ProLogis European Shareholder Wants Talks With ProLogis On Bid

06 May 2011 - 8:37PM

Dow Jones News

Hedge fund Fir Tree Partners has asked ProLogis European

Properties (PEPR.AE) to negotiate directly with U.S. industrial

real-estate giant ProLogis (PLD) on its takeover offer for the

Euronext-listed warehouses developer, or request that regulatory

authorities review the fairness of the tender price.

The New York-based investment fund, which holds around 4.3% of

PEPR's ordinary units, said since the tender offer was launched

April 22 it hasn't seen any evidence that the board is taking

active steps to secure the best possible price for unitholders.

ProLogis' offer for PEPR, which is worth EUR6.10 per unit and

values the company at EUR1.2 billion ($1.73 billion), was seen as

an attempt to fend off the rival consortium of Australian property

investor Goodman Group (GMG.AU) and Dutch pension-fund asset

manager APG Algemene Pensioen Groep NV.

PEPR, the biggest owner of warehouses in Europe, earlier this

week rejected the offer as inadequate but ProLogis reaffirmed that

it plans to retain both its ownership in and management deal with

the company.

ProLogis said Friday so far it had only received for tender, or

purchased in the open market, 8,818 ordinary units. That would

bring its stake to 39% and is unchanged since April 28.

Fir Tree said PEPR should negotiate with ProLogis on the offer

to secure a price that is in the best interests of its unitholders

or refer the matter to Luxembourg's financial watchdog, the

Commission de Surveillance du Secteur Financier.

The hedge fund said it also wants PEPR to "use all of its

powers" to ensure the offer period is extended past its May 11

deadline, citing concerns on the amount of time given to evaluate

the offer.

-By Michael Haddon, Dow Jones Newswires; 4420-7842-9289;

michael.haddon@dowjones.com

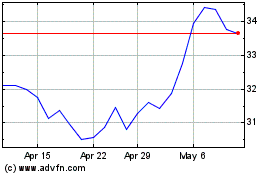

Goodman (ASX:GMG)

Historical Stock Chart

From Apr 2024 to May 2024

Goodman (ASX:GMG)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Goodman Group (Australian Stock Exchange): 0 recent articles

More Goodman News Articles