TIDMWTG

RNS Number : 1381N

Watchstone Group PLC

21 September 2023

Watchstone Group plc

("Watchstone" or the "Company" or the "Group")

Results for the six months ended 30 June 2023

Watchstone today announces its results for the six months ended

30 June 2023.

-- Operating loss of GBP6.1m (2022: loss of GBP2.1m)

-- Group net assets of GBP7.6m at 30 June 2023 (as at 31 December 2022: GBP13.5m)

-- Group cash and term deposits at 30 June 2023 of GBP8.3m (as at 31 March 2023: GBP11.5m)

-- As at 19 September 2023, the Group had cash and term deposits

of GBP7.6m following final settlement of PwC's costs relating to

litigation

For further information:

Watchstone Group plc Tel: 03333 448048

WH Ireland Limited, Adviser and broker Tel: 020 7220

Chris Hardie/James Bavister 1666

------------------

Update

A full summary of actions and issues was presented in our Annual

Report published in April 2023 and an update is provided below.

Update on outstanding legacy matters

Our claim against PricewaterhouseCoopers LLP ("PwC") was heard

in the High Court during January and February 2023. In May 2023,

the High Court handed down its judgement and, disappointingly,

dismissed the claim. The Group has sought permission to appeal this

decision however, in the meantime, has been required to settle the

legal costs of the defendants, in addition to that of the Group.

This resulted in total legal costs during the six months ended 30

June 2023 of GBP4.9m being recognised within these Condensed

Consolidated Financial Statements. This includes amounts actually

paid to PwC on and before 31 August 2023 in full and final

settlement of such costs.

Our appeal for the recovery of historic VAT paid in the ingenie

business was heard by the First Tier VAT Tribunal in December 2021

and we were notified in April 2022 of the Tribunal's judgement in

favour of HMRC. The Group is appealing this decision which is to be

heard in November 2023.

Finally, our Canadian subsidiary's claim against Aviva Canada is

ongoing and the trial is to be heard in January 2024. No other new

claims have been made either for or against the Group and no

further claims are currently envisaged.

Financial update

The costs of pursuing our litigation assets are expensed as

incurred. The costs of litigation are always factored into the

strategic decision to pursue claims and minimising such costs is a

constant challenge. The costs of the HMRC and Canadian claims are

not comparable to the costs of the PwC claim and, accordingly, the

run rate of legal costs going forward will be materially lower than

in the past.

No associated income from settlement, appeal, or otherwise is

recognised until the case is resolved due to the inherent

uncertainty in the outcome and timing of the legal cases. GBP4.9m

of external legal costs were incurred in the six months ended 30

June 2023 primarily in relation to the claim against PwC discussed

above (six months ended 30 June 2022: GBP1.0m) covering both

Watchstone's own costs and those of PwC (GBP2.7m in full and final

settlement).

Since litigation in favour of the Group is pursued at the

discretion of the Group, no provision for legal expenses is made.

As a result of the decision of the First Tier VAT Tribunal finding

in favour of HMRC, a provision for the costs of the defence

incurred by HMRC had been provided at 31 December 2022 and 30 June

2023.

The Group continues to place a proportion of its cash holding

into short term deposits to take advantage of market interest

rates, but for prudence, these are with household name UK

banks.

The net assets of the Group at 30 June 2023 were GBP7.6m (31

December 2022: GBP13.5m). This primarily comprises cash and term

deposits of GBP8.3m (31 December 2022: GBP13.8m).

Any value attributable to litigation in favour of the Group

represents contingent assets and is therefore not recognised in the

Condensed Consolidated Statement of Financial position due to the

inherent uncertainty in respect of their outcome, value and

timing.

As at 19 September 2023, the Group had cash and term deposits of

GBP7.6m.

Board and running costs

Further reductions were made to the ongoing costs of the Group

following the AGM on 30 May 2023 with the resignation of Lord

Howard and David Young. In addition, going forward the finance

function is being carried out via a third-party consultancy

reducing costs by approximately 50%. In the five month period from

1 April to 31 August 2023, the business consumed GBP3.7m of cash

including GBP3.3m in respect of the PwC costs settlement and other

legal costs. As we complete the remaining matters, the Group now

operates remotely with no office costs and only one executive.

Principal risks and uncertainties

The principal risks and uncertainties to which the Group is

exposed remain broadly as set out in section 4 of the Strategic

Report included within the Annual Report and Financial Statements

for the year ended 31 December 2022.

Outlook

We remain focussed on realising the Group's remaining litigation

assets as efficiently as possible and are confident of returning

further cash sums to shareholders in due course.

Directors' Responsibility Statement

Responsibility statement of the Directors in respect of this

interim report.

We confirm that to the best of our knowledge:

-- the set of condensed consolidated financial statements has

been prepared in accordance with IAS 34 Interim Financial

Reporting, as adopted for use in the UK;

-- the interim management report includes a fair review of the information required by:

a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the set of

condensed consolidated financial statements; and a description of

the principal risks and uncertainties for the remaining six months

of the year; and

b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

Stefan Borson

Chief Executive Officer

On behalf of the Directors

Condensed Consolidated Income Statement

for the period ended 30 June 2023

Six months Six months

ended ended

30 June 30 June

2023 2022

Note GBP'000 GBP'000

Administrative expenses 4 (6,086) (2,117)

Group operating loss (6,086) (2,117)

Finance income 134 90

Loss before taxation 4 (5,952) (2,027)

Taxation - -

Loss after taxation for the period from

continuing operations (5,952) (2,027)

Loss for the period from discontinued operations 8 (8) (26)

Loss after taxation for the period (5,960) (2,053)

Attributable to:

Equity holders of the parent (5,960) (2,053)

Non-controlling interests - -

(5,960) (2,053)

-------------------------------------------------- ----------- -----------

Loss per share (pence):

Basic (12.9) (4.5)

Diluted (12.9) (4.5)

-------------------------------------------------- ----------- -----------

Loss per share from continuing activities

(pence):

Basic (12.9) (4.4)

Diluted (12.9) (4.4)

-------------------------------------------------- ----------- -----------

Condensed Consolidated Statement of Comprehensive Income

for the period ended 30 June 2023

Six months Six months

ended 30 ended 30

June 2023 June 2022

GBP'000 GBP'000

Loss after taxation (5,960) (2,053)

Items that may be reclassified in the Consolidated

Income Statement

Exchange differences on translation of foreign

operations 11 (47)

Total comprehensive (loss) for the period (5,949) (2,100)

---------------------------------------------------- ----------- -----------

Attributable to:

Equity holders of the parent (5,949) (2,100)

Non-controlling interests - -

(5,949) (2,100)

------------------------------ -------------------- --------

Condensed Consolidated Statement of Financial Position

as at 30 June 2023

At 30 June At 31 December

2023 2022

Note GBP'000 GBP'000

Current assets

Trade and other receivables 5 557 1,711

Term deposits 7,000 12,000

Cash 1,262 1,768

Total current assets 8,819 15,479

------------------------------- ----- ----------- ---------------

Total assets 8,819 15,479

------------------------------- ----- ----------- ---------------

Current liabilities

Trade and other payables 6 (1,092) (1,803)

Provisions 7 (129) (129)

------------------------------- ----- ----------- ---------------

Total current liabilities (1,221) (1,932)

------------------------------- ----- ----------- ---------------

Total liabilities (1,221) (1,932)

------------------------------- ----- ----------- ---------------

Net assets 7,598 13,547

------------------------------- ----- ----------- ---------------

Equity

Share capital 10 4,604 4,604

Other reserves 69,730 69,719

Retained earnings (66,737) (60,777)

------------------------------- ----- ----------- ---------------

Equity attributable to equity

holders of the parent 7,597 13,546

Non-controlling interests 1 1

Total equity 7,598 13,547

------------------------------- ----- ----------- ---------------

Condensed Consolidated Cash Flow Statement

for the period ended 30 June 2023

Six months Six months

ended ended

30 June 30 June

Note 2023 2022

GBP'000 GBP'000

Cash flows from operating activities

Cash used in operations before net finance

expense and tax 11 (5,652) (2,373)

-------------------------------------------- ----- ----------- -----------

Corporation tax paid - -

Net cash used by operating activities (5,652) (2,373)

-------------------------------------------- ----- ----------- -----------

Cash flows from investing activities

Investment in term deposits (8,000) (8,000)

Maturity of term deposits 13,000 -

Interest income 148 -

Net cash used by investing activities 5,148 (8,000)

-------------------------------------------- ----- ----------- -----------

Cash flows from financing activities

Return of capital - -

Net cash used by financing activities - -

-------------------------------------------- ----- ----------- -----------

Net decrease in cash and cash equivalents (504) (10,373)

Cash and cash equivalents at the beginning

of the period 1,768 12,996

Exchange (losses)/gains on cash and cash

equivalents (2) 7

Cash and cash equivalents at the end

of the period 1,262 2,630

-------------------------------------------- ----- ----------- -----------

Notes to the Interim Statements

1. Preparation of the condensed consolidated financial information

Basis of preparation

The condensed consolidated financial statements for the six

months ended 30 June 2023 have been prepared in accordance with the

AQSE Growth Market Rules and the r ecognition and measurement

requirements of IFRSs as adopted for use in the UK . The interim

financial information should be read in conjunction with the

Group's Annual Report and Financial Statements for the year ended

31 December 2022, which were prepared in accordance with IFRSs as

adopted for use in the UK.

The comparative figures for the financial year ended 31 December

2022 are not the company's statutory accounts for that financial

year. Those accounts have been reported on by the company's auditor

and delivered to the registrar of companies. The report of the

auditor was (i) unqualified, and (ii) did not contain a statement

under section 498 (2) or (3) of the Companies Act 2006.

The Group's business activities together with the factors that

are likely to affect its future developments, performance and

position are set out in the Update. The condensed consolidated

financial statements were approved by the Board of Directors on 20

September 2023.

Going Concern

The Group holds appropriate cash reserves and no debt. The Group

has concluded that its cash reserves will be sufficient to fund the

Group's ongoing running costs together with any future investment

in litigation required.

On this basis, the Directors have a reasonable expectation that

the Group has adequate resources to continue in operational

existence for the foreseeable future. The Directors have not

identified any material uncertainties that would cast significant

doubt on the ability of the Group to continue as a going concern.

Therefore, the Directors continue to adopt the Going Concern basis

of accounting in the preparation of the condensed consolidated

financial statements.

Statement of Directors' responsibilities

The Directors confirm that, to the best of their knowledge, this

set of condensed consolidated financial statements have been

prepared in accordance with the AQSE Growth Market Rules.

Significant Accounting Policies

The accounting policies applied by the Group in this set of

condensed consolidated financial statements are the same as those

applied by the Group in its consolidated financial statements for

the year ended 31 December 2022, except for the adoption of new

standards and interpretations as of 1 January 2023. None of these

standards have any significant impact on the accounting policies,

financial position or performance of the Group, as noted below:

-- Narrow scope amendments to IAS 1, Practice statement 2 and IAS 8.

-- Amendment to IAS 12 - deferred tax related to assets and

liabilities arising from a single transaction.

-- IFRS 17, 'Insurance contracts'.

-- Amendment to IFRS 16 - Leases on sale and leaseback.

-- Amendment to IAS 1 - Non-current liabilities with covenants.

The Group has not early adopted any other standard,

interpretation or amendment that has been issued but is not yet

effective.

2. Critical accounting judgements and key sources of estimation

uncertainty

In the process of applying the Group's accounting policies,

management has made a number of judgements, and the preparation of

condensed consolidated financial statements requires the use of

estimates and assumptions that affect the reported amounts of

assets and liabilities at the date of the condensed consolidated

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual results ultimately may differ from those

estimates.

The key management judgements together with assumptions

concerning the future and other key sources of estimation

uncertainty at 30 June 2023 that have a significant risk of causing

a material adjustment to the carrying amounts of assets and

liabilities during the current financial year are discussed

below.

Estimate and judgement: Legal cases

The Group is involved with a number of actual or potential legal

cases which, if successful, could result in material cash inflows

to the Group. The relative merits of these cases and the assessment

of their likely outcome is highly judgemental by nature. Similarly,

management recognise the hurdle set by accounting standards to

recognise an asset or disclose a contingent asset is very high and

therefore neither is recognised or disclosed within these condensed

consolidated financial statements.

Judgement: Recognition of liabilities arising under the

Distribution Incentive Scheme

As discussed in the Directors' Remuneration Report on pages 8

and 9 of the 2022 Annual Report and Financial Statements the Chief

Executive Officer is entitled to 5.43% of any distribution over and

above a prescribed distribution hurdle which was first and

permanently exceeded during 2020. No amounts have been recognised

in these condensed consolidated financial statements in respect of

any future payments as it is the judgement of management that the

liability does not crystallise, and is materially uncertain, until

Court approval has been obtained for the related capital reduction

and cash return and furthermore, any distribution (and therefore

incentive payment) is made at the discretion of the Group. The

impact of this judgement is 5.43% of any future amounts

distributed.

3. Key performance indicators

Six months Six months

ended 30 June ended 30

2023 June 2022

GBP'000 GBP'000

Cash returned to shareholders - -

------------------------------- --------------- -----------

Group operating loss (6,086) (2,117)

-------------------------------- --------------- -----------

Group net assets 7,598 11,425

-------------------------------- --------------- -----------

Cash and term deposits 8,262 13,768*

-------------------------------- --------------- -----------

Basic loss (pence per share)

- continuing operations (12.9) (4.4)

-------------------------------- --------------- -----------

*At 31 December 2022

4. Administrative expenses

Six months Six months

ended 30 June ended 30

2023 June

2022

GBP'000 GBP'000

Administrative expenses include:

* Legal expenses 4,855 978

* Tax related matters 7 8

4,862 986

---------------------------------- --------------- -----------

Legal expenses during the period ended 30 June 2023 primarily

relate to the costs of the claim against PwC which was found in

favour of the defendants. As a result of the adverse outcome the

settlement of the defendant's legal costs are also included above.

Further details are provided in the Update.

Legal costs during the six months ended 30 June 2022 relate to

the claim against PwC and the claim against KPMG LLP which was

settled in December 2022.

5. Trade and other receivables

30 June 31 December

2023 2022

GBP'000 GBP'000

Other receivables 473 1,652

Prepayments 30 19

Accrued interest 54 40

557 1,711

------------------- -------- ------------

6. Trade and other payables

30 June 31 December

2023 2022

GBP'000 GBP'000

Current liabilities

Trade payables 65 264

Payroll and other taxes including social

security 38 54

Accruals 989 1,485

1,092 1,803

------------------------------------------ -------- ------------

7. Provisions

Legal disputes Total

GBP'000 GBP'000

At 1 January 2022 129 129

At 30 June 2022 129 129

------------------------------ ------------ --------------- ----------

At 1 January 2023 129 129

At 30 June 2023 129 129

------------------------------ ------------ --------------- ----------

Split:

Non-current - -

Current 129 129

Legal disputes and regulatory matters

Provisions at 1 January 2023 and 30 June 2023 relate to the

decision of the First Tier VAT Tribunal which found against the

Group and that Watchstone' s subsidiary WTGIL Limited ("WTGIL") did

not make any supplies of telematics devices or related services in

the VAT periods 07/2014 to 07/2018. Accordingly, WTGIL's appeal was

dismissed. The Group has since appealed this decision.

In legal cases where the Group is the claimant, costs are not

provided as there is no obligation to proceed and the Group is not

contractually committed to incur costs.

8. Discontinued operations and disposals

Loss for the period from discontinued operations:

2023 2022

GBP'000 GBP'000

Ingenie (4) (16)

Hubio (4) (10)

Loss for the period from discontinued

operations net of tax (8) (26)

--------------------------------------- -------- --------

9. Contingent assets and liabilities

Litigation in relation to the historic activities of the Group

is being pursued including claims against Aviva Canada Inc. These

give rise to contingent assets, which are not recognised within the

Condensed Financial Statements due to lack of certainty as to the

outcome, despite an inflow of economic benefit being considered

probable.

10. Share capital

Number Nominal Nominal Nominal

value fully value unpaid value total

paid

000's GBP'000 GBP'000 GBP'000

at 31 December 2022 and

30 June 2023 46,038 4,593 11 4,604

------------------------- ------- ------------- -------------- -------------

11. Cash flow from operating activities

Six months Six months

ended 30 ended 30

June 2023 June 2022

Loss after tax (5,960) (2,053)

Finance income (134) (90)

Operating loss (6,094) (2,143)

Operating cash flows before movements in

working capital and provisions (6,094) (2,143)

Decrease in trade and other receivables 1,153 59

(Decrease) in trade and other payables (711) (289)

Cash outflows from operations before net

finance expense and tax (5,652) (2,373)

------------------------------------------ ----------- -----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXZZGZLZGGGFZZ

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

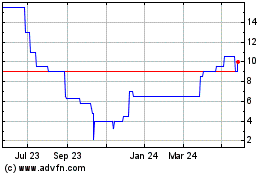

Watchstone (AQSE:WTG)

Historical Stock Chart

From Oct 2024 to Dec 2024

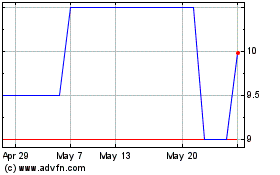

Watchstone (AQSE:WTG)

Historical Stock Chart

From Dec 2023 to Dec 2024