The Growth in SME Loans and illimity's Profits Continues in the Third Quarter of 2021

11 November 2021 - 9:28PM

The Growth in SME Loans and illimity's Profits Continues in

the Third Quarter of 2021

via InvestorWire -- Chaired by Rosalba Casiraghi, the Board of

Directors of illimity Bank S.p.A. (“

illimity” or

“

Bank”) yesterday approved the illimity Group’s

results at 30 September 2021.

illimity again reports solid financial

and operating performance in the third quarter of 2021:

net profit of 18.8 million euro (14.9 million euro

in the second quarter of 2021, +26% q/q, and 9.5 million euro in

the third quarter of 2020, +98% y/y), taking the net result

for the first nine months of the year to 46.2 million

euro, up by 90% over the corresponding period in 2020.

ROE3 closed at over 9% for the first nine

months of 2021 on an annualised basis.

All the new strategic initiatives are

running to schedule and the trajectory towards the

short and medium-long term targets set in the 2021-25

Strategic Plan presented on 22 June is therefore confirmed.

Specifically:

-

Revenues in the third quarter rose by 49%

over the third quarter of 2020, driven by the Group’s

recurring activities and the development of its new initiatives.

The strong performance accompanied the gradual balancing of

the revenue mix, with the component of income other than

net interest income representing around 50% of the total in the

first nine months of 2021.

-

Standing out among revenues is the rise in fees and

commissions, which in the third quarter rose by

18% q/q to reach 10.3 million euro –

three times the corresponding figure for the previous year – driven

by the robust generation of new business volumes in the Growth

Credit segment, including Factoring, the solid results of neprix

and the rising contribution of the new initiatives.

-

Revenues for the period include the first income of 5

million euro arising from the licence agreement

entered into with the ION Group for the use of the

information systems developed by illimity (part of the 90 million

euro planned to be received over five years).

-

The Distressed Credit Division’s performance in

managing purchased loans proved once again to be

excellent in this quarter, with an extremely good

progression in gross cash flows, generating ca. 5.3 million euro of

profit from closed positions and other income of ca. 7.2 million

euro; overall, the Division produced revenues of 146.1 million euro

in the first nine months of 2021.

-

Despite the fact that the Bank continued to invest in new

initiatives which have yet to produce revenues, operating

costs in the third quarter fell by around

9% over the previous quarter due to seasonal savings on

certain staff cost items. This trend, together with the robust

performance of revenues, led to a further improvement in

the Cost income ratio, which reached 56% in the

quarter and 60% in the first nine months of

2021, a clear-cut improvement over the same period of the

previous year (76% in 9M20).

-

As a result of the above dynamics, illimity’s operating

profit rose to 77.5 million euro in the first nine

months of 2021, nearly three

times the figure of 28.0 million euro reported for the same period

in 2020.

-

The Bank’s risk profile strengthened further,

remaining at the top levels of the system: the CET1 Ratio

rose to 20.1% at the end of September 2021 (20.6%

pro-forma with the inclusion of the special shares) due to the

completion of the capital increase reserved to the ION Group and

the profit of the quarter just ended; the ratio between

gross doubtful organic loans and total gross organic loans fell to

2.5%; excluding the loan portfolio of the former Banca

Interprovinciale, this ratio stands at around

0.5%. Liquidity continued to be abundant

at over 1.1 billion euro at the end of September

2021, consistent with the expectation of an acceleration in

opportunities in the distressed credit market in the final part of

the year.

-

Lastly, the Bank continued developing the new initiatives

outlined in the Strategic Plan in line with the timetable.

In September, HYPE launched new services and

products on the market, enhancing its offer, with the aim of giving

a further thrust to the already robust growth performance of the

company, which can currently count on 1.5 million customers,

confirming its leadership position among the fintechs that operate

in Italy. The development of B-ILTY, the new

highly digital direct bank designed for small corporates, ready for

launching in the first quarter of 2022, is running to schedule. And

in conclusion, the operating activities continued for enabling

neprix Sales – the remarketing entity already a leader among

platforms for the sale of real estate and capital goods arising

from legal procedures – to enter the real estate free market by way

of an innovative and digital offer model.

Corrado Passera,

CEO and Founder of

illimity, commented: “The world served by

illimity, that of the small corporates, offers significant

opportunities. A growing number of corporates present ambitious

projects to enhance their potential and many are on solid paths

towards a turnaround. The increase in distressed corporate credit

will also accelerate once the banking moratorium ends, and the role

of banks such as illimity specialising in this market segment will

prove itself fundamental.

The decisions and technology investments we have

made in these years will enable us to provide a service model that

has shown itself to be competitive in terms of both expertise and

efficiency. B-ILTY, the direct bank for small corporates, which

will be launched on the market in the first part of the year 2022,

will complete the construction of the illimity model and be

completely unique, and not only at an Italian level.

The results of the first nine months of 2021 and

in particular the third quarter confirm that the path that illimity

has taken, has only just begun to bear its fruits for our customers

and our shareholders.”

For more details view the entire

announcement:https://assets.ctfassets.net/0ei02du1nnrl/2DFTbB9Vt2QYCNcNT7pm5U/bec4c82968049162bac44bf70d39ea0e/illimity_3Q21_9M21_Results.pdf

For further information:

Investor RelationsSilvia Benzi:

+39.349.7846537 - +44.7741.464948 - silvia.benzi@illimity.com

|

Press & Communication illimity |

|

|

Isabella Falautano, Francesca D’Amico |

Sara Balzarotti, Ad Hoc Communication Advisors |

|

+39.340.1989762 press@illimity.com |

+39.335.1415584 sara.balzarotti@ahca.it |

Wire Service Contact:InvestorWire

(IW)Los Angeles, Californiawww.InvestorWire.com212.418.1217

OfficeEditor@InvestorWire.com

________________________

1 Purchase of tax credits deriving from energy

efficiency interventions, reduction of seismic risk and recovery of

the building heritage provided for by the Relaunch Decree

(so-called 110% Superbonus and other building bonuses).

2 Including special shares for 14.4 million

euro

3 ROE – Return On Equity: calculated as the

ratio between annualised net profit for the period and average

equity for the nine months (1/1-30/9/2021).

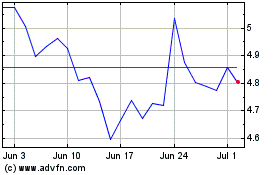

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Jan 2024 to Jan 2025