Lido (LDO) Surges 16% In Single Day, Maintains Dominance In Liquid Staking Market

13 May 2023 - 6:45PM

NEWSBTC

Having survived a week dominated by the bears, the price of Lido

DAO (LDO) is on the rise today, tallying a 16% increase in the past

24 hours. This price recovery has left many wondering if the

bearish trend is over and whether the bulls might be onto something

here. That said, Lido Finance continues to assert its dominance in

the liquid staking market, recording a substantial increase in its

total value locked (TVL) in ETH LSDs in the past week.

Related Reading: Investors Shy Away From Bitcoin (BTC) and Lido DAO

Lido DAO Token Price Overview The past week saw the bears take the

cryptocurrency market by storm; this has pretty much been the case

since the start of May. We watched on as the latest crypto

sensation, PEPE, shed a massive chunk of its recently-accrued value

in the last seven days. The story hasn’t been any much

different for the LDO token. In the past week, this cryptocurrency

lost 1.2% of its value. It is worth noting that this figure has

only just dropped – thanks to the upward price movement of the

token in the last 24 hours. Nevertheless, a broader look at

Lido’s market performance in the past month still shows a steady

price decline. This current downturn in price started as far back

as April 18, with the token’s value dipping by more than 20% within

this period. That said, the token appears to be on some sort

of recovery. According to CoinGecko data, a Lido DAO token

currently trades at $1.88, tallying an impressive 16.1% increase in

the past 24 hours. Meanwhile, there has been a corresponding 63.8%

jump in the token’s daily trading volume. Lido DAO trading at

$1.894 | Source: LDOUSD chart from TradingView Lido Finance

Maintains Dominance In ETH Liquid Staking Data from DeFiLlama

reveals that Lido Finance gained an impressive 4.73% increase in

TVL in the past week. In the same time, Coinbase Wrapped Staked

Ether, the second-largest LSD protocol, lost 0.91% of its

TVL. A broader look at the metrics shows that Lido’s TVL

jumped by more than 11% in the past month. Within the same period,

the TVLs of Rocket Pool and Frax Ether rose by a staggering 35.23%

and 42.52%, respectively. Source: DeFiLlama Indeed, LSD protocols,

such as Rocket Pool and Frax Ether, are beginning to gain

tremendous market share in the liquid staking industry. However,

Lido Finance continues to dominate the market, holding 74.35% of

TVL in ETH liquid staking derivatives (LSDs). This accounts for 6.6

million ETH of the total locked ether. Overall, the liquid staking

market continues to expand – as expected, following the Ethereum

“Shapella” upgrade. As of this writing, a total of 8,886,107 ETH is

locked in LSDs, with over 450,000 ether tokens added in the last

two weeks. Related Reading: Lido DAO Records Biggest Network

Transaction In 2 Years -Featured image from Salomon Magaza, chart

from TradingView

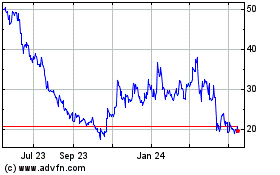

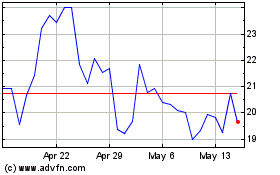

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024