Summers Criticizes Minneapolis Fed President's 'Too Big to Fail' Push

07 April 2016 - 11:30AM

Dow Jones News

ST. LOUIS—Former Treasury Secretary Lawrence Summers on

Wednesday sharply criticized the "style and tone" of Federal

Reserve Bank of Minneapolis President Neel Kashkari's recent push

to address whether taxpayers may have to rescue the biggest U.S.

banks in the future.

Mr. Kashkari, a senior Treasury official during the financial

crisis who became president of the Minneapolis Fed in January, said

in a February speech that postcrisis financial reforms didn't go

far enough to prevent future government bailouts and floated the

idea of breaking up the biggest banks. Mr. Kashkari on Monday

hosted a high-profile symposium on "Ending Too Big To Fail" in

Minneapolis.

"I thought President Kashkari's first speech on the topic was

one of the two or three most blatantly political things...that I've

seen come from a prominent Federal Reserve official in the last 15"

years, Mr. Summers, a former candidate for Fed chairman, told

reporters Wednesday before delivering a lecture at the St. Louis

Fed. "I did not think the style and tone and degree of

collaboration with others was the kind of thing one could expect

from the Fed."

Mr. Summers, a Harvard University economist who served as

Treasury secretary under President Bill Clinton, said, "There is no

question that Dodd-Frank is a place to start, not a place to

finish, in achieving financial stability." But he added that he

"would far prefer an inquiry that stayed a little further from

sloganeering."

Minneapolis Fed spokesman David Wargin said in an email: "This

is not about politics but about addressing a major issue facing us

today. We would welcome Dr. Summers' participation in our upcoming

symposium to share with the public his analysis of why [too big to

fail] is no longer a problem.‎"

Mr. Kashkari, a Republican candidate for California governor in

2014, has said that "if I had any aspiration to run for office

again, this is not what I would be doing." He also said that "Wall

Street critics and the lobbyists are reduced to trying to criticize

the process or criticize my intentions because they can't argue

with me on the substance."

St. Louis Fed President James Bullard attended Monday's

conference in Minneapolis and was supportive of Mr. Kashkari's

recent work, noting on Wednesday that it has been more than five

years since the Dodd-Frank financial reform law was enacted.

"I don't think we should just automatically say, well, we passed

a law and therefore everything's going to work out well in the

future," Mr. Bullard told reporters. "I think it's probably a good

moment to reflect on what the state of affairs is, so I applaud

Neel Kashkari for taking on this project."

Write to Ben Leubsdorf at ben.leubsdorf@wsj.com

(END) Dow Jones Newswires

April 06, 2016 21:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

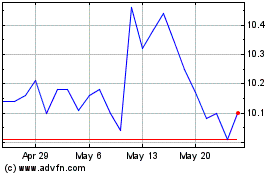

Pacific Current (ASX:PAC)

Historical Stock Chart

From Apr 2024 to May 2024

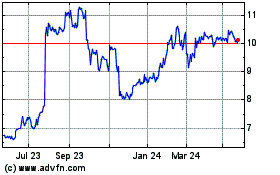

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2023 to May 2024