TIDMRLE

RNS Number : 6385H

Real Estate Investors PLC

31 July 2023

Real Estate Investors Plc

("REI", the "Company" or the "Group")

TRADING UPDATE AND NOTICE OF INTERIM RESULTS

ONGOING SALES, DEBT REPAYMENT & FULLY COVERED DIVIDEND

Real Estate Investors Plc (AIM: RLE), the UK's only

Midlands-focused Real Estate Investment Trust (REIT) with a

portfolio of commercial property across all sectors, is pleased to

provide the following trading update:

DISPOSALS - DELIVERING ON SALES STRATEGY

-- Private investors and owner occupiers have remained active,

allowing us to secure sales - breaking up parades and feeding

demand for smaller assets, despite the challenging macro

environment

-- Year to date disposals of GBP8.7 million (comprising of 11

retail units, 1 mixed retail and office asset and a piece of land

for drive-thru pod development) at an aggregate uplift of 11.7%,

pre-costs, to December 2022 book value

-- Further pipeline of sales in solicitors' hands and we intend

to complete sales to generate receipts to reduce portfolio debt and

execute our strategy

-- We have now achieved total sales of GBP46.55 million from 1 January 2021 to date

DEBT POSITION - INCREASED LIQUIDITY & RETURN ON DEPOSITS

-- Our priority has remained to repay debt with a view to reducing portfolio gearing levels

-- As at 28 July 2023, debt repayment of GBP7.3 million,

reducing total drawn debt to GBP64.2m (FY 2022: GBP71.5

million)

-- Pro-forma loan to value (net of cash) now 34.7% (FY 2022:

36.8%) based on 31 December 2022 valuations

-- Company is maximising returns on cash reserves, with monies

on deposit earning 3.4% at present

-- Average cost of debt maintained at 3.7% (FY 2022: 3.7%)

-- Company's debt is 100% fixed, with a b lended debt profile

term of 17 months. Plans agreed with Royal Bank of Scotland and

Lloyds to begin facility negotiations in Q4 2023

-- As at 30 June 2023, hedge facility had improved by GBP388,000 year-to-date

PORTFOLIO ACTIVITY - HEALTHY PIPELINE OF LETTINGS

-- We have experienced slow occupier decision making since the

year end, however, due to our healthy pipeline of lettings, and

with our further scheduled sales, we anticipate improved contracted

rental income, WAULT and occupancy (over the remainder of the

year), which will further reduce our void costs and support future

covered dividend payments

-- Example key lease event in H1 2023 - AFH Private Wealth, with

18 months left on their lease, took out a new lease for 11.5-years

at the passing rent of GBP396,077 per annum (at ERV) with no break,

now occupying all 25,000 sq ft at Avon House, Bromsgrove

-- Robust rent collection levels for Q2 2023 (March-June) of 99.93%

-- Contracted rental income of GBP12.5 million per annum as at

30 June 2023, due to disposals in line with strategy (FY 2022:

GBP12.6m)

-- Portfolio occupancy of 85.04% as at 30 June 2023 (FY 2022:

84.54%), with potential to rise further as key pipeline lettings

are completed (subject to ongoing sales and ongoing portfolio lease

activity)

ATTRACTIVE, FULLY COVERED DIVIDEND

-- Fully covered dividend for Q1 2023 of 0.625p per share (Q1 2022: 0.8125p per share)

-- GBP47.4 million total declared/paid to shareholders since

commencement of dividend policy in 2012

NOTICE OF INTERIM RESULTS

The Company will release its interim results for the six months

ended 30 June 2023 on 25 September 2023.

PAUL BASSI, CHIEF EXECUTIVE, COMMENTED:

"During H1 we have seen unfavourable and unstable market

conditions for the real estate market, including monthly interest

rate rises, stubbornly high inflation and no end to the war in

Ukraine. Despite these challenges, the REI portfolio remains stable

and we have enjoyed high rent collection, sales of GBP8.7 million,

debt reduction of GBP7.3 million and paid a fully covered Q1

dividend of 0.625p.

Continued interest rate rises, coupled with a poor investment

market have the potential to negatively impact property values,

though our asset management approach should combat some of this

downward pressure. The portfolio is not exposed to large-scale city

centre offices, assets that are particularly at risk.

In the absence of consolidation opportunities that meet the

needs of shareholders and the necessary market conditions to

support portfolio growth, the Company's strategy remains to make

opportunistic and targeted sales and reduce debt further. The

Company will maintain maximum flexibility when considering all

future options, including a return of capital, special dividend to

shareholders or further share buybacks, with the view to maximising

shareholder returns. Alternatively, if the environment for

acquisitions changes and opportunities offering significant value

start to arise, then we may look to make opportunistic

acquisitions, where there is scope to capture material upside

through asset management. The Board evaluates the relative merits

of these options on an ongoing basis."

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the UK version of the EU Market Abuse Regulation

(2014/596) which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended and supplemented from time to

time.

Enquiries:

Real Estate Investors Plc

Paul Bassi/Marcus Daly +44 (0)121 212 3446

Cenkos Securities (Nominated Adviser)

Katy Birkin/Ben Jeynes +44 (0)20 7397 8900

Liberum (Broker)

Jamie Richards/William King +44 (0)20 3100 2000

About Real Estate Investors Plc

Real Estate Investors Plc is a publicly quoted, internally

managed property investment company and REIT with a portfolio of

mixed-use commercial property, managed by a highly-experienced

property team with over 100 years of combined experience of

operating in the Midlands property market across all sectors. The

Company's strategy is to invest in well located, real estate assets

in the established and proven markets across the Midlands, with

income and capital growth potential, realisable through active

portfolio management, refurbishment, change of use and lettings.

The portfolio has no material reliance on a single asset or

occupier. On 1st January 2015, the Company converted to a REIT.

Real Estate Investment Trusts are listed property investment

companies or groups not liable to corporation tax on their rental

income or capital gains from their qualifying activities. The

Company aims to deliver capital growth and income enhancement from

its assets, supporting its dividend policy. Further information on

the Company can be found at www.reiplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFITDDIIVIV

(END) Dow Jones Newswires

July 31, 2023 02:00 ET (06:00 GMT)

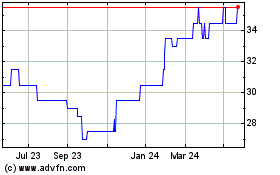

Real Estate Investors (AQSE:RLE.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

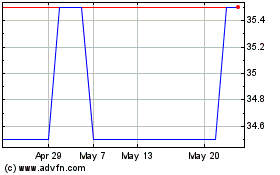

Real Estate Investors (AQSE:RLE.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024