: 58.8p) up 5.7%

-- Completed disposals totalling GBP20.9 million (an aggregate

uplift, before costs, of 8.5% above December 2021 valuation)

-- Disposal proceeds used to pay down GBP18 million of debt in 2022

-- LTV (net of cash) reduced to 36.8% (FY 2021: 42.2%)

-- GBP7.8 million cash at bank as at 31 December 2022

-- Average cost of debt of 3.7%

-- 100% of debt fixed with a weighted average debt maturity of 2 years

-- EPRA*** EPS of 2.7p (FY 2021: 3.7p)

-- Successful GBP2 million share buyback programme launched and

completed in Q4 2022, in line with Company strategy announced on 6

July 2022

Uninterrupted Fully Covered Dividend

-- Final dividend of 0.4375p per share, payable in April 2023 as

a Property Income Distribution (PID)

-- Total fully covered dividend per share for 2022 of 2.5p (FY

2021: 3.0625p) (which would be the basis for the dividend for

FY2023, subject to the pace of further disposals) reflecting a

yield of 8.8% based on a mid-market opening price of 28.25p on 27

March 2023

-- GBP46.3 million total declared/paid to shareholders since

commencement of dividend policy in 2012

Positive valuations and strong lettings activity

-- Like-for-like portfolio valuation up by 1.9% to GBP173.0

million (FY 2021: GBP169.8 million)

-- Gross property assets of GBP175.4 million (FY 2021: GBP190.8

million) with 42 assets and 201 occupiers

-- Rent collection levels for 2022 of 99.54% (2021 overall

collection: 97.81%) and Q1 2023 rent collection to date of 99.80%

(adjusted for monthly/deferred agreements)

-- Completed 127 lease events during the year

-- WAULT**** of 4.98 years to break and 6.29 years to expiry (FY 2021: 5.03 years /6.76 years)

-- Contracted rental income of GBP12.6 million (FY 2021: GBP14.3 million) net of disposals

-- Portfolio occupancy of 84.54% (FY 2021: 85.75%) with

potential to rise further as key pipeline lettings are completed

(subject to ongoing sales and ongoing portfolio lease activity)

Post year end activity - continued demand from private investor

market

-- Additional significant pipeline sales in legals

-- Healthy pipeline of new lettings in legals of GBP828,486 p.a.

-- In March 2023, the Group extended the GBP20 million facility

with Lloyds for 6 months to 31 May 2024 and the GBP31 million

facility with NatWest for 3 months to June 2024

Paul Bassi, CEO of Real Estate Investors Plc, commented:

"Despite the worst property year for transactions since the

financial crisis, REI has successfully disposed of GBP20.9 million

of property and reduced debt by GBP18 million, which has

contributed to pre-tax profits of GBP10.9 million and the

continuation of an attractive covered dividend. Our like-for-like

portfolio valuation has seen a 1.9% recovery during the year. Given

that the UK investment property market suffered average valuation

declines of 14.2% over the year, this outperformance by the REI

portfolio is a clear indication of the portfolio's stability and

diversity.

Despite a sluggish and inactive corporate and institutional

marketplace, we anticipate continued sales to a strong private

investor market, which will allow us to execute our stated strategy

and reduce our debt further. If the significant share price

discount to NTA persists, we will consider a further share buyback,

special dividend or other method of capital return. In the event of

a change in market conditions, we will also consider opportunistic

acquisitions that will provide significant value via income and

capital enhancement to our portfolio."

Financial and Operational Results

31 Dec 2022 31 Dec 2021

Revenue* GBP13.3 million GBP14.7 million

----------------- ----------------

Pre-tax profit GBP10.9 million GBP13.9 million

----------------- ----------------

Underlying profit before GBP4.6 million GBP6.4 million

tax**

----------------- ----------------

Contracted rental income GBP12.6 million GBP14.3 million

----------------- ----------------

EPRA EPS*** 2.7p 3.7p

----------------- ----------------

Basic EPS*** 6.3p 7.8p

----------------- ----------------

Dividend per share 2.5p 3.0625p

----------------- ----------------

Average cost of debt 3.7% 3.5%

----------------- ----------------

Like-for-like rental GBP12.6 million GBP12.6 million

income

----------------- ----------------

31 Dec 2022 31 Dec 2021

----------------- ----------------

Gross property assets GBP175.4 million GBP190.8 million

----------------- ----------------

EPRA NTA per share 62.2p 58.8p

----------------- ----------------

Like-for-like capital GBP125.97 psf GBP123.67 psf

value psf

----------------- ----------------

Like-for-like valuation GBP173.0 million GBP169.8 million

----------------- ----------------

Tenants 201 256

----------------- ----------------

WAULT to break**** 4.98 years 5.03 years

----------------- ----------------

Total ownership (sq 1.37 million 1.49 million sq

ft) sq ft ft

----------------- ----------------

Net assets GBP109 million GBP105 million

----------------- ----------------

Loan to value 42.2% 47.4%

----------------- ----------------

Loan to value net of

cash 36.8% 42.2%

----------------- ----------------

Definitions

* Excludes land sale

** Underlying profit before tax excludes gain on revaluation and

sale of properties and interest rate swaps

*** EPRA = European Public Real Estate Association

**** WAULT = Weighted Average Unexpired Lease Term

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the UK version of the EU Market Abuse Regulation

(2014/596) which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended and supplemented from time to

time.

Enquiries:

Real Estate Investors Plc

Paul Bassi/Marcus Daly +44 (0)121 212 3446

Cenkos Securities (Nominated Adviser)

Katy Birkin/Ben Jeynes +44 (0)20 7397 8900

Liberum (Broker)

Jamie Richards/William King +44 (0)20 3100 2000

About Real Estate Investors Plc

Real Estate Investors Plc is a publicly quoted, internally

managed property investment company and REIT with a portfolio of

1.37 million sq ft of mixed-use commercial property, managed by a

highly-experienced property team with over 100 years of combined

experience of operating in the Midlands property market across all

sectors. The Company's strategy is to invest in well located, real

estate assets in the established and proven markets across the

Midlands, with income and capital growth potential, realisable

through active portfolio management, refurbishment, change of use

and lettings. The portfolio has no material reliance on a single

asset or occupier. On 1st January 2015, the Company converted to a

REIT. Real Estate Investment Trusts are listed property investment

companies or groups not liable to corporation tax on their rental

income or capital gains from their qualifying activities. The

Company aims to deliver capital growth and income enhancement from

its assets, supporting its progressive dividend policy. Further

information on the Company can be found at www.reiplc.com .

CHAIRMAN'S AND CHIEF EXECUTIVE'S STATEMENT

Corporate and institutional buyers remained cautious throughout

2022, with limited demand for larger lot sizes. However, despite

negative market sentiment, rising interest rates and high

inflation, private investor and overseas buyer activity has

remained healthy, resulting in a strong year of sales and debt

reduction for REI.

To take advantage of private investor appetite for smaller lot

sizes and, in line with the Company strategy (outlined in July

2022), REI identified a number of assets with break-up potential

that met this investor demand, successfully disposing of 25

assets/units totalling GBP20.9 million during the year, at an

aggregate uplift, before costs, of 8.5% on 2021 year end book

values and a net initial yield of 6.84%, demonstrating a robust

underlying portfolio value.

Portfolio disposals contributed towards a pre-tax profit of

GBP10.9 million (FY 2021: GBP13.9 million profit) and supported a

fully-covered, uninterrupted dividend payment of 2.5p for the year,

taking the total declared/paid to shareholders since the

commencement of our dividend policy in 2012 to GBP46.3 million.

During the year, GBP18 million of debt was repaid, reducing

overall total drawn debt to GBP71.4 million (FY 2021: GBP89.4

million) and LTV (net of cash) to 36.8% (FY 2021: 42.2%). Our

average cost of debt increased marginally to 3.7% due to the

repayment of low-cost debt, with 100% of our remaining debt fixed

as at 31 December 2022. Management's priority remains to repay

further debt, via additional sales to a strong private investor

market, with a view to maintaining portfolio gearing below 40%,

and, supporting further improvement in the Group's Net Tangible

Assets ("NTA").

In addition to substantial debt repayment, the accelerated sales

rate in 2022 allowed the Company to fund a share buyback of GBP2

million, further supporting the Company's ongoing capital return

strategy, aimed at reducing the unwarranted discount between the

share price and NTA.

As well as reducing debt, the Company is looking to target

GBP300,000 plus of savings in FY 2023 by identifying services that

are no longer required as the portfolio reduces in size. More than

50% of this target saving has already been actioned.

REI's resilient regional portfolio, underpinned by a diversified

tenant and sector spread and consisting of 201 occupiers across 42

assets, has gross property assets of GBP175.4 million (FY 2021:

GBP190.8 million). Our like-for-like portfolio valuation has seen a

1.9% recovery during the year. Given that the UK investment

property market suffered average valuation declines of 14.2% over

the year, this outperformance by the REI portfolio is a clear

indication of the portfolio's stability and diversity. With limited

exposure to sectors that are undergoing a sharp yield correction

and value reduction, conservative portfolio gearing and the benefit

of significant underlying break-up potential demonstrated by recent

sales, the portfolio is well placed to weather ongoing economic

instability. However, should interest rates rise further than

presently anticipated, this could have a negative impact on future

valuations.

Intensive asset management during the year resulted in 127 lease

events, and a WAULT of 4.98 years to break and 6.29 years to expiry

(FY 2021: 5.03 years to break and 6.76 years to expiry). Occupancy

across the portfolio is stable at 84.54% (FY 2021: 85.75%) despite

disposals of fully occupied assets, however, market sentiment and

cost pressures from rising interest rates have resulted in a

slowing down in occupier decisions. A shift in employee working

habits, a legacy of the pandemic, has also contributed to the

hesitation from office occupiers who have not yet seen a full

return of their workforce and are now seeking smaller quality

spaces 'a flight to quality' that will entice employees back to

their desks, whilst also meeting relatively new sustainability

objectives. We anticipate, in light of market sentiment that

occupancy will increase, particularly as we have witnessed an

improvement in occupier demand (albeit decision making remains

slow) in the first quarter of 2023. We are buoyed by the interest

levels in the type of space we have available, much of which is

non-City centre and accessible for those who wish to avoid heavy

commutes and public transport.

Contracted rental income is at GBP12.6 million p.a. (FY 2021:

GBP14.3 million p.a.), with the majority of this reduction due to

the loss of income associated with disposals during the year,

combined with lease terminations and other known lease events which

we would expect to see in any normal trading period.

We currently have a significant pipeline of lettings totalling

GBP828,486 rent p.a. in solicitors hands, including large

government-backed lettings that, once completed, have the potential

to positively impact our occupancy levels, leading to improved

income and WAULT and supporting future valuation recovery.

In another sign of market normalisation and in line with the

easing of Covid 19 related government restrictions in early 2022,

overall rent collection levels for the year were a very healthy

99.54% translating into EPRA earnings per share of 2.7p. For Q1

2023, rent collection levels are currently at 99.80%, signalling

that occupiers are continuing to trade well, despite inflationary

and interest rate pressure.

Ongoing Strategy

The Board renews its commitment set out in the July 2022 Trading

Update and Capital Return Strategy, to deliver maximum value to our

shareholders. The Board believes that the share price discount to

the net tangible assets ("NTA") continues to be unwarranted and

that it is in the best interests of all shareholders to continue to

take steps to reduce this discount.

During 2022, the Company disposed of GBP20.9 million of

portfolio assets at levels exceeding book value and a proportion of

the subsequent disposal receipts, were used to repay GBP18 million

of debt.

In Q4 2022 the Company utilised further disposal receipts to

fund a share buyback, acquiring a total of 7,142,857 shares at an

average cost of 28p per share during November and December 2022.

All 7,142,857 buyback shares purchased under the programme were

cancelled. Therefore, the total number of Ordinary Shares in issue

and carrying voting rights is 172,651,577 with no Ordinary Shares

held in treasury.

Our strategy remains as previously stated and the Board looks to

maintain maximum flexibility when considering how best to allocate

surplus capital, including a return of capital to shareholders,

whether in the form of a further share buyback, special dividend or

other method of capital return. The quantum of any return of

capital will be set to ensure that we maintain a prudent

loan-to-value ("LTV") ratio and will be subject to market

conditions. Alternatively, if the environment for acquisitions

changes and opportunities offering significant value start to

arise, then we may look to make opportunistic acquisitions where

there is scope to capture material upside through asset management.

The Board evaluates the relative merits of these options on an

ongoing basis.

Market commentators suggest that 2023 may see a more normalised

investment market, with corporate and institutional investors

returning to the market, having remained inactive for much of the

last 24 months. If this interest and activity materialises as

predicted, we expect the quantum of REI sales in both volume and

monetary terms to significantly increase, which would see an

acceleration in REI's debt repayment objectives. Likewise, should

market conditions change dramatically and acquisition opportunities

reveal themselves, management will consider acquisitions, should

they offer our portfolio value and income enhancement for

shareholders.

Dividend

The Company's dividend payments continued uninterrupted

throughout 2022, despite unfavourable market conditions and an

ongoing sales programme by REI. The first two quarterly dividend

payments in respect of 2022 were paid at a level of 0.8125p per

share, fully covered. The Q3 2022 dividend was reduced to 0.4375p

per share due to the acceleration of disposals. The final dividend

in respect of 2022 is confirmed as 0.4375p per share, reflecting a

total fully-covered dividend payment for 2022 of 2.5p (FY 2021:

3.0625p) (which would be the basis for the dividend for FY2023,

subject to the pace of further disposals) and a yield of 8.8% based

on a mid-market opening price of 28.25p on 27 March 2023. The Board

remains committed to paying a covered dividend, subject to business

performance and the pace of further disposals.

The proposed timetable for the final dividend, which will be a

Property Income Distribution ("PID") is as follows:

Ex-dividend date: 6 April 2023

Record date: 11 April 2023

--------------

Dividend payment 28 April 2023

date:

--------------

Outlook for 2023

We anticipate continued sales in 2023, with private investor

appetite remaining strong in Q1 2023. Until clarity is available

around interest rates, larger buyers will likely remain inactive.

Sales to private investors are piecemeal and slow but nevertheless

are value enhancing and worth pursuing. Receipts from these

selective disposals will be used towards repaying further debt and

reducing portfolio gearing, with a view to delivering on strategic

objectives and narrowing the discount between share price and

NAV.

The Board intends to maintain 'maximum flexibility' with our

strategy in the months ahead and will consider a further share

buyback or capital return if appropriate, the structure and timing

of which is yet to be decided. The quantum of any return of capital

will be set to ensure that we maintain a prudent LTV ratio, whilst

also being mindful of the overall liquidity in the Company's

shares.

Renewed occupier appetite, combined with a proactive asset

management approach to the existing portfolio over the months ahead

should unlock income from void spaces and lead to improved

occupancy levels. A rise in occupancy, along with evidence from

successful sales should go some way to offsetting any negative

impact of economic instability on future valuations, although

further and higher rate rises could adversely impact these.

Management intends to continue paying an uninterrupted,

fully-covered quarterly dividend payment to shareholders, subject

to portfolio disposals and any acceleration in the sales

programme.

As always, we are aware of market consolidation within the real

estate and REIT market and we remain alert to options that align

with the interests of REI's shareholders.

Our Stakeholders

Our thanks to our shareholders, advisers, tenants and staff for

their continued support.

William Wyatt Paul Bassi CBE D. Univ

Chairman Chief Executive

27 March 2023 27 March 2023

PROPERTY REPORT

UK Property Market Overview

Sentiment around the investment market is shrouded in

uncertainty following a tumultuous 2022. The year started off with

investor optimism on the economic outlook, although economists'

forecasts vary considerably. The impact of central banks raising

interest rates to combat inflation has led to some of the highest

borrowing costs since the 2008 global financial crisis.

Consequently, UK fund activity has so far been subdued during Q1

2023, with noticeable reduction in demand for larger lot sizes,

except for some well let prime industrial investments, where

interest is slowly recovering after a poor year of performance.

However, as witnessed throughout the UK national auction

markets, activity from smaller private investors remains resilient,

albeit on-going sales are piecemeal and slow due to a lack of

market confidence and availability of finance. UK institutions have

started the year very subdued with minimal volume activity for

larger lot sizes. Until the inflationary storm passes, monetary

policy pivots to neutral and the economy proves resilient, we

anticipate that the funds will likely remain inactive or at best

highly selective.

As would have been expected given base rate moves, capital value

declines in 2022 were overwhelmingly driven by expanding yields

(yield impact of -17.3% year-on-year), with rental values seeing

marginal growth (+4.2%) as a result of a strong performance in the

first half of the year. However, overall total returns are down.

According to MCSI's IPD UK Property Index, UK investment property

values declined by 14.2% for the year, making 2022 the worst year

for UK property since the financial crisis.

Higher borrowing costs fed through to the investment market with

prospects of higher rate expectations which has dampened buyer

sentiment towards commercial real estate. Consequently, open-ended

real estate funds have been battling to meet a surge in demand for

redemptions against a backdrop of high inflation and economic

uncertainty. Some of the largest UK property asset managers, have

imposed restrictions on property fund redemptions since September

2022, with many other funds and institutions also cutting their

exposure to commercial property.

Early 2023 valuations look slightly healthier, with sentiment

improving, suggesting that some of the downside risk has been

mitigated. However, property prices are typically negatively

correlated to interest rates, so returns will likely be determined

by how high interest rates need to go to tame inflation. The length

and breadth of a recession is also very important for commercial

property pricing, as this will impact the occupational market.

Reductions in valuations in the investment market is mainly

focussed on industrial and offices sectors. Fortunately, the REI

portfolio is heavily diversified and our valuations have proven to

be more resilient.

With the region firmly on the map, thanks to a very successful

2022 Commonwealth Games and the highly anticipated HS2 project,

Birmingham City centre and the wider Midlands region is witnessing

a continued migration of large businesses from London to the

region, with Goldman Sachs just one of many corporates taking space

in 2022, signing up for 110,000 sq ft of Grade A space.

According to JLL Research, occupiers continue to seek quality,

with Grade A accounting for 49% of office take up across the

Birmingham City Centre office market in 2022. Take up levels in the

City centre totalled 692,700 sq ft for the year, a marginal

increase on the 5-year average, with transaction levels 14% higher.

Recovery in rental values continued with an increase of 7% in

Birmingham's headline rent on 2021 to GBP40.00 per sq ft, 16% above

pre-Covid levels. A lack of quality space is driving the growth,

with only c. 80,000 sq ft of new build development in the pipeline

for Birmingham City Centre, currently under construction and

available. We acknowledge that the market for secondary City centre

offices is experiencing a decline, however our vacancy within this

sector represents c. 1% of our entire portfolio and as such is not

cause for concern.

The REI Portfolio

The REI portfolio, comprising of 42 assets with 201 tenants has

a net initial yield of 6.84% and a reversionary yield of 8.23%.

Valuations have seen a rise of 1.9% on a like-for-like basis to

GBP173.0 million (FY 2021: GBP169.8 million). Further valuation

gains could be achieved during the course of 2023 as REI intends to

continue to sell off assets at a premium to a strong investor

market and generate income from void space within the

portfolio.However, further interest rate rises could add downward

valuation pressure.

The current portfolio sector weightings are:

Sector GBP Income % Income by

by sector sector

Office 5,310,138 42.06

----------- ------------

Traditional Retail 2,189,615 17.34

----------- ------------

Other - Hotels (Travelodge), Leisure

(The Gym Group, Luxury Leisure), Car

parking, AST 1,502,058 11.90

----------- ------------

Discount Retail - Poundland/B&M etc 1,472,350 11.66

----------- ------------

Medical and Pharmaceutical - Boots/Holland

& Barrett etc 759,049 6.01

----------- ------------

Restaurant/Bar/Coffee - Wetherspoons,

Dominos etc 595,750 4.72

----------- ------------

Food Stores - Co-op, Iceland etc 409,545 3.25

----------- ------------

Financial/Licences/Agency - Clydesdale

Bank Plc, Santander UK Plc, Bank of Scotland

etc 386,125 3.06

----------- ------------

Total 12,624,630 100.00

----------- ------------

Disposals

Whilst the more institutional markets were in a state of flux,

during the year we recognised that there was a growing amount of

activity from private investors seeking smaller lot sizes of up to

GBP1 million. We identified several assets that could be broken up

into smaller sales to achieve premium values and disposed several

assets via private treaty to private purchasers at levels above

book value.

During the year, we disposed of 25 assets/units with an average

lot size of GBP836,000, for a combined consideration of GBP20.9

million at an aggregate 8.5% uplift to valuation, comprising the

following:

-- Acocks Green Shopping Centre, comprising twelve separate

units, with a combined sale value of GBP7.03m - sold at an

aggregate uplift of 17% above book value

-- 120-138 High Street, Kings Heath for GBP4.7m - sold at 8% above book value

-- Bearwood Shopping Centre, comprising eight separate units,

with a combined sale of GBP3.7m - sold at an aggregate uplift of 4%

above book value

-- 37a Waterloo Street, Birmingham at GBP3.17m, to a China based

private investor - sold at 9.41% below book value

-- McDonalds Unit Leamington for GBP1.55m - sold at 43% above book value

-- Eastleigh / Hanover retail units, non-core assets to a

private property company for GBP735,000 - no uplift on combined

sales

It is worth noting that, whilst some of our assets were sold on

an opportunistic basis, others, where asset management initiatives

had been completed, were identified as ready for disposal as our

knowledge of the local market meant it was the correct time to be

disposing of them.

Post Period End Disposals

Since the year end we are now under offer on a significant

pipeline of disposals which are in solicitors hands, subject to

contract. REI intends to make further opportunistic sales, should

investor demand prevail.

Acquisitions

No suitable acquisitions were identified during the year and

focus was directed at sales. M anagement will consider portfolio

acquisitions should they offer portfolio value and income

enhancement.

Asset Management

Notwithstanding the backdrop of economic uncertainty amid a

cost-of-living crisis, there was still renewed occupier confidence

experienced in 2022, with the asset management team completing 127

lease events. New lettings during the year totalled just under GBP1

million p.a. with notable lettings at Birchfield House (Oldbury),

Titan House (Telford) and Venture Court (Wolverhampton).

The occupier market remains active with a good number of

pipeline lettings in our void space. Portfolio occupancy is at

84.54% (FY 2021: 85.75%) with potential to rise further with the

completion of key pipeline lettings which are in advanced

discussions. Of the 15.46% vacancy (as at 31 December 2022) within

the portfolio, over half of this (8.01%) can be attributed to

spaces at 4 properties (Barracks Road, Newcastle-under-Lyme; Crewe

Shopping Centre; Kingston House and Birch House).

As a result of the asset management activity in 2022 our WAULT

was 4.98 years to break and 6.29 years to expiry (FY 2021: 5.03

years to break and 6.76 years to expiry).

Key asset management initiatives undertaken during the year

include:

Titan House

Following the refurbishment of the office space to a Grade A

specification, there was strong interest during 2022. BohooMoon

Limited signed for the third floor on a 5-year lease and we are in

legals with an occupier to take the first-floor office space. This

is on a ten-year lease with a tenant break in year 5. The remaining

floor has seen strong interest since the year end to date and we

are confident that the building will be fully occupied by the end

of 2023.

Oldbury

DHU Health Care CIC took occupation of all 16,584 sq ft at

Birchfield House towards the end of 2022 at a market rent of

GBP273,636 p.a. This is on a short-term lease to facilitate a

potential move into all of the 35,749 sq ft at Birch House during

2023.

Tunstall

Argos' 15-year lease expired in 2020 and following a period of

time where they 'held over', this lease was renewed for a further 5

years in mid-2022. Poundland, having taken a temporary lease in

2020 to assess trade post Covid, entered into a new 5-year lease at

a market rent. The proposed Drive Thru 'pod' has seen an increased

demand from a number of operators. All the above support the

sentiment of the strength of this location.

Crewe

The former Argos unit became vacant after the store consolidated

to the local Sainsburys and we are now under offer to a national

occupier for the ground floor of this unit. Additionally, we are in

solicitors' hands for a new lease agreement to Bodycare to take the

former Clinton Cards unit with anticipated opening during the

summer. We currently have two vacancies in the indoor mall which

occurred after Christmas, but we are working hard to find

occupiers, with ongoing interest. We have agreed to sell the

consented new drive thru land in the rear car park to a well-known

fast-food operator and once completed we feel that this will have a

very positive effect on the scheme. Parking revenue has been

resilient and we have recently renewed our parking contract with an

operator which includes brand new parking machines and improved car

park signage.

Brandon Court

Following the successful surrender and reconfiguration of the

Yazaki space, the letting to Bennetts and Comex 2000 completed late

2021/early 2022. The final suite at the scheme was let in June 2022

to City Fibre on a 5-year lease. Once again, the scheme is fully

let.

Redditch

The final vacant unit was let in March 2022 to a Euro

Supermarket. The operator took a 15-year lease and has traded

exceptionally well since opening. Car parking income at the scheme

has seen a strong resurgence since the impact of the Pandemic. A

new operator was appointed and has invested in new equipment and

pay facilities.

Topaz Business Park

Several operators expressed interest in surplus land at Topaz

and, after negotiations, it was decided to proceed with Costa.

Costa is considered one of the best covenants of the Drive Thru

market. An Agreement for Lease was entered into in July 2022 and

tenders are being prepared to obtain a fixed price build contract.

Heads have been agreed on a forward sale with REI committing to

develop the scheme. Once PC is achieved, the lease is entered into

and this will trigger the completion of the sale.

Lease terms:

-- Letting to Costa Limited

-- 15-year lease

-- GBP85,000 per annum

-- 9-months rent free

-- Five yearly rent reviews - open market reviews with cap and

collar limits of 3% and 1% respectively

New tenants to the portfolio in 2022

Microsoft, Shoe Zone (AG), King & Moffat UK Ltd, Delta

Simons Ltd, City Fibre Holdings, Team Support Healthcare &

DHU.

Post Period End Activity and Sentiment

Whilst there have only been a handful of lettings post the year

end, we are noticing a significant increase in enquiries for vacant

space. The vacant office space within key city/town centres is

generating levels of enquiries not seen since the pandemic. Ongoing

lease events are progressing slowly, e.g. Birch House, Oldbury due

to government funding approval and ever-increasing levels of

scrutiny.

Portfolio Summary

Value (GBP) Area Contracted ERV NIY EQY RY Occupancy

(sq ft) Rent (GBP) (GBP) (%) (%) (%) (%)

Portfolio 173,030,000 1,373,631 12,624,630 15,193,820 6.84 8.14 8.23 84.54

------------ ---------- ------------ ----------- ----- ----- ----- ----------

Land 2,389,365 - - - - - - -

------------ ---------- ------------ ----------- ----- ----- ----- ----------

Total 175,419,365 1,373,631 12,624,630 15,193,820 6.84 8.14 8.23 84.54

------------ ---------- ------------ ----------- ----- ----- ----- ----------

*Our land holdings are excluded from the yield calculations

Environmental, Social and Governance ("ESG")

REI has continued to work alongside Measurabl, the leading ESG

technology and services platform for real estate, to collect, track

and report carbon emissions data across REI's landlord-controlled

areas. The reduction of the portfolio's carbon footprint is a

priority for the business.

We have detailed below our emissions for Jan-Dec 2019 and 2020

(carbon emissions data for 2021 and 2022 will be supplied in due

course as we complete the historical data collection):

Carbon Emissions 2020 2019

Scope 1 Emissions* 10,930 MTCO 17,574 MTCO

e e

----------- -----------

Scope 2 Emissions * 904.28 MTCO 1,236 MTCO

e e

----------- -----------

Total Scope 1 and Scope 2 11,834 MTCO 18,810 MTCO

Emissions* e e

----------- -----------

*The above calculations apply to landlord-controlled gas and

electricity consumption only

Portfolio Energy Performance Certification

In accordance with government guidelines, REI has undertaken a

programme to ensure our assets meet the UK statutory regulations

and timeframes for EPCs. We will continue to upgrade assets when

required. An overview of the asset EPC ratings across the portfolio

is noted below, showing the progress since 31 December 2021:

% of portfolio (by sq ft)

EPC

Rating A B C D E F G Total

----- ------ ------ ------ ----- ----- ----- --------

31 Dec

2021 0.00 9.48 37.18 43.15 9.35 0.54 0.30 100.00

----- ------ ------ ------ ----- ----- ----- --------

31 Dec

2022 1.36 22.99 31.18 37.49 6.98 0 0 100.00

----- ------ ------ ------ ----- ----- ----- --------

FINANCIAL REVIEW

Overview

Our results for 2022 are in line with management's expectations

following a successful year of disposals. Profit before tax of

GBP10.9 million (FY 2021: GBP13.9 million), to include a

revaluation gain of GBP3.2 million on investment properties (FY

2021: gain of GBP4.9 million), a gain of GBP948,000 on the sale of

investment property (FY 2021: gain of GBP1.2 million) and a gain in

the market value of our interest rate hedging instruments of GBP2.2

million (FY 2021: gain of GBP1.4 million).

Property disposals during the year amounted to GBP20.9 million,

of which GBP18 million was used to repay debt. Significant debt

repayment, combined with a gain in portfolio valuations has led to

a reduction in our LTV (net of cash) to 36.8% (FY 2021: 42.2%). As

a result, our EPRA NTA per share has risen by 5.8% to 62.2p (FY

2021: 58.8p).

As at 31 December 2022, total drawn down debt was GBP71.4

million (FY 2021: GBP89.4 million) with 100% of the Company's debt

fixed at an average cost of debt of 3.7%. REI continues to meet all

banking covenants (which continue to be measured against LTV of the

loans to property values and the interest cover against rental

income) and have headroom available. REI remains multi-banked

across 4 lenders.

During the year, contracted rental income reduced to GBP12.6

million (FY 2021: GBP14.3 million) due to significant portfolio

disposals, combined with a temporary drop in occupancy levels

across the portfolio as the markets react to economic pressures.

The loss of income resulted in a drop in revenue to GBP13.3 million

(FY 2021: GBP14.7 million). Our like-for-like rental income has

remained constant, due to intensive asset management during the

year. Underlying profit for the year was GBP4.6 million (FY 2021:

GBP6.4 million).

Our pre-tax profits of GBP10.9 million supported uninterrupted

dividend payments throughout 2022, with Q1 and Q2 paid at a level

of 0.8125p per share, fully covered. The Q3 2022 dividend was

reduced to 0.4375p per share due to the acceleration of disposals.

The final dividend in respect of 2022 is confirmed as 0.4375p per

share, reflecting a total fully-covered dividend payment for 2022

of 2.5p (FY 2021: 3.0625p) and a yield of 8.8% based on a

mid-market opening price of 28.25p on 27 March 2023.

31 December 31 December

2022 2021

Gross Property Assets GBP175.4 million GBP190.8 million

---------------------------- -----------------

Underlying profit before GBP4.6 million GBP6.4 million

tax

---------------------------- -----------------

Pre-tax profit GBP10.9 million GBP13.9 million

---------------------------- -----------------

Revenue GBP13.3 million GBP14.7 million

---------------------------- -----------------

EPRA EPS 2.7p 3.7p

---------------------------- -----------------

EPRA NTA per share 62.2p 58.8p

---------------------------- -----------------

Net Assets GBP109 million GBP105 million

---------------------------- -----------------

Loan to value 42.2% 47.4%

---------------------------- -----------------

Loan to value net of cash 36.8% 42.2%

---------------------------- -----------------

Average cost of debt 3.7% 3.5%

---------------------------- -----------------

Dividend per share 2.5p 3.0625p

---------------------------- -----------------

Like-for-like rental income GBP12.6 million GBP12.6 million

---------------------------- -----------------

Like-for-like capital GBP125.97 psf GBP123.67 psf

value psf

---------------------------- -----------------

Like-for-like valuation GBP173.0 million GBP169.8 million

---------------------------- -----------------

Capital Return Strategy & Buyback Programme

The Board is committed to delivering value to its shareholders

and believes that the share price discount to the net tangible

assets ("NTA") continues to be unwarranted. Following successful

sales and subsequent debt repayment in 2022, the Company undertook

a share buyback, acquiring a total of 7,142,857 shares at an

average cost of 28p per share during November and December 2022.

All 7,142,857 buyback shares purchased under the programme

previously held in treasury were cancelled. Therefore, the total

number of Ordinary Shares in issue and carrying voting rights is

172,651,577 with no Ordinary Shares held in treasury.

During 2023, the Board intends to maintain 'maximum flexibility'

in our approach towards our capital return strategy and will

consider a special dividend, further share buyback or other form of

capital return to shareholders, the structure and timing of which

is yet to be decided and subject to the ongoing sales

programme.

Results for the year

The profit before tax of GBP10.9 million (FY 2021: GBP13.9

million), includes a revaluation gain of GBP3.2 million on

investment properties (FY 2021: gain of GBP4.9 million), a gain of

GBP948,000 on the sale of investment property (FY 2021: gain of

GBP1.2 million) and a gain in the market value of our interest rate

hedging instruments of GBP2.2 million (FY 2021: gain of GBP1.4

million). Excluding these items, the underlying profits reduced to

GBP4.6 million (FY 2021: GBP6.4 million).

Due to a loss of income during the year of GBP1.7 million p.a.

(in the main due to loss of income associated with sales of

GBP1.654 million, combined with other expected lease events)

revenues for the year were down to GBP13.3 million (FY 2021:

GBP14.7 million) despite new lettings of just under GBP1 million

p.a. and intensive asset management initiatives offsetting much of

the rental loss. In addition, holding costs of void space and

direct costs increased to GBP2.5 million (FY 2021: GBP1.9

million).

As at 31 December 2022, cash at bank was GBP7.8 million. During

the year, REI did not make any investment property acquisitions due

to a lack of supply. Attention was focussed on achieving value by

disposing of assets at above book value to a strong private

investor market.

As previously stated, the Company is looking to target up to

GBP300,000 of savings in FY 2023 by identifying services that are

no longer required as the portfolio reduces in size. During the

year, administrative costs and overhead expenses increased by

GBP200,000 to GBP3.3 million (FY 2021: GBP3.1 million), mainly due

to a salary rise and increased bonus for staff (excluding

directors) of GBP100,000, maintaining bad debts provision of

GBP50,000 (FY 2021: GBP50,000), and a provision for costs of the

Long-Term Incentive Plan of GBP150,000 (FY 2021: GBP150,000). The

Remuneration Committee agreed that bonuses for the Executive

Directors of GBP180,000, being 25% of salary for 2022 should be

made (FY 2021: GBP180,000).

Interest costs for the year reduced by GBP250,000 to GBP3

million (FY 2021: GBP3.2 million) due to GBP18 million debt

repayment during the year. The weighted average cost of debt rose

marginally to 3.7% (FY 2021: 3.5%) as a result of the Group paying

down cheaper debt.

Earnings per share were:

Basic: 6.3p (FY 2021: 7.8p)

Diluted: 6.3p (FY 2021: 7.6p)

EPRA: 2.7p (FY 2021: 3.7p)

Shareholders' funds increased to GBP109 million at 31 December

2022 (31 December 2021: GBP105 million) as a result of the gain on

property portfolio revaluation.

Basic NAV: 63.1p (FY 2021: 58.5p)

EPRA NTA: 62.2p (FY 2021: 58.8p)

Finance and Banking

Due to a successful disposals programme in 2022 and subsequent

debt repayment of GBP18 million, total drawn debt at 31 December

2022 was GBP71.4 million (FY 2021: GBP89.4 million) with the AIB

facility repaid in full. The Group has GBP7.8 million cash at bank

and remains multi-banked across 4 lenders and continues to meet

banking covenants with its lenders, with headroom available. As at

31 December 2022, 100% of the debt across the portfolio is fixed,

preserving low average costs of debt at 3.7%, with a weighted

average debt maturity of 2 years (FY 2021: 1.8 years). The business

is well-insulated from interest rate rises in the coming

months.

The LTV as at 31 December 2022 was 42.2% (FY 2021: 47.4%) and

the LTV (net of cash) was 36.8% (FY 2021: 42.2%). It is

management's intention to maintain a portfolio LTV of sub 40%. The

Group's hedge facility improved by GBP2.2 million for the year to

31 December 2022 and as at 31 December 2022, the swap position was

an asset of GBP68,000.

Lender Debt Facility Debt Maturity Hedging (%)

(GBPm)

National Westminster

Bank 33.1 March 2024 100

-------------- -------------- ------------

Lloyds Banking Group 20 December 2023 100

-------------- -------------- ------------

Barclays 7.6 December 2024 100

-------------- -------------- ------------

Aviva 11.2 2027 & 2030 100

-------------- -------------- ------------

I n March 2023, the Group extended the GBP20 million facility

with Lloyds Banking Group Plc for 6 months to 31 May 2024 and the

GBP31 million facility with National Westminster Bank Plc for 3

months to June 2024. It was agreed to renew discussions later in

the year in order to formalise new, longer-term facilities when

long-term rates have stabilised. However, management continues to

take a proactive approach to the maturity of these loans, and have

a close dialogue with the banks, with rates monitored on a

continuous basis to renew the facilities earlier if

appropriate.

Going concern

The consolidated financial statements for the Group have been

prepared on a going concern basis.

Long Term Incentive Plan ("LTIP")

The Company's LTIP is designed to incentivise and reward

employees in reaching specific goals that lead to increased

shareholder value and maximised returns. Based on the results for

the year, 50% of the options awarded for 2020 are likely to vest

and so a charge to the provision of GBP150,000 (FY 2021:

GBP150,000) has been made in the accounts in respect of the

LTIP.

Taxation

The Group converted to a Real Estate Investment Trust (REIT) on

1 January 2015. Under REIT status the Group does not pay tax on its

rental income profits or on gains from the sale of investment

properties. The Group continues to meet all REIT requirements for

REIT status.

Dividend

Under the REIT status the Group is required to distribute at

least 90% of rental income taxable profits arising each financial

year by way of a Property Income Distribution. Quarterly dividends

commenced in 2016.

Despite uncertainty in the property markets throughout 2022 and

significant disposals by REI, the Company's dividend payments

continued uninterrupted with the first two quarterly dividend

payments in respect of 2022 paid at a level of 0.8125p per share,

fully covered. The Q3 2022 dividend was reduced to 0.4375p per

share due to the acceleration of disposals.

The final dividend in respect of 2022 is confirmed as 0.4375p

per share, reflecting a total fully-covered uninterrupted dividend

payment for 2022 of 2.5p (FY 2021: 3.0625p) (which would be the

basis for the dividend for FY2023, subject to the pace of further

disposals) and a yield of 8.8% based on a mid-market opening price

of 28.25p on 27 March 2023. This takes the total declared/paid to

shareholders since the commencement of our dividend policy in 2012

to GBP46.3 million.

The dividend will be paid on 28 April 2023 as a Property Income

Distribution (PID), to all shareholders on the register as at 11

April 2023 with an ex-dividend date of 6 April 2023. The Board

remains committed to paying a covered dividend, subject to business

performance and the pace of further disposals.

Marcus Daly, Finance Director

27 March 2023

Real Estate Investors plc

Consolidated statement of comprehensive income

For the year ended 31 December 2022

Note 2022 2021

GBP000 GBP000

Revenue 13,293 15,971

Cost of sales (2,489) (3,329)

---------- ---------

Gross profit 10,804 12,642

Administrative expenses (3,252) (3,045)

Gain on sale of investment property 948 1,177

Gain in fair value of investment properties 3,152 4,951

---------- ---------

Profit from operations 11,652 15,725

Finance income 49 46

Finance costs (2,981) (3,235)

Gain on financial liabilities at fair value through profit and loss 2,214 1,388

---------- ---------

Profit on ordinary activities before taxation 10,934 13,924

Income tax charge - -

Net profit after taxation and total comprehensive income 10,934 13,924

---------- ---------

Total and continuing earnings per ordinary share

Basic 3 6.33p 7.76p

Diluted 3 6.25p 7.64p

EPRA 3 2.68p 3.67p

---------- ---------

The results of the Group for the year related entirely to

continuing operations.

Real Estate Investors plc

Consolidated statement of changes in equity

For the year ended 31 December 2022

Share Capital Share-based

Share premium redemption payment Retained

capital account reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2021 17,938 51,721 749 609 26,657 97,674

Share based payment - - - 150 - 150

Dividends - - - - (6,726) (6,726)

--------- --------- ------------ ------------- ---------- --------

Transactions with

owners - - - 150 (6,726) (6,576)

--------- --------- ------------ ------------- ---------- --------

Profit for the year

and total comprehensive

income - - - - 13,924 13,924

At 31 December 2021 17,938 51,721 749 759 33,855 105,022

--------- --------- ------------ ------------- ---------- --------

Share based payment - - - 150 - 150

Share buy back (714) - - - (1,296) (2,010)

Transfer re capital - - 714 - (714) -

Share issue 42 108 (150) - -

Dividends - - - - (5,131) (5,131)

Transactions with

owners (672) 108 714 - (7,141) (6,991)

--------- --------- ------------ ------------- ---------- --------

Profit for the year

and total comprehensive

income - - - - 10,934 10,934

At 31 December 2022 17,266 51,829 1,463 759 37,648 108,965

========= ========= ============ ============= ========== ========

Real Estate Investors plc

Consolidated statement of financial position

At 31 December 2022

Note 2022 2021

GBP000 GBP000

Assets

Non-current

Intangible assets - -

Investment properties 4 173,030 188,485

Property, plant and equipment 3 4

173,033 188,489

--------- ---------

Current

Inventories 2,389 2,384

Trade and other receivables 3,110 3,588

Derivative financial asset 68 -

Cash and cash equivalents 7,818 9,836

--------- ---------

13,385 15,808

--------- ---------

Total assets 186,418 204,297

========= =========

Liabilities

Current

Bank loans (20,325) (2,479)

Trade and other payables (5,982) (7,685)

--------- ---------

(26,307) (10,164)

--------- ---------

Non-current

Bank loans (51,146) (86,965)

Derivative financial liabilities - (2,146)

--------- ---------

(51,146) (89,111)

--------- ---------

Total liabilities (77,453) (99,275)

========= =========

Net assets 108,965 105,022

========= =========

Equity

Share capital 17,266 17,938

Share premium account 51,829 51,721

Capital redemption reserve 1,463 749

Share-based payment reserve 759 759

Retained earnings 37,648 33,855

-------- --------

Total Equity 108,965 105,022

======== ========

Net assets per share 63.1p 58.5p

======== ========

Real Estate Investors plc

Consolidated statement of cash flows

For the year ended 31 December 2022

2022 2021

GBP000 GBP000

Cash flows from operating activities

Profit after taxation 10,934 13,924

Adjustments for:

Depreciation 2 2

Net gain on valuation of investment property (3,152) (4,951)

Gain on sale of investment property (948) (1,177)

Share based payment 150 150

Finance income (49) (46)

Finance costs 2,981 3,235

Gain on financial liabilities at fair value through profit and loss (2,214) (1,388)

(Increase)/decrease in inventories (5) 1,412

Decrease in trade and other receivables 478 752

Decrease in trade and other payables (1,051) (100)

--------- ---------

Net cash from operating activities 7,126 11,813

--------- ---------

Cash flows from investing activities

Expenditure on investment properties (609) (955)

Purchase of property, plant and equipment (1) (2)

Proceeds from sale of investment properties 20,164 16,119

Interest received 49 46

--------- ---------

19,603 15,208

--------- ---------

Cash flows from financing activities

Interest paid (2,981) (3,235)

Share based payment - -

Share buy back (2,010) -

Equity dividends paid (5,783) (6,278)

Payment of bank loans (17,973) (11,910)

--------- ---------

(28,747) (21,423)

--------- ---------

Net (decrease)/increase in cash and cash equivalents (2,018) 5,598

Cash, cash equivalents and bank overdrafts at beginning of period 9,836 4,238

--------- ---------

Cash, cash equivalents and bank overdrafts at end of period 7,818 9,836

========= =========

NOTES:

Cash and cash equivalents consist of cash in hand and balances

with banks only.

Real Estate Investors plc

Notes to the preliminary announcement

For the year ended 31 December 2022

1. Basis of preparation

The financial statements have been prepared under the historical

cost convention, except for the revaluation of properties and

financial instruments held at fair value through profit and loss,

and in accordance with international accounting standards in

conformity with the requirements of the Companies Act 2006.

It should be noted that accounting estimates and assumptions are

used in preparation of the financial statements. Although these

estimates are based on management's best knowledge and judgement of

current events and actions, actual results may differ from those

estimates. The areas involving a higher degree of judgement or

complexity, or areas where assumptions and estimates are

significant to the financial statements, are set out in the Group's

annual report and financial statements.

The consolidated financial statements incorporate the financial

statements of the Company and its subsidiaries made up to 31

December each year. Material intra-group balances and transactions,

and any unrealised gains arising from intra-group transactions, are

eliminated on consolidation. Unrealised losses are also eliminated

unless the transaction provides evidence of an impairment of the

asset transferred.

The principal accounting policies are detailed in the Group's

annual report and financial statements.

Going concern

The Group has prepared and reviewed forecasts and made

appropriate enquiries which indicate that the Group has adequate

resources to continue in operational existence for the foreseeable

future, being a period of 12 months from the date of approval of

these financial statements to 31 March 2024. These enquiries

considered the following:

-- the significant cash balances the Group holds and the low

levels of historic and projected operating cash outflows

-- any property purchases will only be completed if cash

resources or loans are available to complete those purchases

-- the Group's bankers have indicated their continuing support

for the Group. In March 2023 the Group extended the GBP20 million

facility with Lloyds Banking Group Plc for 6 months to 31 May 2024

, whilst continuing negotiations to extend the facility by a

further 3 years.

-- In March 2023 the Group extended the facility of GBP31

million with National Westminster Bank PLC by a further 3 months to

June 2024.

-- The directors have at the time of approving these financial

statements, a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future being a period of not less than 12 months from the date of

approval of these financial statements.

For these reasons, the Directors continue to adopt the going

concern basis in preparing the financial statements.

2. Gross profit

2022 2021

GBP000 GBP000

Revenue Rental income 12,725 13,934

Sale of inventory property - 1,225

Surrender premiums 568 812

-------- --------

13,293 15,971

-------- --------

Cost of sales Direct costs (2,489) (1,932)

Cost of inventory stock - (1,397)

-------- --------

10,804 12,642

-------- --------

3. Earnings per share

The calculation of earnings per share is based on the result for

the year after tax and on the weighted average number of shares in

issue during the year.

Reconciliations of the earnings and the weighted average numbers

of shares used in the calculations are set out below.

2022 2021

Average Average

number of Earnings per number of Earnings

Earnings shares Share Earnings shares per share

GBP000 GBP000

Basic earnings per share 10,934 172,651,577 6.33p 13,924 179,377,898 7.76p

Dilutive effect of share options - 2,312,675 - - 2,883,365 -

--------- ------------ ------------- ----------- ------------ -----------

Diluted earnings per share 10,934 174,964,252 6.25p 13,924 182,261,263 7.64p

========= ============ ============= =========== ============ ===========

The European Public Real Estate Association indices below have

been included in the financial statements to allow more effective

comparisons to be drawn between the Group and other business in the

real estate sector.

EPRA EPS per share

2022 2021

Earnings Earnings

Earnings Shares per share Earnings Shares per share

GBP000 No p GBP000 No P

Basic earnings per share 10,934 172,651,577 6.33 13,924 179,377,898 7.76

Net gain on valuation of investment

properties (3,152) (4,951)

Gain on disposal of investment

properties (948) (1,177)

Loss on sale of inventory properties - 172

Gain in fair value of derivatives (2,214) (1,388)

--------- -----------

EPRA earnings per share 4,620 172,651,577 2.68 6,580 179,377,898 3.67

========= ===========

NET ASSET VALUE PER SHARE

The Group has adopted the new EPRA NAV measures which came into

effect for accounting periods starting 1 January 2020. EPRA issued

new best practice recommendations (BPR) for financial guidelines on

its definitions of NAV measures. The new NAV measures as outlined

in the BPR are EPRA net tangible assets (NTA), EPRA net

reinvestment value (NRV) and EPRA net disposal value (NDV).

The Group considered EPRA Net Tangible Assets (NTA) to be the

most relevant NAV measure for the Group and we are now reporting

this as our primary NAV measure, replacing our previously reported

EPRA NAV and EPRA NNNAV per share metrics. EPRA NTA excludes the

intangible assets and the cumulative fair value adjustments for

debt-related derivatives which are unlikely to be realised.

31 December 2022

EPRA NTA EPRA NRV EPRA NDV

GBP'000 GBP'000 GBP'000

Net assets 108,965 108,965 108,965

Fair value of derivatives (68) (68) -

Real estate transfer tax - 11,245 -

EPRA NAV 108,897 120,142 108,965

------------ ------------ ------------

Number of ordinary shares issued for diluted and EPRA net assets per share 174,964,252 174,964,252 174,964,252

EPRA NAV per share 62.2p 68.7p 62.3p

============ ============ ============

The adjustments made to get to the EPRA NAV measures above are

as follows:

-- Real estate transfer tax: Gross value of property portfolio

as provided in the Valuation Certificate (i.e. the value prior to

any deduction of purchasers' costs).

-- Fair value of derivatives: Exclude fair value financial

instruments that are used for hedging purposes where the company

has the intention of keeping the hedge position until the end of

the contractual duration.

31 December 2021

EPRA NTA EPRA NRV EPRA NDV

GBP'000 GBP'000 GBP'000

Net assets 105,022 105,022 105,022

Fair value of derivatives 2,146 2,146 -

Real estate transfer tax - 13,127 -

----------------------------------------------------------------------------

EPRA NAV 107,168 120,295 105,022

---------------------------------------------------------------------------- ------------ ------------ ------------

Number of ordinary shares issued for diluted and EPRA net assets per share 182,261,263 182,261,263 182,261,263

EPRA NAV per share 58.8p 66.0p 57.6p

============================================================================ ============ ============ ============

31 December 2022 31 December 2021

No of Shares No of Shares

Number of ordinary shares issued at end of period 172,651,577 179,377,898

Dilutive impact of options 2,312,675 2,883,365

Number of ordinary shares issued for diluted and EPRA net assets per share 174,964,252 182,261,263

----------------- -----------------

Net assets per ordinary share

Basic 62.2p 58.8p

Diluted 68.7p 66.0p

----------------- -----------------

EPRA NTA 62.3p 57.6p

================= =================

4. Investment properties

Investment properties are those held to earn rentals and for

capital appreciation.

The carrying amount of investment properties for the periods

presented in the consolidated financial statements is reconciled as

follows:

GBP000

Carrying amount at 1 January 2021 197,520

Additions - subsequent expenditure 955

Disposals (14,941)

Change in fair value 4,951

---------

Carrying amount at 31 December 2021 188,485

Additions - subsequent expenditure 609

Disposals (19,216)

Change in fair value 3,152

Carrying amount at 31 December 2022 173,030

=========

5. Publication

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. The consolidated statement

of financial position at 31 December 20 22 and the consolidated

statement of comprehensive income, the consolidated statement of

changes in equity, the consolidated statement of cash flows and the

associated notes for the year then ended have been extracted from

the Group's financial statements upon which the auditor's opinion

is unqualified and does not include any statement under section 498

of the Companies Act 2006. The statutory accounts for the year

ended 31 December 20 22 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

6. Copies of the announcement

Copies of this announcement are available for collection from

the Company's offices at 2(nd) Floor, 75-77 Colmore Row,

Birmingham, B3 2AP and from the Company's website at www.reiplc.com

. The report and accounts for the year ended 31 December 2022 are

available from the Company's website and will be posted to

shareholders in May 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEDFMWEDSEDD

(END) Dow Jones Newswires

March 28, 2023 02:00 ET (06:00 GMT)

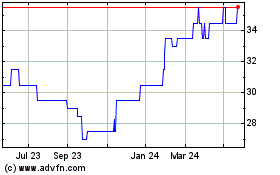

Real Estate Investors (AQSE:RLE.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

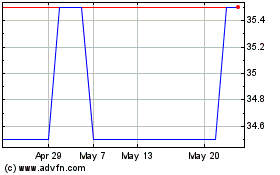

Real Estate Investors (AQSE:RLE.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024