Quarterly Activities Report For the Period Ended 31 December 2018

30 January 2019 - 11:00PM

Bannerman Resources Limited (ASX:BMN, NSX:BMN) (“Bannerman” or “the

Company”) is pleased to report on a productive quarter in which it

undertook reconnaissance drilling to test potential satellite

targets whilst continuing the DFS Update work, against a backdrop

of improving uranium prices and industry sentiment.

HIGHLIGHTS

- Reconnaissance drilling program

- Targeting two areas within 10km of the proposed Etango

processing plant

- 8 drill holes for 973 m of RC drilling completed

- Results expected in March quarter

- DFS Update continuing

- Qubeka Mining Consultants engaged for mining and process

schedule optimisation

- Further refinement of cost input parameters.

- Uranium prices strengthening

- U3O8 spot price closed 2018 at US$28.50

- Uranium price increased 25% since 1 July 2018

- Strong outlook driven by supply reductions and secondary

buying

- Strong cash balance of A$7.4m at quarter end

- Includes cash inflow of A$172,612 after Chairman exercised 3.9m

options

- Financial strength maintained

Bannerman’s Chief Executive Officer, Mr Brandon

Munro, said, “We have maintained our fiscal discipline whilst

undertaking high value-add activities at the Etango Project, such

as testing targets with the potential to be satellite deposits and

the ongoing work associated with the DFS Update. The uranium

market has tightened substantially and we are well positioned for

further price improvement with an advanced asset and a healthy

balance sheet.”

Brandon MunroChief Executive

Officer30 January 2019

For further information please contact:

|

Brandon MunroChief Executive OfficerPerth, Western

AustraliaTel: +61 (8) 9381 1436info@bannermanresources.com.au |

Robert DaltonCompany SecretaryPerth, Western

AustraliaTel: +61 (8) 9381 1436info@bannermanresources.com.au |

Michael Vaughan (Media)Fivemark PartnersPerth,

Western AustraliaTel: +61 422 602

720michael.vaughan@fivemark.com.au |

| |

About Bannerman - Bannerman

Resources Limited is an ASX and NSX listed exploration and

development company with uranium interests in Namibia, a southern

African country which is a premier uranium mining

jurisdiction. Bannerman’s principal asset is its 95%-owned

Etango Project situated near Rio Tinto’s Rössing uranium mine,

Paladin’s Langer Heinrich uranium mine and CGNPC’s Husab uranium

mine. A definitive feasibility study has confirmed the viability of

a large open pit and heap leach operation at one of the world’s

largest undeveloped uranium deposits. From 2015 to 2017, Bannerman

conducted a large scale heap leach demonstration program to provide

further assurance to financing parties, generate process

information for the detailed engineering design phase and build and

enhance internal capability. More information is available on

Bannerman’s website at www.bannermanresources.com.

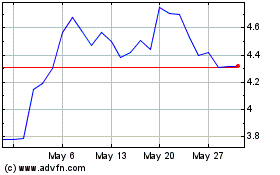

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Feb 2025 to Mar 2025

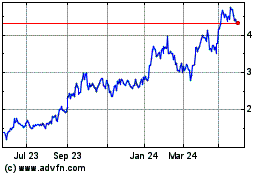

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about Bannerman Energy Ltd (Australian Stock Exchange): 0 recent articles

More News Articles