Solana Posts More Net Inflows Than All Major Chains Combined: When Will SOL Break $160?

03 October 2024 - 11:00AM

NEWSBTC

Like Bitcoin, Ethereum, and other top altcoins, Solana remains

under immense selling pressure. While bulls struggle for momentum,

$160 is emerging as a local resistance level for traders to watch

out for. Despite the upside momentum in September, Solana buyers

didn’t lift prices above this line. At press time, there is a local

double top, even as one analyst on X notes that Solana outperformed

other platforms, posting a sharp influx in net inflow. Solana

Received Over $800 Million In Net Flows Over Three Months Unlike

Ethereum, Solana is a modern blockchain with relatively high

scalability. The platform can process thousands of transactions

every second, translating to low fees, and thus, more projects are

choosing to launch on the network so that user experience remains

unaffected. Events over the last three months, looking at the

influx of capital to Solana, cement this position. Related Reading:

Bitcoin Starts October In The Red After Crash To $61,000, Is

‘Uptober’ A Myth? To put in the numbers, Solana registered over

$800 million in net flows. This capital injection is more than

double what OP Mainnet, an Ethereum layer-2, received and way

more than what Sui, another scalable blockchain, posted in the last

three months. It is also more than what Base and Starknet–two of

Ethereum’s popular layer-2s, posted, and exceeds what Avalanche and

the BNB Chain received. Interestingly, during this period,

Arbitrum, an Ethereum layer-2 and the largest of them all, Linea,

Blast, and Bitcoin saw outflows. Despite being the largest smart

contracts platform, Ethereum posted massive outflows of nearly $800

million. It remains to be seen what could have triggered the

outflows in Ethereum while encouraging capital to Solana. While

on-chain fee differences could be a factor, the continuous dump of

ETH in Q3 2024 could have triggered the outflow. At spot rates, ETH

is down 35% from Q3 2024 highs, while Solana is just 25% from July

highs when it rose to around $192 before pulling back. Will SOL

Break $160? Even as Solana attracts capital, the coin remains under

intense selling pressure. The local line at $160 needs to be

convincingly broken for the uptrend seen in the second half of 2023

to continue. Further gains will see Solana float to as high as $190

and possibly break out from the current range. Related Reading: UNI

Bullish Rebound Signals Upsurge, Targets $8.7 Resistance Ahead

Nonetheless, there could be headwinds. If Bitcoin fails to recover,

it could drag the altcoin markets, including Solana, with it. At

the same time, there are concerns that the upcoming FTX token

distribution would negatively impact SOL prices. Moreover,

according to Token Unlocks, the team plans to release tokens on

December 26, 2024. Over 66,000 SOL will go out every day for a

year. Feature image from DALLE, chart from TradingView

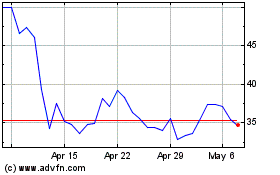

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024