The Entire Crypto Bull Run Hinges On These Factors: Analyst

29 August 2024 - 5:50PM

NEWSBTC

In a thread shared with his 538,000 followers on X, crypto analyst

Miles Deutscher highlights the vital importance of retail investors

to the sustainability of the crypto bull market. To understand the

possible return of the crypto bull run, Deutscher believes it is

essential to understand what has happened in recent years.

Deutscher recalls the substantial rally from March 2020 through

November 2021, highlighting the extreme gains made across various

altcoins. Understanding The Crypto Bull Run Dynamics “From March

2020 until November 2021, the crypto market rallied 2,672%, with

many alts pulling 50-100x+ multiples,” Deutscher states, pointing

to a period characterized by significant financial stimulus and

increased public interest due to global lockdowns. However, the

glory days were short-lived, as Deutscher pointed out, marking the

peak of the market in November 2021 followed by a steep decline.

The downward spiral was accentuated by the LUNA & UST collapse

in May 2022, which not only erased significant market value but

also exacerbated the decline across the broader crypto market.

“Crypto technically topped in November 2021. But it wasn’t until

May 2022 that crypto would be delivered its final death blow: The

LUNA & UST collapse,” he explained, illustrating the

precariousness of crypto investments during that period. Related

Reading: Signs Of A New Crypto Winter? Warren Buffett’s $1 Billion

Stock Sales Spark Market Crash Fears The aftermath of these events

led to a widespread exodus of retail investors, who were either

financially devastated or disillusioned by the dramatic downturns.

“If you were burnt financially, you left. If you weren’t burnt

financially, you still left (price/time capitulation),” Deutscher

explains, capturing the deep-seated anxiety that permeated the

retail investor base following the market’s collapse. Despite the

challenging environment, 2023 ushered in a new wave of optimism

with significant institutional movements, notably BlackRock’s

application for a Bitcoin spot ETF in June, which was later

approved. “On the 16th of June, BlackRock applied for a Bitcoin

spot ETF […] This not only signaled a positive catalyst on the

horizon but a paradigm shift in the way BTC was being viewed by

major institutions,” Deutscher highlighted, pointing to a critical

moment that potentially marked the beginning of a new era for

Bitcoin and possibly the broader crypto market. As of January 2024,

the crypto market had seen a surge in Bitcoin prices, reaching new

all-time highs following the successful launch of the ETF. “Over

$17b has flowed into the BTC spot ETFs so far this year,” Deutscher

notes, underscoring the significant impact of institutional

investment on Bitcoin’s valuation and the broader market sentiment.

However, Deutscher tempers expectations regarding the altcoin

market, which has not seen parallel success. The lack of a similar

rally in altcoins is attributed by Deutscher to the new market

dynamics introduced by the ETF, which altered traditional liquidity

flows and investment patterns. “The primary driver of this cycle

has been the BTC ETF. This is vastly different from the last cycle,

where the primary driver was macro conditions,” he remarks. When

Will The Bull Run Return? Looking ahead, Deutscher speculates on

the conditions that might entice retail investors to return. He

emphasizes the critical role of Bitcoin achieving new all-time

highs, suggesting that Bitcoin reaching or surpassing $100,000

could ignite renewed interest across the crypto sector. “Yes, many

of the aforementioned issues like altcoin dispersion would still

exist, but it would definitely pave over some cracks. A BTC rally =

media attention, people front running an altcoin rotation, renewed

optimism,” he added. Related Reading: New Memecoin Popcat Claws Its

Way Up, Dominates Top 100 Cryptos With 62% Rally Deutscher also

highlights the natural inclination of humans towards gambling,

noting that the thrill of high returns might quickly attract retail

investors back to the market if altcoins show sustained rallies. He

referenced the Pareto principle to remind followers that

significant market gains often occur late in the investment cycle.

“80% of gains in a bull market come in the last 20%, of the move.

Retail joins the party late. We simply may just be too early (in

terms of cycle duration we comparatively still are), Deutscher

states. Additionally, he points to the potential of emerging

technologies in AI, gaming, and decentralized finance (DeFi) to

create compelling new use cases for crypto. He suggested that just

a few successful applications could drive widespread adoption,

fostering a more sustainable interest in the crypto market. Because

of that Deutscher remains optimistic about the return of retail

investors. He concludes, “so in conclusion, yes – retail is

(mostly) gone. There are valid reasons why, and this cycle is

fundamentally different because of them. But it won’t take much for

retail to return. And that day may be sooner than you think.” At

press time, BTC traded at $59,650. Featured image created with

DALL.E, chart from TradingView.com

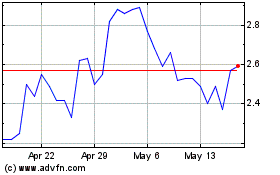

Optimism (COIN:OPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Optimism (COIN:OPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024