TIDMSUS

RNS Number : 3926W

S & U PLC

12 December 2023

12 December 2023

S&U plc

("S&U" or "the Group")

TRADING STATEME NT

S&U, the specialist motor and property financier, today

announces its trading update for the period from 1 August 2023 to

11 December 2023.

Following a very good first half, S&U continues to make

steady, if more cautious, progress despite the "current economic,

tax and regulatory burdens weighing on business" we reported at

half year. Thus, Group net receivables now stand at GBP446 million

(December 2022: GBP404 million) against GBP417 million at half

year. Net receivables in Advantage, our motor finance business, are

up GBP14 million in the period and GBP31 million on a year ago and

stand at GBP327 million.

At Aspen, our Property Bridging lender, the net receivables are

up GBP15 million in the period and GBP11 million on a year ago and

stand at GBP119 million. These levels of activity and payment of

the interim dividend have seen Group borrowing increase from GBP184

million at half year to GBP209 million now. This compares with

GBP180 million a year ago and with Group committed facilities of

GBP280 million.

Nevertheless, caution is necessary. Those burdens weighing on

business are reflected in a lack of consumer confidence,

cost-of-living pressures, persistently higher rates of interest,

and a new raft of regulation, all of which inevitably affect

profitability.

Further out, an anaemic outlook for growth in the UK, recently

predicted by both the Office for Budget Responsibility and by the

Governor of the Bank of England, combined with restrained growth in

household expenditure over the next two years, make S&U's focus

on working with our customers, credit quality and appropriate

forbearance more essential than ever before. The volume of consumer

finance used-car market transactions fell by 5% in the year to

October 2023 according to the Finance and Leasing Association

("FLA"), whilst prices in the housing market remain subdued and, in

many areas, actually in retreat. Hence, whilst we remain ambitious

and optimistic, it would be unwise to plan for major growth until

these trends have stabilised and economic prospects improved.

Advantage Motor Finance

Although transaction numbers have picked up well in the period,

particularly in the higher tiers of customer quality which now make

up 45% of new business, collection rates have felt the impact of

the economic pressures mentioned earlier and live collections in

the period were 91% of due (H1 23: 94%).

However, the number of bad debts and voluntary terminations in

the period continued below budget, as it was in the first half

year. Much of this has resulted from Advantage's long experience in

adapting to customer circumstances offset by higher living costs

and the need to codify and adapt to the requirements of the FCA's

Consumer Duty introduced at half year.

This Duty forms part of a regulatory regime, encompassing

forbearance, affordability and customer vulnerability, which for

S&U stretches back over 50 years to our obligations under the

Consumer Credit Act. More recently, these have been supplemented by

a significant influx of consumer regulation from the Financial

Conduct Authority as set out in its Principles for Business,

Consumer Credit Source Book, its "Dear CEO" letters, the Borrowers

in Financial Difficulty review, its Tailored Support

Guidance..........and now by the Consumer Duty. As a consequence,

attempting to reconcile and interpret the policy, process and

operational requirements of these dictates has now become a major,

often subjective and expensive process.

Following the FCA's special focus on Borrowers in Financial

Difficulty (BiFD) in non-prime motor finance, the "review of

Advantage's, collecting processes, procedures and policies" we

noted at half year, has developed into a more formal interaction

with the FCA. Along with many other lenders in our market segment,

Advantage has appointed a Skilled Person. They are tasked, where

necessary, to advise and guide Advantage in delivering, these

regulatory requirements. This may be a lengthy and costly process,

but it should prove valuable in providing assurance on our

longstanding methods of serving our customers, and ensuring, that

our products continue to meet their differing needs. These methods

have been validated by Advantage's excellent record with the

Financial Ombudsman Service which at an uphold rate of just 15% is,

by some margin, the best in the motor finance industry.

This will provide both challenges and opportunities and, in

paying tribute to the professionalism, patience and fortitude of

our people at Advantage and to the leadership of Graham Wheeler,

our retiring CEO, it gives me the opportunity to welcome his

successor, Karl Werner, at an important and ultimately rewarding

time.

Aspen Property Bridging Finance

Whatever the current headwinds in the U.K.'s residential

property market, Aspen, our dynamic bridging lender, continues to

make solid progress. Although, compared to the same period last

year, increased interest costs which inherently take time to

reflect in the pricing of the book, have put a break on recent

profit growth, the outlook for interest rates and bridging

transactions has improved in the period.

Collections in the period have continued to perform well and the

number and value of extended or technically defaulted loans is 16,

similar to the 15 we reported at the half year. Repayments in the

past four months are an encouraging 20% above budget. At present

around 55% of business is conducted in London and the South-east

where refurbishment and tenant demand remains strong.

Recent trends on prospective business are also encouraging. The

Aspen pipeline of new cases is at a record level and 30% above

budget. Overall, Aspen is sensibly and steadily fulfilling the

potential we foresaw at its founding seven years ago.

Funding

Group committed facilities of GBP280 million, against current

borrowing of GBP209 million, comfortably allow for the cautious and

sustainable growth we anticipate for S&U over the next

year.

Outlook

Commenting on the Group's performance and outlook, Anthony

Coombs, S&U chairman, said:

"It would be foolish to underestimate the obstacles all

businesses face in times of feeble growth, pressures on the

consumer, high taxation and inflation, and regulatory changes and

political uncertainty. Fortunately, this cocktail of challenges

will be met with S&U's long-standing experience, ingenuity,

expertise, decency and sheer hard work, allowing the Group to

emerge as successful and as strong as ever."

For further information, please contact:

Enquiries S&U plc c/o SEC Newgate

Anthony Coombs

Financial Public Relations

Bob Huxford, Molly Gretton, Harry

Handyside SEC Newgate 020 7653 9848

--------------- ----------------

Broker

Andrew Buchanan, Adrian Trimmings,

Sam Milford Peel Hunt LLP 020 7418 8900

--------------- ----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBLBDDLUBDGXB

(END) Dow Jones Newswires

December 12, 2023 02:00 ET (07:00 GMT)

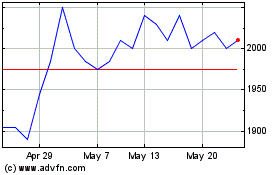

S and U (AQSE:SUS.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

S and U (AQSE:SUS.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024