Bitcoin (BTC) Long-Term Holders Locking Consistent Gains: A Sign Of Stability?

25 August 2024 - 2:39PM

NEWSBTC

In the past few weeks, following a series of corrections, Bitcoin

and the broader crypto market have experienced a significant surge

from the lower prices of 2024. Related Reading: Bitcoin (BTC)

Ready To Break Past $65,000, On-Chain Data Shows The momentum

picked up notably on Friday after Jerome Powell, Chairman of the

Board of Governors of the Federal Reserve System, announced a shift

in policy, hinting at a potential interest rate cut in September.

This announcement has fueled optimism among investors, leading to

increased market activity. Additionally, valuable data from

Glassnode reveals that long-term holders (LTH) are locking in

consistent gains of $138 million in profit per day. But what does

this mean for the market moving forward? Bitcoin Daily Capital

Inflows Crucial For Price Stability Bitcoin long-term holders (LTH)

have been consistently locking in gains over the past few months,

even amid the market’s uncertainty and volatility. According to the

Bitcoin Long-Term Holder Net Realized Profit/Loss chart from

Glassnode, LTH are currently selling Bitcoin at a rate of

approximately $138 million per day. This selling pressure serves as

a crucial benchmark for the market, indicating the amount of new

capital that must flow into Bitcoin daily to counterbalance the

selling and stabilize the price. If daily inflows into Bitcoin fall

short of this $138 million benchmark, the price could potentially

face downward pressure due to LTH’s ongoing sales. This dynamic

underscores the delicate balance between buyer demand and LTH’s

profit-taking activities. As the market continues to navigate this

phase, Bitcoin’s price action will be particularly interesting to

watch in the coming weeks. Whether new investor inflows can match

or exceed this selling pressure will be key to determining BTC’s

next major move. BTC Breaks Past $64,900: What’s Next?

Bitcoin is currently trading at $64,360, as of this writing, after

enduring weeks of aggressive selling pressure, fear, and

uncertainty that caused its price to dip to $49,577 just 20 days

ago. Related Reading: Will Bitcoin Perform Better In

September Compared To August? Here’s What The Data Says Now, BTC is

flirting with the $65,000 mark following two successful daily

candles closing above the crucial 200-day moving average—a key

indicator that investors use to identify a bullish or bearish

market structure. This development suggests that Bitcoin is

regaining strength, but it must hold above this indicator and

ideally test it as support to sustain the uptrend. If BTC can

maintain this level, breaking past $65,000 should be a

straightforward task, with the next target likely around $67,000.

However, if the price fails to hold above the 200-day moving

average near $63,000, Bitcoin may be at risk of retesting local

demand levels around $60,000. Featured image created with Dall-E,

chart from Tradingview.com

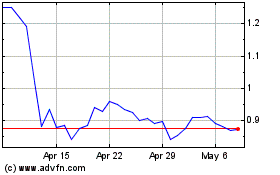

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024