Bitcoin And Ethereum: Crypto Pundit Says Expect A Repeat Of Massive 2019 Rally

04 November 2023 - 9:00PM

NEWSBTC

Partner at the Venture Capital firm Placeholder Capital and

prominent figure in the crypto community, Chris Burniske, has given

an instance where assets like Bitcoin and Ethereum could see a

repeat of what happened in mid-2019. New Highs Before A “Final

Wipeout” In a post shared on his X (formerly Twitter) platform,

Burniske mentioned that a repeat of mid-2019 could happen if the

top two cryptocurrencies, Bitcoin and Ethereum, were to “rip” from

their current levels. If that happens, the crypto founder believes

that the broader crypto market could follow suit. Related Reading:

XRP And Shiba Inu Rally Is Not Over According To This Indicator As

to how these crypto tokens could go, he noted that they could rise

enough to make people believe that they could hit new all-time

highs soon, but that may not be the case as these investors could

endure a “final wipeout” soon after (possibly in the first quarter

of next year) with these tokens steady declining to higher

lows. To drive home his point, Burniske suggested that

Bitcoin and Ethereum’s current price action shared similarities to

the period between December 2019 and January 2019 before the

“painful descent into March 2020 lows.” According to him, although

that period was the COVID era, “everything is also the same about

the actors on the stage.” Burniske seemed to be certain about his

assertions. In a subsequent post, he warned investors that the

rollercoaster “could get extreme” in relation to what he had said

earlier and urged them to have their seatbelts on. ETH price

sitting at $1,844 | Source: ETHUSD on Tradingview.com Market Cycle

And Macro Factors Affecting Bitcoin And Ethereum Many didn’t seem

to react well to Burniske’s projections, considering that it could

mean that the crypto market and everyone in it could be in more

pain, even if a massive rally (as the crypto founder predicts) is

likely to happen before that. A particular X user, however,

seemed to agree with his position as he stated that Burniske’s

prediction makes so much sense as that is how the “cycle

psychology” works, just that this time, it happens to line up

“perfectly” with some highly likely macro scenarios. Burniske

responded to the post as he agreed that those were the points he

was trying to drive home. Related Reading: ProShares Goes

Short On Ethereum With New ETF Launch One of these macro scenarios,

which was alluded to, could be the rising inflation and how the

Federal Reserve and other authorities globally are increasing

interest rates to battle the economic downturn. Bloomberg analyst

Mike McGlone had once mentioned how Bitcoin could crash to $10,000,

with inflation being one of the factors that could lead to the

decline. Another crypto analyst, Nicholas Merten, had also

noted that Bitcoin could decline further if the Feds do not do

enough to curb the rising inflation. Featured image from The

Street, chart from Tradingview.com

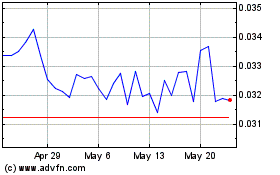

JUST (COIN:JSTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

JUST (COIN:JSTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025

Real-Time news about JUST (Cryptocurrency): 0 recent articles

More JUST News Articles