Asia Shares Tread Water Ahead of BOJ, Fed

20 September 2016 - 1:30PM

Dow Jones News

Asian share-trading stayed tentative Tuesday as investors

awaited policy decisions from the U.S. Federal Reserve and the Bank

of Japan.

Markets reflected the uncertain balance between risks and

rewards heading into this week's central bank meetings, said Ric

Spooner, chief market analyst at CMC Markets.

Japan's Nikkei Stock Average was up 0.4% as bank stocks bounced

back from recent losses due to speculation that the BOJ would cut

its interest rate on excess reserves further into negative

territory. Mitsubishi UFJ Financial Group Inc. was up 0.9%,

Sumitomo Mitsui Financial Group Inc. was up 0.8%, and Resona

Holdings Inc. was up 0.8%.

Australia's S&P/ASX 200 fell 0.1%. A technical problem

delayed the opening of Australia's main equities market Monday by

about 90 minutes. The ASX said it will provide a detailed incident

report on the matter later this week. BHP Billiton Ltd. was up 1.8%

with Rio Tinto Ltd. higher by 1%.

Australia's central bank indicated Tuesday it would keep

interest rates on hold, possibly until next year, to support

growth. Interest rate-sensitive sectors of the economy, such as

housing construction, are being helped by record low rates, while

the economy is growing strongly, the Reserve Bank of Australia said

in the minutes of its Sept. 6 board meeting released Tuesday.

Hong Kong's Hang Seng Index and the Shanghai Composite were both

down about 0.1%. South Korea's Kospi was unchanged.

Trading volumes were largely expected to stay low as traders

awaited the BOJ's policy decision Wednesday, analysts said. The

U.S. Fed announces its decision in the early hours Thursday, Asia

time.

"It's about risk management," said Chris Weston, chief market

strategist at IG, noting that the emphasis was on protecting

capital and hedging exposure.

Brent crude traded 0.3% lower in early Asia trade after a survey

by S&P Global Platts said U.S. crude inventories likely saw a

buildup of 2.8 million barrels in the week ended Sept. 16, caused

by a decline in refinery utilization.

Gold was almost unchanged, with nickel futures on the London

Metal Exchange higher by 2.8% and zinc contracts up 0.6%.

Kosaku Narioka, Robb M. Stewart, James Glynn and Jenny Hsu

contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com and Willa Plank

at willa.plank@wsj.com

(END) Dow Jones Newswires

September 19, 2016 23:15 ET (03:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

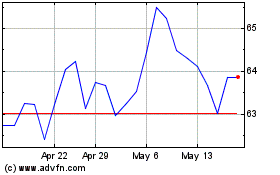

ASX (ASX:ASX)

Historical Stock Chart

From Dec 2024 to Jan 2025

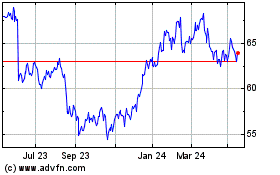

ASX (ASX:ASX)

Historical Stock Chart

From Jan 2024 to Jan 2025