Bitcoin Plunges Below $40 As Russia Has Reportedly Given Its Forces Order To Attack Ukraine

21 February 2022 - 9:26PM

NEWSBTC

Bitcoin plunges below $40,000 in the early hours of the weekend and

proceeded to backpedal in the face of escalating tensions on the

Ukraine-Russia border, not to mention ongoing inflationary unease.

At the time of writing, the world’s most popular cryptocurrency was

trading near $38,700, down 3.4% in the previous 24 hours and at its

lowest level since February 3. Bitcoin had been holding solidly

above $40,000 in recent days, however Friday’s decline was the

first time since February 4 that it fell back into the $30,000

region. Ether and nearly all other major cryptocurrencies were down

as well. A probable misuse of OpenSea, the leading NFT platform,

may have shooed away investors even further away from

cryptocurrency. Related Article | Bitcoin Falls As Russia-Ukraine

Tensions Escalate Bitcoin Plunges: Lots Of Factors At Play

Bitcoin’s price has been slowing in recent weeks following Federal

Reserve Chairman Jerome Powell’s announcement that the central bank

will begin hiking rates at its March meeting in response to

persistent inflationary pressures. More broadly, January’s

significant BTC decline occurred following the stock market’s worst

month since March 2020 and the issuance of the Fed’s long-awaited

research on the possibility of a government-issued digital

currency. All of these concerns may have prompted investors to

“reduce their exposure to crypto,” according to Joe DiPasquale,

chief executive officer of fund manager BitBull Capital. Prior to

Feb. 4, Bitcoin had been unable to break through the $40,000

barrier since January 20. On Jan. 24, Bitcoin fell below $34,000

for the first time since July of last year. BTC total market cap at

$736.97 billion in the daily chart | Source: TradingView.com

Russian Forces Given Green Light To Invade? The price decline

occurred as US intelligence revealed Russia is on the verge of

attacking Ukraine. On Sunday, US Secretary of State Antony Blinken

stated that everything “appears to be taking place” in the run-up

to the invasion. Russian forces gathered near Ukraine’s border have

received orders to invade, according to The Guardian on Monday,

citing information from U.S. intelligence agencies. Elsewhere, Yuan

Shows Strength As last week in Asia came to a conclusion, Chinese

official media announced that the yuan, China’s currency, was

comfortably flexing its muscles. According to China’s media, the

value of RMB payments climbed by nearly 11% in January, citing data

from SWIFT, a Belgian cooperative society that acts as an

intermediate and executor of financial transactions between banks

from around the world. Related Article | Bitcoin Slows Plunge Below

$40K, What’s The Best Point For A Pullback? As a result of the

unexpectedly sluggish performance of the digital yuan during the

Winter Olympics, RMB payments rose more than 10% versus December.

The RMB now accounts for 3.3% of all global transactions, up from

2% in November. On the other hand, the British pound accounts for

6.2% of global commerce. … But The US Dollar Dominates

Interestingly, when it comes to digital currencies, the US dollar

continues to reign supreme. Chainalysis stated in 2020 that $50

billion in cash went out of China in cryptocurrency, the most of it

in dollar-pegged tether. “Despite the United States’ declining

share of global GDP, the dollar continues to dominate, most notably

in the digital environment,” Bloomberg commodity strategist Mike

McGlone stated in April last year. Meanwhile, momentum indicators

remain negative, showing that selling pressure has been constant

over the last month for Bitcoin. BTC failed to break above its

40-week moving average of $45,724, indicating a bearish bias.

Featured image from NewsXPres.com, chart from TradingView.com

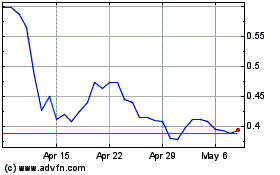

Secret (COIN:SCRTUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Secret (COIN:SCRTUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025

Real-Time news about Secret (Cryptocurrency): 0 recent articles

More Secret News Articles