Walls & Futures REIT PLC (WAFR) Final Results and Audited

Annual Report and Accounts for the Year to 31 March 2021

09-Sep-2021 / 16:30 GMT/BST Dissemination of a Regulatory

Announcement that contains inside information according to

REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group. The

issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT)

REGULATIONS 2019/310.

9 September 2021

WALLS & FUTURES REIT PLC

("Walls & Futures" or the "Company")

Final Results and Audited Annual Report and Accounts for the

Year to 31 March 2021

Walls & Futures REIT plc ("WAFR") the Ethical Housing

Investor and Developer, is pleased to announce its final results

and the publication of its audited annual report and accounts for

the year to 31 March 2021. A copy of the annual report and accounts

has been published on the Company's website,

www.wallsandfutures.com, in accordance with its articles of

association, and can also be viewed through a link at the bottom of

this announcement.

Walls & Futures is an ethical housing investor and developer

on a mission to address the unfulfilled demand for specialist

social housing in the UK.

We design, fund and develop specialist social housing which is

let on Full Repairing and Insuring (FRI), inflation linked leases

to our partners and customers who include local authorities,

registered providers and charities. Their tenants are often

individuals with learning & physical disabilities, autism,

dementia, mental health and life changing injuries.

Walls & Futures REIT plc does not have any involvement with

the care delivered within the properties, this is managed by care

providers approved by local authorities.

Highlights

-- Net Asset Value (NAV) down 4.9% to 102p per share (2020: 107p

per share)

-- Revenue GBP148,420 up 7.5% (2020: GBP138,036)

-- Loss -GBP214,169 (2020: Profit of GBP625,767)

-- 100% of Specialist Supported Housing rents collected

-- 97% of Private Rental Sector rents collected

-- Investment property value fell by 1%

-- Earnings per share -5.70p (2020: 16.93p)

-- Outperformed MSCI UK residential benchmark by 423% for year

ending 31 December 2020

-- Generated over GBP1.3m cash through sale of two Private

Rented Sector (PRS) properties with funds to beinvested in new

SSH

-- Repaid entire GBP600,000 revolving credit facility

-- Pipeline of new partners & projects

Key elements of the final results can be viewed below.

Joe McTaggart, CEO of Walls & Futures REIT plc said:

"Against the challenging economic backdrop caused by Covid-19,

we are pleased with the performance of our portfolio which saw 100%

of our Specialist Supported Housing rents and 97% of our Private

Rental Rents collected.

Our investment strategy showed further resilience as we

outperformed our benchmark, the MSCI UK Residential Annual Property

Index for the fourth year running with a total return of 3.53% over

0.57%.

We're looking forward to announcing further partners in the

coming months and continuing to build the future of specialist

supported housing with the launch of our bespoke modular housing

solution for autism."

For further information, contact:

Walls & Futures REIT PLC 0333 700 7171

Joe McTaggart, Chief Executive

Website www.wallsandfutures.com

Allenby Capital Limited (Corporate Adviser)

Nick Harriss/James Reeve 020 3328 5656

Overview

Against the challenging economic backdrop caused by Covid-19,

which has seen many property companies experience non-payment of

rents and significant falls in asset values, we are pleased with

the robust performance of our portfolio. For the 12 months to 31st

March 2021, we collected 100% of the Specialist Supported Housing

(SSH) and 97% of Private Rental Sector (PRS) rents due.

Part of our strategy, previously outlined, involved selling our

London PRS properties, which were let on Assured Shorthold

Tenancies (ASTs), to fund further SSH investments. The sale was

delayed by emergency legislation introduced by the government to

protect tenants on ASTs, with notice periods increased to 6 months.

Working with our tenants we completed the sale of two of the three

properties.

Our Wimbledon property completed in June 2020 at GBP656,000 and

was followed by one of our Southfields properties which completed

in January 2021 at GBP660,000. Generating a total of GBP1,316,000

in cash before fees, part of which was used to pay down our

GBP600,000 revolving credit facility.

Following the valuation of our property assets, we can report a

modest fall of 1.9% due to a fall in our last PRS property. Our SSH

assets remained the same as last year. As at 31st March 2021, our

Net Asset Value (NAV) fell by 4.9% to 102p per share.

Our investment strategy built on developing our own projects has

enabled us to build a resilient portfolio. We are delighted to

announce that for the calendar year ending 2020, our portfolio

outperformed the benchmark, MSCI UK Residential property index

delivering a total return of 3.53% vs 0.57%. This is the fourth

consecutive year we have outperformed the benchmark. Our intention

is to scale the business so our investment strategy, which averaged

a total return of 268%, is reflected in terms of operating cash

flow and share price.

To illustrate the financial impact of our strategy, we have to

date invested a total of GBP1.34 million in SSH developments. Based

on the long-term nature of the leases, the quality of the covenants

and the income generated they are currently valued at GBP2.57

million. An increase of GBP1.23 million in value or 92 percent.

Unsolicited offer and share price performance

On 8th April 2021, we received an unsolicited bid from Virgata

Services Ltd. It materially undervalued the company and was

overwhelmingly rejected by our shareholders and ultimately lapsed

on 6th July 2021.

Our share price has underperformed relative to our NAV over the

last few years. We believe a significant component this is due to a

small number of shareholders who hold their Walls & Futures

Shares on one particular investment platform continually selling

because the platform was unfamiliar with the regulatory status of

the AQSE Growth Market.

We believe the majority of the Shareholders are long term

holders so in the short term we are actively working to engage with

new investors to replace the minority of shareholders who voted to

accept the bid. With fewer investors selling and more buying into

the company we believe this will serve to close the discount that

we currently trade at.

Additionally, we have had constructive discussions with Aquis

regarding improving liquidity in Walls & Futures Shares.

In November 2020, the Aquis Stock Exchange introduced a new

market-making scheme with founding market makers Canaccord Genuity,

Liberum, Peel Hunt, Shore Capital, Stifel and Winterflood

Securities all supporting the initiative to reduce spreads and

increase liquidity.

Both AJ Bell and Interactive Investor recently announced that

they have added AQSE Growth Market securities to their online

trading platforms, extending AQSE Growth Market investment

opportunities to over 500,000 retail investors. It is reported that

Hargreaves Lansdown and IG Group are also working with Aquis to

include Aquis Stock Exchange traded securities on their online

offering, joining Barclays Smart Invest and Jarvis who already

offer most AQSE Growth Market securities online.

Outlook for the future

Throughout 2020, we actively engaged with stakeholders including

special education needs (SEN) schools, care providers, local

authority commissioners, charities and housing associations in

order to identify an area that was not being adequately served.

We concluded that autism was an area where we could apply our

experience of delivering high quality, design led, specially

adapted homes. This has enabled us to maximise both our positive

social impact and generate returns for our ethically minded

investors.

We have developed direct relationships with new partners across

a network of specialist charities, care providers and housing

associations who provide support, care and advice to those affected

by autism.

Together with these partners, who geographically cover most of

England, we plan to provide small, innovative housing solutions to

accommodate three to ten individuals with autism per development.

The aim is to provide our partners with the ability to deliver a

pathway of progress and highly specialised services which can

support individuals, from childhood (as young as seven), through

adolescence and onto adulthood. With the right support, individuals

will be able to progress through autism-specific homes and avoid

hospitals.

We have now agreed lease terms and signed memorandums of

understanding with new partners covering the North East, South West

and the South East. These memorandums set out the framework for the

provision of SSH which will be let to our partners on long term

leases and work together on joint venture opportunities to deliver

new schemes. There is no guarantee that these memorandums will

result in final agreements being entered into with these

partners.

We are in the process of finalising the design of our bespoke

home for autism. Designed in collaboration with a specialist

architectural practice and our partners, we believe our autism

housing solution enables us to deliver homes at scale, that support

the needs and sensory requirements of individuals across the autism

spectrum.

(MORE TO FOLLOW) Dow Jones Newswires

September 09, 2021 11:30 ET (15:30 GMT)

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Oct 2024 to Nov 2024

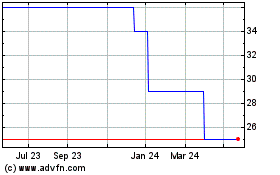

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Nov 2023 to Nov 2024