2nd UPDATE: ANZ Plans To Bulk Up Bank's Domestic Operations

05 August 2009 - 4:36PM

Dow Jones News

Australia and New Zealand Banking Group Ltd. (ANZ.AU) Chief

Executive Mike Smith Wednesday said he plans to bulk up the bank's

domestic operations, though an offer for a regional bank isn't on

the immediate radar.

Smith's remarks come a day after ANZ completed a US$550 million

deal to buy some of Royal Bank of Scotland's operations in Asia and

signal that although regional expansion is the priority, the bank

continues to keep a firm eye on domestic opportunities.

On the bank's home market share, Smith said its current slice of

16% is not enough, and he criticized both the government's four

pillars banking policy and comments from competition authorities,

which he said preempt possible mergers.

The four pillars policy bans any of the country's four major

banks from merging with each other.

Asked if the Australian Competition and Consumer Commission

policy on banking mergers would prevent ANZ making an offer for

regional bank Suncorp-Metway (SUN.AU), Smith said that it would

not.

He also said that "there are other opportunities and I would

very much like to build the business".

Smith said that Australia's four pillars banking policy has

restricted the development of domestic banking infrastructure.

"The actual investment in infrastructure has not been at a

global pace."

Speaking to reporters after a business luncheon, Smith said,

regional banks play an important role in Australia's banking system

and further consolidation would not "necessarily be a great

thing".

Asked if ANZ had any interest in making an offer for a regional,

Smith said: "you never say never, but right now it's not on the

radar."

The CEO of Australia's fourth largest bank by market

capitalization said still high funding costs means it's likely

banks will lift their mortgage rates ahead of any monetary policy

tightening, a move which could have important repercussions for

policy makers.

Smith said that the Reserve Bank of Australia should not "muck

around" with the official cash rate, as the cost of borrowing will

lead to a natural adjustment of mortgage rates and inflation can be

contained.

"The banks cost of funding is still high comparative to what it

was, and that is going to wash through, so there will be natural

adjustment anyway, so let that cycle take effect and don't muck

around with the official rate."

He also cautioned the RBA against hiking rates before its clear

the economic recovery is sustainable and whilst inflation is still

manageable.

"Mortgages are incredibly well priced," he said.

Responding to reporter's questions, Smith said it is possible

banks lift their mortgage rates before the Reserve Bank of

Australia officially tightens policy.

"If that's out of cycle, it's out of cycle," he said.

Although Australia will likely be the first country to emerge

from the global downturn, Smith said the recovery will be long and

gradual, rather than "V" shaped, although he added he does not see

risk of another systemic crisis emerging.

He said that Europe has yet to see a trough in its downturn,

while the U.S. is "talking itself up", with little to show for

it.

"Asia, meanwhile, is moving well."

Smith said the next chief executive of ANZ will be likely chosen

from within the bank.

"It's incumbent on me to have a choice of successors within the

ranks."

He added ANZ expects to make an announcement on a systematic

review of its fees in coming weeks.

-By Enda Curran, Dow Jones Newswires;

61-2-8272-4687; enda.curran@dowjones.com

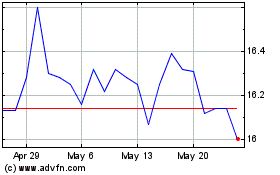

Suncorp (ASX:SUN)

Historical Stock Chart

From Apr 2024 to May 2024

Suncorp (ASX:SUN)

Historical Stock Chart

From May 2023 to May 2024