Solana Price’s 70% Rally Persuades Detractor, Arthur Hayes Makes Confession

03 November 2023 - 9:00AM

NEWSBTC

Supported by a spike in volatility, the Solana price has

skyrocketed from its yearly lows into a new high. The bullish

momentum left some players in disbelief, while others capitulated

to the price action and tried to capture some of the profits.

Related Reading: Dormant Bitcoin Whales Rouse From Slumber To

Threaten BTC Rally As of this writing, SOL trades at $40 with

sideways movement in the last 24 hours. Over the previous week, the

cryptocurrency recorded a 30% profit, but the monthly chart saw a

70% increase, while other tokens hardly saw double-digit gains.

Solana Rally Changes Arthur Hayes’ Mind SOL’s recent bullish price

action is even more impressive when considering higher timeframes.

At the end of 2022, due to the collapse of its most prominent

supporter crypto exchange, FTX, the cryptocurrency lost almost all

its yearly profits. During the 2021 bull run, Solana climbed to an

all-time high of around $250. In the last days of FTX and Sam

Bankman Fried (SBF), the cryptocurrency declined below $10. Now

that the token approaches the $50 mark, critics like the former CEO

of crypto exchange BitMEX, Arthur Hayes, have reconsidered their

position. Hayes has been vocal about its stance regarding FTX,

Bankman-Fried, and the other bankrupted companies in 2022 and the

tokens associated with these entities. However, regarding SOL, the

BitMEX Co-Founder said: Fam I have something embarrassing I must

admit. I just bot $SOL, I know its a Sam-coin piece of dogshit L1

that at this point is just a meme. But it is going up, and I’m a

degen. Let’s Fucking Go! Arthur Hayes Expects Further Gains The

former BitMEX CEO has publicly expressed his position regarding

Bitcoin’s potential to reach new all-time highs. A rally in the

number one cryptocurrency would inevitably spill over to Solana. As

NewsBTC reported, in a detailed analysis, Hayes highlighted the

intricate connection between global financial trends and Bitcoin’s

future, emphasizing the influence of government policies and

financial disturbances on investment strategies. The former BitMEX

CEO anticipates a period of market turbulence, with Bitcoin’s value

chopping around $25,000 to $30,000, driven by negative real rates

and a shift towards diversified investment portfolios. This, he

believes, will particularly favor cryptocurrencies, such as Solana.

Looking ahead, Hayes projects a bullish trend for Bitcoin,

estimating its value could reach approximately $70,000 by the end

of 2024, influenced by the Bitcoin Halving event and potential

Exchange Traded Fund (ETF) launches. His long-term vision extends

even further, predicting an extraordinary financial boom across

various markets, potentially driving Bitcoin’s value between

$750,000 and $1,000,000 by 2026. This optimistic forecast is rooted

in his belief that major financial indices, like the NASDAQ and

S&P, alongside other significant assets, will experience

unprecedented growth, marking a historic boom in the financial

markets. Related Reading: Analyst Reveals Why Ethereum Is

Underperforming Against Bitcoin On a related note, Hayes also

speculated that a return to aggressive money printing strategies by

the US Federal Reserve could act as a substantial catalyst for

Bitcoin’s ascent, further fueling the anticipated financial

euphoria. Cover image from Unsplash, chart from Tradingview

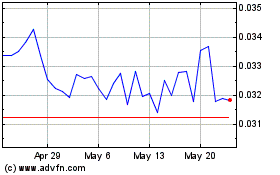

JUST (COIN:JSTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

JUST (COIN:JSTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about JUST (Cryptocurrency): 0 recent articles

More JUST News Articles