TIDMTPT

RNS Number : 9451L

Topps Tiles PLC

06 January 2023

Amends formatting errors to sentence "In advance of the AGM, the

Company would like to provide the following additional key

information to its shareholders:" and "As previously announced, the

Requisitioned Resolutions served by MSG are as follows:" All other

information remains unchanged.

6 January 2023

Topps Tiles Plc

Update on AGM resolutions

Topps Tiles Plc (LSE: TPT) ("Topps", the "Company" and together

with its subsidiary undertakings, the "Group"), the UK's leading

tile specialist, provides an update in connection with the

requisition notices received by the Company on 6 December 2022 (the

"Requisition Notices"), served on behalf of MS Galleon GmbH ("MSG")

which required the Board to include resolutions (the "Requisitioned

Resolutions") in the notice of the Company's annual general meeting

to be held on 18 January 2023 (the "AGM").

In advance of the AGM, the Company would like to provide the

following additional key information to its shareholders:

-- The Topps board of directors (the "Board") has now become

aware that MSG has been contacting certain Topps shareholders

individually, with information which contradicts previous

statements made directly to Topps around the link between

sourcing and MSG's equity interest in the Company;

-- In addition to the potential conflict of interest around

sourcing, the Board believes MSG may also be preparing

to launch its Nexterio tile retail brand in the UK, potentially

establishing a direct competitor to Topps, which would

create a further material conflict of interest;

-- The Company has secured further support from key shareholders.

Over 41 per cent. of Topps' shareholders have now committed

to vote against the Requisitioned Resolutions.

Further information is provided below.

The Requisition Notices

As previously announced, the Requisitioned Resolutions served by

MSG are as follows:

-- that Darren Shapland be removed from office as a director

of the Company, and from the position of Non-Executive

Chairman of the Company, with immediate effect;

-- that Lidia Wolfinger, having consented to act, be appointed

as a non-executive director of the Company with immediate

effect; and

-- that Michal Bartusiak, having consented to act, be appointed

as a non-executive director of the Company with immediate

effect.

MSG currently beneficially owns approximately 29.8 per cent. of

the Company's voting share capital. Lidia Wolfinger and Michal

Bartusiak are both employees of companies owned by MSG.

The Board does not consider the Requisitioned Resolutions to be

in the best interests of the Company and its shareholders as a

whole and has therefore recommended that shareholders vote AGAINST

the Requisitioned Resolutions at the AGM.

Sourcing linked to equity

The Board outlined its position in detail in its announcement of

7 December 2022. In summary, the Board believes that the proposed

appointment of MSG's non-executive directors has the primary

objective of aligning Topps' business and strategy to MSG's

commercial objectives as owner of Cersanit, a manufacturer of

tiles, and is therefore not in the best interests of the Company

and Topps' shareholders as a whole.

Since its announcement of 7 December 2022, the Topps Board

understands that MSG has been contacting certain Topps shareholders

individually in an attempt to garner support for the Requisitioned

Resolutions. Information provided to shareholders by MSG included a

statement that it had recently discussed increasing its share of

Topps' product purchases to 5 per cent.

However, this statement is not an accurate representation of the

entirety of those discussions and directly contradicts statements

made by MSG to Topps. MSG has, on a number of occasions, directly

linked the level of its equity holding in the Company with the

level of supply that it wishes Topps to source from Cersanit. To

this end, one of the proposed directors, Lidia Wolfinger, requested

as recently as 25 November 2022 that Topps should source 29.9 per

cent. of its tile purchases from Cersanit in line with MSG's

shareholding in Topps, with interim stage gates for achieving a 5

per cent. and then 10 per cent. share over the short term(1) .

Moreover, when Topps has reviewed opportunities to source

products from Cersanit, the frequent conclusion has been that as a

supplier it is uncompetitive when compared with other manufacturers

of similar products.

The Board continues to believe that all sourcing should be

conducted on an arms-length commercial basis. In addition, a

diverse global supply chain is a key source of competitive

advantage for Topps and the Board believes strongly that becoming

overly reliant on a single supplier is not in the best interests of

the Company and its shareholders as a whole. Topps' sourcing policy

does not allow for more than 10 per cent. of tile purchases to come

from any one supplier in order to avoid concentration risk.

The Board believes it is incompatible for the proposed

non-executive directors to have the target of increasing tile

purchases from Cersanit to 29.9 per cent., whilst at the same time

acting in the best interests of all shareholders of Topps.

Control linked to equity

The Board has tried to engage constructively with MSG but in its

interactions with Topps, MSG has made it clear on a number of

occasions that it believes that the size of its shareholding

entitles it to expect the Company's management and the Board to

comply with its requests. Previous requests have extended to

sourcing, the composition of the Board, and also supporting MSG's

strategic plans for UK growth. The Board sees no linkage between a

minority equity stake and control of the Company and believes lack

of compliance with MSG's requests led to MSG voting against Darren

Shapland's re-election at the 2022 annual general meeting and that

this is also driving the proposal to remove Darren from the Board

as well as the proposed appointment of two new directors

representing MSG in 2023.

The Board is currently compliant with the UK Corporate

Governance Code's requirements in relation to board composition. It

is well qualified and experienced and has helped the executive team

steer the business through the COVID-19 pandemic to a position

which is stronger than before the pandemic. This is evidenced by

Topps' recent FY22 results, which announced a second consecutive

record year of revenue and significant market share gains(2) .

Potential competitor

MSG owns Nexterio, a retailer of tiles and associated products

with over 40 outlets in Poland, which the Board understands is

being prepared for a launch into the UK. A new company, Nexterio.UK

Limited was incorporated on 22 November 2022, the website

www.nexterio.co.uk has been registered and the Board understands a

search for suitable trading locations around the UK is underway.

Nexterio would be a direct competitor to Topps, and the Board

believes that the appointment of non-executive directors onto the

Board who represent a direct competitor would be a further conflict

of interest and would not be in the interests of all shareholders

of Topps.

Update on shareholder engagement

Following its announcement on 7 December 2022, the Board has

been contacted by a number of other large institutions to confirm

their support for the Board's position. Together with the major

shareholders listed in the original announcement, shareholders

representing 41.3 per cent. of the Company's voting share capital

have now confirmed their intention to vote against the

Requisitioned Resolutions.

Darren Shapland, Non-Executive Chairman of Topps, said:

"The Board continues to believe that these proposals would

expose shareholders to a number of serious conflicts of interest

and are not therefore in the interests of all shareholders of the

Company. The Board welcomes the strong support received from other

large shareholders who support the Board's position in voting

against the Requisitioned Resolutions at the AGM."

Keith Down, Senior Independent Director of Topps, said:

"The Board has unanimously rejected these resolutions which it

does not believe are in the best interests of the Company and its

shareholders as a whole. MSG is attempting to remove the Chairman,

who has been leading communications with MSG on behalf of the

Board, to allow it to increase its control over the business."

(1) In the financial year ended 1 October 2022, Topps sourced

1.1 per cent. of its cost of goods sold (by value) from Cersanit on

commercial arm's length terms.

(2) The Group announced full year results on 29 November for the

52 week period ended 1 October 2022. Revenues of GBP247.2 million

were up 8.4% year on year, the second consecutive record year of

revenue for the Group. Adjusted pre-tax profit was GBP15.6 million,

up 4.0% year on year. Estimated market share increased 1.4

percentage points to 19.0%. The full year dividend of 3.6 pence per

share (including a proposed final dividend of 2.6 pence per share)

was up 16.1% year on year. Relative to 2019, the last full year

before Covid-19, Group sales in 2022 were GBP28.0 million higher (a

12.8% increase) and adjusted profit before tax was up GBP1.9

million (a 14.1% increase). Note that adjusted profit before tax in

2019 has been restated in line with the IFRIC agenda decision on

cloud computing and includes the trading loss from the Parkside

brand which was excluded from adjusted profit at the time.

Enquiries:

Topps Tiles Plc +44 (0) 116 282 8000

Helen Evans, Company Secretary

Citigate Dewe Rogerson +44 (0) 20 7638 9571

Kevin Smith/Ellen Wilton toppstiles@citigatedewerogerson.com

Notes to editors

Topps Tiles Plc is the UK's leading specialist supplier of tiles

and associated products, targeting the UK domestic refurbishment

and commercial markets and serving homeowners, trade customers,

architects, designers and contractors from 304 nationwide Topps

Tiles stores, four commercial showrooms and six websites:

www.toppstiles.co.uk , www.parkside.co.uk , www.protilertools.co.uk

, www.northantstools.co.uk , www.premiumtiletrim.co.uk and

www.tilewarehouse.co.uk .

Since opening its first store in 1963, Topps has maintained a

simple operating philosophy -- inspiring customers with unrivalled

product choice and providing exceptional levels of customer

service. For further information on the Group, please visit

http://www.toppstilesplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUNRKROWUARRR

(END) Dow Jones Newswires

January 06, 2023 04:14 ET (09:14 GMT)

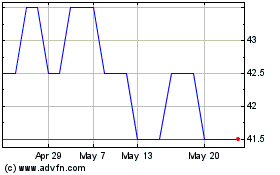

Topps Tiles (AQSE:TPT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Topps Tiles (AQSE:TPT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024