Treasury Wine Sharpens Focus in U.S.

28 December 2015 - 1:00PM

Dow Jones News

MELBOURNE, Australia—Treasury Wine Estates Ltd. is making

another big run at the U.S. market, after overly rosy estimates

about demand there a few years ago led the Australian wine producer

to famously dump thousands of gallons of unsold inventory.

Now Treasury is focusing on pricier wines in the $10 to

$100-plus range a bottle, rather than popular but cheaper wines

such as its $6 a bottle White Zinfandel. Treasury is the world's

eighth-largest wine producer by volume, according to data provider

Euromonitor International.

The wine producer has also ditched marketing staples, such as

close-ups of bottles against stately vineyard backdrops, instead

spending millions of dollars on a campaign for its Beringer brand

featuring postcard-style images launched first on Instagram.

The Instagram-led campaign is Beringer's first major U.S. ad

campaign in five years, elevating social media alongside

traditional advertising such as magazines and billboards. It

launched in the U.S. in late October and will run through the

holiday season, and it is set to roll out across Asia next

year.

The campaign is Treasury's latest move in the important U.S.

market, which is the leading wine consumer in the world. Americans

accounted for 15% of the $223.27 billion in reds, whites and roses

consumed last year, according to Euromonitor.

Some observers are skeptical.

"Beringer is fundamentally a commercial, mass-market brand,"

said Daniel Mueller, an analyst at investment-research firm

Morningstar. While investing in the label is positive, it will be a

"long slog" building up its image, he said.

Beringer, best known for its mass-market offerings, suffers from

a lingering hangover in the U.S. after the company in 2013 was

forced to destroy thousands of gallons of wine that had passed its

drink-by date, after overestimating demand for its lower-priced

wines. That cost it about 150 million Australian dollars, or

roughly US$109 million.

Treasury also faltered in a recent foray into low-calorie wine

with the Skinny Vine brand in the U.S. During that campaign,

Treasury invited consumers in a YouTube video to take a taste test

to see if they could distinguish between the low-calorie product

and regular wine. But the wines were seen as compromising on an

indulgence, and Skinny Vine was discontinued this year because of

disappointing sales.

The Australian wine producer in 2014 fended off two takeover

approaches, including one from private-equity giant KKR & Co.

The company bet instead on a turnaround strategy proposed by Chief

Executive Michael Clarke—hired in March 2014—who has retail

experience in everything from Indian chutneys to gravy

granules.

Mr. Clarke has focused Treasury on 15 brands out of a portfolio

of roughly 80, and is pushing the company to seek earlier estimates

on popularity of products so unwanted bottles don't pile up.

Treasury posted total revenue for the year ended June 30 of

A$1.96 billion, up 8.1% from a year earlier. It swung to a

fiscal-year profit of A$77.6 million from a year-earlier loss of

A$100.9 million. Treasury in October increased its bet on its U.S.

prospects when it bought most of Diageo PLC's North American and

British wine operations in a US$552 million deal.

The campaign emphasizes several of Beringer's pricier vintages

such as its $160-a-bottle Private Reserve Cabernet Sauvignon.

In the series, dubbed "Better Beckons," ad company J. Walter

Thompson Co. teamed the winemaker with Murad Osmann, a Russian

photographer with 3.7 million Instagram followers, for an initial

six photographs. Mr. Osmann's photographs feature his wife, Nataly

Osmann, in front of such scenes as the New York City skyline and

the Golden Gate Bridge. It was Mr. Osmann's Instagram photographs

of his wife as they traveled around the world that caught the

attention of the ad company and Treasury.

"With digital, you know immediately if people are engaged," said

Simon Marton, Treasury's chief marketing officer. The first photo

garnered 200,000 "likes" on Mr. Osmann's Instagram feed in its

first two weeks, said Mr. Marton, who described that as a strong

start.

While makers of spirits and beer have seized on social media in

recent years, Beringer's Instagram-led campaign differed from many

wine companies' emphasis on product shots, said Ben James, creative

director at J. Walter Thompson.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 27, 2015 20:45 ET (01:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

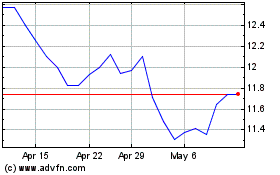

Treasury Wine Estates (ASX:TWE)

Historical Stock Chart

From Dec 2024 to Jan 2025

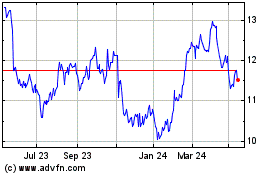

Treasury Wine Estates (ASX:TWE)

Historical Stock Chart

From Jan 2024 to Jan 2025