TIDMTPT

RNS Number : 2695A

Topps Tiles PLC

23 May 2023

23 May 2023

Topps Tiles Plc

Interim Financial Report

Record half year sales, profit in line with expectations

Topps Tiles Plc ("Topps Group", the "Company" or the "Group"),

the UK's leading tile specialist, announces its unaudited

consolidated interim financial results for the 26 weeks ended 1

April 2023.

Strategic and Operational Highlights

-- Record six-month period for sales of GBP130.3 million, up 9.3% year on

year

-- Record first half for sales in the Topps Tiles brand, driven by nationwide

store coverage, world class customer service, and strong omni-channel

capability, with average sales per store up 30% compared to 2019

-- Strong results in Online Pure Play brands, with exceptional sales growth

in Pro Tiler Tools

-- Group growth strategy on track to deliver market share goal of '1 in 5

by 2025' ahead of schedule

-- Proud to be celebrating 60 years of trading since the first Topps Tiles

store opened in Sale, Manchester in 1963, in a developed and diversified

Group

Financial Highlights

26 weeks ended 26 weeks ended YoY

1 April 2023 2 April 2022

(H1 2023) (H1 2022)

(restated(5)

)

Adjusted Measures

Topps Tiles like-for-like revenue

year-on-year(1) 4.3% 19.7% n/a

Adjusted profit before tax(2) GBP4.4 million GBP7.1 million (38.0)%

Adjusted earnings per share(3) 1.57p 2.83p (44.5)%

Adjusted net cash at period end(4) GBP19.9 million GBP13.4 million GBP6.5 million

Statutory Measures

Group revenue GBP130.3 million GBP119.2 million 9.3%

Gross profit GBP68.7 million GBP66.9 million 2.7%

Gross margin % 52.8% 56.1% (3.3) ppts

Profit before tax GBP1.7 million GBP5.6 million (69.6)%

Basic earnings per share 0.25p 2.14p (88.3)%

Interim dividend per share 1.2p 1.0p 20.0%

Financial Summary

-- Group revenue up 9.3% to GBP130.3 million

-- Group gross profit up 2.7% to GBP68.7 million

-- Group gross margin lower at 52.8%, due to rapid growth in Pro Tiler Tools,

which operates at a lower gross margin, and adverse FX movements

-- Gross margin percentage within the Topps Tiles brand starting to increase

as shipping and gas prices normalise

-- Adjusted profit before tax of GBP4.4 million, down 38.0% as previously

guided, following adverse exchange rate movements and the impact of inflation

on operating expenses

-- H1 profits were also impacted by a non-cash holiday pay accrual of GBP0.9

million which will reverse in full in H2

-- Cash increased GBP6.5 million against H1 2022, with strong operating cash

flows and positive working capital movements

-- Robust balance sheet with GBP19.9 million net cash and GBP49.9 million

headroom within committed borrowing facilities

-- Interim dividend of 1.2 pence declared (H1 2022: 1.0 pence)

Current Trading and Outlook

-- Like-for-like sales in Topps Tiles over the first seven weeks of the second

half were up 4.1% on an underlying basis, with a negative impact of about

1.3 percentage points due to the additional bank holiday, giving overall

like-for-like sales growth of 2.8%

-- Previous well-documented headwinds in supply chain, inflation and recruitment

are now easing, strengthening our confidence in the gross margin and trading

outlook for the second half

-- Profit in second half expected to increase materially, driven by the growth

of our new businesses, improving gross margins, as well as gas costs reducing

and holiday pay accruals reversing, giving confidence that we will perform

in line with current market expectations for the year as a whole(6)

-- Our strategy is delivering, leaving us well-positioned to deliver our

market share goal of '1 in 5 by 2025' ahead of schedule

Commenting on the results, Rob Parker, Chief Executive said:

"As we mark our 60(th) anniversary, we are pleased to be

reporting record first half revenue for the Topps Group, reflecting

our successful development and diversification as we strengthen our

position as the UK's leading tile specialist. Our Topps Tiles brand

delivered a further period of robust like-for-like sales growth,

with Pro Tiler Tools achieving another exceptional performance, to

maintain its strong track record since acquisition in 2022.

"As expected, our first half profitability reflects the impact

of inflation year on year, including significantly increased energy

costs, and a number of other one offs. These effects are now

reducing or will reverse in full in the second half, underpinning

our confidence in a much stronger profit performance in the balance

of the year. Our strong trading, when combined with our successful

strategy, world class customer service, leading product offer and

strong balance sheet, gives us increasing confidence in our

outlook. We remain confident that we are on track to hit our 20%

market share target ahead of schedule."

Notes

(1) Topps Tiles like-for-like revenue is defined as sales from

online and Topps Tiles stores that have been trading for more than

52 weeks. In H1 2023 like-for-like revenue was GBP115.3 million (H1

2022: GBP111.9 million), with an average of 304 stores included in

the weekly calculation.

(2) Adjusted profit before tax excludes the impact of items

which are either one-off in nature or fluctuate significantly from

year to year. See the financial review section of this document for

a reconciliation to statutory profit before tax.

(3) Adjusted earnings per share is adjusted for the items

highlighted above, plus the impact of corporation tax. See note 5

of the financial statements.

(4) Adjusted net cash is defined as cash and cash equivalents,

less bank loans, before unamortised issue costs as at the balance

sheet date. It excludes lease liabilities under IFRS 16.

(5) Prior year values are restated throughout this document

following the adoption of the IFRIC agenda decision in relation to

configuration and customisation expenditure relating to cloud

computing arrangements. See note 1 to the accounts for more

information. The impact on adjusted profit before tax in H1 2022

was GBP0.1 million and the impact on statutory profit before tax

was GBPnil.

(6) Current market expectations as of 22 May 2023 are a range of

GBP10.6 million to GBP12.3 million of adjusted profit before tax,

with a consensus of GBP11.5 million.

For further information please contact:

Topps Tiles Plc (23/5/23) 020 7638 9571

Rob Parker, CEO (Thereafter) 0116 282 8000

Stephen Hopson, CFO

Citigate Dewe Rogerson 020 7638 9571

Kevin Smith/Ellen Wilton

INTERIM MANAGEMENT REPORT

Topps Group is the largest specialist distributor of tiles and

related products in the UK. The majority of our revenues are

generated from the domestic market for the renovation, maintenance

and improvement (RMI) of UK homes, through our market-leading Topps

Tiles brand. Over recent years, the business has diversified and

expanded into the commercial tile market, which approximately

doubled the size of our addressable market while staying within our

core specialism of tiles. The commercial market includes tiles

supplied for both new build and refurbishment of commercial

premises across sectors such as leisure, transport, retail and

office buildings, and new build residential housing. In 2022, the

Group was developed further, with the addition of the Pro Tiler

Tools and Tile Warehouse brands, both of which focus on the Online

Pure Play market.

All of the brands within the Group derive benefit from the scale

of the business, the specialist focus of our business model and our

passion for tiles. We enjoy a competitive advantage in sourcing

differentiated products from around the world that we can access on

an exclusive basis and deliver world class customer service through

our store network, award-winning digital platforms and commercial

sales teams. We aim to lead the tile market in environmental

matters, including our goal of being carbon neutral across scope 1

and 2 emissions by 2030, or earlier.

STRATEGIC AND OPERATIONAL UPDATE

The core purpose of Topps Group is to inspire customers through

our love of tiles. This gives us a very clear focus on our

specialism in tiles and associated products and encourages all our

colleagues to be passionate about the products we sell. It also

puts our customers at the heart of what we do and reminds us that

all roles in the Group are either serving customers directly or

supporting those colleagues that are. We are making good progress

towards the achievement of our market share goal of '1 in 5 by

2025' and this is supported by our growth strategy, with each of

our main business areas, Topps Tiles, Parkside and Online Pure

Play, supported by our Group strategies of Leading Product, Leading

People and Environmental Leadership.

2023 is the 60(th) anniversary of the first Topps Tiles store

opening in Sale, Manchester in 1963 and we are pleased to have

delivered a record six-month period for sales in this anniversary

year.

Leading Product

As the UK's leading tile specialist, our expertise in the

ranging, sourcing and procurement of tiles on a global basis is a

core part of our competitive advantage. The last three years have

seen us leverage this advantage significantly, as we have resourced

multiple ranges from around the world in response to volatile

conditions in the tile supply chain. As a result, we have continued

to maintain competitive cost prices whilst securing good inventory

availability to support the high levels of demand in the business.

Supply chain pressures now appear to be reducing, with shipping and

gas prices falling and availability of tile supply improving.

The ability of Topps Group to introduce new, exclusive products

continues to be central to our Leading Product strategy. In the

first half of the year, we introduced 32 new products into Topps

Tiles (H1 2022: 13 new products), with over a third of these ranges

developed by Topps Group, as well as new ranges across Tile

Warehouse and Parkside. Within Pro Tiler Tools, the introduction of

new trade-focused brands such as Kubala tools continues to drive

growth and provide an unrivalled trade product offer. Trade brand

authority continues to be a major focus for Topps Group, with over

50 proprietary and owned brands for tilers to choose from across

the Group.

A highlight has been the continued success of new product

categories in Topps Tiles, such as outdoor tiles, luxury vinyl

tiles (LVT), and large format tiles, which have delivered

significant growth year on year. Owned brands such as Excel Bond,

Dex, Rise and Regenr8 now contribute over GBP30 million of sales

and are portable across the Group's various trading entities.

Leading People

Our performance across all of our businesses is underpinned by

world-class customer service, delivered through engaged and highly

skilled colleagues. Vacancy rates fell across the first half and

overall staff turnover is now 34.0% (H1 2022: 37.8%). Staff

turnover across Topps Tiles store managers has fallen

substantially, which is particularly important given the critical

role that these colleagues play in delivering our customer

experience across our store network. A significant driver of the

improvement year on year has been our focus on recruiting the right

people into the business through an improved recruitment and

induction process, as well as lessening of pressure in the

employment market more generally.

Our focus on wellbeing continues, with a particular emphasis on

mental health. In the first half, in partnership with Mental Health

First Aid England, our 64 mental health first aiders were trained

or reaccredited, including colleagues from Pro Tiler Tools, and

line manager training on mental health has been rolled out across

the organisation. Our corporate partnership with Alzheimer's

Society, which commenced in 2022, is gathering momentum and we have

raised over GBP150k to date in support of this important cause.

Both customers and colleagues continue to give generously through

micro donations and fund raising.

Diversity and inclusion represents an ever increasing area of

importance for our business and, following a focus on increasing

the accuracy of our data in the first half, we are preparing to

roll out our D&I strategy in the second half, which will

include colleague engagement, recruitment processes and the

creation of colleague resource groups.

Delivering great service depends on an ongoing investment into

the capability of our people. In the first half, we have made good

steps forward, including utilising the Apprentice Levy to support

our training programmes, with 15 store managers and 15 deputy

managers now enrolled on our Retail Management qualification,

accredited by the Institute of Leadership and Management, to

support their development through the organisation. We also retain

our focus on sales training for colleagues in stores, as well as

our senior management development programme.

Environmental Leadership

Our environmental leadership strategy is based around two

pillars: carbon neutrality and supporting circularity. Our goal is

to be carbon balanced across scope 1 and 2 emissions by 2030, or

earlier, and we have partnered with the World Land Trust to support

this objective. Parkside, our Commercial business, is already

carbon neutral. The Group's total scope 1 and 2 emissions are

currently approximately 4,800 tonnes per annum. Following the

actions reported in last year's annual report, this year we have

installed solar panels on the roof of our head office and main

distribution centre, which should reduce electricity usage on these

sites by approximately 70% and save approximately 340,000 kWh of

electricity per annum. Our environmental focus is now switching to

measuring our scope 3 emissions, which is a significant challenge

due to the complexity of our global supply chain. Scope 3 will be

an order of magnitude higher than scope 1 and 2 emissions, and we

are currently selecting a partner to help us with this exercise. We

have committed to report scope 3 emissions as part of our TCFD

reporting by the end of 2024.

Supporting circularity is largely about minimising waste and

recycling, as well as product and packaging innovation and

sourcing. A major target this year, which forms part of the Group's

strategic objectives and therefore executive remuneration, is to

reduce tile waste by 10% and performance in the first half is in

line with the delivery of this goal.

Omnichannel: Topps Tiles

Topps Tiles is our market leading, omni-channel specialist

business, which serves the domestic RMI market and has significant

opportunities for profitable growth.

Sales continue to perform well, with like-for-like sales growth

in the first half of 4.3%. This resulted in a record first half

year performance for the brand with revenue of GBP115.8 million.

Average sales per store are now up 30% compared to the pre-pandemic

period as a result of our successful store rationalisation

programme which saw customers transfer from closed stores, as well

as significant underlying sales growth. The rationalisation

programme was completed at the end of the last financial year and

we believe that the current store estate of 304 stores, offering

nationwide coverage, is approximately the right size moving

forward, meaning that like-for-like sales growth will broadly

mirror total sales growth in future years.

Our customer mix continues to be a mix of professional trade

customers and homeowners. The relationship between the two groups

is very close - often a professional installer will use a Topps

Tiles store as an extension of their own workspace, visiting the

store with the customer or simply referring them to us. However,

the way the professional trader and the homeowner use the various

parts of the omni-channel Topps Tiles offer can be quite

different.

Homeowners will almost always use both our award-winning website

and the store as part of their purchasing journey. We know that 98%

of customers will use a store at some point, either to see the

product, engage with our teams for advice, inspiration, service or

aftersales, or to collect their order at a time convenient for

them. In addition, almost all customers will use the website for

research, to order samples or to place their order. Online sales

made up 18% of tile sales to homeowners in the period, up from 9%

in 2015 and comparable to other retailers in our industry, and we

continue to invest in incremental improvements to our digital

platforms.

For professional trade customers, a dedicated website and trade

app is available, as well as key digital services such as click and

collect. However, trade customers retain a very strong preference

for the physical store, with strong relationships built on trust

and high levels of technical advice and service. Trade customers

can offer high levels of repeat custom and we focus on offering

price competitiveness, a loyalty scheme and excellent

representation from key trade focused brands. Trade customers made

up 59% of sales in Topps Tiles in the first half (H1 2022: 58%)

and, as such, Topps Tiles is more of a merchant than a retail

business. For trade customers and contractors, Topps Tiles offers a

dedicated direct sales operation which continues to deliver

excellent growth. Supported from a central team, this operation

grew sales by 23% year on year to GBP7.0 million in the first half

and we continue to believe this model offers further growth

opportunities.

As well as financial performance, our key measure of success is

customer satisfaction, which we measure through our Tile Talk

surveys. Overall satisfaction increased again in the first half, by

1.7 percentage points, meaning that 91.3% of the 8,500 surveys

completed in the half year rated Topps Tiles as 5 star for overall

satisfaction. In addition, 6.8% of the survey responses scored the

business as 4-star, and just 1.9% of respondents rated the business

as 3-star or lower. Our data suggests that this performance is

genuinely world-class, and scores higher than a number of other

leading consumer-facing brands (source: the United Kingdom Customer

Service Institute, Jan 2023).

The Topps Tiles store estate has remained at 304 trading stores

over the course of the first half year, with two relocations

completed, at Guildford and Aintree. Our three store formats -

superstores (37 stores), core stores (253 stores) and clearance (14

stores) continue to offer the most relevant offer for the local

catchment and physical site. We retain a flexible property

portfolio, with an average unexpired lease term to the next break

opportunity of 2.9 years (H1 2022: 3.2 years), or 2.7 years

excluding strategically important stores (H1 2022: 2.9 years).

Following the conclusion of the store rationalisation programme, we

had 8 closed Topps Tiles stores at the end of the trading period,

reduced from 11 at the start of the financial year, and expect to

exit a further 3 stores by year end.

Topps Tiles continues to perform very strongly, with world-class

service and a leading product offer, an increasing trade mix, a

right-sized store estate, and further opportunities for growth in

the period ahead.

Commercial: Parkside

Parkside is a specialist tile distributor, aimed at architects,

designers and contractors in the commercial market. Becoming part

of Topps Group in 2017, Parkside is now a top-five competitor

within the sector.

After five consecutive years of sequential sales growth,

Parkside has experienced a tougher period of trading. The market

remains substantially smaller when compared to the pre-covid

period. Sales were down GBP0.4 million year-on-year to GBP4.6

million in the first half year due to delays in projects from key

clients. With performance below expectations, a business

improvement plan has been launched.

The commercial market for tiles, which is almost the same size

as the domestic RMI market, is an important part of our B2B

operations and as such remains a strategic priority for Topps

Group.

Online Pure Play: Pro Tiler brands and Tile Warehouse

Our Online Pure Play business now consists of five brands. Four

of these (Pro Tiler Tools, Northants Tools, Premium Tile Trim and

Warm Floor Store, collectively the 'Pro Tiler brands') are

trade-focused, digital-only consumables and tools brands, operated

by the Pro Tiler management team. Tile Warehouse is a

homeowner-orientated, value-focused, digital-only tiles business,

offering a complimentary positioning to Topps Tiles.

Performance has been exceptionally strong in the first half,

with excellent sales growth and net margin in line with our

expectations. The Pro Tiler brands have delivered year on year

growth in excess of 40% (including the pre-acquisition period in

the comparative period) as a result of exceptionally strong

customer focus (average review score 4.8/5 as of May 2023), further

extensions of trade brands, and investments in marketing and stock.

In the first half, the newest brand launched, warmfloorstore.co.uk,

specialising in wet and dry underfloor heating products, including

industry-leading brands such as WarmUp, Schluter and Devi. Further

opportunities for material growth exist within these brands and

from further new brand launches. We believe the Pro Tiler brands

collectively represent in excess of a GBP30 million sales

opportunity for the Group.

Tile Warehouse provides an entry into the GBP100m online pure

play tile market, with a range of quality tiles at very competitive

price points, leveraging the Group's scale, supplier relationships,

digital expertise and financial resources. In its first year, the

focus has been on refining the technical proposition and building

the digital strategy and customer offer. We believe that this

business provides an opportunity to deliver sales of GBP15 million

within a five-year time frame, but will require investment,

primarily in digital marketing, in the initial stages.

Key Performance Indicators

As set out in our most recent Annual Report, we monitor our

performance implementing our strategy with reference to a clearly

defined set of financial and non-financial key performance

indicators ("KPIs"). Our performance in the 26 weeks to 1 April

2023 is set out in the table below, together with the prior year

performance data. The source of data and calculation methods are

consistent with those used in the 2022 Annual Report. Further

information on adjusted performance measures can be found on page

2.

26 weeks to 26 weeks to YoY

1 April 2 April

2023 2022

(restated(5)

)

Financial KPIs

Group revenue growth year-on-year 9.3% 15.5% n/a

Topps Tiles like-for-like sales growth

year-on-year 4.3% 19.7% n/a

Group gross margin 52.8% 56.1% (3.3) ppts

Adjusted profit before tax GBP4.4 million GBP7.1 million (38.0)%

Adjusted earnings per share 1.57 pence 2.83 pence (44.5)%

Adjusted net cash GBP19.9 million GBP13.4 million GBP6.5 million

Inventory days 117 127 (10) days

Non-financial KPIs

Topps Tiles customer overall satisfaction

score 91.3% 89.6% 1.7 ppts

Colleague turnover 34.0% 37.8% (3.8) ppts

Number of Topps Tiles stores at year

end 304 312 (8)

FINANCIAL REVIEW

Consolidated Statement of Profit or Loss

Sales growth in the period was strong, with total Group sales up

9.3% to GBP130.3 million in the first half, representing a record

six-month trading period for the Group. Within this, the Topps

Tiles brand delivered like-for-like sales growth of 4.3% against H1

2022, which was itself an extremely strong trading period with

sales +22.7% on a two-year like-for-like basis. As a result,

average sales per store in Topps Tiles were 30% higher in the first

half of FY 2023 than the pre-pandemic period of 2019. Sales in

Parkside were down GBP0.4 million, and sales in Online Pure Play

were exceptionally strong, driven by the ongoing success of Pro

Tiler Tools. Revenue consolidated into the Group accounts by

business area was as follows:

Revenue by brand (GBPm) H1 2023 H1 2022 Variance

Topps Tiles 115.8 113.1 +2.4%

-------- -------- ---------

Parkside 4.6 5.0 -8.0%

-------- -------- ---------

Online Pure Play* 9.9 1.1 +800%

-------- -------- ---------

Topps Group 130.3 119.2 +9.3%

-------- -------- ---------

*Online Pure Play includes Pro Tiler Tools and its associated

brands, which were acquired in March 2022, and Tile Warehouse,

which was launched in May 2022.

This strong sales growth, partly driven by the acquisition of

Pro Tiler Tools last year, also reflects the success of our growth

strategy, as we continue to progress towards the delivery of our

goal of accounting for GBP1 in every GBP5 spend across the UK

market for tiles and related products by 2025 ('1 in 5 by 2025').

With our market share increasing to 19.0% in 2022 (2021: 17.6%), we

are confident that we will achieve our goal ahead of schedule. We

will provide a further update on our progress towards our target in

our 2023 full year results, following the publication of the latest

independent market research reports.

Overall, we estimate that 63% of sales in the Group were made to

trade or professional customers in the period (H1 2022: 60%), with

37% of sales made direct to homeowners (H1 2022: 40%), which is

important given the high levels of repeat custom that trade and

professional customers can offer.

The Group's gross margin of 52.8% was down 3.3 percentage points

against H1 2022, with 2.1 percentage points of the decline due to

business mix changes, specifically the rapid growth in Online Pure

Play which operates at a structurally lower gross margin than the

rest of the Group, 1.0 percentage point due to mark-to-market

movements on foreign currency transactions and retranslation of

monetary items, and 0.2 percentage points due to changes in the

margins in individual brands. The mark-to-market and retranslation

movements in the period were unusually large, caused by the

revaluation of our forward currency contracts, under which we

contract to buy foreign currency in advance of our requirements. As

the pound recovered from its lows against the dollar and euro in

late September 2022, these contracts are revalued, resulting in a

significant non-cash charge in the first half. In addition,

monetary items such as foreign currency and trade payables are

revalued based on the exchange rates in place at the end of the

trading period.

The gross margin within Topps Tiles, which has been impacted in

recent years by inflationary pressures, product and customer mix

movements and the introduction of new product categories, improved

modestly over the period as inflationary pressures abated or in

some cases reversed. We are confident that the gross margin within

the Topps Tiles brand will increase sequentially in the second half

year compared to the first half.

Operating costs were GBP64.9 million compared to GBP59.3 million

in H1 2022. Excluding adjusting items which are explained below,

operating expenses increased by GBP4.3 million compared to the

prior year period to GBP62.1 million, explained by the following

key items:

GBP million

HY 2022 adjusted operating expenses (restated) 57.8

Increased utilities expense (gas) 0.6

Other inflation 2.2

Reduced store space (304 stores on average vs 314 in

HY 2022) (1.1)

Online Pure Play including Pro Tiler Tools brand amortisation 2.6

HY 2023 adjusted operating expenses 62.1

In line with our expectations, the high levels of inflationary

costs (approximately 5% operating cost inflation, across utilities

costs, employment costs, property costs and other expenses) have

impacted profit in the first half. As previously noted, we have

been able to offset some but not all of these costs through our

smaller store estate and efficiency programmes.

The first half contains a non-cash expense of GBP0.9 million

relating to holiday pay accruals (H1 2022: GBP0.7 million expense),

which will reverse in full over the second half of the financial

year (resulting in a GBP1.8 million increase in half-on-half

profits); and in addition, gas usage in the business will also

reduce substantially in the second half, leading to a smaller

adjusted cost base in the second half compared to the first half

year. The Forward Guidance section below sets out in more detail

some of the factors influencing operating costs in H2 compared to

H1.

Adjusted net finance costs increased from GBP1.9 million in H1

2022 to GBP2.2 million in H1 2023 as a result of increased IFRS 16

lease interest costs and the unwind of various discounted balance

sheet liabilities.

As a result of the above, and in line with our expectations,

adjusted profit before tax for the period was GBP4.4 million (H1

2022 restated: GBP7.1 million), however profitability in the second

half is expected to be substantially higher.

Looking further forward, we expect cost inflation to start to

reduce, with the exception of our utilities expense, where at the

end of this financial year the Group will exit its current fixed

price contracts. Based on forward utilities contract pricing, we

currently expect our energy costs across gas and electricity to

increase by approximately GBP0.5 million in FY 2024 compared to the

current financial year, with significant increases in electricity

pricing compared to our current two-year contract more than

offsetting the recent falls in the gas price.

Adjusting items

The Group's management uses adjusted performance measures, to

plan for, control and assess the performance of the Group. Adjusted

profit before tax differs from the statutory profit before tax as

it excludes the effect of one-off or fluctuating items, allowing

stakeholders to understand results across years in a more

consistent manner. In line with prior years, we continue to adjust

for any impairment charges or impairment reversals of right of use

assets, derecognition of lease liabilities where we have exited a

store, and one-off gains and losses through sub-lets. We have also

excluded property costs in relation to store closures which formed

part of the store rationalisation programme which ended in FY 2022.

Property costs relating to store closures moving forward will form

part of adjusted profit. In the period 2022 - 2024 we will exclude

the cost relating to the 40% purchase of shares of Pro Tiler

Limited which we expect to make from March 2024, which, under IFRS

3, is treated as a remuneration expense rather than an acquisition

cost. Please see the 2022 Annual Financial Results statement for a

full description of this transaction and its accounting

treatment.

An analysis of movements from adjusted profit before tax to

statutory profit before tax is given below:

H1 2023 GBPm H1 2022 GBPm

(restated(5)

)

Adjusted profit before tax 4.4 7.1

------------- --------------

Property

------------- --------------

Vacant property and closure costs (0.7) (1.0)

------------- --------------

Impairment of property, plant and equipment nil (0.1)

------------- --------------

Right-of-use asset impairment and lease exit

gains and losses 0.1 0.2

------------- --------------

(0.6) (0.9)

------------- --------------

Business development

------------- --------------

Pro Tiler Limited share purchase provision (1.7) (0.2)

------------- --------------

Tile Warehouse set up costs and Pro Tiler

Limited acquisition expenses nil (0.4)

------------- --------------

Restructuring and other one-off costs (0.4) nil

------------- --------------

(2.1) (0.6)

------------- --------------

Statutory profit before tax 1.7 5.6

------------- --------------

The effective tax rate for the 26 weeks to 1 April 2023 was

58.1% (H1 2022: 25.4%). Tax rates are based on expectations for the

full year and then adjusted for the impact of items which are not

deductible for corporation tax purposes, notably in this half year

by the Pro Tiler Limited share purchase provision increase. On an

adjusted basis, the effective tax rate for the period was 24.7% (H1

2022: 22.1%), with the year-on-year increase reflecting the

increase in the main rate of UK corporation tax from 19% to 25% as

of 1 April 2023.

Basic earnings per share were 0.25 pence (H1 2022: 2.14 pence).

Adjusting for the post-tax impact of the adjusting items detailed

above, the adjusted basic earnings per share were 1.57 pence (H1

2022: 2.83 pence).

Dividend

The Group's capital allocation and dividend policy was updated

as part of the Interim Results in 2022. Interim dividends will be

set at one third of the full year dividend from the previous year,

and as such, an interim dividend of 1.2 pence has been declared by

the Board (H1 2022: 1.0 pence). The shares will trade ex-dividend

on 8 June 2023 and the dividend will be paid on 14 July 2023.

Consolidated Statement of Financial Position

Capital Expenditure

Capital expenditure in the first half was GBP2.0 million (H1

2022: GBP1.0 million). The majority of this expenditure was on the

Topps Tiles store estate, including two store relocations,

conversions of four more of our larger stores to superstore status,

and general refurbishment.

The Board expects capital expenditure in the full year to be

between GBP5 million and GBP6 million, including further

relocations and merchandising for new products in the core Topps

Tiles stores, together with further investment into our

superstores. Any acquisitions that the Group may consider as part

of its growth plans would be additional to this guidance.

Inventory

Inventory at the period end was GBP38.8 million (H1 2022:

GBP37.0 million) including GBP2.7 million held within Pro Tiler

Limited, representing 117 stock days (H1 2021: 127 stock days). At

the last year end, inventory was GBP38.6 million, representing 126

days turnover, with the movement over the half year explained by a

GBP0.4 million increase in the stock held at Pro Tiler and a GBP0.2

million decrease in stock held across the rest of the Group

businesses.

Consolidated Cash Flow Statement

The Group's cash balance increased in the period by GBP3.7

million from GBP16.2 million at year end to GBP19.9 million at the

half year end. The table below analyses the Group's adjusted cash

flow:

HY 2023 HY 2022

(restated)(5)

GBPm GBPm

Cash generated by operations, including interest

and capital elements of leases, before WC movements 8.8 9.4

Changes in working capital 4.2 (10.1)

Capital expenditure (2.0) (1.0)

Disposals - 0.1

Interest - (0.1)

Tax (2.0) (2.1)

Other (0.2) (0.1)

Free cash flow 8.8 (3.9)

Acquisition of Pro Tiler Limited, net of cash and

debt acquired - (4.4)

Dividends (5.1) (6.1)

Change in adjusted net cash 3.7 (14.4)

Adjusted net cash at start of period 16.2 27.8

Adjusted net cash at end of period 19.9 13.4

The strong level of cash generated by operations, combined with

a GBP4.2 million inflow from working capital movements, led to good

free cash generation in the period, and ultimately to an increase

in adjusted net cash of GBP3.7 million in the first six months of

the year, after payment of the final dividend relating to 2022. The

cash generated by operations excludes a number of non-cash items

which reduced profit before tax in the first half, including a

GBP0.9 million holiday pay accrual, non-cash movements on the value

of foreign currency contracts, an increase in the share purchase

provision in relation to the future purchase of the remaining

shares in Pro Tiler Limited and share option charges. The working

capital inflow largely related to increases in payables, including

higher trade payables and a higher VAT creditor.

Return on Capital Employed

Lease adjusted returns on capital employed in the first half

were 15.5% (H1 2022: 15.6%), based on the average capital employed

over the half and the annualised profit delivered over the last

twelve-month period.

Banking Facilities

The Group maintains a very robust balance sheet, providing

resilience and allowing investment in growth opportunities. A

GBP30.0 million revolving credit facility is in place which is

committed to October 2025 with extension options for a further two

years (H1 2022: GBP39.0 million facility, committed to June 2023).

At the half year, none of this facility was drawn (H1 2022: GBPnil

drawn). Based on net cash excluding lease liabilities of GBP19.9

million, the Group has GBP49.9 million of headroom to its banking

facilities at the period end (H1 2022: GBP52.4 million).

Forward Guidance

The first half year was a period of record sales for the Group,

however profits were impacted by a number of factors described

above, principally inflationary pressure on operating expenses. We

have confidence that profits in the second half will be materially

stronger, as a result of the following factors:

-- The Group's gas expense has increased from approximately GBP0.4

million in recent years to an estimated GBP2.4 million this

year. Gas is primarily used for heating purposes and therefore

disproportionately impacts the colder months which fall into

the Group's first half. The gas expense in the first half

was GBP1.7 million with an estimated expense in the second

half of GBP0.7 million, resulting in a GBP1.0 million increase

in half on half profits in the second half;

-- The first half contained a GBP0.9 million expense relating

to holiday pay accruals, which will reverse in the second

half, resulting in a GBP1.8 million increase in half on half

profits in the second half;

-- Gross margins within Topps Tiles are starting to improve as

the cost of shipping and production starts to fall and we

expect margins within Topps Tiles to be sequentially higher

in the second half compared to the first half;

-- Newer parts of the Group are expected to contribute more profit

in the second half compared to the first half.

As a result of these factors, we remain confident that the Group

will perform in line with current market expectations for the year

as a whole(6) .

Current Trading and Outlook

The second half has started well with like-for-like sales in

Topps Tiles in the first seven weeks up 4.1% on an underlying

basis, in line with the first half. The additional bank holiday

reduced like-for-like sales by an estimated 1.3 percentage points

in the period, resulting in overall like-for-like sales growth in

the first seven weeks of 2.8%.

Our key areas of focus in previous periods have been managing

and reducing cost inflation, dealing with supply chain challenges

and meeting staff recruitment targets. Whilst we are maintaining a

keen focus on all of these areas moving forward, the near-term

pressure from inflation appears to be abating, we have maintained

good levels of inventory throughout the period, staff turnover is

reducing and vacancy levels are slightly below the longer-term

average. As explained in the section above, we expect profit in the

second half to increase materially, and these factors, when

combined with our successful strategy, world class customer

service, leading product offer and strong balance sheet, give us

increasing confidence as we look forward.

Risks and Uncertainties

The Board continues to monitor the key risks and uncertainties

of the Group. The main risks considered by the Board remain as

documented in the 2022 Annual Report and Accounts. These key risks

and uncertainties include: macroeconomic changes and consumer

confidence; inflationary cost increases of products for resale and

not for resale; sustainability and climate change; attracting and

retaining talent / loss of key personnel; cyber security; warehouse

capacity; growth strategy through diversification; global pandemic

including Covid-19; and global supply chain. Whilst all key risks

remain, the Board considers that the scale of the risks associated

with attracting and retaining talent / loss of key personnel,

inflationary cost increases of products for resale and not for

resale, and global supply chains have all reduced since the

publication of that Report.

Going concern

When considering the going concern assertion, the Board reviews

several factors including a review of risks and uncertainties, the

ability of the Group to meet its banking covenants and operate

within its banking facilities based on current financial plans,

along with a detailed review of more pessimistic trading scenarios

that are deemed severe but plausible. The two downside scenarios

modelled include a moderate decline in sales and a more severe

decline in sales, which result in much lower sales and gross profit

than the base scenario, resulting in worse profit and cash

outcomes. The more severe downside scenario modelled this year was

based on a severe prolonged period of macroeconomic stress in the

UK, lasting for more than two years, with sales falling

substantially in each year in our main brand, Topps Tiles, as well

as year-on-year declines in gross margins.

The Group has already taken a number of actions to strengthen

its liquidity over the recent years, and the scenarios start from a

position of relative strength. The going concern review also

outlined a range of other mitigating actions that could be taken in

a severe but plausible trading scenario. These included, but were

not limited to, savings on store employee costs, savings on central

support costs, reduced marketing activity, a reduction of capital

expenditure, management of working capital and suspension of the

dividend. The Group's cash headroom and covenant compliance was

reviewed against current lending facilities in both the base case

and the severe but plausible downside scenario. The current lending

facility was refinanced in October 2022 and expires at the earliest

in October 2025.

In all scenarios, the Board has concluded that there is

sufficient available liquidity and covenant headroom for the Group

to continue to meet all of its financial commitments as they fall

due for the foreseeable future, a period of not less than 12 months

from the date of this report. Accordingly, the Board continues to

adopt the going concern basis in preparing the financial

statements.

Responsibility Statement

We confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' as

contained in UK-adopted IFRS;

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

Rob Parker Stephen Hopson

Chief Executive Officer Chief Financial Officer

23 May 2023

Condensed Consolidated Statement

of Profit or Loss

for the 26 weeks ended 1 April

2023

Restated*

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Group revenue 130,310 119,222 247,241

Cost of sales (61,569) (52,366) (111,818)

---------------------------------- ----- ------------ ------------ ----------

Gross profit 68,741 66,856 135,423

Distribution and selling costs (46,147) (44,929) (89,316)

Other operating expenses (3,634) (1,549) (5,953)

Administrative costs (11,610) (10,291) (19,827)

Sales and marketing costs (3,463) (2,579) (5,495)

Group operating profit 3,887 7,508 14,832

Net finance costs (2,203) (1,908) (3,887)

---------------------------------- ----- ------------ ------------ ----------

Profit before taxation 1,684 5,600 10,945

Taxation 3 (978) (1,422) (1,754)

---------------------------------- ----- ------------ ------------ ----------

Profit for the period 706 4,178 9,191

---------------------------------- ----- ------------ ------------ ----------

Profit is attributable to:

Owners of Topps Tiles Plc 482 4,174 9,005

Non-controlling interests 224 4 186

---------------------------------- ----- ------------ ------------ ----------

706 4,178 9,191

---------------------------------- ----- ------------ ------------ ----------

All results relate to continuing

operations of the Group.

Earnings per ordinary share

- Basic 5 0.25p 2.14p 4.60p

- Diluted 5 0.24p 2.10p 4.55p

There are no other recognised gains and losses for the current

and preceding financial periods other than the results shown above.

Accordingly, a separate Condensed Consolidated Statement of

Comprehensive Income has not been prepared.

* See note 1 for an explanation of the prior period

restatement.

Condensed Consolidated Statement

of Financial Position

as at 1 April 2023

Restated*

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

------------------------------------------ ----- ------------ -------------- ----------

Non-current assets

Goodwill 2,101 2,118 2,101

Intangible assets 5,087 5,825 5,423

Property, plant and equipment 19,998 21,755 20,888

Other financial assets 1,700 2,104 1,947

Deferred tax assets 152 401 114

Right-of-use assets 86,329 91,817 88,545

------------------------------------------ ----- ------------ -------------- ----------

115,367 124,020 119,018

------------------------------------------ ----- ------------ -------------- ----------

Current assets

Inventories 38,842 36,989 38,605

Other financial assets 487 458 542

Trade and other receivables 6,002 5,618 6,419

Current tax asset 122 - -

Cash and cash equivalents 19,911 13,415 16,241

------------------------------------------ ----- ------------ -------------- ----------

65,364 56,480 61,807

------------------------------------------ ----- ------------ -------------- ----------

Total assets 180,731 180,500 180,825

Current liabilities

Bank loans 6 - (4) -

Trade and other payables (50,047) (43,245) (43,650)

Lease liabilities (17,420) (19,641) (18,187)

Current tax liabilities - (2,461) (1,152)

Provisions (346) (346) (352)

Total current liabilities (67,813) (65,697) (63,341)

------------------------------------------ ----- ------------ -------------- ----------

Net current liabilities (2,449) (9,217) (1,534)

------------------------------------------ ----- ------------ -------------- ----------

Non-current liabilities

Bank loans 6 - - -

Lease liabilities (82,096) (86,965) (84,741)

Provisions (5,483) (2,027) (3,694)

------------------------------------------ -----

Total liabilities (155,392) (154,689) (151,776)

------------------------------------------ ----- ------------ -------------- ----------

Net assets 25,339 25,811 29,049

------------------------------------------ ----- ------------ -------------- ----------

Equity

Share capital 8 6,556 6,556 6,556

Share premium 2,636 2,636 2,636

Own shares (192) (1,216) (415)

Merger reserve (399) (399) (399)

Share-based payment reserve 5,837 5,053 5,162

Capital redemption reserve 20,359 20,359 20,359

Accumulated losses (12,151) (9,494) (7,319)

------------------------------------------ ----- ------------ -------------- ----------

Capital and reserves attributable

to owners of Topps Tiles Plc 22,646 23,495 26,580

Non-controlling interests 2,693 2,316 2,469

Total equity 25,339 25,811 29,049

------------------------------------------ ----- ------------ -------------- ----------

* See note 1 for an explanation of the prior period

restatement.

Condensed Consolidated Statement of Changes in Equity

For the 26 weeks ended 1 April 2023

Equity attributable to equity holders of the parent

----------------- ---------------------------------------------------------------------------------

Share-based Capital

Share Share Own Merger payment redemption Accum-ulated Non-controlling Total

capital premium shares reserve reserve reserve losses interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Balance

at

1 October

2022 (Audited) 6,556 2,636 (415) (399) 5,162 20,359 (7,319) 2,469 29,049

------------------ -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Profit and

total

comprehensive

income

for the

period - - - - - - 482 224 706

Issue of

share capital - - - - - - - - -

Dividends - - - - - - (5,104) - (5,104)

Own shares

disposed

of in the

period - - 223 - - - (216) - 7

Credit to

equity for

equity-settled

share based

payments - - - - 675 - - - 675

Deferred

tax on

share-based

payment

transactions - - - - - - 6 - 6

Non-controlling

interest

on business

combination - - - - - - - - -

Balance

at

1 April

2023

(Unaudited) 6,556 2,636 (192) (399) 5,837 20,359 (12,151) 2,693 25,339

------------------ -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity (continued)

For the 26 weeks ended 2 April 2022

Equity attributable to equity holders of the parent

----------------- --------------------------------------------------------------------------------

Share-based Capital

Share Share Own Merger payment redemption Accum-ulated Non-controlling Total

capital premium shares reserve reserve reserve losses interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------- -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Restated*

balance at

2 October

2021 (Audited) 6,555 2,625 (1,216) (399) 4,642 20,359 (7,610) - 24,956

----------------- -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Profit and

total

comprehensive

income

(restated)*

for the

period - - - - - - 4,174 4 4,178

Issue of

share capital 1 11 - - - - - - 12

Dividends - - - - - - (6,058) - (6,058)

Credit to

equity for

equity-settled

share based

payments - - - - 411 - - - 411

Non-controlling

interest

on business

combination - - - - - - - 2,312 2,312

Restated*

balance at

2 April

2022

(Unaudited) 6,556 2,636 (1,216) (399) 5,053 20,359 (9,494) 2,316 25,811

----------------- -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Condensed Consolidated Statement of Changes in Equity (continued)

For the 52 weeks ended 1 October 2022

Equity attributable to equity holders of the parent

------------- ----------------------------------------------------------------------------------------

Share-based Capital

Share Share Own Merger payment redemption Accum-ulated Non-controlling Total

capital premium shares reserve reserve reserve losses interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- --------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Restated* balance

at

2 October 2021

(Audited) 6,555 2,625 (1,216) (399) 4,642 20,359 (7,610) - 24,956

--------------------- -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Profit and total

comprehensive

expense

for the period - - - - - - 9,005 186 9,191

Dividends - - - - - - (8,015) - (8,015)

Issue of share

capital 1 11 - - - - - - 12

Own shares purchased

in the period - - (207) - - - - - (207)

Own shares issued

in the period - - 1,008 - - - (699) - 309

Credit to equity

for equity-settled

share based

payments - - - - 520 - - - 520

Acquisition of

non-controlling

interest on

business

combination - - - - - - - 2,283 2,283

--------------------- -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

Balance at

1 October 2022

(Audited) 6,556 2,636 (415) (399) 5,162 20,359 (7,319) 2,469 29,049

--------------------- -------- -------- -------- -------- ------------ ----------- ------------- ---------------- --------

* See note 1 for an explanation of the prior period restatement.

Condensed Consolidated Cash Flow Statement

for the 26 weeks ended 1 April 2023

Restated*

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

------------------------------------------------- ------------ ------------ ----------

Cash flow from operating activities

Profit for the period 706 4,178 9,191

Taxation 978 1,422 1,754

Finance costs 2,301 1,945 4,010

Finance income (98) (37) (123)

Group operating profit 3,887 7,508 14,832

Adjustments for:

Depreciation of property, plant and equipment 2,686 2,830 5,609

Depreciation of right-of-use assets 9,012 9,181 18,212

Amortisation of intangible assets 386 101 500

Loss on disposal of property, plant and

equipment and intangibles 69 - 394

Loss/(gain) on sublease 101 36 (88)

Impairment charge of property, plant

and equipment 54 427 240

Impairment of right-of-use assets 5 1,771 1,473

Gain on lease disposal (240) (2,265) (1,544)

Share option charge 675 411 520

Increase in earn out liability provision 1,589 - 1,581

Increase in provisions and accruals 1,595 693 -

Non-cash loss/(gain) on derivative contracts 676 - (455)

(Increase)/decrease in receivables (139) 456 (1,080)

Increase in inventories (848) (2,794) (4,362)

Increase/(decrease) in payables 5,145 (7,810) (5,603)

------------------------------------------------- ------------ ------------ ----------

Cash generated by operations 24,653 10,545 30,229

Interest paid (82) (138) (354)

Interest received on operational cash

balances 50 - 58

Interest element of lease liabilities

paid (1,997) (1,777) (3,626)

Taxation paid (1,991) (2,085) (3,453)

------------------------------------------------- ------------ ------------ ----------

Net cash generated from operating activities 20,633 6,545 22,854

Investing activities

Interest received - 4 -

Interest received on sublease assets 29 34 65

Receipt of capital element of sublease

assets 213 247 493

Purchase of property, plant, equipment (1,931) (938) (3,090)

Purchase of intangibles (50) (92) (115)

Proceeds on disposal of property, plant

and equipment - 131 183

Acquisition of subsidiary, net of cash

acquired - (4,436) (3,968)

Net cash used in investment activities (1,739) (5,050) (6,432)

Financing activities

Payment of capital element of lease liabilities (9,977) (9,822) (19,601)

Dividends paid (5,104) (6,058) (8,015)

Financing arrangement fees (150) - -

Proceeds from issue of share capital - 11 12

Purchase of own shares - - (207)

Receipt on disposal of own shares 7 - 309

Repayment of bank loans - - (468)

Net cash used in financing activities (15,224) (15,869) (27,970)

Net increase/(decrease) in cash and cash

equivalents 3,670 (14,374) (11,548)

------------------------------------------------- ------------ ------------ ----------

Cash and cash equivalents at beginning

of period 16,241 27,789 27,789

------------------------------------------------- ------------ ------------ ----------

Cash and cash equivalents at end of

period 19,911 13,415 16,241

------------------------------------------------- ------------ ------------ ----------

* See note 1 for an explanation of the prior period

restatement.

1. General information

The interim report was approved by the Board on 23 May 2023. The

financial information for the 52 week period ended 1 October 2022

has been based on information in the audited financial statements

for that period.

The comparative figures for the 52 week period ended 1 October

2022 are an abridged version of the Group's full financial

statements and, together with other financial information contained

in these interim results, do not constitute statutory financial

statements of the Group as defined in section 434 of the Companies

Act 2006. A copy of the statutory accounts for that 52 week period

has been delivered to the Registrar of Companies. The auditor has

reported on those accounts: their report was unqualified, did not

draw attention to any matters by way of emphasis and did not

contain a statement under s498 (2) or (3) of the Companies Act

2006.

This condensed set of consolidated financial statements has been

prepared for the 26 weeks ended 1 April 2023 (H1 2023) and the

comparative period has been prepared for the 26 weeks ended 2 April

2022 (H1 2022).

The interim financial statements have not been audited or

reviewed by auditors pursuant to the Auditing Practices Board

guidance on "Review of interim financial information" and do not

include all of the information required for full annual financial

statements.

Basis of preparation and accounting policies

The annual financial statements of Topps Tiles Plc are prepared

in accordance with IFRSs as adopted by the European Union. The

unaudited condensed consolidated set of financial statements

included in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34 'Interim

Financial Reporting', as adopted by the European Union and in

conformity with the requirements of the Companies Act 2006. The

same accounting policies, presentation and methods of computation

are followed in the condensed set of financial statements as

applied in the Group's latest annual audited financial

statements.

New and amended standards adopted by the Group

The Group continues to monitor the potential impact of other new

standards and interpretations which have been or may be endorsed

and require adoption by the Group in future reporting periods.

Going concern

When considering the going concern assertion, the Board reviews

several factors including a review of risks and uncertainties, the

ability of the Group to meet its banking covenants and operate

within its banking facilities based on current financial plans,

along with a detailed review of more pessimistic trading scenarios

that are deemed severe but plausible. The two downside scenarios

modelled include a moderate decline in sales and a more severe

decline in sales, which result in much lower sales and gross profit

than the base scenario, resulting in worse profit and cash

outcomes. The more severe downside scenario modelled this year was

based on a severe prolonged period of macroeconomic stress in the

UK, lasting for more than two years, with sales falling

substantially in each year in our main brand, Topps Tiles, as well

as year-on-year declines in gross margins.

The Group has already taken a number of actions to strengthen

its liquidity over the recent years, and the scenarios start from a

position of relative strength. The going concern review also

outlined a range of other mitigating actions that could be taken in

a severe but plausible trading scenario. These included, but were

not limited to, savings on store employee costs, savings on central

support costs, reduced marketing activity, a reduction of capital

expenditure, management of working capital and suspension of the

dividend. The Group's cash headroom and covenant compliance was

reviewed against current lending facilities in both the base case

and the severe but plausible downside scenario. The current lending

facility was refinanced in October 2022 and expires at the earliest

in October 2025.

In all scenarios, the Board has concluded that there is

sufficient available liquidity and covenant headroom for the Group

to continue to meet all of its financial commitments as they fall

due for the foreseeable future, a period of not less than 12 months

from the date of this report. Accordingly, the Board continues to

adopt the going concern basis in preparing the financial

statements.

IFRIC: Configuration or Customisation Costs in a Cloud Computing

Arrangement (IAS38 Intangible Assets)

During the prior year, management re-evaluated the impact of the

IFRIC guidance released during 2021 relating to accounting for

cloud-based SaaS arrangements. Further details of the impact of

this re-evaluation can be found in the 2022 Annual Report and

Accounts.

During the first half of 2022, GBP100k was capitalised in

relation to cloud-based SaaS with GBP98k amortisation being

charged. The H1 2022 Consolidated Statement of Profit or Loss and

the Consolidated Cash Flow Statement have been restated to

recognise the post-tax impact of GBP100k SaaS costs being

recognised as an operating expense and the reversal of GBP98k

amortisation.

The H1 2022 Consolidated Statement of Financial Position has

been restated to de-recognise the post-tax impact of previously

capitalised SaaS costs.

A summary of the impact, including taxation, is included in the

following table:

H1 2022 H1 2022

(previously Restatement Restated

reported)

GBP'000 GBP'000 GBP'000

-------------------------------------- -------------- ------------- -----------

Consolidated Statement of Profit or Loss

impact

Administrative costs (10,288) (3) (10,291)

Profit before taxation 5,603 (3) 5,600

Tax charge (1,423) 1 (1,422)

Adjusted earnings per ordinary

share (pence) 2.79 0.04 2.83

Consolidated Statement of Financial Position

impact

Intangible assets 6,603 (778) 5,825

Deferred tax asset 243 158 401

Total assets 181,120 (620) 180,500

Net assets 26,431 (620) 25,811

Accumulated losses (8,874) (620) (9,494)

Total equity 26,431 (620) 25,811

Consolidated Cash Flow Statement impact

Profit for the period 4,180 (2) 4,178

Taxation (1,423) 1 (1,422)

Amortisation of intangible assets 199 (98) 101

Cash generated by operations 10,645 (100) 10,545

Net cash from operating activities 6,645 (100) 6,545

Purchase of intangibles (192) 100 (92)

Net cash used in investing activities (5,150) 100 (5,050)

-------------------------------------- -------------- ------------- -----------

In addition to the above, the prior period Consolidated Cash

Flow Statement has been restated by GBP693k to reflect a

recategorisation of movements from Payables to Provisions and

Accruals.

2. Business segments

The Group has one reportable segment in accordance with IFRS 8 -

Operating Segments, which encompasses the Topps Tiles Group revenue

generated instore and online from retail and commercial customers.

The Board receives monthly financial information at this level and

uses this information to monitor performance, allocate resources

and make operational decisions.

Revenue can be split by the following geographical regions:

26 weeks 26 weeks

ended ended

1 April 2 April

2023 2022

GBP'000 GBP'000

UK 130,003 119,222

EU 255 -

Rest of World 52 -

-------------- -------- --------

Total 130,310 119,222

-------------- -------- --------

3. Taxation

Restated

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

-------------------------------------- ------------ ------------ ----------

Current tax - debit for the period 1,010 1,520 2,577

Deferred tax - (credit) / debit

for the period (32) (98) 360

Deferred tax - adjustment in respect

of previous periods - - (1,183)

978 1,422 1,754

-------------------------------------- ------------ ------------ ----------

4. Interim dividend

An interim dividend of 1.20p (2022: 1.00p) per ordinary share

has been declared. A final dividend of 2.60p per ordinary share was

approved and paid in the period, in relation to the 52-week period

ended 1 October 2022.

5. Earnings per share

The calculation of earnings per share is based on the earnings

for the financial period attributable to equity shareholders and

the weighted average number of ordinary shares.

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

---------------------------------------- ------------ ------------ ------------

Weighted average number of issued

shares for basic earnings per share 196,681,818 196,680,195 196,681,007

Weighted average impact of treasury

shares for basic earnings per share (525,062) (1,259,275) (1,099,370)

---------------------------------------- ------------ ------------ ------------

Total weighted average number of

shares for basic earnings per share 196,156,756 195,420,920 195,581,637

---------------------------------------- ------------ ------------ ------------

Weighted average number of shares

under option 1,025,157 3,171,408 2,165,790

---------------------------------------- ------------ ------------ ------------

For diluted earnings per share 197,181,913 198,592,328 197,747,427

---------------------------------------- ------------ ------------ ------------

Restated

GBP'000 GBP'000 GBP'000

Profit for the period 482 4,174 9,005

Adjusting items 2,605 1,348 3,005

---------------------------------------- ------------ ------------ ------------

Adjusted profit for the period 3,087 5,522 12,010

---------------------------------------- ------------ ------------ ------------

Earnings per ordinary share - basic 0.25p 2.14p 4.60p

Earnings per ordinary share - diluted 0.24p 2.10p 4.55p

Earnings per ordinary share - adjusted 1.57p 2.83p 6.14p

---------------------------------------- ------------ ------------ ------------

The calculation of the basic and diluted earnings per share used

the denominators as shown above for both basic and diluted earnings

per share.

Adjusted earnings per share for the 26 weeks ended 1 April 2023

were calculated after adjusting for the post-tax impact of the

following items: vacant property and closure costs of GBP0.6m

(2022: GBP0.8m), impairment of property, plant and equipment of nil

(2022: GBP0.1m), impairment of right-of-use assets and lease exit

gains and losses of GBP0.1m gain (2022: GBP0.2m gain), Pro Tiler

Limited earn out provision increase of GBP1.7m (2022: GBP0.2m),

Tile Warehouse set up costs and Pro Tiler Limited acquisition

expenses of nil (2022: GBP0.4m), and restructuring and other

one-off costs of GBP0.4m (2022: nil).

6. Bank loans

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

------------------------------- ------------ ------------ ----------

Bank loans (all sterling) - (4) -

------------------------------- ------------ ------------ ----------

The borrowings are repayable

as follows:

On demand or within one year - (4) -

In the second year - - -

In the third to fifth year - - -

------------------------------- ------------ ------------ ----------

- - -

Less: total unamortised issue

costs (250) (76) -

------------------------------- ------------ ------------ ----------

(250) (76) -

Issue costs to be amortised

within 12 months 100 64 -

------------------------------- ------------ ------------ ----------

The Group has a revolving credit facility to October 2025 of

GBP30.0 million. As at 1 April 2023, GBPnil of this facility was

drawn (2022: GBPnil). The loan facility contains financial

covenants, which are tested on a bi-annual basis. The Group did not

breach any covenants in the period.

7. Financial instruments

The Group has the following financials instruments which are

categorised as fair value through profit and loss:

Carrying value and fair value

26 weeks 26 weeks 52 weeks

ended ended ended

1 April 2 April 1 October

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

------------------------------------ ------------ ------------ ----------

Financial assets

Fair value through profit and loss (158) 54 518

Financial liabilities

Fair value through profit and loss - - -

------------------------------------ ------------ ------------ ----------

The fair values of financial assets and financial liabilities

are determined as follows:

Foreign currency forward contracts are measured using quoted

forward exchange rates and yield curves derived from quoted

interest rates matching maturities of the contracts.

The fair values are therefore categorised as Level 2 (2022:

Level 2), based on the degree to which the fair value is

observable. Level 2 fair value measurements are those derived from

inputs other than unadjusted quoted prices in active markets (Level

1 categorisation) that are observable for the asset or liability,

either directly (i.e. as prices) or indirectly (i.e. derived from

prices).

At 1 April 2023 the fair value of the Group's currency

derivatives is a loss of GBP158,000 within trade and other

receivables (2022: GBP54,000 gain). These amounts are based on the

market value of equivalent instruments at the Statement of

Financial Position date.

Losses of GBP676,000 are included in cost of sales in the 26

weeks ended 1 April 2023 (2022: GBP9,000 loss).

8. Share capital

The issued share capital of the Group as at 1 April 2023

amounted to GBP6,556,000 (2 April 2022: GBP6,556,000). During the

period the Group issued nil shares (2 April 2022: 19,687 shares),

and therefore the number of shares at 1 April 2023 were 196,681,818

(2 April 2022: 196,681,818).

9. Seasonality of sales

Historically there has not been any material seasonal difference

in sales between the first and second half of the reporting period,

with approximately 50% of annual sales arising in the period from

October to March.

10. Related party transactions

MS Galleon AG is a related party by virtue of their 29.8%

shareholding (58,569,649 ordinary shares) in the Group's total

voting rights (2 April 2022: 20.1% shareholding).

MS Galleon AG is the owner of Cersanit, a supplier of ceramic

tiles with whom the Group made purchases of GBP659,000 during the

first half of the year which is 1.1% of cost of goods sold (2022:

purchases of GBP424,000 during the first half of the year which is

0.8% of cost of goods sold).

An amount of GBP303,000 was outstanding with Cersanit at 1 April

2023 (2 April 2022: GBP205,000). All transactions were conducted on

commercial arm's length terms.

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note, in accordance with the exemption available

under IAS 24.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLLLLXELEBBL

(END) Dow Jones Newswires

May 23, 2023 02:00 ET (06:00 GMT)

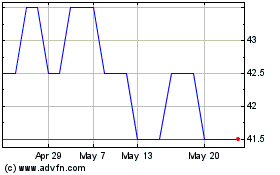

Topps Tiles (AQSE:TPT.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Topps Tiles (AQSE:TPT.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024