Dexus Asks Regulator to Intervene in Battle for Investa Office - Update

22 March 2016 - 5:19PM

Dow Jones News

By Rebecca Thurlow

SYDNEY--Australia's Takeovers Panel has been asked to intervene

in a battle for Investa Office Fund (IOF.AU) as demand for

commercial property in the country intensifies.

Australia's biggest office landlord, Dexus Property Group

(DXS.AU), has made a cash-and-shares bid valuing the trust at 2.6

billion Australian dollars (US$2.0 billion) and wants IOF's former

manager Morgan Stanley to abstain from voting on its stake when

shareholders meet to decide on the offer next month.

The deal would entrench Dexus's dominance of the listed office

trust sector in Australia after it snapped up rival Commonwealth

Property Office Fund in 2014 following a takeover fight with GPT

Group. The offer of 0.424 Dexus shares and A$0.8229 cash for every

IOF share already has the approval of the IOF board, but is being

opposed by Investa Commercial Property Fund Group, which took over

IOF's management from Morgan Stanley as part of a move by the U.S.

investment bank to divest its Australian commercial property

business Investa Property Group. In an unusual mis-alignment

between the advice of a real estate trust's manager and that of its

board, ICPF is urging shareholders to reject the Dexus offer and

instead buy half the management platform.

Dexus wants Morgan Stanley to abstain from voting its 8.9% stake

in IOF, which is held on behalf of unitholders in the bank's real

estate investment trusts, when shareholders meet on April 8 to

decide on the takeover bid, saying it would be unacceptable for the

U.S. investment bank to vote because it is associated with

ICPF.

The Takeovers Panel said Tuesday it has received the application

from Dexus but no decision has yet been made as to whether to

conduct proceedings.

The panel will need to decide whether Morgan Stanley has a

conflict of interest because the second tranche of its A$90 million

payment from ICPF for the management rights is conditional on the

platform being retained in its current form -- meaning it stands to

make A$45 million if the Dexus takeover fails.

Dexus also wants ICPF to withdraw the information it has

circulated to shareholders advocating they reject the Dexus deal

which it says undervalues the company.

ICPF Chief Executive Jonathan Callaghan noted in a statement

that the Panel hasn't made any comment on the merits of the

application. He added: "We are very comfortable with our position

and content to let the Panel and the courts make their

determination."

A spokesman for Morgan Stanley declined to comment on the

application.

CLSA analysts Michael Scott and Sholto Maconochie said both the

Dexus and ICPF proposals have merit for shareholders and it is good

that investors have a choice, however to a large extent the outcome

may depend on whether Morgan Stanley is allowed to vote. The Dexus

deal acquires approval of 75% of shares voted at the meeting to

succeed.

"With A$45 million at risk, we believe Morgan Stanley are a

related party and should abstain from voting," the analysts said in

a research note before the announcement.

-Write to Rebecca Thurlow at rebecca.thurlow@wsj.com

(END) Dow Jones Newswires

March 22, 2016 02:04 ET (06:04 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

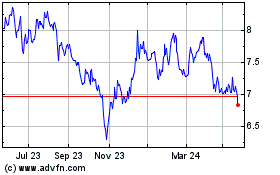

Dexus (ASX:DXS)

Historical Stock Chart

From Dec 2024 to Jan 2025

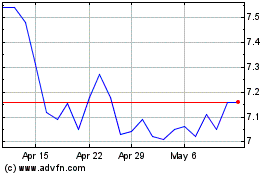

Dexus (ASX:DXS)

Historical Stock Chart

From Jan 2024 to Jan 2025