A Right Way for Investors – From Traditional Investment to DeFi Mining in Encryption Market

22 March 2022 - 10:34PM

NEWSBTC

To offer the best option for all investors from traditional

securities to cryptocurrency investment. 1. Berkshire Hathaway, a

Magnate Unequal to Retail Investors Berkshire’s investment practice

is full of initiative. It makes use of its sensitive business sense

to take the initiative and always maintains the professional

quality of discovering value targets, Of course, every investment

of Berkshire is in line with the long curve growth trend.

● Anxiety of Retail Investors

Berkshire’s record or Buffett’s charm makes people want to exchange

all their chips for more because everyone wants to earn more.

However, from a personal stance, we have to admit that such a

threshold will block us out. Berkshire’s high return on investment

belongs to institutional investors and has nothing to do with

retail investors! So how can individual investors choose a good way

of investment? 2. Grayscale Fund, Filling up Old Bottle with

New Wine, Engaging in Cryptocurrency of Wall Street Before

introducing Grayscale, we should learn about the encryption

magnate, Digital Currency Group (hereinafter referred to as DCG),

which is called by its founder as the Berkshire Hathaway of the

encryption world. Its scale has already exceeded US $10 billion.

Including investment in Coinbase, the world’s largest exchange,

Decentraland, the leader of metaverse concept, etc. Its Grayscale,

CoinDesk and Genesis are particularly famous. Holding Coca-Cola

alone is enough to shock ordinary investment institutions. In 1988,

Buffett bought 593 million US dollars of Coca-Cola stock. In 1989,

the amount increased significantly to 1.024 billion US dollars. In

1994, the total investment reached 1.299 billion US dollars, which

has remained unchanged since then. This is amazing. Of course,

every investment of Berkshire is in line with the long curve growth

trend. ● Only-In-No-Out, Rising

Unilaterally From the perspective of operation mode, the trust fund

of Grayscale can be regarded as an ETF. It was investigated and

dealt with by the SEC in 2014. Therefore, since then, Grayscale

deliberately stopped the “redemption” function on the grounds that

the SEC would not approve it and did not strive for it anymore,

which led to the ETF becoming a multi-currency encrypted capital

pool with multiple encrypted currencies led by bitcoin. With no

channels for getting back the digital currency, the investors could

only cash in the OTC market with the Grayscale trust and the

currency holding of the Grayscale fund would only rise

unilaterally. This is why the price of Grayscale trust has always

been at a premium. ● No Alternative

for Retail Investors Up to now, the Grayscale trust has held a

total of 13 currencies, which are successively the leading projects

of subdivided projects such as BTC, ETH, LINK, FIL and MANA.

Although investors do not have to worry about the risk of

return-to-zero, the optional power for them still lacked diversity.

Grayscale, as a cryptocurrency trust, has the same over-centralized

management as that of Buffett’s Berkshire. At the same time, the

door of the Grayscale fund is not open to individual investors.

Like Berkshire, it is a hotbed for institutional investors, which

still discourages some individual investors. So it seems that the

Grayscale fund fails to give a better solution to personal

investment! 3. BlackHoleDAO, Integrating with Various Advantages

Superior Protocol Mechanism BlackHoleDAO is an upgraded version

based on Olympus DAO, but such a description may be too narrow. To

be exact, BlackHoleDAO constructed a brand-new standardized model

based on DeFi 3.0, with a burn mechanism that solved the imbalance

between high inflation and deflation based on the principle of

splitting and merging of the traditional stock market. Moreover,

the credit loan service of DAOs is launched in the new mechanism.

It can be interpreted simply as a service protocol for enterprise

asset management, which includes the splitting and merging function

while providing the unsecured credit loan services based on itself.

So it is like a loan business of a bank.

● No Risk of Inflation BlackHoleDAO

also cleverly uses and upgrades the principles of stack and bond in

Olympus. In order to solve the original high inflation problem of

Olympus, BlackHoleDAO enabled the deflation mechanism on the

premise of determining the total amount of tokens, which solved the

problem while making passive gains. ●

Asset Management with DAOs BlackHoleDAO Protocol is supported by

the Treasury, with smart contracts to connect VC Pool and Donation

Pool. VC Pool supports investment in multiple currencies, part of

which is used to burn BHO (BlackHole DAO token) in the liquidity

pool, and the rest for credit loan after the successful DAOs

investment. Donation Pool receives the BUSD direct investment from

investment institutions, DAOs teams and individuals, and finally

gives return at twice in BUSD, and Transaction Fee Pool, in turn,

provides operational support for Donation Pool, DAOs Community, and

Black Hole Reactor. VC Pool, the most mentionable in the

BlackHoleDAO protocol, can be understood as another way to buy

Bonds, except that the VC Pool only accepts valuable vouchers such

as unstable tokens, NFTs and liquidity LPs. The tokens, NFTs and

liquidity LPs online in the VC Pool are the tokens proposed by each

DAOs community that are voted through.

● Enhanced Supportive Stock (BHO)

After the VC Pool reaches a certain amount of assets, a certain

proportion of different Tokens will be taken out from the liquidity

LPs for grouping LPs and providing liquidity and LP loan services

for leading products such as Curve, Compound and Aave. All the

earnings will enter the VC Pool to support the circulation value of

the stock (BHO). Tokens that can be selected into the VC Pool need

to be strictly reviewed and screened by the DAOs community. In this

way, the long tail effect on potential assets by malicious behavior

can be prevented, thereby avoiding the shrinkage and inflation of

stocks (BHO). Such an operation is like the Grayscale fund that is

decentralized, which is friendlier to individual investors. There

is no doubt that excellent precipitated assets are bound to support

the shares of BlackHoleDAO Protocol (BHO) to obtain a beautiful

curve of steady rise. So far, a solution that can meet a variety of

investment users seems to appear. Summary BlackHoleDAO is more like

a decentralized Berkshire company. All users invest digital assets

in exchange for BHO (similar to stocks), and rely on asset

appreciation to provide value support for BHO. The development

trend of digital assets is high-speed and upward. BHO converges

digital assets of almost all categories and passively manages these

assets.

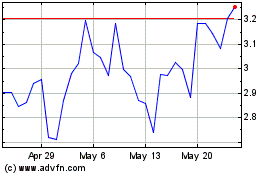

BOND (COIN:BONDDUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

BOND (COIN:BONDDUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024