Walls & Futures REIT PLC (WAFR) Half Year Results for the

period to 30 September 2021 & Directorate Change 31-Dec-2021 /

10:00 GMT/BST Dissemination of a Regulatory Announcement that

contains inside information according to REGULATION (EU) No

596/2014 (MAR), transmitted by EQS Group. The issuer is solely

responsible for the content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT)

REGULATIONS 2019/310.

31 December 2021

WALLS & FUTURES REIT PLC

("Walls & Futures" or the "Company")

Half Year Results for the period to 30 September 2021

Directorate Change

Walls & Futures REIT plc ("WAFR") the Ethical Housing

Investor and developer, is pleased to announce its unaudited

interim results for the six months to 30 September 2021.

Highlights

-- Net Asset Value (NAV) down 5.8% to 96p per share (Mar 2021

102p per share)

-- 100% of Specialist Supported Housing rents collected

-- Loss of GBP200,677

Chief Executive's Statement

While the defence of the unsolicited offer from Virgata Services

was successful, the direct cost has led to charge of approximately

GBP169,000, approximately 85% of the loss for the period.

Despite the ongoing economic challenges affecting the property

market by Covid-19, 100% of our Specialist Supported Housing rents

have been collected.

Post the 30 September 2021, we have successfully disposed of our

final Private Rental Sector (PRS) property for GBP662,500

reflecting a premium of 1.9% to its valuation as dated 31 March

2021. The proceeds will be invested into further Specialist

Supported Housing projects.

We are reviewing several Specialist Supported Housing investment

opportunities, and are confident that future projects will, like

our existing projects in the sector, make a significant positive

impact on both our net asset value and revenue.

The design work on our bespoke home for autism is now complete

and we are finalising the marketing materials to launch in the New

Year.

We also announce David White will step down from the board as of

the 31 December 2021 to focus on other business interests. We thank

him for his efforts and wish him all the best in his new

endeavours.

We are delighted to welcome Keisha Robinson to the board as of

the 1 January 2022. Keisha brings a broad range of complementary

skills to the board which will be of great importance as we roll

out our bespoke home for autism. Further information regarding

Kiesha's appointment are set out below following the half-yearly

financial statements

Joe McTaggart

Chief Executive

Consolidated Income Statement

For the Six-Month Period to 30 September 2021

6 Months to Year ended

6 Months to

30 September 31 March

2021 30 September 2020

2021

GBP GBP GBP

65,063 79,023 148,420

Rent received

Cost of sales (1,334) (31,409) (40,106)

Increase in property values 35,000 - (35,000)

Other Income 28 27,617 (21,861)

Gross Profit 98,757 75,231 51,453

Administrative Expenses

*(299,145) (121,630) (258,654)

Depreciation - (316) (631)

____________ ____________ ____________

OPERATING PROFIT/(LOSS) (200,388) (46,715) (207,805)

Interest receivable and similar income - - 27

Interest payable (289) (5,578) (6,6364)

____________ ____________ ____________

PROFIT/(LOSS) BEFORE TAXATION (200,677) (52,293) (214,169)

Taxation - - -

Loss on disposal of fixed assets & depreciation - (19,000) -

____________ ____________ ____________

PROFIT/(LOSS) FOR THE FINANCIAL PERIOD (200,677) (71,293) (214,169)

Other comprehensive income - 176,118 -

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD (200,677) 104,825 (214,169)

*Includes approx. GBP169,000 of the Exceptional Expenses

directly related to the defense of the Virgata Services unsolicited

offer

Consolidated Balance Sheet

30 September 2021

30 September 2021 30 September 2020 31 March 2021

GBP GBP GBP GBP GBP GBP

FIXED ASSETS

Investment Property 3,250,000 3,950,316 3,215,000

CURRENT ASSETS

Cash at Bank 412,472 40,313 651,357

Debtors and Prepayments 5,268 6,934 3,421

CREDITORS

Amounts falling due within one year (26,917) (5,189) (25,281)

NET CURRENT ASSETS 390,823 42,058 629,497

TOTAL ASSETS LESS CURRENT LIABILITIES 3,640,823 3,992,374 3,844,497

Provision for Liabilities - - -

Amounts falling due over one year (22,004) (30,000) (25,000)

NET ASSETS 3,618,819 3,962,374 3,819,497

CAPITAL AND RESERVES

Called up share capital 187,754 187,754 187,754

Share Premium 3,505,154 3,505,154 3,505,154

Fair Value Reserve 1,223,519 934,900 1,188,519

Retained Earnings (1,297,608) (665,434) (1, 061,930)

3,618,819 3,962,374 3,819,497)

Consolidated Cash Flows

For the Six-Month Period to 30 September 2021

30 September 30 September 31 March

2021 2020 2021

GBP GBP GBP

Cash flows from operating activities

Cash generated from operations (237,126) (62,967) (110,612)

Interest paid (250) (5,514) (6,364)

Net cash from operating activities (237,376) (68,481) (116,976)

Cash flows from investing activities

Purchase of investment property - - -

Sale of tangible fixed assets - (19,000) -

Sale of fixed asset investments - 19,000 -

Sale of investment property - 655,999 1,316,000

Interest received - - 27

Net cash from investing activities - 655,999 1,316,027

Cash flows from financing activities

New loans in year - - 30,000

Loan repayments in year (1,997) (570,000) (600,000)

Share issue - - -

Share buyback - - -

Net cash from financing activities (1,997) (570,000) (570,000)

Increase/(decrease) in cash and cash equivalents (239,373) 17,518 629,051

Cash and cash equivalents at beginning of period 651,357 22,306 22,306

Cash and cash equivalents at end of period 411,984 39,824 651,357

The above figures have not been reviewed by the Company's

auditors.

Appointment of Director

The Company is pleased to announce the appointment with effect

from 1 January 2022 of Ms Kiesha Robinson as an Independent

Non-Executive Director of the Company. Ms Robinson will also be

appointed Company Secretary after a handover period with the

incumbent.

Ms Robinson is an experienced legal and company secretarial

practitioner who has spent the last decade working within the

inhouse legal teams of Vitol, Reckitt Benckiser, Bank of America

Merrill Lynch and Hearst Magazines. She is currently a

Non-Executive Director and Company Secretary of AQSE-quoted SulNox

Group plc, a hydrocarbon fuel emulsification specialist focussed on

emissions reduction and fuel savings.

The Directors of the issuer accept responsibility for the

contents of this announcement.

For further information, contact:

Walls & Futures REIT PLC 0333 700 7171

Joe McTaggart, Chief Executive

Website www.wallsandfutures.com

Allenby Capital Limited (Corporate Adviser)

Nick Harriss/James Reeve 020 3328 5656

Disclosure of Information Required Under Rule 4.9 of the AQSE

Growth Market Access Rulebook

Kiesha Mae Robinson

Age 34

Ordinary Shares held - Nil

Current Directorships

SulNOx Group plc

Noy Consulting Limited

Former Directorships

Luxury Cleaning Services Limited

(MORE TO FOLLOW) Dow Jones Newswires

December 31, 2021 05:00 ET (10:00 GMT)

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Oct 2024 to Nov 2024

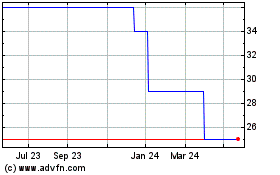

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Nov 2023 to Nov 2024