2ND UPDATE: EDF Requests Extraordinary Edison Board Meeting

12 April 2012 - 2:01AM

Dow Jones News

PARIS/ROME (Dow Jones) -- French power group Electricite de

France SA (EDF.FR) has requested an extraordinary board meeting of

Edison SpA (EDN.MI) for Monday in its latest effort to revive a

long-sought plan to seize control of the Italian utility, people

familiar with the situation said.

The meeting has been set up at the request of EDF's

representative within Edison's board, one of the people said,

noting that the discussion could focus on Edison's finances. Board

members could also discuss a potential plan to increase the group's

capital.

EDF has been trying for more than two years to take strategic

control of Edison, which would strengthen the French company's hold

in Italy and bolster its natural gas exposure. But EDF's efforts

have met repeated problems in Italy, most recently when Italian

securities regulator Consob said the price offered by the French

company was too low.

For now, Monday's agenda is set to focus strictly on the

regulator's ruling on EDF's share price offer, another person

familiar with the matter said. But the meeting could also consider

other topics.

Milan-based Edison, which has been badly hit by costly gas

contracts, had a net debt of EUR3.88 billion at the end of 2011,

slightly higher than a year earlier. Wednesday, Edison's market

capitalization was around EUR4.54 billion.

EDF representatives are also to meet with the Italian regulator

Consob on Friday, during a "technical meeting" to get details about

the regulator's arguments and calculations, one of the people

said.

No one at the Consob was immediately available to comment.

A preliminary deal, announced in December, would see EDF

increase its stake in Edison from 50% to 80.7% at a cost of around

EUR700 million, and would grant Delmi, a company controlled by

Italian utility A2A SpA (A2A.MI), 70% of Edipower SpA, which owns

nine power plants in Italy. Edison owns 50% of Edipower.

EDF's efforts met political resistance from the former

government of Prime Minister Silvio Berlusconi. The current

government of Premier Mario Monti didn't object to the Edison deal

between EDF and Italian shareholders. Italian regulator Consob has

been set up as an independent agency. It isn't clear whether EDF's

latest potential move would win Consob backing absent a higher

premium.

Last week, EDF said it is seeking alternative ways to "secure"

the future of Edison after Consob said the EUR0.84-a-share price

offered for a planned bid for additional shares in Edison was too

low.

EDF has previously made confirmation by Consob of the

EUR0.84-a-share price an undisputable condition for the deal to be

sealed.

Even though analysts initially believed EDF could increase the

price, some of them have turned more skeptical of such a tactic and

believe a capital increase could be the solution for the French

group.

"EDF maintains its strict position of a maximum price of EUR0.84

per Edison share," Natixis analyst Philippe Ourpatian said, adding

EDF's statement last week on the matter was "very clear." He rates

EDF at neutral.

A capital increase would allow EDF to increase its shareholding

position as other shareholders such as A2A SpA (A2A.MI) and Iren

SpA (IRE.MI) through Delmi and Carlo Tassara might not have the

means to inject additional cash into Edison, Ourpatian noted,

adding that this would also lower Edison's ultimate valuation.

The situation is "a test of EDF's capital discipline," said

Credit Suisse analyst Michel Debs. "While Edison has a clear

strategic value to EDF as it plays into its long-term strategy of

diversifying away from nuclear and building up a gas platform, any

cash paid for minorities would have to be backed by clear

value-creation targets and a well-defined strategy."

At 1341 GMT, shares in EDF were trading 1.7% higher to EUR16.80

while the CAC-40 benchmark index was up 1.4%. Edison shares were

down 1.0% at EUR0.84, while Italy's benchmark FTSE Mib was up

2.5%.

- By Geraldine Amiel and Liam Moloney, Dow Jones Newswires; +33

1 40171767; geraldine.amiel@dowjones.com,

liam.moloney@dowjones.com;

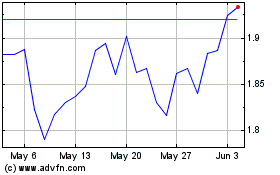

Iren (BIT:IRE)

Historical Stock Chart

From Feb 2025 to Mar 2025

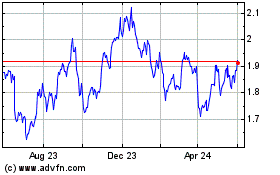

Iren (BIT:IRE)

Historical Stock Chart

From Mar 2024 to Mar 2025