Piedmont Lithium Inc. (“Piedmont” or the “Company”)

(Nasdaq:PLL; ASX:PLL) today announced the pricing of an upsized

underwritten public offering of 1.75 million shares (“shares”) of

its common stock (“Public Offering”), at a price per share to the

public of $65.00, for aggregate gross proceeds of $113.75 million.

Piedmont has granted the underwriters a 30-day option to purchase

up to an additional 262,500 shares at the issue price of the Public

Offering. The Public Offering is expected to close on March 24,

2022, subject to customary closing conditions.

Piedmont intends to use the net proceeds from the offering to

fund the Company’s share of the capital required to restart the

operations at North American Lithium in Quebec, to fund exploration

and definitive feasibility studies at Eyowaa in Ghana, to advance

the Company’s merchant lithium hydroxide plant in the southeastern

United States, and to continue development of the Carolina Lithium

Project, including ongoing permitting activities, engineering

design, and property acquisition. Additionally, the net proceeds

may be used to fund possible strategic initiatives and for general

corporate purposes.

J.P. Morgan and Evercore ISI are acting as joint book-runners

for the Public Offering. Canaccord Genuity, B. Riley Securities,

BTIG, LLC, Clarksons Platou Securities, Inc., D.A. Davidson &

Co., Jett Capital Advisors LLC, Loop Capital Markets, Roth Capital

Partners, ThinkEquity and Tuohy Brothers are acting as co-managers

for the Public Offering.

The Public Offering is being made pursuant to an effective shelf

registration statement that has been filed with the U.S. Securities

and Exchange Commission (the “SEC”). A final prospectus supplement

related to the Public Offering will be filed with the SEC and made

available on the SEC’s website at http://www.sec.gov and on the ASX

website. Copies of the final prospectus supplement, when available,

and the accompanying prospectus relating to the Public Offering may

be obtained from J.P. Morgan Securities LLC, c/o Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717,

by telephone at (866) 803-9204 or by e-mail at

prospectus-eq_fi@jpmchase.com; and Evercore Group L.L.C.,

Attention: Equity Capital Markets, 55 East 52nd Street, 35th Floor,

New York, NY 10055, by telephone at (888) 474-0200 or by e-mail at

ecm.prospectus@evercore.com.

This press release is not an offer or sale of the securities

in the United States or in any other jurisdiction where such offer

or sale is prohibited, and such securities may not be offered or

sold in the United States absent registration or an exemption from

registration under the Securities Act of 1933, as amended.

Forward-Looking Statements

This press release contains “forward-looking statements” as

defined by the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties. In some cases, you can

identify forward-looking statements by terms such as “anticipate,”

“believe,” “expect,” “estimate,” “may,” “might,” “will,” “could,”

“can,” “shall,” “should,” “would,” “leading,” “ objective,”

“intend,” “contemplate,” “design,” “predict,” “potential,” “plan,”

“target” and similar expressions are generally intended to identify

forward-looking statements. Forward-looking statements are subject

to a variety of known and unknown risks, uncertainties and other

factors which could cause actual events or results to differ from

those expressed or implied by the forward-looking statements. Such

factors include, among others, risks related to: risks related to

whether the Company will close the Public Offering on the expected

terms, or at all; the anticipated use of the net proceeds of the

Public Offering; the fact that the Company’s management will have

broad discretion in the use of the proceeds from any sale of the

shares; the risk that anticipated plans, development, production,

revenues or costs are not attained; the Company’s operations being

further disrupted and the Company’s financial results being

adversely affected by public health threats, including the novel

coronavirus pandemic; the Company’s limited operating history in

the lithium industry; the Company’s status as a development stage

company, including the Company’s ability to identify lithium

mineralization and achieve commercial lithium mining; mining,

exploration and mine construction, if warranted, on the Company’s

properties, including timing and uncertainties related to acquiring

and maintaining mining, exploration, environmental and other

licenses, permits, access rights or approvals in Gaston County,

North Carolina, the Province of Quebec, Canada and Cape Coast,

Ghana as well as properties that Piedmont may acquire or obtain an

equity interest in the future; completing required permitting

activities required to commence processing operations for the LHP-2

Project; the Company’s ability to achieve and maintain

profitability and to develop positive cash flows from the Company’s

processing activities; the Company’s estimates of mineral reserves

and resources and whether mineral resources will ever be developed

into mineral reserves; investment risk and operational costs

associated with the Company’s exploration activities; the Company’s

ability to develop and achieve production on the Company’s

properties; the Company’s ability to enter into and deliver

products under supply agreements; the pace of adoption and cost of

developing electric transportation and storage technologies

dependent upon lithium batteries; the Company’s ability to access

capital and the financial markets; recruiting, training and

developing employees; possible defects in title of the Company’s

properties; compliance with government regulations; environmental

liabilities and reclamation costs; estimates of and volatility in

lithium prices or demand for lithium; the Company’s common stock

price and trading volume volatility; the development of an active

trading market for the Company’s common stock; the Company’s

failure to successfully execute its growth strategy, including any

delays in the Company’s planned future growth; and other factors

set forth in the Company’s most recent Transition Report on Form

10-KT and subsequent reports, as filed with the SEC.

All forward-looking statements reflect Piedmont’s beliefs and

assumptions based on information available at the time the

assumption was made. These forward-looking statements are not based

on historical facts but rather on management’s expectations

regarding future activities, results of operations, performance,

future capital and other expenditures, including the amount, nature

and sources of funding thereof, competitive advantages, business

prospects and opportunities. By its nature, forward-looking

information involves numerous assumptions, inherent risks and

uncertainties, both general and specific, known and unknown, that

contribute to the possibility that the predictions, forecasts,

projections or other forward-looking statements will not occur.

Although Piedmont has attempted to identify important factors that

could cause actual results to differ materially from those

described in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those anticipated, believed, estimated, or

expected. Piedmont cautions readers not to place undue reliance on

any such forward-looking statements, which speak only as of the

date made. Except as otherwise required by the securities laws of

the United States, Piedmont disclaims any obligation to

subsequently revise any forward-looking statements to reflect

events or circumstances after the date of such statements or to

reflect the occurrence of anticipated or unanticipated events.

Piedmont qualifies all the forward-looking statements contained in

this release by the foregoing cautionary statements.

About Piedmont Lithium

Piedmont Lithium is developing a world-class, multi-asset,

integrated lithium business focused on enabling the transition to a

net zero world and the creation of a clean energy economy in North

America. The centerpiece of our operations, located in the renowned

Carolina Tin Spodumene Belt of North Carolina, when combined with

equally strategic and in-demand mineral resources, and production

assets in Quebec, and Ghana, positions us to be one of the largest,

lowest cost, most sustainable producers of battery-grade lithium

hydroxide in the world. We will also be strategically located to

best serve the fast-growing North American electric vehicle supply

chain. The unique geology, geography and proximity of our

resources, production operations and customer base, will allow us

to deliver valuable continuity of supply of a high-quality,

sustainably produced lithium hydroxide from spodumene concentrate,

preferred by most EV manufacturers. Our planned diversified

operations should enable us to play a pivotal role in supporting

America’s move toward decarbonization and the electrification of

transportation and energy storage. As a member of organizations

like the International Responsible Mining Association, and the Zero

Emissions Transportation Association, we are committed to

protecting and preserving our planet for future generations, and to

making economic and social contributions to the communities we

serve.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220322006118/en/

Keith Phillips President & CEO T: +1 973 809 0505 E:

kphillips@piedmontlithium.com

Patrick Brindle EVP – Chief Operating Officer T: +1 412

818 0376 E: pbrindle@piedmontlithium.com

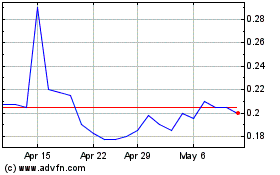

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Jan 2025 to Feb 2025

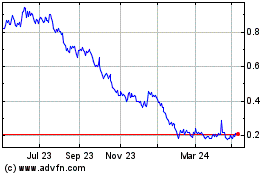

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Feb 2024 to Feb 2025