Visioneering Technologies, Inc. Successfully Lists on ASX

28 March 2017 - 12:15PM

Business Wire

- Visioneering Technologies, Inc.

(ASX:VTI) lists on the Australian Securities Exchange

(ASX)

- VTI received strong institutional and

retail investor support raising AUD$33.3 million in fully

underwritten IPO

- VTI has developed a proprietary daily

disposable contact lens called NaturalVue® (etafilcon A) Multifocal

1 Day contact lenses (NaturalVue MF) used in two major

vision care applications – loss of near-vision in those over 40

(called presbyopia) and near-sightedness in children (paediatric

myopia)

- NaturalVue MF has been cleared by the

FDA and is available in the US following a successful initial US

market launch

- Funds raised in the IPO to be used to

expand the sales force and inventory towards a rapid broadening and

acceleration of the US market launch of NaturalVue MF

Visioneering Technologies, Inc. (ASX:VTI), a US-based

medical device company engaged in the design, manufacture, sale and

distribution of its proprietary NaturalVue™ Multifocal 1 Day

(NaturalVue MF) contact lenses, has today listed on the

Australian Securities Exchange after raising A$33.3 million

following the close of its Initial Public Offer (IPO).

The IPO was fully underwritten by Cannacord Genuity and strongly

supported by institutional and sophisticated investors in Australia

and Asia.

The IPO proceeds will be used to expand the Company’s US sales

force and inventory as VTI broadens and accelerates its US launch

of NaturalVue MF, which are daily disposable contact lenses for

adults with presbyopia (age-related loss of near vision), and

children with myopia (near-sightedness). VTI also plans to launch

additional contact lens products.

The revolutionary optical design overcomes several major

challenges associated with existing presbyopia solutions by

providing superior near, intermediate, and distance vision, and is

easy for eye care professionals to optimize to each of their

patients.

VTI offered for issue approximately 79.4 million CHESS

Depositary Interests (CDIs), each representing an interest

in one share of VTI’s Class A common stock. The offer was priced at

A$0.42/CDI, with an indicative market capitalisation of

approximately A$88.2 million (on a fully-diluted basis). The CDIs

will trade on the ASX under the ticker VTI.

Dr Stephen Snowdy, CEO of VTI said of the IPO, “We couldn’t be

happier with the warm reception from investors. With the IPO funds

successfully raised, we can rapidly expand our sales structure and

marketing efforts for our products in the US and globally.”

Dr Snowdy continued, “We believe that NaturalVue MF contact

lenses represent one of the most significant innovations in the

optical design of multifocal contact lenses in over 20 years. We

are looking forward to significantly accelerating the

commercialisation of our NaturalVue MF contact lenses and other

products.”

VTI’s Senior Vice President of Sales and Marketing, Mr Tony

Sommer, will lead the growth of the US sales force. Mr Sommer was

the head of sales for the US Vision Care division at Bausch &

Lomb, one of the largest multi-national contact lens companies.

The funds raised in the IPO are intended to further build out

the US sales force to approximately 45 direct sales representatives

over the 12 months following listing, and to build inventory that

will support the expanded sales effort.

“The ability to expand our sales force to reach more

practitioners and patients is extremely exciting,” said Mr Sommer.

“Our increased sales coverage, inventory, and product development

pipeline will enable VTI to meet the vision needs of more patients

and the clinical needs of more practitioners.”

The NaturalVue MF contact lens has been cleared by the US Food

and Drug Administration (FDA), and a pilot launch in the US market

commenced in 2015 generated strong interest. Within 12 months of

the pilot launch commencing, demand for the NaturalVue MF contact

lenses far outpaced VTI’s ability to supply product with its

then-limited infrastructure, and 90 per cent of patients who had

been using the lenses long enough to use up their supplies

reordered, indicating strong repeat purchasing.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170327006321/en/

If you have any questions in relation to the IPO, please

contact:Offer information line1300 646 967 (within

Australia) or +61 3 9415 4019 (outside Australia) between 8.30am

and 5.00pm (Sydney time) Monday to Friday until 7 April

2017.orCompanyVisioneering Technologies, Inc.Stephen

SnowdyCEOssnowdy@vtivision.comwww.vtivision.comwww.vtivisioninvestors.com

(for investors)orInvestor and media relationsWE BuchanKyahn

Williamson, +61 (3) 9866

4722kwilliamson@buchanwe.com.au

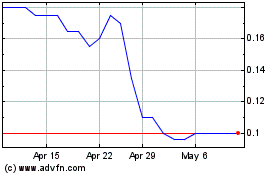

Visioneering Technologies (ASX:VTI)

Historical Stock Chart

From Nov 2024 to Dec 2024

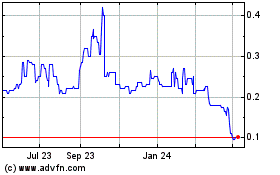

Visioneering Technologies (ASX:VTI)

Historical Stock Chart

From Dec 2023 to Dec 2024