2nd UPDATE: Prologis European Says Prologis Takeover Bid Too Low

04 May 2011 - 12:03AM

Dow Jones News

ProLogis European Properties (PEPR.AE) Tuesday dismissed a

takeover bid from U.S. industrial real-estate giant ProLogis (PLD)

that values the Euronext-listed warehouses developer at EUR1.2

billion ($1.73 billion), saying the offer is inadequate.

"Based on our strategy, business plans and the quality of our

portfolio, we believe that the offer does not reflect the full

value potential of PEPR," Chief Executive Peter Cassells said in a

statement.

The biggest owner of warehouses in Europe said it had considered

an opinion from Deutsche Bank AG (DB), which judged the offer as

inadequate from a financial perspective.

However, it added the bid could still represent a "liquidity

event" for investors who believe their shareholding doesn't meet

their investment objectives and who fear the stock's liquidity

could be hampered by an increased shareholding from ProLogis.

ProLogis launched a mandatory takeover offer worth EUR6.10 per

unit April 22 after it raised its stake in PEPR to about 38%. The

Denver-based company said Tuesday it had since received for tender,

or purchased in the open market, 8,818 ordinary units that would

bring its stake to 39%.

A statement from ProLogis said, "The PEPR board's recommendation

acknowledges that ProLogis' unconditional offer gives PEPR

investors the choice either to realize certain and immediate value

through the tender of their units or to remain investors to realize

PEPR's long-term upside potential."

ProLogis can't be replaced as manager before 2016 and the

company reaffirmed once again that it plans to retain both its

ownership in and management deal with ProLogis European.

ProLogis' offer represents a 22% premium over the closing share

price April 12 when Australian property investor Goodman Group

(GMG.AU) and Dutch pension-fund asset manager APG Algemene Pensioen

Groep NV had a joint takeover bid for ProLogis European rejected.

Goodman and APG were prepared to offer ProLogis EUR6 per share for

its stake, which valued ProLogis European at about EUR1.1

billion.

APG spokesman Harmen Geers said the consortium was unlikely to

raise its previous indicative bid and declined to comment on

whether or not it will tender its 12% stake under the current

ProLogis offer, or any potential raised bid.

"The question is whether the price is fair or whether they are

taking advantage of the situation of being major shareholder and

manager of the fund at the same time," Geers added, indicating that

APG's valuation of PEPR's net asset value was around EUR6.37. The

company has been at loggerheads for years with ProLogis on how the

majority shareholder controls the fund.

Martijn ter Laak, real estate research analyst at Rabobank, said

an increased bid by Goodman and APG was unlikely as the consortium

had previously stated their EUR6 per share offer was compelling

value and ProLogis is not willing to cancel its external management

contract.

Hedge fund Fir Tree Partner, which holds about 4.3% of PEPR,

balked at Prologis' offer April 27 and said in a letter to the U.S.

company's chief executive, Walter Rakowich, that the bid was "not

in the best interests of PEPR or its unitholders because it does

not constitute fair value for the units of the fund."

ProLogis European had a portfolio with a market value of EUR2.8

billion at the turn of the year. It consisted of 232 buildings

across 11 countries, covered 4.9 million square meters, and had an

occupancy level of 94.5%. At 1315 GMT, its shares traded down 0.5%

at EUR6.12.

Jean-Yves Devloo, equity analyst for European property at ING

Groep NV (INGA.AE), said recent news wouldn't force ProLogis to

increase its offer and that there was no valuation ground

minorities could use to demand a higher bid. As a result he would

advise unitholders to tender their shares to ProLogis so as not to

risk PEPR remaining listed, where the resurfacing of old problems

could cause the share price to plummet.

Investors and analysts have complained about a weak

corporate-governance structure at ProLogis European that puts small

unitholders at a significant disadvantage. Investors with less than

a 20% holding have no powers to call general meetings or make

proposals to the board.

The deal activity around the company comes as ProLogis and U.S.

rival AMB Property Corp. (AMB) enter the final stages of their

effort to close a $14 billion merger that would form a global

real-estate powerhouse with gross assets of $46 billion. The deal

is expected to be finalized June 3. ProLogis shares closed Monday

at $16.29, valuing the company at just over $9.2 billion.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

(Archie van Riemsdijk and Maarten van Tartwijk in Amsterdam

contributed to this article.)

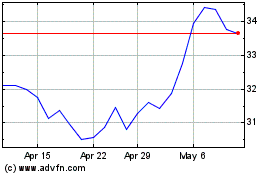

Goodman (ASX:GMG)

Historical Stock Chart

From Apr 2024 to May 2024

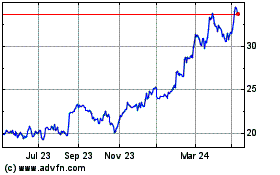

Goodman (ASX:GMG)

Historical Stock Chart

From May 2023 to May 2024