Tectonic Gold Plc Year End Corporate Update

08 August 2023 - 4:00PM

UK Regulatory

TIDMTTAU

8 August 2023

TECTONIC GOLD PLC

("Tectonic" or the "Company")

Year end corporate update

Tectonic Gold plc (TDIM: TTAU, is pleased to provide an update on key corporate

and operational developments including funding from the Australian Government,

partnering with a leading Australian mining group on the ongoing development of

the Specimen Hill gold project and an engagement to lead commercialisation of a

major gold portfolio in Ghana.

Highlights:

1. Receipt of R&D funds from Australian Government

2. Farm-out of Specimen Hill copper/gold project

3. Commercialisation of privately held gold portfolio in the Ashanti Gold Belt

4. Rare earths outcome in Heavy Mineral Sands("HMS") joint venture

Tectonics' strategy is to build participation in projects through a transfer of

its IP, technology and expertise without having to internally fund project

development. Farming out Specimen Hill at the completion of the research

program, coupled with an expert advisory engagement to earn an interest in the

Ghanaian portfolio is the most efficient way to crystalise value without having

to raise additional capital. We are constantly evaluating additional

opportunities to build project level interests and over time, a diversified

revenue from those interests.

R&D update

In July Tectonic received a further $157,000 from the Australian Government

under its research and development funding program. Over $3 million has been

received from this program to date which has substantially funded the

development of exploration technology improving the efficiency of gold resource

identification and delineation.

The technology expertise and exploration methodology created through years of

rigorous in-field testing at Specimen Hill has generated two significant

opportunities.

1. The data package generated over multiple seasons of field testing at

Specimen Hill has attracted a farm-in partner to undertake the continued

development of the project. This is discussed in more detail below.

2. The advanced technical expertise developed over the program attracted the

interest of an international gold investor and has resulted in Tectonic being

appointed to lead the commercialisation of a large privately held gold portfolio

in the world class Ashanti Gold Belt in Ghana. Details of this are provided

below.

Expenses in Australia have been significantly reduced and all foreseeable costs

will be covered by cash in hand and expected future funding from the Australian

Government.

Specimen Hill project farm-out

In August Tectonic finalised terms with Fiddlers Creek Mining Company Pty Ltd

(Fiddlers Creek) on an option for Fiddlers Creek to farm-in to a majority

position in the Specimen Hill project. Fiddlers Creek is the exploration

division of ASX listed White Energy Limited, a corporate vehicle being developed

by a highly successful Queensland resources investment group. The terms are as

follows:

· Stage 1 - an option to acquire 51% at the project level for a cash spend of

AU$1 million within 3 years

· Stage 2 - an option to acquire a further 25% (76% in total) by spending a

further AU$2 million

· Stage 3 - Tectonic has the choice of co-funding further development or

selling a further 15% to Fiddlers Creek for AU$2 million in cash

· The remaining interest may then be converted into a non-diluting 3% royalty.

White Energy has a similar technology approach to Tectonic and has a proprietary

ionic geochemistry technique that they will be deploying on Specimen Hill in the

second half of August. This advanced testing is highly effective in identifying

copper targets at depth and will complement the extensive work Tectonic has

already completed on testing the gold in the Specimen Hill system. This will

enable a comprehensive understanding of the copper/gold prospectivity of

Specimen Hill.

This arrangement brings advanced technology and a successful Queensland based

team into the project to complement the work done to date. In addition, it

enables Tectonic to retain a significant economic exposure to Specimen Hill

without incurring development cost as the project is further de-risked.

Ashanti Gold portfolio development lead

Tectonic has been working closely with the principals of Optimus Resources Ltd

("Optimus") over the last six months reviewing a 1,500km2 tenement portfolio

surrounding the lucrative Obuasi and Tarkwa operations within the Ashanti Gold

belt in Ghana. Independently verified historic exploration on this portfolio

reports immediate resources of over 1 million ounces of gold.

The portfolio has been privately held for over twenty years by a leading Ghanian

family office. Their interests span media, insurance, packaging and real estate

and the family wishes to now commercialise the gold portfolio, building a

vertically integrated gold mining business. Their objective is to have it listed

on a major international stock exchange. Tectonic has been engaged to provide

technical expertise and a corporate development strategy for the portfolio.

The Company has begun to evaluate, rank and prioritise assets within the

portfolio and construct a project development pipeline, commercialisation

strategy, identify suitable merger and acquisition opportunities and define a

pathway to listing the group on a major exchange.

This program is being fully funded by the owners.

This is an exceptional opportunity for Tectonic to gain access to a tenement

package of this scale in one of the most productive geological settings in the

world. The Ashanti Gold Belt has been a major source of global gold production

for over a century and hosts a number of the largest international mining

companies. Tectonics' key management has experience on the ground in Ghana and

companies affiliated with Tectonics' founding team are already operating in

country, servicing these major gold mines. Tectonic is bringing its deep

technical research capability, developed with support from the Australian

Federal Government and leading Australian exploration and mining research

institutions, to contribute to the discovery and development of the next

generation of Ghanaian gold mines.

Rare earths in heavy mineral sands joint venture

Tectonic holds a 40% economic interest in Whale Head Pty Ltd, a heavy mineral

sands mining ("HMS") project being developed by joint venture partner, AIM

quoted Kazera Global Plc ("Kazera"). In July, Kazera announced elevated

radioactivity readings in ores beneficiated from alluvial mining of HMS in the

Walviskop project in South Africa and as a result the need to engage South

Africa's National Nuclear Regulator. This is worth understanding in more

technical detail as the source of the radiation is weakly radioactive thorium, a

Rare Earth Element (REE) found in monazite.

The HMS ores at Walviskop include economic concentrations of rutile, zircon, and

monazite. Rutile and zircon are widely used with a range of industrial

applications. Monazites are less well known, but are rare earth minerals

typically comprising thorium, lanthanum and cerium. Lanthanum and its neighbour

on the periodic table, cerium, are used in high end lighting applications, think

flat screen TVs and iPhones. Thorium is used in heat resistant ceramics and

platinum catalytic converters in diesel engines on cars, trucks, ships and

trains. The elevated radiation readings in the Kazera testing should be

understood as evidence that the ores contain valuable monazites. With China's

recent restrictions on the export of certain REEs, this is a positive outcome

for Tectonic.

Mr. Brett Boynton, Managing Director - Tectonic Gold Plc

"The team is really encouraged by the recognition for what we have achieved in

our research in Australia over the last five years. The Fiddlers Creek

endorsement is validation of Tectonics' courage to pioneer new ideas in

exploration and winning the role with Optimus is a Company changing opportunity

to take all of that experience into one of the premier gold belts in the world.

Tectonic is still deeply entrenched in research in Australia and is now

exporting that expertise to Ghana, with a strong in-country partner who has a

genuine desire, and the means, to see a new major gold play created. Ghana, like

Australia, has a long and storied gold mining history. Tectonic is bringing

expertise directly from the crucible of research and development in Australia,

to be a part of the next generation of Ashanti mining stories.

Tectonic is actively reviewing opportunities where we can build a portfolio of

holdings in high quality global gold projects."

The Directors of the Company accept responsibility for the contents of this

announcement.

Investors can sign up to Tectonic's mailing list at the following link:

http://www.tectonicgold.com/contact

Follow us on Twitter: @Tectonic_Gold

For further information, please contact:

Tectonic Gold plc +61 2 9241 7665

Brett Boynton

Sam Quinn

www.tectonicgold.com

@tectonic_gold

Aquis Stock Exchange Corporate Adviser and Broker +44 20 3005??? 5004???

VSA Capital Limited

Andrew Raca - Corporate Finance

Andrew Monk - Corporate Broking

This information was brought to you by Cision http://news.cision.com

https://news.cision.com/tectonic-gold-plc/r/year-end-corporate-update,c3814595

END

(END) Dow Jones Newswires

August 08, 2023 02:00 ET (06:00 GMT)

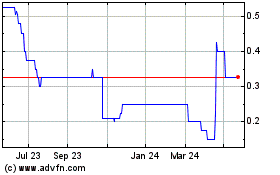

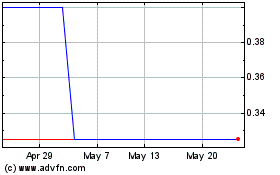

Tectonic Gold (AQSE:TTAU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tectonic Gold (AQSE:TTAU)

Historical Stock Chart

From Nov 2023 to Nov 2024