Mining Shares Sink Deep

24 August 2015 - 8:50PM

Dow Jones News

SYDNEY—Shares in major mining companies took a hammering Monday

as concern grew over the health of China, the biggest buyer of

commodities from copper to iron ore.

The rout began in Australia after disappointing results from two

big mining companies there. South32 Ltd., which mines commodities

from coal to manganese, fell 7.6%, taking its overall slide since

it was spun out of BHP Billiton PLC in May to 34%. Fortescue Metals

Group Ltd., the world's fourth-largest producer of iron ore,

tumbled 15%, after reporting an 88% dive in annual earnings. A

broader measure of mining stocks listed in Sydney was down 5% on

Monday, to its lowest level in more than a decade.

Investors' bearishness spread to London, with shares in major

miners BHP, Anglo American PLC and Glencore PLC all down more than

5% in early trading.

The sector is being hit hard by fears of a deepening slowdown in

China, which this month has offered lackluster economic numbers and

an unexpected currency devaluation. China's main stock market

closed 8.5% lower Monday.

For miners, a weakening Chinese economy may impair their best

customer's appetite for resources. China buys two thirds of all

iron ore traded by sea, and about 40% of the world's copper.

"It is a key moment for China—the equity market in free fall,

the banking system increasingly starved of liquidity, rising

capital outflows and a rapidly slowing economy," said Angus

Nicholson, a Melbourne-based analyst for broker IG.

CMC Markets U.K. chief market analyst Michael Hewson said miners

and technology businesses are at the sharp end of the souring

outlook for the world's No. 2 economy.

"While it appears this month's selloff catalyst was a fairly

innocuous and not unreasonable readjustment in the trading band for

the Chinese yuan, this particular Chinese butterfly also appears to

have triggered a complete turnaround in sentiment and reassessment

of stock-market valuations across the globe," he wrote in a

note.

The share prices of resources companies on Monday tracked the

tumbling prices for the commodities they produce, including copper,

which sank to its lowest point in more than six years, and oil,

with Brent crude falling below US$45 a barrel for the first time

since March 2009. Iron-ore futures on China's Dalian Commodity

Exchange were recently down 4%.

The carnage was visible across the Australian stock market,

heavy in resources producers. The benchmark index dropped to its

lowest level in two years as BHP Billiton Ltd., the world's biggest

miner, fell 5% and Rio Tinto Ltd. 5.2%.

While metals prices are the key reason for miners' woes, there

are growing concerns about their balance sheets as well. Fortescue,

for example, is struggling to pay down a $10 billion debt pile run

up during the commodities boom years. Its market value is now down

to roughly $4 billion—though it said Monday it would continue to

pay an annual dividend, albeit sharply less than last year's.

South32 said it planned to slash operating costs as it reported

a lower-than-anticipated net profit in its maiden annual fiscal

result.

Chief Executive Graham Kerr said South32's shares had largely

been caught up in the selloff. "If you look at the share market

today, it is just swamped with other information," Mr. Kerr said in

an interview.

IG's Mr. Nicholson said some companies might bounce back if

investors deem they've been dragged indiscriminately lower by the

broad-based rout.

"There are not any strong macro reasons for a rally yet;

however, it is important to keep an eye on this as a lot of stocks

are seeing their values become increasingly competitive," he

said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

August 24, 2015 06:35 ET (10:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

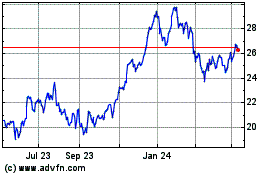

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024