Asian Shares Mostly Higher

23 November 2015 - 3:20PM

Dow Jones News

Australian shares are nearing their highest level since late

October on Monday, though falling commodities prices muted gains

triggered by stimulus hopes in Europe.

The S&P/ASX 200 rose 0.4% to 5277.40, while South Korea's

Kospi rose 0.8%.

Hong Kong's Hang Seng Index fell 0.3% and the Shanghai Composite

Index rose 0.1%.

Markets in Japan are closed for holiday.

Expectations of more stimulus from the European Central Bank and

greater certainty that the U.S. will raise rates in December have

kept markets resilient, said Kevin Leung, director of equity

research at Haitong Securities.

Still, the central banks' timing remains hazy, so "it's been a

mixture of good and bad days" for the region recently, he

added.

The gains in Australia come after ECB President Mario Draghi

said Friday that the bank stands ready to deploy its full range of

stimulus measures to fight low inflation, the latest sign that

further easing is a strong possibility at the bank's next meeting

in December.

The region's markets mostly rose last week, with Australia

logging more than 4%, its best week in over a month.

Resources shares were mixed, as commodities prices come under

another wave of pressure. Fortescue Metals Group Ltd. rose 3.4%

while BHP Billiton Ltd. fell 1.9% and Rio Tinto Ltd. lost 0.6%.

Copper prices reached their lowest since 2009 on Friday, as

pressure from a firmer dollar and concerns about weak demand for

industrial metals turned up selling pressure. Nickel prices fell to

a 12-year low.

On Friday, U.S. stocks posted their largest week of gains in

nearly a year, boosted by health-care and technology shares.

Taking that lead, health-care shares led gains in Australia.

Mayne Pharma Group Ltd., Cochlear Ltd. and Mesoblast Ltd. each rose

more than 2%.

Meanwhile, Australia's money markets are continuing to price out

the chance of further central-bank easing, helping the Australian

dollar strengthen, according to Macquarie Bank. The Reserve Bank of

Australia signaled recently it sees signs of improvement in the

economy, though it said there is scope to cut interest rates.

The Australian dollar was up 0.3% at $0.7220 compared with

Friday's levels in Asia.

In China, new requirements that make it more expensive for local

investors to buy shares using borrowed money from brokerages take

effect Monday. The Shanghai and Shenzhen stock exchanges announced

earlier in the month that investors will only be able to borrow an

amount equal to the funds in their investment accounts, compared

with twice that amount previously.

A 35% increase in margin loans since September has helped the

Shanghai market rally more than 20% from its August lows. Margin

loans climbed to 1.22 trillion yuan ($187.84 billion) as of Friday,

according to Wind Info.

Meanwhile, some analysts say that state funds recently sold

shares, after being tasked to prop up the market with buying since

July. China Securities Financial Corp., which owns shares in nearly

half of all listed companies, has reduced holdings in around 20

stocks and stopped buying new shares since October, according to a

recent research note by brokerage Huatai Securities.

Brent crude oil, the global benchmark, was down 1.1% at $44.17 a

barrel.

Gold prices fell 0.3% to $1,073.10 a troy ounce.

James Glynn contributed to this article.

Corrections & Amplifications: Markets in Japan are closed

for holiday on Monday. An earlier version of this article

incorrectly stated markets were closed in Japan, India, the

Philippines and Thailand. (Nov. 23, 2015)

Write to Chao Deng at Chao.Deng@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 22, 2015 23:05 ET (04:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

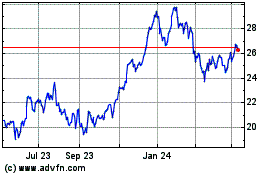

Fortescue (ASX:FMG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Fortescue (ASX:FMG)

Historical Stock Chart

From Dec 2023 to Dec 2024