UPDATE: Noble's Gloucester To Raise A$410 Million, Buy Middlemount Stake

04 August 2010 - 1:04PM

Dow Jones News

Singapore-based commodity trader Noble Group Ltd. (N21.SG) will

release capital from its majority-owned subsidiary Gloucester Coal

Ltd. (GCL.AU) through a deal to transfer its stake in Queensland's

Middlemount coal mine to the Australian company.

The deal should reduce Noble's stake in Gloucester to around

61%-63% from its current 87.7%, while simultaneously significantly

raising Gloucester's profile as an Australian coal miner.

"Noble's interest is not to be an owner of coal mines, it's to

have a strong market for its products," said a Gloucester

spokesman.

"This will dilute Noble very, very significantly and make

Gloucester into the leading metallurgical coal company in

Australia."

Under the deal, Gloucester will raise at least A$410 million of

new equity at A$9.25 a share and issue A$100 million of stock to

Noble, while receiving Noble's 30% equity and royalty interests in

Middlemount, a coking coal mine in Queensland's Bowen Basin.

The mine is tipped to produce 1.8 million metric tons of

unprocessed coal per year after production begins later this

year.

The combination of Middlemount and Gloucester's existing assets

should raise saleable coal production to around 5 million tons a

year by 2014, the company said in a presentation, making it one of

Australia's leading coking coal producers.

The deal would also allow Noble to release capital by diluting

its stake in Gloucester, a move that fits the trader's long-term

strategy in spite of its outstanding A$12.60-a-share offer to

acquire the 12.3% of the company it doesn't already own.

Noble has consistently said that it wants only strategic

minority stakes in Australian coal companies, viewing itself as a

trader which can benefit from a seat at the table rather than a

miner seeking control of its assets.

"You can't go down from nearly 90% to nearly 50% without looking

like you're deserting the company," said one person with knowledge

of the companies' strategy. "By vending other assets Noble can

gradually dilute themselves out."

Noble, Gloucester and Middlemount's 70% majority owner Macarthur

Coal Ltd. (MCC.AU) have been involved in a complex tussle over

their Australian coal assets for months.

Earlier in the year, Macarthur attempted to take over Gloucester

and acquire Noble's stake in Middlemount, in return for offering

Noble a portion of its own equity.

After the collapse of that deal, Noble made an offer for the

remaining 12.3% of Gloucester, which the person with knowledge of

the company characterised as a defensive move designed to underpin

Gloucester's market price.

Macarthur also was the subject of abortive takeover bids earlier

this year from New Hope Corp. Ltd. (NHC.AU) and Peabody Energy

Corp. (BTU).

Australia is the world's largest coal exporter and a key

supplier of Asian steelmakers and power stations, and its coal

companies have been the subject of vigorous acquisitive interest of

late.

Banpu PCL (BANPU.TH) last month launched a takeover of

Centennial Coal Co. Ltd. (CEY.AU) and Linc Energy Ltd. (LNC.AU)

yesterday sold its Galilee thermal coal operation to India's Adani

Enterprises Ltd. (512599.BY), while Anglo American PLC (AAL.LN)

last month sold its local coal assets to a consortium led by major

Korean consumers.

The Middlemount interests Gloucester will acquire from Noble are

valued at A$437.5 million, consisting of a 27.52% direct

stake--valued at A$269.5 million--plus Noble's right to royalties

from Middlemount's coal sales, which is set to 4% of the sale value

of loaded coal at Australian ports.

Gloucester is separately acquiring Noble's option to buy 2.48%

of Middlemount from Macarthur for A$8 million, and an option to

spend A$100 million in the next 18 months to buy a further 20%

stake from Macarthur.

Those options would bring Gloucester's overall holding in

Middlemount to 50%.

Gloucester will fund the spending through A$337.5 million from

the capital raising and A$100 million in stock issued to Noble.

Gloucester said that around A$410 million of its capital raising

was already underwritten by institutions and that retail investors

may subscribe for a further A$45 million.

It may also raise a further A$90 million through an additional

institutional placement, the company said.

Noble, which is not participating in the equity raising, would

likely see its stake reduced to 57%-59% if the additional placement

went ahead, Gloucester said.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

(Gaurav Raghuvanshi in Singapore contributed to this

article)

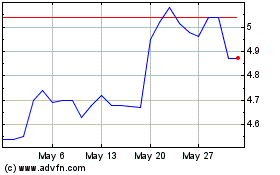

New Hope (ASX:NHC)

Historical Stock Chart

From Apr 2024 to May 2024

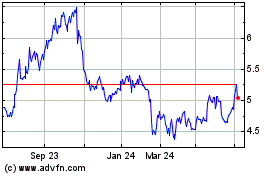

New Hope (ASX:NHC)

Historical Stock Chart

From May 2023 to May 2024