Binance Market Dominance Plunges: A Deep Dive Into The 36% Share Drop

04 October 2024 - 11:30AM

NEWSBTC

According to a recent report by Bloomberg, Binance, the world’s

largest cryptocurrency exchange by trading volume, is facing

significant challenges as its market share continues to

decline. In September, Binance’s share of trading volume in

the roughly $2 trillion digital asset market fell to 36.6%, down

sharply from 42.7% at the start of the year and the lowest level in

four years, according to data from CCData. Binance Spot And

Derivatives Trading Hits Four-Year Lows The drop in market share is

particularly pronounced in both the spot and derivatives trading

arenas. Binance’s 27% share of the spot market represents its

lowest level since January 2021, while its derivatives trading

share stands at 40.7%, also the lowest in four years. Related

Reading: Crypto Analyst Maintains $7.50 XRP Target Despite SEC

Appeal Against Ripple Per the report, this decline can be

attributed to the legal saga that the exchange has been

experiencing globally since last year, but particularly in the US,

which has not only had a notable impact on the exchange’s financial

metrics, but has also led to changes in its leadership. The company

has been under increased scrutiny globally, following a settlement

with the US Department of Justice (DOJ) last year over serious

charges, including sanctions violations, which resulted in a hefty

$4 billion fine. The fallout from these regulatory actions

included the resignation of co-founder and former CEO Changpeng

Zhao (CZ), who served four months in prison as part of the

proceedings. However, the former CEO was released by US authorities

last Friday after serving his sentence. In an effort to rebuild

trust and navigate the regulatory landscape, Binance appointed

Richard Teng, a former regulator, as its new CEO. Teng has been

actively engaged with regulators investigating Binance in various

jurisdictions, while also appointing a new board of directors and

the intentions of establishing a new headquarter. Centralized

Crypto Exchanges Face 17% Volume Drop The report further highlights

that the broader market for centralized crypto exchanges is also

facing challenges, with combined spot and derivatives trading

volumes dropping 17% in September. However, this decline is

typical for the month, which is often seasonally weak, but it has

resulted in the lowest monthly trading activity since June.

Notably, Binance has seen the most severe market-share decline

among top exchanges, as competitors such as Bybit, Bitget, and

Crypto.com have begun to capture a larger share of the market.

Related Reading: Crypto Analyst Says Solana-Based BONK Is In Prime

Position For Legendary Rally Jacob Joseph, a senior research

analyst at CCData, noted that this trend may indicate a growing

confidence among crypto participants in alternative platforms that

“offer similar user experiences,” including low trading fees,

minimal slippage, and high market liquidity. Despite the

challenges, Binance recently achieved a significant milestone,

becoming the first centralized crypto exchange to surpass $100

trillion in lifetime trading volume, according to CCData. At

the time of writing, the exchange’s native token, BNB, currently

the fourth largest cryptocurrency on the market, is trading at

$545, up just 1% in the last 24 hours amid the broader market

decline. Featured image from DALL-E, chart from TradingView.com

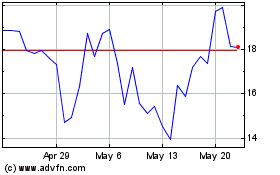

Prime (COIN:PRIMEUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Prime (COIN:PRIMEUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025