Bitcoin Slows Plunge Below $40K, What’s The Best Point For A Pullback?

20 February 2022 - 1:35AM

NEWSBTC

Bitcoin continues to trend lower over the weekend and seems at risk

of re-testing previous lows. The first crypto by market cap was

rejected at mid area north of $40,000 and was unable to muster

momentum to hold those levels. Related Reading | Did Top Three

Bitcoin Addresses Just Call Another Local Bottom? As of press time,

Bitcoin trades at $39,921 with a 1.2% and 5.2% loss in the last day

and 7 days, respectively. Yuya Hasegawa, analyst for Bitbank,

attributes BTC’s price recent price action to the Russia-Ukraine

situation. In that sense, the analyst expects potential relief as

the U.S. Secretary of State Antony Blinken and the Russian Minister

of Foreign Affairs Sergey Lavrov scheduled a phone call for next

week. This could tone down the tensions around the situation at the

border. On top of that, the analyst claims Bitcoin is sitting at

“ample technical support” which could protect its price for further

downside. However, is a long weekend in the U.S. which usually

leads to potential periods of high volatility driven by low trading

volumes across the crypto market. Hasegawa said talking about BTC’s

price immediate and medium-term potential headwinds: We still have

the January U.S. PCE, February jobs report, and CPI until the March

FOMC meeting, so it is safe to say that, depending especially on

these inflation data, the worst may be still ahead of us, and even

if the price rebounds from the current level in the short term,

upside is likely quite limited unless the Russian military shows

some signs of retreating. The macro-situation seems to occupy

everyone’s attention. A separate analyst from Material Indicators

(MI) claims the Russia-Ukraine situation could see an outcome after

the Winter Olympics in Beijing. These events have been linked to

similar crisis in the past, such as the invasion of Crimea which

took place in 2014 during the Olympics hosted by Russia. Bitcoin To

See Short Squeeze Over Long Weekend? Further data provided by

Material Indicators claims BTC could have entered a distribution

phase. Reccomending traders to “avoid knife catching”, specially

during periods of low volume, MI presented their Trend Precognition

indicator which flashed a bearish arrow on the daily chart as BTC’s

price trend below $40,000. This could suggest the benchmark crypto

might re-test its lows which could find good support, as MI

claimed, “in areas of prior consolidation”. The levels between

$35,000 to $38,000 were relevant during BTC’s price prior sell-off

and could operate as support. However, MI noted that there are

“Liquidity gaps”, levels on the orderbook with low bids or asks

orders, on both sides of the BTC/USDT trading pair. Thus, Bitcoin

could see a short squeeze to the upside or downside. Related

Reading | Comparing Apple’s Growth With Bitcoin, Why This Expert

Sets $700K As Long-Term Goal Currently, there are around $10

million in bid order around $39,500. Therefore, there seems to be a

strong support for BTC at that levels which could favor the bulls,

at least in the short term.

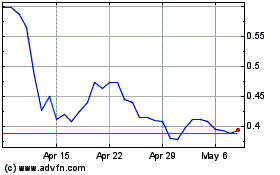

Secret (COIN:SCRTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Secret (COIN:SCRTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Secret (Cryptocurrency): 0 recent articles

More Secret News Articles