Nasdaq To Sell Stock Directly To Consumers In Loyal3 Partnership

02 June 2011 - 6:03AM

Dow Jones News

Nasdaq is aiming to make investing in stocks almost as easy as

clicking a "like" button on Facebook.

The exchange Thursday will unveil a partnership with Internet

startup Loyal3 to sell stock directly to consumers via the Web,

including through social-networking site Facebook. The companies

envision people scooping up investments while they are browsing

Facebook, using a specially designed app to buy or sell shares, or

perusing a participating company's website.

Nasdaq, a unit of Nasdaq OMX Group Inc. (NDAQ), and Loyal3 say

they are trying to reach small-time investors who don't use a

brokerage but do have strong loyalties to favorite companies. They

contend they can turn the non-investing customers of well-known,

consumer-oriented public companies into shareholders, giving the

companies more loyalty in both areas.

"This is a very frictionless way to bring small investors into

the market," John Jacobs, Nasdaq's chief marketing officer, said.

"There's a segment of the market that has never opened a brokerage

account. It can be rather intimidating for some people."

In fits and starts, the securities business has been figuring

out how to adjust to social media, and how new media might be used

to tap new audiences. Success has been mixed, with exchanges and

brokerages diving into Twitter feeds, video offerings and more.

Even the Securities and Exchange Commission has gotten in on the

game, investigating alleged stock touting schemes on Facebook and

Twitter.

Loyal3 is a registered transfer agent, a category that includes

companies such as Computershare Ltd. (CMSQY, CPU.AU) and Bank of

New York Mellon Corp. (BK). Transfer agents record changes of stock

ownership, maintain records and distribute dividends. Loyal3's

board includes former Facebook chief privacy officer Chris

Kelly.

Under Nasdaq and Loyal3's plan, investors won't pay the

transaction fees that come with a conventional brokerage account.

That feature, plus what the companies hope will be a social-media

groundswell, has the companies forecasting strong interest.

So-called direct stock purchase plans have been around since the

early 1970s, and historically they haven't had a large impact on

the market. Those plans tended to be run by the companies

themselves. They generally are paper-heavy and lack strong

incentives for participants, Loyal3 Chairman and Chief Executive

Barry Schneider said in an interview with Dow Jones Newswires. He

called the predecessors "Jurassic."

The planned service, called a "customer stock ownership plan,"

will be offered to all Nasdaq-listed companies. Nasdaq OMX Group

will begin selling its own shares through the plan this summer.

Under the Nasdaq-Loyal3 program, investors can buy as little as

$10 worth of stock. They will be able to purchase shares in

fractional amounts. Spending such a small amount usually isn't

practical in a typical discount brokerage account, where fees take

a bite out of small-time investing. Purchases in the new program

are capped at a maximum of $2,500 per month.

Both Nasdaq and Loyal3 are quick to highlight the program's ease

of use as one reason customers should be drawn in. Loyal3's

Facebook application lets a user buy stock in as few as three mouse

clicks. Meanwhile, participating companies get what Loyal3 pledges

is a means of building up both customer and investor loyalty. These

companies, which pay a per-customer fee to participate, also get a

consumer-analytics service.

Nasdaq and Loyal3 both acknowledge they face the daunting task

of luring potential investors who may not know a price-earnings

ratio from a Fibonacci retracement. But the companies say they are

enticed by the many millions of people who might be coaxed to

invest for the first time if the process is made easier, and the

barriers to entry are made lower.

"This market will grow over time, just like the first discount

broker," Nasdaq's Jacobs said. "[But] I do think that you'll see it

get adopted rather quickly."

Loyal3 has ambitious forecasts for the size of the market.

Schneider, the company's chief executive, puts the figure at $90

billion in the U.S. after weighing the size and customer base of

500 top consumer companies in the country.

-By Brendan Conway, Dow Jones Newswires; (212) 416-2670;

brendan.conway@dowjones.com

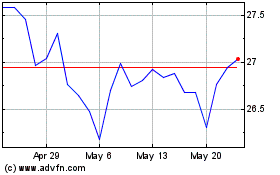

Computershare (ASX:CPU)

Historical Stock Chart

From Apr 2024 to May 2024

Computershare (ASX:CPU)

Historical Stock Chart

From May 2023 to May 2024