TIDMZIOC

RNS Number : 2812H

Zanaga Iron Ore Company Ltd

23 November 2022

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 which is part of UK law

by virtue of the European Union (Withdrawal) Act 2018. Upon

publication of this announcement, such information is now

considered to be in the public domain.

23 November 2022

PROPOSED ACQUISITION OF GLENCORE'S SHAREHOLDING IN THE ZANAGA

IRON ORE PROJECT

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM:

ZIOC) is pleased to announce that an agreement has been reached

with Glencore Projects , for the acquisition of Glencore Projects'

controlling shareholding in the Project, located in the Republic of

Congo through the purchase of Glencore Projects' 50% plus one share

interest in Jumelles, an entity which indirectly holds the benefit

of the Project's mining licence, for a minority shareholding in

ZIOC. ZIOC and MPD, an indirect wholly owned subsidiary of Jumelles

which holds the benefit of the Project's mining licence, have also

entered into a Marketing Agreement with Glencore International,

which will take effect immediately prior to Completion, for the

sale and purchase of all future iron ore production from the

Project or any other of their or their Affiliates' assets using

similar infrastructure in the Republic of Congo.

Highlights

-- Proposed acquisition by ZIOC of Glencore Projects'

controlling shareholding in Jumelles, indirect owner of the

Project

o Subject to ZIOC shareholder approval, the Acquisition will be

concluded through the issuance of 286,340,379 new Shares to

Glencore Projects, which are expected to represent a shareholding

of 48.26% in ZIOC on Completion.

o Relationship Agreement to be entered into between Glencore

Projects and ZIOC with effect from Completion to ensure that the

Company can carry on its business independently of Glencore

Projects.

o Glencore Projects will have the right with effect from

Completion to appoint two non-executive directors to the Board of

ZIOC.

o Glencore Projects has agreed that it will not dispose of any

of the Consideration Shares in the Company in the six months

following Admission without the consent of the Company (not to be

unreasonably withheld or delayed) other than in certain limited

circumstances and to comply with orderly market provisions in the

following six months.

-- Marketing Agreement entered into between Glencore

International, the Company and MPD which will take effect

immediately prior to Completion

o Life-of-mine marketing agreement granting Glencore

International the exclusive marketing right for all iron ore

conforming to certain specifications produced by MPD, ZIOC or their

respective Affiliates from the Project or in the Republic of Congo

using similar infrastructure that is not subject to existing sales

arrangements.

o Agreement by Glencore Projects to purchase from MPD or the

Company the Product, or sell the Product on behalf of the Company

on arm's length terms.

o Glencore International to be entitled to receive a marketing

fee in accordance with the detailed provisions of the Marketing

Agreement.

-- Funding agreement

o In order to fund the Project's continuing work programme and

budget, as well as the working capital requirements of ZIOC, until

31 December 2023, Glencore Projects has agreed to amend the terms

of the Loan Agreement as follows:

-- increase in loan quantum from US$1.2 million to US$1.8

million;

-- extension of loan repayment date to 31 December 2023.

-- Jumelles may utilise up to US$200,000 of the loan facility to

advance loans to ZIOC to fund its working capital.

-- General Meeting

o A notice of a general meeting to be convened for on or around

13 December 2022 will be sent to Shareholders shortly to seek

authority for the directors to: (i) issue 286,340,379 Shares

pursuant to the Acquisition; and (ii) not require Glencore Projects

to make a takeover offer in accordance with Regulation 33 of the

Articles in connection with the Acquisition.

Clifford Elphick, Non-Executive Chairman of ZIOC, commented:

"The acquisition of Glencore Projects' shareholding in the

Project is a key milestone for ZIOC's shareholders, demonstrating

to third party investors that the Project is now represented by a

single entity and management strategy. The Acquisition is value

accretive to Shareholders and increases effective equity ownership

of the Project by existing Shareholders, enhancing their

look-through ownership of the Project and securing control of the

Project without paying any premium for such interest.

Furthermore, entering into the Marketing Agreement with Glencore

International now provides comfort to investors and financiers that

the Project's future production is underpinned by one of the

largest iron ore traders globally."

For further information, please contact:

Zanaga Iron Ore Company Limited

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Scott Mathieson, Edward Thomas

Adviser and Corporate Broker +44 20 3100 2000

About us:

Zanaga Iron Ore Company Limited ("ZIOC" or the "Company") (AIM

ticker: ZIOC) is the owner of 50% less one share in the Zanaga Iron

Ore Project based in the Republic of Congo through its investment

in its associate Jumelles Limited. The Zanaga Iron Ore Project is

one of the largest iron ore deposits in Africa and has the

potential to become a world-class iron ore producer.

General

All statements, other than statements of historical facts,

included in this announcement, including, without limitation, those

regarding the Company's financial position, business strategy,

plans and objectives of management for future operations or

statements relating to expectations in relation to dividends or any

statements preceded by, followed by or that include the words

"targets", "believes", "expects", "aims", "intends", "plans",

"will", "may", "anticipates", "would", "could" or similar

expressions or the negative thereof, are forward-looking

statements. Such forward-looking statements involve known and

unknown risks, uncertainties and other important factors beyond the

Company's control that could cause the actual results, performance,

achievements of or dividends paid by the Company to be materially

different from actual results, performance or achievements, or

dividend payments expressed or implied by such forward-looking

statements. Such forward-looking statements are based on numerous

assumptions regarding the Company's net asset value, present and

future business strategies and income flows and the environment in

which the Company will operate in the future.

These forward-looking statements speak only as of the date of

this announcement. The Company expressly disclaims any obligation

or undertaking to disseminate any updates or revisions to any

forward-looking statements contained herein to reflect any change

in the Company's expectations with regard thereto, any new

information or any change in events, conditions or circumstances on

which any such statements are based, unless required to do so by

law or any appropriate regulatory authority.

Shareholders should read the risk factors set out in the

Company's annual report and accounts that could affect the

Company's future performance and the industry in which it operates.

In light of these risks, uncertainties and assumptions, the events

described in the forward-looking statements in this announcement

may not occur.

DETAILS OF THE ACQUISITION

Transaction overview

The Company and Glencore Projects' ownership of the Project is

managed through a joint venture agreement in respect of Jumelles.

The Company currently holds 50% less one share of the entire issued

share capital of Jumelles, whilst Glencore Projects owns 50% plus

one share of the entire issued share capital of Jumelles. The

Company is proposing to purchase Glencore Projects' entire holding

in the Project (comprising 50% plus one share interest in Jumelles)

in consideration for issuing new Consideration Shares in the

Company to Glencore Projects.

Transaction rationale

The Project is one of the largest iron ore deposits in Africa

and the Company expects that the Project has the potential to

become a world-class iron ore producer. Based on 2014 FS, the

quality of the Project's iron ore resource indicates the potential

to produce premium iron ore product with prospective premium

pricing. It is expected that new strategic investors are required

to enable the development and construction of the Project.

The Acquisition will:

(a) consolidate the Company's ownership of Jumelles to provide a

clear ownership structure and direction in respect of the

development and management of the Project;

(b) provide Glencore Projects with the right to appoint up to

two non-executive directors of the Company (comprising of a

minority within the Board) whilst still also requiring Glencore

Projects to observe the terms of the Relationship Agreement;

(c) provide a new structure that is expected to facilitate

capital raising and enhance liquidity for Shareholders; and

(d) remove the complexities of the current joint venture structure.

The Company expects that the factors mentioned above will

enhance the attractiveness of the Project as a potential investment

for large strategic investors.

Project

The Project is planned to be a large scale iron ore mine,

processing and infrastructure operation to produce 30Mtpa of high

grade iron ore (pellet feed) concentrate over a 30 year life of

mine and developed in two stages.

-- Stage One - 12Mtpa of pellet feed

-- Stage Two - 18Mtpa expansion to 30Mtpa of pellet feed

The primary facilities for the Project are currently proposed to

include:

-- An open pit mining operation and associated process plant and mine infrastructure.

-- Slurry pipeline for transport of iron ore concentrate from the mine to the port facilities.

-- Port facilities and infrastructure for dewatering and

handling of the iron ore products for export to the global

sea-borne iron ore market located within a proposed third party

constructed port facility.

Total Stage One capital expenditures are estimated to be US$2.2

billion, with US$1.2 billion of direct costs and US$1 billion of

indirect costs and contingency.

Total Stage Two capital expenditures are estimated to be US$2.5

billion, with US$1.5 billion of direct costs and US$1 billion of

indirect costs and contingency.

Stage One capital costs have been estimated to a 2014 FS level

of definition. The Stage Two costs are supported by a lower level

of engineering (PFS level) but significantly leverages the work

completed for the Stage One development. Cost escalation is

excluded from the capital cost estimate. The capital cost estimate

assumes the use of a third party port facility at

Pointe-Indienne.

Expenditure and Financing

The Company had cash reserves of US$90,000 as at 22 November

2022 and is expected to have cash reserves of US$80,000 as at

Completion and the Company continues to take a prudent approach to

managing these funds which are required to cover corporate head

office costs. To assist with this, each of the Directors has agreed

to defer their fees until such time as is resolved by the

Board.

Whether or not Completion occurs, the Project's work programme

and budget is currently funded until 30 June 2023 under the terms

of the Loan Agreement from Glencore Projects, which is then

repayable on that date.

Pursuant to the terms of the Loan Amendment (summarised further

below) which will become effective on Completion, Glencore Projects

has agreed to provide Jumelles with a line of credit to finance the

Project's continuing work programme and budget of approximately

US$1.2 million for the twelve months to 31 December 2023,

US$200,000 of which can be advanced as an intragroup loan by

Jumelles to the Company to meet the Company's working capital

requirements from Completion until 31 December 2023. The Company's

working capital requirement from Completion until 31 December 2023

have been budgeted at approximately US$200,000.

Whilst the Loan Amendment provides Jumelles and the Company with

the funding necessary to maintain the Project from Completion, the

development of the Project remains dependent on the Company

securing additional finance. The Directors believe that the

Acquisition will assist the Company when seeking such finance as

the Acquisition will consolidate the Company's sole ownership and

control of Jumelles providing a clear ownership structure and

direction in respect of the development and management of the

Project.

Conditions to Completion

Subject to the passing of the Resolutions, it is anticipated

that Completion will occur on or before 16 December 2022.

Completion is conditional upon (amongst other matters):

(a) the Resolutions being duly passed at the General Meeting;

(b) Admission of the Consideration Shares;

(c) entry into certain transaction documents by various parties; and

(d) other matters which are customary for an acquisition of this nature.

In addition to the conditions, each of the parties has limited

termination rights prior to Completion. Accordingly, if the

Resolutions are not passed at the General Meeting, the Sale and

Purchase Agreement will terminate and the Acquisition will not

proceed.

If the Acquisition does not complete, the Loan Amendment will

not become effective and whilst the Loan Agreement will meet the

Project's work programme and budget until 30 June 2023, the Company

will remain responsible for funding its share of the work

programme. The Company will therefore need to raise additional

funding for this and to also repay the loan facility under the Loan

Agreement which will, in those circumstances, become due on 30 June

2023. If the Company is unable to fund its share of the work

programme, then ultimately its interest in the Project may be

diluted.

Shareholder approval

The Company is acquiring the Sale Shares (in connection with the

Project) in exchange for issuing the Consideration Shares. The

Company has also entered into the Marketing Agreement pursuant to

which it will grant an offtake over 100% of all future iron ore

produced by MPD, ZIOC or their respective Affiliates in the

Republic of Congo. By virtue of the fact that the Company is

acquiring the half of the Project that it does not currently own,

the total consideration for the Acquisition is estimated to be

around the same value as 100% of the Company's issued share capital

on Completion as at the date of the Sale and Purchase

Agreement.

The Directors believe that the Acquisition is akin to a

corporate restructuring, with Glencore Projects moving its

approximate 50% interest in the Project from the joint venture

level in Jumelles to a holding in the Company, rather than a

commercial acquisition or disposal.

Whilst the Acquisition is not a reverse takeover under the AIM

Rules for Companies requiring shareholder approval, pursuant to the

Resolutions, the Company is seeking Shareholder approvals required

in connection with the issue of the Consideration Shares pursuant

to the Acquisition. Therefore, existing Shareholders have the right

to consider the merits of the Acquisition and to decide whether to

vote in favour of the Resolutions, approvals of which are necessary

for the Acquisition to proceed.

IMPACT OF THE TRANSACTION ON THE COMPANY

Business of the Company

The business of the Company will remain the same, the

development of the Project. Following Completion, the Company

intends to continue to progress the Project and the Loan Amendment

will provide the Company with a line of credit to enable the

Company to fund the work programme of the Company until 31 December

2023. During this time, the Company will also seek to engage with

potential funders for the development of the Project. The

acquisition of Glencore Projects' interest in Jumelles simply

enables the Company to have more direct control over the Project

and a simplified ownership structure which should assist in

attracting funding.

Board composition

Following Completion and on the assumption that Glencore

Projects chooses to exercise its right to appoint directors to the

Board as provided for in the Relationship Agreement, the new Board

will comprise five directors. Glencore Projects will have the right

to nominate two directors and the remaining three directors will

comprise the three directors currently serving on the Board, who

are all non-executive directors. The existing directors will

therefore remain a majority on the Board.

A further announcement will be made when the Glencore Projects

appointees are appointed and as required by applicable rules and

regulations, including the information required by the AIM Rules

for Companies.

Employees and consultants

The Company does not expect any material changes to its current

employees and / or consultants following Completion and to the

delivery of the work programme in 2023. During this time, the

Company will also seek to initiate discussions regarding the

funding required for the development of the Project. Once funding

has been secured and work on the development of the Project has

commenced, the Company expects to recruit an executive team to meet

the demands of the Company and the Project.

Corporate governance

The Company remains committed to maintaining high standards of

corporate governance throughout its operations and to ensuring that

all of its practices are conducted transparently and efficiently.

The Company believes that scrutinising all aspects of its business

and reflecting, analysing and improving its procedures will result

in the continued success of the Company and improve Shareholder

value.

The Company adheres to the following objectives of the Corporate

Governance Code:

-- it is led by an effective and entrepreneurial Board which is

collectively responsible for the long-term success of the

Company;

-- the role of the Board is to promote the long-term sustainable success of the Company;

-- the Board has the appropriate balance of skills, experience,

independence, and knowledge of the Company to enable it to

discharge its duties and responsibilities effectively;

-- the Board establishes a formal and transparent arrangement

for considering how it applies the corporate reporting, risk

management, and internal control principles and for maintaining an

appropriate relationship with the Company's auditors; and

-- there is a dialogue with Shareholders based on the mutual understanding of objectives.

In view of the constraints on the Company, the Board currently

operates on a streamlined basis and is expected to continue to do

so following Completion until financing is secured to develop the

Project.

The Board currently consists of only three directors although

this will increase to up to five directors following Completion on

the assumption that Glencore Projects chooses to exercise its right

to appoint directors to the Board as provided for in the

Relationship Agreement. As part of such streamlined approach the

audit committee, the remuneration committee and the Health, Safety,

Social and Environment Committee have been discontinued and the

duties and responsibilities which were delegated to them have

reverted to the Board and this will continue to be the case

immediately following Completion. As previously announced,

responsibility for nominations to the Board continues to be

reserved to the Board; consequently no nominations committee has

been put in place (Corporate Governance Code Provisions 17 and 23).

The Board is also responsible for monitoring the activities of the

executive management team, as and when one is appointed.

Following Completion, the Company expects to continue to depart

from the following provisions of the Corporate Governance Code for

the reasons stated below:

-- The division of powers between the non-executive chairman and

a chief executive officer. In addition, the Company departs from

the Corporate Governance Code by only having non-executive

directors (Corporate Governance Code Principle G and Corporate

Governance Code Provisions 9 and 13).

-- In view of the small size of the Company and the limited

number of directors, the establishment of a nomination committee

and the formal appointment of a senior independent director are

regarded as unnecessary. Where new directors are to be appointed,

the non-executive chairman conducts an informal consultation

process with the other directors. Consequently, Corporate

Governance Code Principles J and Corporate Governance Code

Provisions 12, 17 and 23 are departed from.

-- In view of the small size of the Company and the limited

number of directors, there is no fixed requirement for the chairman

to stand down after a period of years or for all directors to seek

annual re-election, thereby departing from Corporate Governance

Code Provisions 18 and 19.

-- As explained above, the Board has decided not to appoint an

audit committee or a remuneration committee, thereby departing from

the following Corporate Governance Code Provisions: 24 to 26

inclusive, 32 and 33.

-- In view of the small size of the Company, a streamlined

approach for the Board's role in relation to the remuneration of

directors and staff and the establishment and implementation of

share incentive schemes has been adopted. Consequently there is a

degree of departure from Corporate Governance Code Provisions 36

and 37.

-- As mentioned and for the reasons stated above, no internal

audit function has been set up, thereby departing from Corporate

Governance Code Provisions 24 to 26 inclusive.

The Company will continue to assess its corporate governance

approach including if and when it secures additional financing and

intends to incorporate additional corporate governance procedures

and policies to reflect the Company's expected growth and future

changes when appropriate.

Working capital

The Directors believe, taking account of the monies available

for drawdown pursuant to the Loan Amendment and a loan agreement

between Jumelles Limited and the Company, that the working capital

available to the Group is sufficient for the Group's current

requirements that is for at least the next 12 months from

Completion.

Substantial share interests

As at 21 November 2022, the percentage of Shares not in public

hands was 26.42%. This reflects the Shares and share options in

which non-executive directors of the Company are interested.

Following Completion and assuming that there are no further issues

of shares or acquisitions or disposals of shares other than

pursuant to the Acquisition, the percentage of Shares not in public

hands is expected to be 61.78%.

Following Completion, the following Shareholders are expected to

be interested, directly or indirectly, in 3 per cent. or more of

the Company's issued share capital, assuming that they do not make

any acquisitions or disposal prior to Completion and no options are

exercised prior to Completion:

Shareholder Number of Shares % of share capital

Glencore Projects 286,340,379 48.26%

Guava Minerals Limited* 80,252,592 13.52%

*Clifford Elphick, the non-executive chairman of the Company, is

indirectly interested in these Shares, currently representing

26.14% of the issued share capital of the Company, by virtue of his

interest as a potential beneficiary in a discretionary trust which

has an indirect interest in these Shares.

UK City Code / Articles

Whilst, as a company incorporated under the laws of BVI, the

Company is not subject to the UK City Code, the Company has

included provisions in its Articles which reflect, in substance,

the requirements of Rule 9 of the UK City Code (Regulation 33).

Whilst it is in power of the Directors to waive these provisions,

given Shareholder approval is in any event needed to issue the

Consideration Shares, the Directors believe that Shareholders

should be asked to authorise the directors to formally waive

compliance with this provision in the Articles. The resolution

authorising the directors to waive the takeover provisions in the

Articles in respect of the issue of the Consideration Shares is a

condition to the Acquisition and if Shareholders do not approve

this resolution, the Acquisition will not proceed.

Following Completion, Regulation 33 of the Articles will

continue to provide that if at any time when the Company is not

subject to the UK City Code or any successor regime governing the

conduct of takeovers and mergers in the United Kingdom or any other

regime governing the same in any other country (any of such being

the "Takeover Regime"):

(a) any person who, together with persons acting in concert with

him, acquires, whether by a series of transactions over a period of

time or not, interests in Shares which (taken together with

interests in Shares held or acquired by persons acting in concert

with him) carry 30 per cent. or more of the voting rights of the

Company; or

(b) any person who, together with persons acting in concert with

him, holds interests in Shares representing not less than 30 per

cent. but not more than 50 per cent. of the voting rights and such

person, or any person acting in concert with him, acquires an

interest in additional Shares which increase his percentage of the

voting rights,

the Board shall be entitled, but not obliged, to require such

person (other than Computershare Investor Services plc in its

capacity as depository / custodian for Shares issued in

uncertificated form) (the "offeror") to extend an offer, on the

basis set out in Regulation 33, to all the Shareholders in the

Company.

No acquisition of Shares which would give rise to a requirement

for any offer under Regulation 33 may be made or registered if the

making or implementation of such offer would or might be dependent

on the passing of a shareholder resolution of the offeror or upon

any other conditions, consents or arrangements. Offers made under

Regulation 33 must, in respect of each class of Shares involved, be

in cash or be accompanied by a cash alternative at not less than

the highest price paid by the offeror or any person acting in

concert with it for Shares of that class during the offer period

and within 12 months prior to its commencement. Offers made under

Regulation 33 must be made in writing and publicly disclosed and

must be open for acceptance for a period of not less than 30 days.

The cash offer or the cash alternative must remain open after the

offer has become or is declared unconditional as to acceptances for

not less than 14 days after the date on which it would otherwise

have expired.

The offer shall be made on terms that would be required by the

UK City Code, save to the extent that the Company's board of

directors otherwise determines. Except with the consent of the

Company's board of directors, Shareholders shall comply with the

requirements of the UK City Code in relation to any dealings in any

Shares of the Company and in relation to their dealings with the

Company in relation to all other matters. Any matter which under

the UK City Code would fall to be determined by the United Kingdom

Panel on Takeovers and Mergers (the "Panel") shall be determined by

the Company's board of directors in its absolute discretion or by

such person appointed by the Company's board of directors to make

such determination provided that no infringement is ever made of

the general principal of equality between Shareholders. Any notice

which under the UK City Code is required to be given to the Panel

or any person (other than the Company) shall be given to the

Company at its registered office.

If an offer shall be made pursuant to Regulation 33 and:

(a) the offeror (together with persons acting in concert with

him) has by virtue of acceptance of the offer acquired or

contracted to acquire some (but not all) of the Shares to which the

offer relates; and

(b) those Shares, with or without any other Shares which the

offeror (together with persons acting in concert with him) holds or

has acquired or contracted to acquire,

would result in the offeror (together with persons acting in

concert with him) obtaining or holding an interest in Shares

conferring in aggregate 90 per cent. or more of the voting rights

conferred by all the Shares then in issue then:

(c) the offeror shall be entitled to give a notice (the "Squeeze

Out Notice") to all other holders of Shares in respect of all the

Shares then in issue and held by them in respect of which the offer

has not yet been accepted; and

(d) the Squeeze Out Notice shall be made in writing, be, at the

same price and on the same terms as the offer and be capable of

acceptance for a period of not less than 30 days after the date of

the Squeeze Out Notice.

Upon delivery of the Squeeze Out Notice each of the recipients

("Called Shareholders") (a) shall be deemed to have accepted the

offer in respect of all Shares held by it and (b) shall become

obliged to deliver to the offeror or as the offeror may direct an

executed transfer of such Shares and (if it exists) the

certificate(s) in respect of the same. Squeeze Out Notices shall be

irrevocable but will lapse if for any reason there is not a sale of

the Called Shareholders' Shares within 60 days after the date of

service of the Squeeze Out Notice. The offeror shall be entitled to

serve further Squeeze Out Notices following the lapse of any

particular Squeeze Out Notice.

Joint Venture Agreement

Upon the Company becoming the sole shareholder of Jumelles the

existing joint venture agreement in respect of Jumelles will

terminate, save in respect of prior breaches and certain general

provisions.

TRANSACTION DOCUMENTS

Sale and Purchase Agreement

Under the Sale and Purchase Agreement, which was entered into on

22 November 2022, the Company will purchase Glencore Projects' 50%

plus one share interest in Jumelles, comprising of the Sale Shares.

The total consideration for the Sale Shares is the issue on

Completion to Glencore Projects of the Consideration Shares, which

are expected to represent 48.26% of the Shares on Completion. Under

the Sale and Purchase Agreement, Completion is subject to various

conditions, including, amongst others:

(a) Admission;

(b) entry by various parties into each of the Marketing

Agreement, the Relationship Agreement, the Director Acceptance

Letters and the Loan Amendment (each as described further

below);

(c) the appointment of each proposed Nominated Director;

(d) the passing of the Resolutions;

(e) the Project's mining licence remaining unrevoked; and

(f) the adoption by the Company of a revised anti-corruption and bribery policy.

Given the historical nature of the joint venture arrangements

and the relationship between each of Glencore Projects and the

Company in respect of Jumelles, the parties have provided a limited

scope of seller and buyer warranties in relation to the Project.

Under the SPA, ZIOC has also agreed not to issue any further Shares

or rights over shares prior to Completion other than pursuant to

matters previously announced by the Company.

Loan Amendment

In order to fund the Project's approved budget and work

programme and the working capital requirements of the Company until

31 December 2023, on 22 November 2022 Glencore Projects agreed to

amend the terms of the Loan Agreement, pursuant to the Loan

Amendment, with effect from Completion. The Loan Amendment includes

the following amendments to the Loan Agreement:

(a) the aggregate sum of the loan facility shall be increased

from US$1.2 million to US$1.8 million;

(b) the repayment date shall be extended to 31 December 2023;

(c) Jumelles will repay in full the outstanding US$1.8 million

debt owed by Jumelles to Glencore Projects following any equity

raise (or raises) by the Company which result in net proceeds to

the Company greater than or equal to US$1.8 million (determined on

a rolling twelve month basis).

In addition, the Company has agreed to become a direct party to

the Loan Amendment and has undertaken to transfer to Jumelles such

equity capital raising funds that Jumelles requires to repay the

outstanding debt under the Loan Agreement.

The additional funds received pursuant to the Loan Agreement, as

amended by the Loan Amendment, are intended to be applied towards

the retention of the Project's mining licence, community work,

engagement with technical consultants in connection with the

Project and general costs and financing in respect of the Project

and the Company. Under the Loan Amendment, Jumelles is permitted to

advance an intragroup loan of up to US$200,000 to the Company to

meet its working capital requirements.

Relationship Agreement

Once the Consideration Shares in the Company have been issued to

Glencore Projects in accordance with the Sale and Purchase

Agreement and have been admitted to trading on AIM, Glencore

Projects will exercise or control 30% or more of the votes to be

cast on all or substantially all matters at general meetings of the

Company. The Company and Glencore Projects have agreed to enter

into the Relationship Agreement to regulate the relationship

between them, with effect from Completion. Under the Relationship

Agreement, for so long as Glencore Projects individually or

together with its Associates (as defined in the Relationship

Agreement) holds 10% or more of the Shares, Glencore Projects is

entitled to appoint one non-executive director, and for so long as

Glencore Projects individually or together with its Associates (as

defined in the Relationship Agreement) holds 25% or more of the

Shares, Glencore Projects is entitled to appoint two non-executive

directors, who, in each case, may be appointed or replaced by

written notice from Glencore Projects to the Company from time to

time.

The Relationship Agreement shall continue in full force and

effect from Completion until:

(a) Glencore Projects and / or its Associates (as defined in the

Relationship Agreement) individually or together cease to be

interested in 10% or more of the Shares; or

(b) the Shares cease to be admitted to trading on AIM (which for

the avoidance of doubt does not include any period of suspension of

trading).

However, if Glencore Projects and / or its Associates (as

defined in the Relationship Agreement) individually or together

become interested in 10% or more of the Shares within three months

of ceasing to hold such interests the Relationship Agreement shall

be re-instated and once again be in full force and effect.

The Relationship Agreement also includes various undertakings

given by Glencore Projects to ensure that the Company can carry on

its business independently of Glencore Projects and provides that

any transactions between the parties will be on arm's length terms.

Glencore Projects has also agreed to certain restrictions

regulating the manner in which Glencore Projects exercises its

voting rights in the Company including restricting Glencore

Projects from using its shareholding to requisition a general

meeting of the Company for the purposes of proposing any resolution

to de-list the Shares from trading on AIM. Glencore Projects has

also agreed that any non-executive directors appointed to the Board

by Glencore Projects, in consultation with the Company's Nominated

Adviser, will comply with certain requirements set out in the

Relationship Agreement.

Further, under the terms of the Relationship Agreement, Glencore

Projects has agreed that it will not dispose of any of the

Consideration Shares in the Company in the six months following

Admission without the consent of the Company (not to be

unreasonably withheld or delayed) other than in certain limited

circumstances and to comply with orderly market provisions in the

following six months.

Marketing Agreement

MPD and ZIOC have entered into a life-of-mine marketing

agreement with Glencore International which will take effect

immediately prior to Completion, pursuant to which MPD has granted

Glencore International the exclusive marketing right for all iron

ore produced from the Zanaga iron ore mine located in the Republic

of Congo that is being developed and shall be owned and operated by

MPD or one of its Affiliates and any other production of iron ore

from assets belonging to MPD, ZIOC or their respective Affiliates

in the Republic of Congo using similar infrastructure, subject to

the terms and conditions of the Marketing Agreement and in the case

of any projects acquired subject to pre-existing marketing

rights.

Pursuant to the terms of the Marketing Agreement in respect of

the Mine:

(a) The Marketing Agreement shall remain in effect on an

evergreen life-of-mine basis, until otherwise terminated in

accordance with the terms of the Marketing Agreement by Glenore

International or by MPD where there is an unremedied material

breach by Glencore International. If Completion has not occurred by

31 December 2022, or if the Sale and Purchase Agreement is

terminated in accordance with its terms, the Marketing Agreement

will be automatically terminated, unless otherwise agreed in

writing by the parties. For these purposes, "life-of-mine" means

the time in which, through the employment of the available capital,

the iron ore reserves, or such reasonable extension of the iron ore

reserves as conservative geological analysis may justify, will be

extracted from the Mine.

(b) Glencore International has agreed to purchase all or part of

the Product from MPD, and will be entitled to receive a marketing

fee in relation to the arrangement.

(c) MPD has agreed to grant Glencore International the exclusive

marketing right for all of the Product produced by the Mine during

the term of the Marketing Agreement in accordance with the terms

and conditions set out in the Marketing Agreement.

(d) MPD and ZIOC shall procure that MPD, ZIOC and / or any of

Affiliate of ZIOC shall offer to Glencore International for

purchase, whether under the terms of the Marketing Agreement or a

separate agreement, any other production of iron ore from assets

belonging to MPD, ZIOC or their Affiliates, but in each case only

to the extent such assets are located in the Republic of Congo and

use similar infrastructure that is not subject to existing sales

arrangements as at the later of: (i) the Effective Date (as defined

in the Marketing Agreement) or (ii) in the case of an Affiliate of

MPD or an Affiliate of ZIOC, the date that such Affiliate became an

Affiliate (the "Relevant Date") (including any such production that

becomes available following the expiry or termination of any sales

arrangements following the Relevant Date). MPD and ZIOC shall

procure that any such additional production shall be offered to

Glencore International under the same pricing terms as established

in the Marketing Agreement and on terms and conditions that are

materially similar to the terms and conditions set out in the

Marketing Agreement. If Glencore International elects to accept

such an offer, the parties (and / or such Affiliate of MPD or the

Company as applicable) shall enter into an amendment to the

Marketing Agreement or a separate agreement (at the election of

Glencore International) to implement the sales arrangement.

(e) Glencore International shall be entitled to be paid an arm's

length marketing fee as a result of Glencore International's

services during the term of the Marketing Agreement.

(j) MPD will receive full payment for each shipment once it has

arrived at Glencore Projects' nominated discharge port, in each

case subject to the detailed provisions of the Marketing

Agreement.

(k) The price payable for each shipment of Product shall be the

Final FOB Value (as defined in the Marketing Agreement) of that

shipment, which shall be calculated in accordance with the detailed

provisions of the Marketing Agreement, based on the price which is

achieved by Glencore International in the market when it sells the

Product to a final buyer.

(l) The Marketing Agreement contains provisions exempting both

parties in certain circumstances from liability for delays in

performing or failure to perform any of their obligations (except

for failure to pay money when due) due to events of force

majeure.

(m) If there is a direct or indirect change in ownership of MPD

amounting to 50% + 1 share or more of the issued share capital of

the relevant target entity, and, following such change in

ownership, MPD notifies Glencore International in accordance with

the terms of the Marketing Agreement that it wishes to cancel the

Marketing Agreement and enter into a new life-of-mine marketing

agreement (a "New Marketing Agreement") in respect of 100% of the

production of the Mine with the relevant investor or its Affiliate

(a "New Buyer"), then Glencore International may notify MPD,

subject to the terms and requirements of the Marketing Agreement,

that either:

(i) it shall match the terms of the New Marketing Agreement, in

which event the parties shall discuss and agree in good faith such

minimum amendments required to the Marketing Agreement to align

with the key commercial terms agreed between MPD and the New Buyer

under the New Marketing Agreement; or

(ii) it agrees to the termination of the Marketing Agreement, in

which event the Marketing Agreement shall be terminated upon

execution by MPD of the New Marketing Agreement and thereafter

Glencore International shall be entitled, for the term of the New

Marketing Agreement and / or any replacement or supplement to such

agreement, to receive a fee in each calendar month by way of

consideration for the initial marketing role played by Glencore

International under the Marketing Agreement ("Royalty"), and

the Marketing Agreement shall be terminated only upon execution

of the Royalty by Glencore International and MPD in a form

acceptable to Glencore International acting reasonably.

If Glencore International fails to provide a response to MPD in

accordance with the requirements of the Marketing Agreement, it

shall be deemed to have accepted the termination of the Marketing

Agreement, in which event the terms of paragraph (m)(ii) above

shall apply.

MPD has also agreed to indemnify Glencore International in

respect of any breach by MPD.

Director Acceptance Letter

The Company shall enter into director acceptance letters with

each of the non-executive directors of the Company appointed by

Glencore Projects pursuant to the Relationship Agreement. The

letters are contracts for services on similar terms to the current

director acceptance letters that are in force in respect of the

Board and set out, amongst other things, the duties and obligations

of the Nominated Directors, the term of their appointment, and

their annual fee of GBP57,500 per annum. Annual fees in respect of

the Nominated Directors are to be paid by the Company to Glencore

International, however payment is to be deferred until such date as

is determined by the Board.

details of the general meeting

A notice of a General Meeting to be convened for on or around 13

December 2022 will be sent to Shareholders shortly to seek to

authorisation for the directors to issue 286,340,379 Shares

pursuant to the Acquisition and to authorise the Directors to not

require Glencore Projects to make a takeover offer in accordance

with Regulation 33 of the Articles in respect of its acquisition of

the Consideration Shares.

Conclusion

-- The Company believes that the Acquisition is in the best

interests of Shareholders as a whole.

-- The Acquisition is expected to have a substantial beneficial

impact on future funding discussions and financing negotiations

with lenders and infrastructure partners - potentially providing a

major catalyst in accelerating the development of the Project and

unlocking value to Shareholders.

-- The Acquisition is akin to a corporate restructuring and not

a commercial acquisition or disposal.

-- Following Completion, the Company believes it will be

significantly more attractive to a broad range of investors on the

AIM market.

DEFINITIONS

The following definitions apply throughout this announcement

unless the context otherwise requires:

"Acquisition" means the proposed acquisition of Glencore

Projects' 50% + one share interest in Jumelles for a minority

shareholding in the Company.

"Admission" means the admission to trading on AIM of the

Consideration Shares taking place in accordance with the AIM Rules

for Companies.

"Affiliate" means any entity that, directly or indirectly

through one or more intermediaries, controls or is controlled by,

or is under common control with the entity in question and

"Affiliates" shall be construed accordingly. For the purpose of

this definition, "control" means the beneficial ownership of 50% or

more of the issued equity of any entity (or the whole or majority

of the entity's assets), and / or the right or ability to direct or

otherwise control the entity or the votes attaching to the entity's

issued share capital and "controlled" or "under common control"

shall have a similar meaning.

"AIM" means the AIM market operated by the London Stock

Exchange.

"AIM Rules for Companies" means the AIM Rules for Companies, as

published and amended from time to time by the London Stock

Exchange.

"Articles" means the articles of association of the Company as

amended from time to time.

"Board" or "Directors" means the directors of the Company from

time to time.

"Business Days" means any day (excluding Saturdays and Sundays)

on which the major clearing banks are open for business in London,

United Kingdom and "Business Day" shall be construed

accordingly.

"BVI" means the British Virgin Islands.

"Completion" means completion of the purchase of the Sale Shares

by the Company in accordance with the terms of the Sale and

Purchase Agreement.

"Consideration Shares" means the 286,340,379 Shares to be issued

by the Company to Glencore Projects pursuant to the

Acquisition.

"Corporate Governance Code" means the 2018 UK Corporate

Governance Code.

"Director Acceptance Letter" means a letter from the Company to

each Nominated Director to be entered into regarding the terms of

each Nominated Director's appointment as a non-executive director

of the Company.

"General Meeting" means the meeting of Shareholders to be held

on or around 13 December 2022.

"Glencore International" means Glencore International AG, a

company incorporated in Switzerland with the unique enterprise

identification number CHE-106.909.694.

"Glencore Projects" means Glencore Projects Pty Limited, a

company incorporated in Australia with registered number

128109115.

"Group" means the Company and its subsidiaries.

"Jumelles" means Jumelles Limited, a company incorporated and

registered in the British Virgin Islands under company number

1024369.

"Loan Agreement" means the loan agreement dated 29 June 2022

between Jumelles (as borrower) and Glencore Projects (as lender),

as amended from time to time.

"Loan Amendment" means the amendment letter dated 22 November

2022 between each of the Company, Jumelles and Glencore Projects

amending the terms of the Loan Agreement.

"London Stock Exchange" means London Stock Exchange plc.

"Marketing Agreement" means the marketing agreement dated 22

November 2022 regarding the grant of offtake rights in respect of

the supply of high quality iron ore product from the Project

entered into between MPD, ZIOC and Glencore International which

will take effect immediately prior to Completion.

"Mine" means the Zanaga iron ore mine located in the Republic of

Congo that is being developed and shall be owned and operated by

MPD or one of its Affiliates.

"MPD" means MPD Congo S.A., the indirect wholly owned subsidiary

of Jumelles which holds the benefit of the Project's mining

licence.

"Mtpa" means million tonnes per annum.

"Nominated Adviser" means Liberum Capital Limited.

"Nominated Director" means a proposed non-executive director of

the Company nominated by Glencore Projects and to be appointed in

accordance with the terms of the Relationship Agreement and the

Director Acceptance Letter.

"Product" means all iron ore conforming to certain

specifications produced by MPD or its Affiliates from the Mine or

in the Republic of Congo using similar infrastructure that is not

subject to existing sales arrangements.

"Project" means the Zanaga Iron Ore Project located in the

Republic of Congo.

"Relationship Agreement" means the relationship agreement to be

entered into regarding the relationship between Glencore Projects

(as a Shareholder) and the Company, with effect from

Completion.

"Resolutions" means the resolutions set out in the notice to the

General Meeting.

"Sale and Purchase Agreement" means the sale and purchase

agreement dated 22 November 2022 entered into between the Company

and Glencore Projects in respect of the Acquisition.

"Sale Shares" means 2,000,001 issued ordinary shares of US$1 par

value in the capital of Jumelles to be transferred to the Company

pursuant to the Acquisition.

"Shareholders" means registered holders of Shares in the Company

and "Shareholder" shall be construed accordingly.

"Shares" means ordinary shares of no par value of the

Company.

"UK City Code" means the UK City Code on Takeovers and

Mergers.

"2014 FS" means the feasibility study, managed by Glencore

Projects, which confirms the project economics for the Project.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUUVURUSUAUUA

(END) Dow Jones Newswires

November 23, 2022 02:00 ET (07:00 GMT)

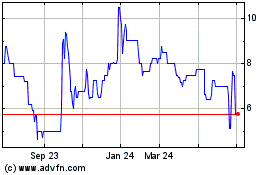

Zanaga Iron Ore (AQSE:ZIOC.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

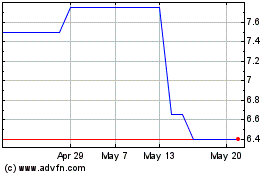

Zanaga Iron Ore (AQSE:ZIOC.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025