Moncler Denies Reports of M&A Talks With Kering as Shares Soar

06 December 2019 - 1:08AM

Dow Jones News

By Cristina Roca

Moncler SpA's (MOV.MI) main shareholder and chief executive Remo

Ruffini on Thursday threw cold water on reports that the company

has held exploratory talks with French luxury-goods conglomerate

Kering (KER.FR) over a possible deal.

Mr. Ruffini said he is in contact with sector players, including

Kering, to explore potential opportunities. "At the moment,

however, there is not any concrete hypothesis under consideration,"

Mr. Ruffini said, referring to a Bloomberg report late on Wednesday

that said the Italian company, known for its luxury puffer jackets,

has held early-stage discussions with Kering.

The report got luxury investors buzzing about the possibility of

another big M&A deal after LVMH Moet Hennessy Louis Vuitton SE

(MC.FR) scooped up Tiffany & Co. (TIF) last month in a mammoth

$16.2 billion deal.

At 1315 GMT, shares in Moncler traded 8.2% higher at EUR42.00

($46.53), while the news also buoyed shares of smaller Italian

luxury-goods companies seen by investors as potential M&A

targets. Shares in Salvatore Ferragamo SpA (SFER.MI) traded 6.7%

higher, and Tod's SpA (TOD.MI) stock was up by 5.1%. Both Italian

heritage shoe brands that have struggled to keep up with larger

players in recent years.

LVMH's recent Tiffany megadeal has put pressure on other big

sector players like Kering to join the M&A dance, Bernstein

analyst Luca Solca said.

Kering has had a great run in the past few years. Shares in the

luxury group now trade three times higher than four years ago,

buoyed by the huge success of Gucci, the main brand in its

portfolio. But recently its overreliance on the brand, which brings

in 83% of the group's total earnings before interest and tax,

according to Equita SIM's estimates, is making investors

jittery.

Kering needs M&A to move to the next level, and Moncler

could help it balance its portfolio, becoming the group's

second-biggest brand by value, Jefferies analyst Flavio Cereda

said.

Moncler's best-in-sector margins and leading position in its

market niche are attractive, Equita SIM analyst Paola Carboni

said.

The company has gone from a small skiwear maker into a runaway

success story in luxury under the helm of chief executive Remo

Ruffini. He bought a stake in Moncler in 2003 and took the brand

upmarket, creating buzz through collaborations with famous

designers like Valentino Fashion Group SpA's Pierpaolo

Piccioli.

The brand has been enjoying steady double-digit organic sales

growth for the past few years, and analysts expect it continue,

with a consensus estimate provided by FactSet forecasting 13%

organic sales growth for 2019.

However, Bernstein's Luca Solca believes Moncler isn't the

perfect target for Kering: Firstly, Moncler does nothing to enhance

Kering's hard-luxury credentials at a time when competition in the

jewelry category seems to be heating up following the LVMH-Tiffany

tie-up.

Secondly, Ruffini's management team has already done a very good

job with the brand, meaning it will be harder for Kering to add

value--especially if it has to pay a hefty premium to get its hands

on the brand, the analyst said.

With shares in Moncler now worth 48% more than at the beginning

of this year and a EUR10.89 billion market valuation, any deal to

snap it up would be considerable in size. Ms. Carboni believes

Moncler could fetch EUR50 euros a share, representing a 30%

premium. This would bring the company's valuation close to EUR13

billion.

And given the brand's bright outlook, the French owner of Gucci

shouldn't expect to get any discounts. "Ruffini is in no hurry to

sell," according to Mr. Solca.

"It is not a cheap deal," Mr. Cereda said.

Kering declined to comment when contacted by Dow Jones

Newswires.

Write to Cristina Roca at cristina.roca@dowjones.com;

@_cristinaroca

(END) Dow Jones Newswires

December 05, 2019 08:53 ET (13:53 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

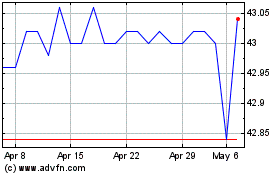

Tod`s (BIT:TOD)

Historical Stock Chart

From Nov 2024 to Dec 2024

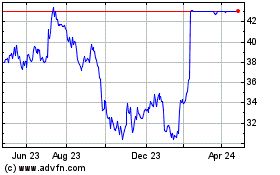

Tod`s (BIT:TOD)

Historical Stock Chart

From Dec 2023 to Dec 2024