3rd UPDATE: Yanzhou, Gloucester In Talks To Create A$8 Billion Coal Miner-Sources

20 December 2011 - 5:17PM

Dow Jones News

China's Yanzhou Coal Mining Co. (YZC) is in initial talks with

Gloucester Coal Ltd. (GCL.AU) to merge their Australian coal assets

and create a miner worth up to 8 billion Australian dollars (US$7.9

billion), three people familiar with the matter said Tuesday.

The move is a bold step by China's third largest coal miner by

output to secure a listing on Australia's main exchange and meet

undertakings given to the Australian government in 2009 to seal a

A$3.5 billion takeover of Felix Resources Ltd. It also gives it

access to producing coal mines, boosting its production growth

profile at a time when output at its mines in China's Shandong

province are stagnating.

Analysts said the proposed deal is unlikely to encounter

opposition from Australia's foreign investment watchdog, despite

previous big investments by state-backed Chinese companies

triggering criticism from some politicians.

Gloucester is worth A$1.44 billion (US$1.42 billion) based on

Monday's closing share price, and its 1.8 million metric tons of

coal production represents less than 1% of Australia's total 406

million tons output in the year to June 30.

"I don't think Gloucester is a big enough a producer for the

Foreign Investment Review Board to knock any potential deal back,

if they approved the Felix takeover you think they'd easily allow

Gloucester to be absorbed into the entity," Royal Bank of Scotland

analyst Tom Sartor told The Wall Street Journal.

In a statement to the Australian Securities Exchange,

Sydney-based Gloucester said it had requested trading in its shares

be halted until Thursday, by when it expects to make an

announcement in connection with a "possible change of control

transaction."

Gloucester, which operates two open-pit mines and holds

exploration licenses, said it wasn't yet in a position to make such

an announcement.

Yanzhou's board secretary and deputy general manager, Zhang

Baocai, last week said the company was considering a reverse

takeover to fulfil a commitment to Australian regulators that it

will float at least 30% of its Australian assets, known as Yancoal

Australia, by the end of next year.

Gloucester and Noble Group (N21.SG), Gloucester's majority

shareholder with a 64.5% stake, declined to comment on a possible

deal.

UBS and Citi are advising Yanzhou, and Lazard is advising

Gloucester.

Demand for Australian coal has intensified in recent years as

companies seek sources of the commodity both for fuel and a key

steelmaking ingredient to feed China, India and other rapidly

industrializing countries.

In a recent wave of consolidation, Rio Tinto PLC (RIO) and

partner Mitsubishi Corp. (8058.TO) bought the remaining shares they

didn't hold in Coal & Allied Industries Ltd. in a deal that

valued the target at A$10.8 billion. Among other deals, U.S. coal

miner Peabody Energy Corp. (BTU) in November gained control of

Macarthur Coal Ltd. with a A$4.9 billion bid, and Whitehaven Coal

Ltd. (WHC.AU) this month agreed to buy smaller Aston Resources Ltd.

(AZT.AU) for almost A$2.3 billion.

E.L. & C. Baillieu analyst Adrian Prendergast said the

potential merger was very positive.

"Since the Felix takeover in 2009, I think Yancoal has been

sizing up all of the potential fits for them as a way of backing in

the assets and listing," he told The Wall Street Journal. "From the

product point of view, it gives it substantial scale and really

broadens their market ability in terms of coal type."

Prendergast said the combined entities of Yancoal-Gloucester, as

well as Whitehaven-Aston, would both be attractive targets for

global players. However, Chinese companies have little track record

of selling out of assets that they control.

Yanzhou shares were placed in trading halt on the Hong Kong

Stock Exchange pending the release of an announcement which is

price sensitive in nature and on the Shanghai Stock Exchange due to

a proposed transaction.

-By Gillian Tan, The Wall Street Journal;

gillian.tan@wsj.com

--Robb M. Stewart of Dow Jones Newswires in Melbourne

contributed to this article.

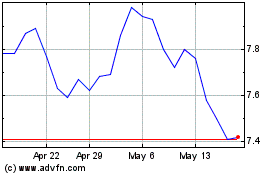

Whitehaven Coal (ASX:WHC)

Historical Stock Chart

From Apr 2024 to May 2024

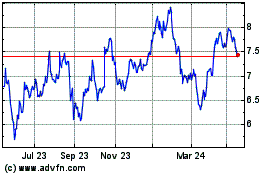

Whitehaven Coal (ASX:WHC)

Historical Stock Chart

From May 2023 to May 2024