TIDMTHRU

RNS Number : 8905T

Thruvision Group PLC

20 November 2023

20 November 2023

Thruvision Group plc

Interim Results

Thruvision Group plc (AIM: THRU, "Thruvision" or the "Group"),

the leading provider of walk-through security technology, today

announces unaudited results for the six months ended 30 September

2023 (H1 of 2024 financial year - H1 2024) .

Highlights

-- Revenue grew 28% to GBP3.5 million (H1 2023: GBP2.8 million) driven mainly by:

-- Customs market revenue growing 16% to GBP2.0 million (H1 2023: GBP1.7 million) underpinned

by a major contract win with a new Asian customer.

-- Entrance security market seeing renewed demand with revenue increasing to GBP0.8 million (H1

2023: GBP0.04 million).

-- Adjusted gross margin(1) up 5.0pp to 53.9% (H1 2023: 48.9%) helped by particularly positive

pricing mix.

-- Adjusted EBITDA loss(1) reduced slightly to GBP1.4 million (H1 2023: loss GBP1.6 million).

-- Cash balance at 30 September 2023 was GBP2.4 million (31 March 2023: GBP2.8 million).

-- GBP3.2 million (gross) equity fund raising on 26 October 2023 from Pentland Group amongst

other investors to support continued investment in sales and marketing capability and delivering

key new software functionality as well as providing additional working capital flexibility

and strengthening the balance sheet.

-- Pentland Group, owner of numerous consumer brands and majority shareholder in one of the Group's

longest-standing customers, JD Sports, has subsequently increased its strategic shareholding

to 10%.

H1 2024 H1 2023

Unaudited Unaudited

GBPm GBPm Change

------------------------------------- ---------------------------------- -------------- -----------

Adjusted measures(1) :

Adjusted gross profit 1.9 1.4 +41%

Adjusted gross margin 53.9% 48.9% +5.0pp

Adjusted EBITDA loss (1.4) (1.6) +11%

Adjusted loss before tax (1.6) (1.8) +11%

Statutory measures:

Revenue 3.5 2.8 +28%

Gross profit(2) 1.6 1.1 +47%

Gross margin(2) 45.7% 39.8% +5.9pp

Operating loss (1.6) (1.9) +18%

Loss before tax (1.6) (1.9) +17%

------------------------------------- ---------------------------------- -------------- -----------

(1) Alternative performance measures ('APMs') are used

consistently throughout this announcement and are referred to as

'adjusted'. These are defined in full and reconciled to the

reported statutory measures in the Appendix.

(2) As restated see note 5 in the interim financial

statements.

Commenting on the results, Colin Evans, Chief Executive of

Thruvision, said:

"Our proven track record in a number of international markets

has allowed us to deliver a resilient performance despite the US

Customs setback that we reported in October. In addition to further

new Customs agency wins elsewhere, we have seen a marked pick-up in

activity in our Entrance Security market, driven by heightened

geopolitical tension. To capitalise fully on this, we are

accelerating our appointment of new Value-Added Resellers to

broaden our reach geographically.

"Given JD Sports' history as a long-term Thruvision customer,

Pentland Group's strategic investment provided a clear endorsement

of the value of our technology, particularly for the retail market.

This strengthening of the balance sheet, combined with our order

backlog and healthy sales pipeline, gives us confidence that we

will grow strongly into the second half and beyond."

For further information please contact:

Thruvision Group plc +44 (0)1235 425 400

Colin Evans, Chief Executive

Victoria Balchin, Chief Financial Officer

Investec Bank plc +44 (0)20 7597 5970

Patrick Robb / James Rudd / Sebastian Lawrence

Meare Consulting +44 (0)7990 858 548

Adrian Duffield

About Thruvision

Thruvision is the leading developer, manufacturer and supplier

of walk-through security technology. Its technology is deployed in

more than 20 countries around the world by government and

commercial organisations in a wide range of security situations,

where large numbers of people need to be screened quickly, safely

and efficiently. Thruvision's patented technology is uniquely

capable of detecting concealed objects in real time using an

advanced AI-based detection algorithm. The Group has offices and

manufacturing capabilities in the UK and US.

Important information

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

Interim report

Headlines

The Group demonstrated a resilient performance in the six-month

period to 30 September 2023. The business performed well and

benefited from increasing demand from a broader base of customers,

mainly as a result of a deteriorating security environment

globally.

Revenue grew by 28% to GBP3.5 million (H1 2023: GBP2.8 million),

with an order backlog at 30 September of GBP1.0 million expected to

be delivered in the third quarter. Cash at 30 September 2023 was

GBP2.4 million (31 March 2023: GBP2.8 million).

In particular, we saw increased international government

activity, including initial orders from two new Customs agencies

and renewed focus on improving entrance security across government

and non-government customers. We continued to make good progress in

R&D ahead of a planned new product launch later this financial

year.

Broader US Federal budget challenges meant that, as we reported

in October, CBP did not place an anticipated order by the end of

the first half. We remain engaged with them to ensure that they

derive maximum value from our technology and are in a position to

resume purchasing when the current border crisis allows.

Strategic update

Our strategy is to build on our market-leading position as a

developer, manufacturer and supplier of walk-through security

technology. We aim to become a mainstream provider to, and increase

our market-share in, a number of growing and established

international markets. The continued investment in improving our

patented AI-enhanced Terahertz (THz) imaging technology will

maintain our significant competitive advantage.

The increased geopolitical instability around the world has

added further impetus to the Entrance Security market where

organisations are looking for proven capability to detect weapons

and explosives. This market was somewhat dormant through COVID, but

our strong brand and proven capability has meant we have seen

growing interest and demand in the last few months.

Retailers continue to manage a wide range of conflicting

priorities, including the challenging economic backdrop which is

impacting their investment plans. Our recently published UK-focused

research, undertaken with Retail Economics, shows retail theft is

forecast to be GBP7.9bn this year with some 40% of this

attributable to employees. We continue to focus on retailers who

recognise that Thruvision offers an effective and easy to install

way to reduce, and deter, employee theft while providing an

attractive in-year return on investment.

We are seeing continued interest from Customs agencies

internationally. This is driven by the ongoing focus on border

control and migration management and counter-narcotics

operations.

Given the increasing awareness of our unique technology and

growing demand from an increasing number of countries , we have

accelerated the process of appointing Value-Added Resellers (VARs)

to support the international opportunities and our widening

geographical footprint across Europe, Middle East and Asia.

Strategic investor and fund raising

On 26 October 2023, the Group raised GBP3.2 million gross in new

equity to support its continued investment in sales and marketing

capability and delivering key new software functionality as well as

providing additional working capital flexibility and strengthening

the balance sheet.

After starting discussions earlier in the summer, Pentland Group

became a strategic investor in the Group through this fund-raising.

JD Sports, which is majority owned by Pentland Group, was one of

Thruvision's earliest customers and remains a strong advocate of

our technology. Pentland Group's strategic investment is a clear

endorsement of our capabilities and demonstration of the value of

our technology, particularly for the retail market.

Current trading and outlook

Business performance is resilient and demonstrating good levels

of non-CBP growth. With geopolitical risks driving a strong

bounce-back performance in our Entrance Security market, and

continued strategic progress in Retail Distribution, our unique

technology is being successfully used by a growing number of major

international organisations.

As we outlined on 2 October 2023, the anticipated order from CBP

was not awarded in September which reduced our expectations for the

Group's full year revenue.

However, the recent strengthening of the balance sheet, combined

with our order backlog and healthy sales pipeline, gives us

confidence that we will grow strongly into the second half and

beyond .

Operational review

We operate in four distinct markets where there is the need to

detect, quickly and reliably, a range of different items being

concealed in clothing. These markets are driven by different

factors and protect us against changing political and economic

circumstances.

Customs

Our Customs market revenue grew by 16%, underpinned by a major

contract win with a new Asian customer and another from a new

Central American customs agency, maintaining our momentum in this

global market. In addition, we are expecting further orders in H2

with existing Asian customers who are intending to augment and/or

upgrade their existing fleets of Thruvision units.

Retail Distribution

In Retail Distribution, the Group added new customers including

GXO, the global logistics provider, and TD Synnex, a global

technology provider. We continue to receive orders from existing

customers in the UK and Europe and expand our sales pipeline with

new names in the US. With a new product launch planned later this

year, we expect to see further upgrading by existing customers

moving forward.

On 13 November 2023, Thruvision and Retail Economics published a

report which forecast that the overall theft would cost UK

retailers some GBP7.9bn this year, with employee theft accounting

for some 40% of this total. Around two thirds of those interviewed

in the survey believe that over the past decade the opportunity for

crime in DCs has accelerated and 70% state that they have seen an

increase in organised crime activities in DCs.

Our technology specifically addresses this major problem for

retailers and we expect this report to stimulate further interest

in Thruvision given the proven, rapid return on investment that we

can demonstrate.

Entrance Security

Given the general deterioration in the international security

situation, we have seen increased interest and sales activity in

VIP locations, prisons, critical national infrastructure sites,

natural resources and high security buildings. This interest is

driven by the heightened threat, once more, of weapons and

explosives being brought into facilities, and the fact that

Thruvision is recognised as a fully proven means of detecting such

items at a safe distance.

We secured new customers in Africa and Asia and have seen

further order flow from existing Middle East customers in H1 and

since the period end. The current level of sales enquiries suggest

that this is set to continue into the second half.

Encouraged by this broadening demand, we are accelerating the

rate at which we sign-up regional VARs, focusing on those that new

team members have worked with successfully in the past. This

ensures that we can be confident that these new partners bring

strong relationships with organisations we wish to focus on and

excellent technical capability in terms of supporting our equipment

in the field once deployed.

Aviation

With a formal change in US Government policy now in progress, US

airports are soon to be required to upgrade their approach to the

security screening of staff as they go to work on the "airside" of

an airport. Although in the early stages of development, this

opportunity is expected to mature over the next two years and,

based on the four years of operational experience we have gained

with Seattle Tacoma International Airport, we are very well placed

to provide approved technology to meet this requirement.

Although we have an established solution for security screening

of employees in airports in the US, we require formal US Government

Transportation Security Administration accreditation to compete

with airport body scanners for the passenger screening market. We

started this process in 2020 and, after several COVID-related

delays, it has now restarted. Some further progress has been made

although this remains a protracted process.

Product R&D and Intellectual Property ('IP')

We remain on track to launch our next generation camera range

early in 2024. This will provide an upgraded hardware platform in

addition to new software functionality which will be offered on a

chargeable annual licence basis.

Financial review

Summary

Revenue for the six months ended 30 September 2023 was up 28% to

GBP3.5 million (H1 2023: GBP2.8 million) principally driven by

significant growth in Entrance Security sales. On a constant

currency basis revenue was up 29%.

Adjusted EBITDA loss improved by 11% or GBP0.2 million to GBP1.4

million (H1 2023: loss GBP1.6 million), with adjusted gross profit

growth up GBP0.5 million to GBP1.9 million (H1 2023: GBP1.4

million) more than offsetting overheads which were up, as planned,

by GBP0.3 million.

Adjusted gross margin improved by 5pp to 53.9% (H1 2023: 48.9%)

driven by a pricing mix benefit. Statutory gross margin was up

5.9pp to 45.7%. Operating loss was GBP1.6 million (H1 2023: loss

GBP1.9 million).

Cash as at 30 September 2023 was GBP2.4 million (31 March 2023:

GBP2.8 million), with cash as at 17 November 2023 of

GBP4.3 million. Trade and other receivables were GBP2.9 million

(31 March 2023: GBP4.3 million) and reflect the receipt of all

outstanding balances at 31 March from CBP during the period offset

by recent sales. Cash and the balance sheet more generally have

been strengthened following the fundraise on 26 October 2023.

Revenue

Revenue is split between the two principal activities below:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------- -------------- -------------- ----------

Product 3,404 2,364 11,782

Support and Development 141 407 638

------------------------- -------------- -------------- ----------

Total 3,545 2,771 12,420

------------------------- -------------- -------------- ----------

Revenue is split by market sector and geographical region

below:

6 months

ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

Revenue by market sector GBP'000 GBP'000 GBP'000

-------------------------- ------------- -------------- ----------

Retail Distribution 799 1,025 2,429

Customs 1,978 1,699 9,165

Aviation 6 12 246

Entrance Security 762 35 580

Total 3,545 2,771 12,420

-------------------------- ------------- -------------- ----------

6 months

ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

Revenue by geographical region GBP'000 GBP'000 GBP'000

-------------------------------- ------------- -------------- ----------

UK and Europe 974 990 2,249

Americas 235 1,759 9,223

Rest of World 2,336 22 948

Total 3,545 2,771 12,420

-------------------------------- ------------- -------------- ----------

Revenue was adversely impacted by translational exchange as the

GBP depreciated against the US$ and decreased revenue by

approximately GBP0.03 million, compared to the prior year average

exchange rate. This resulted in constant currency growth in revenue

of 29% and reported revenue growth of 28%.

Gross profit

Adjusted gross profit improved by GBP0.5 million with a volume

impact of GBP0.3 million and mix impact of GBP0.2 million.

Adjusted gross margin improved by 5.0pp to 53.9% (H1 2023:

48.9%) and reflected the positive price mix. Statutory gross margin

was 5.9pp higher at 45.7% (H1 2023: 39.8%) also reflecting

operational leverage.

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------ -------------- -------------- ----------

Revenue 3,545 2,771 12,420

Adjusted gross profit 1,912 1,356 6,401

Adjusted gross margin 53.9% 48.9% 51.5%

------------------------ -------------- -------------- ----------

Statutory gross profit 1,621 1,104 5,837

Statutory gross margin 45.7% 39.8% 47.0%

------------------------ -------------- -------------- ----------

Administrative expenses

Administrative expenses increased by 6% to GBP3.2 million with

overheads up by 13% to GBP3.0 million. As well as overheads,

administrative expenses include share-based payment charges or

credits, depreciation and amortisation and impairment of intangible

assets. Overheads as a proportion of sales were 86% (H1 2023: 98%;

2023: 49%) reflecting the growth and phasing of revenue and

continued tight control.

Higher sales and marketing expenditure was impacted by higher

sales commission resulting from the growth in orders. Management

costs decreased with one-off CFO replacement costs in the prior

period, whilst PLC costs were up due to higher insurance costs.

Property and administration costs were higher resulting mainly from

additional finance team headcount supporting growth in the

business.

Adjusted overheads are analysed as follows:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------- -------------- -------------- ----------

Sales and marketing 1,122 1,085 2,215

Engineering 607 589 1,270

Management 466 666 1,135

PLC costs 414 354 829

Property and administration 307 191 417

Bonus 47 20 458

Foreign exchange losses

/ (gains) 81 (203) (198)

------------------------------- -------------- -------------- ----------

Overheads 3,044 2,702 6,126

Depreciation and amortisation 205 238 569

Share based payment (credit)

/ charge (72) 51 96

Impairment of intangible

assets - - 36

Administrative expenses 3,177 2,991 6,827

------------------------------- -------------- -------------- ----------

Loss before and after tax and loss per share

Adjusted loss before tax of GBP1.6 million improved by 11% (H1

2023: loss GBP1.8 million) with statutory loss before tax of GBP1.6

million improving by 17% (H1 2023: loss GBP1.9 million).

Statutory loss after tax improved by 18% to a loss of GBP1.5 m

illion with the adjusted loss after tax of GBP1.6 million improving

by 11% (H1 2023: loss GBP1.8 million).

The loss per share and adjusted loss per share were 1.01 pence

and 1.06 pence respectively (H1 2023: loss per share and adjusted

loss per share of 1.23 pence and 1.19 pence respectively) and

reflected the movements in adjusted and statutory loss after

tax.

Cash flow

The decrease in cash and cash equivalents of GBP0.4 million to

GBP2.4 million at 30 September 2023 (30 September 2022: GBP1.1

million, 31 March 2023: GBP2.8 million) was driven by an operating

cash outflow before working capital of GBP1.4 million partly offset

by a net working capital inflow of GBP1.0 million and an R&D

tax credit received of GBP0.4m together with investing outflows and

financing outflows of GBP0.2 million each.

Movements in working capital in the period were:

-- Trade and other receivables decreased by GBP1.5 million, principally

driven by cash received from CBP of GBP2.7 million.

-- Increased inventory to support order backlog to be delivered

in the second half of the year resulted in a GBP0.3 million

outflow.

-- A decrease in trade and other payables resulted in an outflow

of GBP0.2 million. Trade creditors decreased due to the timing

of stock purchases.

On 26 October 2023, the Group completed a placing of 13,617,021

new ordinary shares of 23.5 pence per share raising GBP3.2 million

of gross proceeds. The net proceeds of the placing will be used for

continued investment in the Group's sales and marketing capability

and delivering key new software functionality. It will also provide

the Group with additional working capital flexibility and

strengthen the Group's balance sheet.

Other

A limited programme of share purchases by the Thruvision plc EBT

commenced on 1 April 2023 with the purpose of partly satisfying

future employee exercises of share options. During the period

455,029 shares in the Group were purchased by the EBT for total

consideration of GBP119,000.

Consolidated income statement

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2022 2022(1) 2023

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

------------------------- ------ ------------- ------------- ----------------

Revenue 2 3,545 2,771 12,420

Cost of sales (1,924) (1,667) (6,583)

------------------------- ------ ------------- ------------- ----------------

Gross profit 1,621 1,104 5,837

Administrative expenses (3,177) (2,991) (6,827)

Operating loss (1,556) (1,887) (990)

Financial income 25 11 26

Finance costs (37) (16) (15)

------------------------- ------ ------------- ------------- ----------------

Loss before tax (1,568) (1,892) (979)

Taxation credit 86 89 174

------------------------- ------ ------------- ------------- ----------------

Loss for the period (1,482) (1,803) (805)

------------------------- ------ ------------- ------------- ----------------

Loss per share

------------------------- ------ ------------- ------------- ----------------

Loss per share - basic

and diluted 3 (1.01p) (1.23p) (0.55p)

------------------------- ------ ------------- ------------- ----------------

All operations are continuing.

(1) As restated see note 5 to the interim financial

statements.

Consolidated statement of comprehensive income

6 months 6 months Year ended

ended ended

30 September 30 September 31 March 2023

2023 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ------------- ------------- --------------

Loss for the period attributable

to owners of the parent (1,482) (1,803) (805)

Other comprehensive loss

- items that may be subsequently

reclassified to profit or

loss:

------------------------------------ ------------- ------------- --------------

Exchange differences

on retranslation

of foreign operations (24) (45) (50)

Total comprehensive loss

attributable to owners of

the parent (1,506) (1,848) (855)

------------------------------------ ------------- ------------- --------------

Consolidated statement of financial position

at 30 September 2023

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- --------------- ------------- ------------

Assets

Non-current assets

Property, plant and equipment 1,210 962 1,173

Other intangible assets 116 140 109

------------------------------- ----- --------------- ------------- ------------

1,326 1,102 1,282

Current assets

Inventories 3,895 4,772 3,639

Trade and other receivables 2,851 3,813 4,342

Current tax receivable 81 302 375

Cash and cash equivalents 2,372 1,091 2,810

------------------------------- ----- --------------- ------------- ------------

9,199 9,978 11,166

------------------------------- ----- --------------- ------------- ------------

Total assets 10,525 11,080 12,448

Current liabilities

Trade and other payables (2,493) (2,399) (2,690)

Lease liabilities (132) (158) (121)

Provisions (102) (206) (107)

------------------------------- ----- --------------- ------------- ------------

(2,727) (2,763) (2,918)

------------------------------- ----- --------------- ------------- ------------

Net current assets 6,472 7,215 8,248

------------------------------- ----- --------------- ------------- ------------

Non-current liabilities

Trade and other payables (54) (69) (72)

Lease liabilities (557) (449) (604)

Provisions (38) (38) (38)

------------------------------- ----- --------------- ------------- ------------

(649) (556) (714)

------------------------------- ----- --------------- ------------- ------------

Total liabilities ( 3,376) (3,319) (3,632)

------------------------------- ----- --------------- ------------- ------------

Net assets 7,149 7,761 8,816

------------------------------- ----- --------------- ------------- ------------

Equity

Share capital 4 1,474 1,472 1,472

Share premium 352 308 325

Capital redemption reserve 163 163 163

Translation reserve (13) 16 11

Retained earnings 5,173 5,802 6,845

------------------------------- ----- --------------- ------------- ------------

Total equity attributable to

owners of the Company 7,149 7,761 8,816

-------------------------------------- --------------- ------------- ------------

Consolidated statement of changes in equity (unaudited)

Capital

Share Share redemption Translation Retained Total

capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- --------- ------------ --------------- ------------ -----------------

At 31 March 2022 1,466 201 163 61 7,554 9,445

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Shares issued 6 107 - - - 113

Share based payment

charge - - - - 51 51

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders 6 107 - - 51 164

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Loss for the period - - - - (1,803) (1,803)

Other comprehensive

loss - - - (45) - (45)

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

loss - - - (45) (1,803) (1,848)

------------------------ --------- --------- ------------ --------------- ------------ -----------------

At 30 September 2022 1,472 308 163 16 5,802 7,761

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Shares issued - 17 - - - 17

Share based payment

charge - - - - 45 45

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders - 17 - - 45 62

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Profit for the period - - - - 998 998

Other comprehensive

expense - - - (5) - (5)

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

(loss)/income - - - (5) 998 993

------------------------ --------- --------- ------------ --------------- ------------ -----------------

At 31 March 2023 1,472 325 163 11 6,845 8,816

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Shares issued 2 27 - - - 29

Purchase of own shares - - - - (119) (119)

Share based payment

credit - - - - (71) (71)

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders 2 27 - - (190) (161)

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Loss for the period - - - - (1,482) (1,482)

Other comprehensive

loss - - - (24) - (24)

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

loss - - - (24) (1,482) (1,506)

------------------------ --------- --------- ------------ --------------- ------------ -----------------

At 30 September

2023 1,474 352 163 (13) 5,173 7,149

------------------------ --------- --------- ------------ --------------- ------------ -----------------

Consolidated statement of cash flows

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------- ------------- ------------- -----------

Operating activities

Loss after tax (1,482) (1,803) (805)

Adjustments for:

Taxation credit (86) (89) (174)

Financial income (25) (10) (26)

Finance costs 37 16 15

Depreciation of property, plant

and equipment 227 258 619

Profit on disposal of property,

plant & equipment - (10) (10)

Amortisation of intangible assets 9 10 20

Impairment of intangible assets - - 36

Share-based payment (credit)

/ charge (72) 51 96

---------------------------------------- ------------- ------------- -----------

Operating cash outflow before

changes in working capital and

provisions (1,392) (1,577) (229)

Decrease / (increase) in trade

and other receivables 1,491 (1,811) (2,360)

Increase in inventories (256) (904) (183)

(Decrease) / increase in trade

and other payables (191) 26 321

(Decrease) / increase in provisions (5) 28 (71)

Cash utilised in operations (353) (4,238) (2,522)

Net income taxes received 380 - -

----------------------------------------- ------------- ------------- -----------

Net cash inflow / (outflow) from

operating activities 27 (4,238) (2,522)

----------------------------------------- ------------- ------------- -----------

Investing activities

Purchase of property, plant &

equipment (241) (26) (37)

Purchase of intangible assets (18) (70) (86)

Proceeds from disposal of property,

plant and equipment - 11 11

Interest received 25 10 26

Net cash outflow from investing

activities (234) (75) (86)

----------------------------------------- ------------- ------------- -----------

Financing activities

Proceeds from issues of shares 29 93 130

Purchase of own shares (119) - -

Payments on principal portion

of lease liabilities (93) (81) (180)

Other finance costs (12) - -

Interest paid on lease liabilities (23) (4) (15)

Net cash outflow from financing

activities (218) (89) (65)

----------------------------------------- ------------- ------------- -----------

Net decrease in cash and cash

equivalents (425) (4,305) (2,673)

----------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at beginning

of the period 2,810 5,441 5,441

Effect of foreign exchange rate

changes (13) (45) 42

----------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at

end of the period 2,372 1,091 2,810

----------------------------------------- ------------- ------------- -----------

Notes to the financial statements

1. Accounting policies

Basis of preparation

The consolidated interim financial statements include those of

Thruvision Group plc and all of its subsidiary undertakings

(together "the Group") drawn up at 30 September 2023 and have been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting" ("IAS 34") as adopted for use in the

European Union ("EU"). The consolidated interim financial

statements have been prepared using accounting policies and methods

of computation consistent with those applied in the consolidated

financial statements for the period ended 31 March 2023.

The Group is a public limited company incorporated and domiciled

in England & Wales and whose shares are quoted on AIM, a market

operated by The London Stock Exchange. All values are rounded to

GBP'000 except where otherwise stated.

Accounting policies

The annual consolidated financial statements of the Group are

prepared on the basis of International Financial Reporting

Standards ("IFRS"). The consolidated interim financial statements

are presented on a condensed basis as permitted by IAS 34 and

therefore do not include all the disclosures that would otherwise

be required in a full set of financial statements and should be

read in conjunction with the most recent Annual Report and Accounts

which were approved by the Board of Directors on 20 July 2023 and

have been filed with Companies House. The condensed interim

financial statements do not constitute statutory accounts as

defined in Section 435 of the Companies Act 2006 and are unaudited

for all periods presented. The financial information for the

12-month period ended 31 March 2023 is extracted from the financial

statements for that period. The auditors' report on those financial

statements was unqualified and did not contain an emphasis of

matter reference and did not contain a statement under section

498(2) or (3) of the Companies Act 2006 .

The half year results for the current period to 30 September

2023 have not been audited or reviewed by auditors pursuant to the

Auditing Practices Board guidance of Review of Interim Financial

Information.

Adoption of new and revised International Financial Reporting

Standards

The Group's accounting policies have been prepared in accordance

with IFRS effective as at its reporting date of

30 September 2023.

Standards Issued

The standards and interpretations that are issued up to the date

of issuance of the Group's interim financial statements are

disclosed below. The Group has adopted these standards, if

applicable, when these became effective. Further details are

disclosed in the 31 March 2023 Annual Report available on the

Group's website: www.thruvision.com.

Accounting developments - new standards, amendments and

interpretations issued and adopted

There were no new accounting standards or amendments requiring

disclosure in the period.

Going concern

The Group's loss before tax from continuing operations for the

period was GBP1.6 million (H1 2023: GBP1.9 million; FY 2023: GBP1.0

million). As at 30 September 2023 the Group had net current assets

of GBP6.5 million (30 September 2022: GBP7.2 million; 31 March

2023: GBP8.2 million) and cash and cash equivalents of GBP2.4

million (30 September 2022: GBP1.1 million; 31 March 2023: GBP2.8

million).

The Board has reviewed cash flow forecasts for the period up to

and including 31 December 2024. These forecasts and projections

take into account reasonably possible changes in trading

performance and show that the Group will be able to react as

required in order to operate within the level of current funding

resources, and no need for the Group to take on any debt. In order

to stress-test the adoption of the going concern basis, a cashflow

forecast was also produced which looked at the highly unlikely

scenario in which no further sales took place, other than delivery

of existing backlog, and certain discretionary areas of cash

expenditure were reduced. This showed that even under this extreme

condition, the Group would still have positive cash reserves as at

31 December 2024 with no need to take on external debt. The

Directors therefore believe there is sufficient cash available to

the Group to manage through these requirements. As with all

businesses, there are particular times of the year where the

Group's working capital requirements are at their peak. However,

the Group is well placed to manage business risk effectively and

the Board reviews the Group's performance against budgets and

forecasts on a regular basis to ensure action is taken where

needed.

The Directors therefore are satisfied that the Group has

adequate resources to continue operating for a period of at least

12 months from the approval of these accounts. For this reason,

they have adopted the going concern basis in preparing the

financial statements.

Notes to the financial statements (continued)

2. Segmental information

The Directors do not split the business into segments in order

to internally analyse the business performance. The Directors

believe that allocating overheads by department provides a suitable

level of business insight. The overhead department cost centres

comprise of engineering, sales and marketing, property and

administration, management and PLC costs, with the split of costs

as shown in the Financial Review on page 6.

Analysis of revenue by customer

There have been two (H1 2023: two; FY 2023: one) individually

material customer(s) (each comprising in excess of 10% of revenue)

during the period. These customers individually represented

GBP1,885k and GBP440k of revenue (H1 2023: GBP1,335k and GBP415k,

FY 2023: GBP8,268k).

The Group's revenue by market sector, geographical location and

type is detailed below:

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

Revenue by market sector GBP'000 GBP'000 GBP'000

-------------------------- -------------- -------------- ----------

Retail Distribution 799 1,025 2,429

Customs 1,978 1,699 9,165

Aviation 6 12 246

Entrance Security 762 35 580

Total 3,545 2,771 12,420

-------------------------- -------------- -------------- ----------

6 months 6 months Year ended

ended 30 ended 30 31 March

September September 2023

2023 2022

Unaudited Unaudited Audited

Revenue by geographical location GBP'000 GBP'000 GBP'000

---------------------------------- ----------- ----------- --------------

UK and Europe 974 990 2,249

Americas 235 1,759 9,223

Rest of World 2,336 22 948

3,545 2,771 12,420

---------------------------------- ----------- ----------- --------------

6 months ended 6 months ended Year ended

30 September 30 September 31 March

2023 2022 2023

Revenue by type GBP'000 GBP'000 GBP'000

------------------------- -------------- -------------- ----------

Product 3,404 2,364 11,782

Support and Development 141 407 638

------------------------- -------------- -------------- ----------

Total 3,545 2,771 12,420

------------------------- -------------- -------------- ----------

The Group's non-current assets by geography are detailed

below:

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------- -------------- -------------- -------------

UK 1,110 1,037 1,027

United States of America 216 65 255

1,326 1,102 1,282

-------------------------- -------------- -------------- -------------

Notes to the financial statements (continued)

2. Segmental information (continued)

The Group's revenue by type is detailed below:

6 months ended 6 months Year ended

30 September ended 30 31 March

2023 September 2023

2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------- --------------- ----------- --------------

Revenue recognised at point

in time 3,507 2,398 11,888

Revenue recognised over time

- extended warranty and support

revenue 38 373 532

3,545 2,771 12,420

---------------------------------- --------------- ----------- --------------

3. Loss per share

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

Loss after tax (GBP'000) (1,482) (1,803) (805)

----------------------------------- ------------- ------------- ----------------

Weighted average number of shares 147,292,757 147,097,721 147,138,774

----------------------------------- ------------- ------------- ----------------

Basic and diluted loss per share

(pence) (1.01p) (1.23p) (0.55p)

----------------------------------- ------------- ------------- ----------------

The inclusion of potential Ordinary Shares arising from LTIPs

and EMI Options would be anti-dilutive. Basic and diluted loss per

share has therefore been calculated using the same weighted number

of shares for each period.

4. Share capital

As 30 September 2023, there were 147,368,117 Ordinary Shares in

issue (30 September 2022: 147,165,718;

31 March 2023: 147,247,239). The Thruvision Group Plc Employee

Benefit Trust held 455,029 shares in the Company (30 September

2022: nil; 31 March 2023: nil).

On 26 October 2023, the Company issued 13,617,021 new Ordinary

Shares of 1 penny each at a premium of 22.5 pence each as part of

the placing for which gross proceeds of GBP3.2 million was

received. Following the placing, 161,015,138 Ordinary Shares were

in issue.

5. Restatement

In the audited results for the year ended 31 March 2023, gross

margin was restated to correctly classify certain fixed costs and

variable production overheads including production staff costs and

related overheads to cost of sales from administrative expenses.

The unaudited results for the six months ended 30 September 2022

have been restated accordingly to ensure comparability, with total

costs reclassified from administrative expenses to cost of sales of

GBP0.3 million. There is no impact on operating profit, basic and

diluted loss per share or the Statement of Financial Position.

6. Post balance sheet events

On 26 October 2023, the Group concluded a placing of 23.5 pence

per share raising GBP3.2 million of gross proceeds and issuing

13,617,021 new Ordinary Shares, including a significant strategic

investment from Pentland Capital.

APPIX - ALTERNATIVE PERFORMANCE MEASURES ('APMs')

Policy

Thruvision uses adjusted figures as key performance measures in

addition to those reported under IFRS, as management believe these

measures enable management and stakeholders to assess the

underlying trading performance of the businesses as they exclude

certain items that are considered to be significant in nature

and/or quantum.

The APMs are consistent with how the businesses' performance is

planned and reported within the internal management reporting to

the Board. Some of these measures are used for the purpose of

setting remuneration targets.

The key APMs that the Group uses include adjusted measures for

the income statement together with adjusted cash flow measures.

Explanations of how they are calculated and how they are reconciled

to an IFRS statutory measure are set out below.

Adjusted measures

The Group's policy is to exclude items that are considered to be

significant in nature and/or quantum, where the item is volatile in

nature and cannot be directly linked to underlying trading, and

where treatment as an adjusted item provides stakeholders with

additional useful information to better assess the period-on-period

trading performance of the Group.

The Group excludes certain items, which management have defined

as:

- Share based payments charge or credit

- Impairments of intangible assets

Gross profit, excluding production overheads is used to enable a

like-for-like comparison of underlying sales profitability.

Production overheads are excluded due to changes in product mix and

investments in the production team which have improved capacity and

therefore changes the labour and overhead absorption rates. This is

represented by adjusted gross profit.

Based on the above policy, the adjusted performance measures are

derived from the statutory figures as follows:

a) Adjusted gross profit

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------- ------------- ------------- ------------

Gross profit 1,621 1,104 5,837

----------------------- ------------- ------------- ------------

Add back:

Production overheads 291 252 564

----------------------- ------------- ------------- ------------

Adjusted gross profit 1,912 1,356 6,401

----------------------- ------------- ------------- ------------

b) Adjusted EBITDA

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ------------- ------------- ------------

Statutory operating loss (1,556) (1,887) (990)

--------------------------------- ------------- ------------- ------------

Add back:

Depreciation and amortisation 236 268 639

Impairment of intangible assets - - 36

Share-based payment (credit)

/ charge (72) 51 96

--------------------------------- ------------- ------------- ------------

Adjusted EBITDA (1,392) (1,568) (219)

--------------------------------- ------------- ------------- ------------

c) Adjusted loss before tax

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------- ------------- ------------- ------------

Statutory loss before tax (1,568) (1,892) (979)

--------------------------------- ------------- ------------- ------------

Add back:

Impairment of intangible assets - - 36

Share-based payment (credit)

/ charge (72) 51 96

--------------------------------- ------------- ------------- ------------

Adjusted loss before tax (1,640) (1,841) (847)

--------------------------------- ------------- ------------- ------------

d) Adjusted loss per share

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2023 2022 2023

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ------------- ------------- ------------

Statutory loss after tax (1,482) (1,803) (805)

----------------------------------- ------------- ------------- ------------

Add back:

Impairment of intangible assets - - 36

Share-based payment (credit)

/ charge (72) 51 96

----------------------------------- ------------- ------------- ------------

Adjusted loss after tax (1,554) (1,752) (673)

----------------------------------- ------------- ------------- ------------

Weighted average number of shares 147,292,757 147,097,721 147,138,774

----------------------------------- ------------- ------------- ------------

Statutory loss per share (pence) (1.01) (1.23) (0.55)

----------------------------------- ------------- ------------- ------------

Adjusted loss per share (pence) (1.06) (1.19) (0.46)

----------------------------------- ------------- ------------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DDLFFXFLLFBX

(END) Dow Jones Newswires

November 20, 2023 02:00 ET (07:00 GMT)

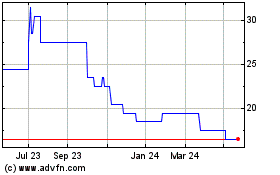

Thruvision (AQSE:THRU.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

Thruvision (AQSE:THRU.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025