Litecoin Sees Sudden Exodus Of Retail Investors: Why This Can Be Bullish

28 August 2024 - 12:00PM

NEWSBTC

On-chain data shows Litecoin has recently seen a sudden exit of

small hands, which can favor LTC’s price. Small Litecoin Investors

Have Been Displaying FUD Recently In a new post on X, the on-chain

analytics firm Santiment discussed the latest shift in Litecoin’s

userbase. A couple of relevant indicators are relevant here: Total

Amount of Holders and Supply Distribution. Related Reading: Solana,

Ethereum Attract Traders Amid Bitcoin Open Interest Plunge The

first of these, the Total Amount of Holders, measures, as its name

suggests, the total number of addresses on the LTC network carrying

some non-zero balance. When this metric’s value goes up, new

addresses with balance are popping up on the blockchain. This

indicates that adoption is taking place, which can naturally be

bullish for the asset. On the other hand, the indicator’s value

decreasing suggests some investors have decided to clear out their

wallets, perhaps in an attempt to exit from the cryptocurrency

completely. Now, here is a chart that shows the trend in the

Litecoin Total Amount of Holders over the last few months: As

displayed in the above graph, the Litecoin Total Amount of Holders

has registered a sharp drop recently, a potential sign that many

investors have decided to leave the asset. While the decrease shows

a departure from the network, the Total Amount of Holders contains

no information about which type of investors are selling here. This

is where the second indicator comes in: the Supply Distribution.

This metric tells us about the total number of addresses currently

belonging to a particular wallet group. In the chart, Santiment has

attached the Supply Distribution data specifically for the

investors with their address balance in the 0.1 to 1 LTC range.

This is a small amount, so the only holders who qualify for this

group would be the smallest of the hands: retail. From the graph,

it’s apparent that the Litecoin addresses falling within this range

have recently seen their number go through a rapid decline. More

specifically, around 45,200 retail addresses have suddenly cleared

themselves out during this plunge. Related Reading: Bitcoin Breaks

$64,000, But This Pattern Could Mean Bull Run Isn’t Safe Given this

trend, it would appear that a good chunk of the decrease in the

Total Amount of Holders has come from these small investors. While

selling itself can be bearish, the fact that the retail holders are

capitulating here may not be so bad. As the analytics firm

explains, “Small fish impatiently ‘jumping ship’ is often a

turnaround sign for an asset to begin turning bullish once again.”

Thus, whether this market FUD would lead to a rebound for

Litecoin remains to be seen. LTC Price At the time of writing,

Litecoin is floating around $62, down more than 4% over the last

seven days. Featured image from Dall-E, Santiment.net, chart from

TradingView.com

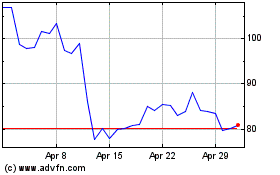

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

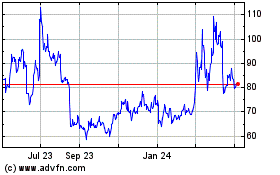

Litecoin (COIN:LTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024