Walls & Futures REIT PLC (WAFR) Walls & Futures REIT

PLC: Notice of General Meeting 06-Feb-2023 / 11:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMENDMENT) (EU EXIT)

REGULATIONS 2019/310.

6 February 2023

WALLS & FUTURES REIT PLC

("Walls & Futures" or the "Company")

Notice of General Meeting

Walls & Futures REIT plc (Ticker: WAFR), the Ethical Housing

Investor and Developer, announces that a general meeting of the

Company's shareholders will be held at Octagon Point, 5 Cheapside,

London, EC2V 6AA on 23 February 2023 at 1.00pm (the "GM"). A

circular to shareholders including the notice of the GM (the

"Circular") will be posted to shareholders today, and a copy of the

Circular will be added to the Company's website.

The key elements of the Circular are extracted below.

For further information, contact:

Walls & Futures REIT PLC 0333 700 7171

Joe McTaggart, Chief Executive

Website www.wallsandfutures.com

Allenby Capital Limited (Corporate Adviser)

Nick Harriss/James Reeve 020 3328 5656 1. Introduction

The goal of the board of directors at Walls & Futures (the

"Board") has been to generate long-term, sustainable income by

making investments in a portfolio of real estate with an ethical

focus. Our strategy was to get a total return by combining the

capital we made from developing our own assets with the long-term

income we would receive from the long-term indexed leases on the

finished projects.

Although the investments we have made have produced returns that

are above average, finding institutional investors to help us scale

has been one of our biggest hurdles. Sadly, we discovered that our

approach was inapplicable to funds run by institutional investors,

whose objectives were to produce either income or capital returns,

but not both.

In order to scale the Company in terms of equity investment and

investment capacity to deliver long-term secure income through

ethically focused property investments, we have been in regular

communication with a number of strategic investors.

Unfortunately, we were unable to complete a partnership in time

for our 2022 annual general meeting (the "AGM"), so an alternative

proposal was made to refocus just on building our Pax Homes home

for autistic people and to surrender our REIT status.

Following approval of this strategy change at the AGM, the Board

has been seeking financing solutions for a material Pax Homes roll

out, resulting in promising discussions with several lenders. While

we are currently considering funding options which the Board

consider would deliver attractive returns to shareholders over a

period of 3 to 5 years, the Board's view is that shareholders

expect material progress prior to this in light of the recent

budget and increase in interest rates.

As announced on 23 December 2022, Vengrove, a UK focussed,

vertically integrated, real estate investment manager with a

10-year track record (consisting of a group of different legal

entities, collectively referred to here as Vengrove), has become a

significant shareholder in the Company, with a purchase of 250,000

ordinary shares of 5 pence each in the capital of the Company

("Ordinary Shares"), approximately 6.66% of the Ordinary Shares.

The Board have had several discussions with the Vengrove team and

have agreed what both parties believe will be an opportunity for

shareholders to benefit in the medium to long term, taking

advantage of the Company's current real estate investment trust

("REIT") status, as well as from the potential of Pax Homes over

the longer term. The plan we have worked together is designed to

build a strategy and action plan that we believe will give the

Company the funding and investment platform it needs to grow and

begin paying dividends in 2023 (the "Proposals").

I'm happy to have found a strategic investor with whom we can

partner to accomplish our initial goal of generating long-term

stable income from a portfolio of property assets with an ethical

focus. As of Q3 2022, Vengrove had GBP650m of assets under

management including residential, commercial (office and

industrial) and operational real estate. Vengrove currently have a

team of 21, who bring a depth of knowledge and expertise covering

all aspects of real estate investment management. Together they

have the capability to acquire, develop, asset manage and finance

real estate transactions in-house. 2. The Proposals

The Board has called the GM so our shareholders are being asked

to approve resolutions necessary for the implementation of the

Proposals. The Proposals will require the issue of new Ordinary

Shares for cash to subscribers to be procured by Vengrove in order

to progress the revised strategy that is set out below. The

implementation of the Proposals will result in the number of

Ordinary Shares in issue increased by a factor of approximately 10,

and this requires the approval of shareholders.

The revised strategy involves the retention of the Company's

status as a REIT under UK tax rules. To enable this, the resolution

put and approved at the AGM to remove the requisite article from

the Company's Articles of Association is being proposed to be

reversed.

This letter explains the background to, and reasons for, the

Proposals and explains why your Board considers the Proposals are

likely to promote the success of the Company for the benefit of the

Company's shareholders as a whole and why the Board unanimously

recommends that you vote in favour of the Resolution to be proposed

at the GM, notice of which is set out at the end of this document.

3. Platform for growth and dividend

Below is an outline of the proposed changes in structure,

strategy and funding that we believe will be required to deliver

the capital and investment platform required to drive growth and

begin paying dividends in 2023.

Structure

The Company is currently structured as an internally managed

investment company. It is proposed that the Company adopts a more

conventional structure, in line with other UK REIT and appoint an

external investment manager, Vengrove SI-REIT Advisors Limited, a

constituent of the Vengrove group, who will be delegated the

responsibility of raising capital and the executing the investment

strategy. It is proposed this change will coincide with an initial

fundraise which is outlined later in this document.

The Company will retain the Company's status as a real estate

investment trust ("REIT"), which had previously been set to be

relinquished following the vote at the AGM.

During this process we will appoint a board member from the

Vengrove team, who will step-down once the initial fundraise is

complete.

The Board has concluded that the further development of the Pax

Homes business will be best undertaken externally if the Proposals

are approved, as development activities will not be compatible with

the revised strategy. If resolutions 1, 2 and 3 are passed at the

GM, it is proposed that the Pax Homes business will be sold to

Joseph McTaggart, structured in a way that will provide a

reasonable return to the Company's shareholders for the investment

made to date. It is anticipated that the transaction will complete

prior to the end of the Company's current financial year, at which

point full details of any such transaction will be announced.

Investment Strategy

In order to scale the Company in terms of equity investment and

investment capacity to deliver long-term secure income through

ethically focused property investments, we will no longer develop

and will acquire stabilised income producing real estate assets.

This will enable us to scale faster and pay a dividend.

It is proposed that the Company will broaden its investment

strategy, targeting social infrastructure which is defined as

foundational assets that support the quality of life of regional

and local communities.

The four core sectors are 1. Affordable Housing - e.g.

Intermediate Rent and Discount to Market Rent PRS (Private Rental

Sector)

Affordable Housing is fundamental to a fair and healthy

community and those most vulnerable are impacted the most. The REIT

will acquire affordable housing to lease to key workers and others

finding it hard to afford market rent prices across the UK. 2.

Education - e.g. Children's Nurseries, Special Education Needs

& Schools

Education is an essential pillar in driving economic growth in

local communities across all age groups. The REIT will acquire key

educational facilities to further support the education/training of

individuals across communities. 3. Roadside & Transport - e.g.

Service stations (EV & Petrol), Car Parks, Bus depots

Community urban infrastructure assets are the physical

facilities needed to support and sustain a community of people to

live and work. The REIT will acquire roadside & transport

assets that act as key infrastructure for a local community and

beyond. 4. Civic, Community & Justice - e.g. Community Centres,

Libraries, Law Courts, Recycling Facilities

Civic, community and justice buildings often embody the identity

of the communities they serve. In addition to official functions,

they fulfil a variety of other purposes such as a place to meet.

The REIT will acquire community assets that are used for the

well-being of the wider community.

In order to more effectively reflect the company's ongoing

strategy, the Board also proposes changing the name of the company

to Social Infrastructure REIT.

Investment & equity funding

(MORE TO FOLLOW) Dow Jones Newswires

February 06, 2023 06:00 ET (11:00 GMT)

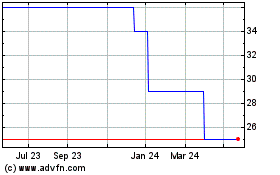

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Walls & Futures REIT (AQSE:WAFR)

Historical Stock Chart

From Nov 2023 to Nov 2024