Bitcoin Remains Below $100,000: Is the Bull Market Over or Just Taking a Breather?

03 January 2025 - 4:30PM

NEWSBTC

The Bitcoin market has been experiencing a phase of correction in

recent weeks following its recent surge beyond $108,000. This

decline has led to growing concerns among investors about whether

the market is entering a prolonged cooling-off period or if this

correction signifies the end of the bull cycle. However,

historically, such phases have been common in Bitcoin’s market

cycles, often followed by periods of renewed upward momentum.

Analysts are now turning to key on-chain metrics to provide

insights into the current phase and its implications for Bitcoin’s

price trajectory. Related Reading: Market Alert: Bitcoin’s $81K

Support Zone Could Decide Its Next Big Move Key On-Chain Indicators

Reflect Market Sentiment A CryptoQuant analyst known as Avocado

Onchain recently shared an analysis suggesting that the market

remains within a broader bull cycle. Using on-chain indicators such

as the Adjusted Spent Output Profit Ratio (SOPR), Miner Position

Index (MPI), and funding rates, the analyst outlined the current

state of Bitcoin. According to the report, the SOPR (7-day Simple

Moving Average) remains above 1 but is trending downward,

indicating reduced profit margins for sellers. This metric often

acts as an early signal of market sentiment shifts, with drops

below 1 historically triggering rebounds as selling pressure

subsides. The report further analyzed Bitcoin’s Miner Position

Index (MPI). This index measures miner behavior, particularly their

tendency to sell Bitcoin in anticipation of significant market

events, such as halving cycles or peak price levels. The current

trend in MPI shows no significant outflows from miners to

exchanges, suggesting that large mining operations are holding

their Bitcoin reserves. Avocado added that this indicates

confidence in the long-term value of Bitcoin, even as short-term

volatility persists. However, periodic sell-offs to cover

operational costs are still expected. Another important indicator

highlighted by the CryptoQuant analyst is total network fees,

measured using a 7-day Simple Moving Average (SMA). This metric

reflects transaction activity and overall on-chain engagement.

Avocado disclosed that the recent decline in network fees suggests

reduced trading activity and a temporary cooling-off phase in

market participation. Historically, such periods of lower

transaction activity have preceded periods of renewed bullish

momentum, especially when other indicators align with this trend.

Bitcoin Funding Rates And Investor Sentiment Funding rates, another

significant indicator in the analysis, have shown a downward trend.

Funding rates represent the cost of holding long or short positions

in Bitcoin futures contracts and are often used to gauge market

sentiment. During bull cycles, sharp drops in funding rates have

often been followed by rebounds, as bearish sentiment reaches an

extreme point and buyers return to the market. Related Reading:

Bitcoin Price Eyes Fresh Gains: Can Bulls Break Through? The

analyst emphasized that while current on-chain data suggests a

cooling-off phase rather than the end of the bull cycle, short-term

price movements remain uncertain. Historically, funding rate drops

have served as buying opportunities for long-term investors,

particularly during periods of heightened market pessimism.

Featured image created with DALL-E, Chart from TradingView

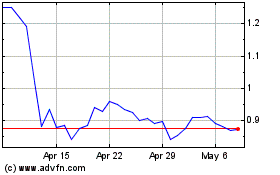

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025