Bitcoin Short Squeeze Could Catapult Price To New All-Time High – Here’s Why

29 September 2024 - 6:30PM

NEWSBTC

Bitcoin has been on an incredible price momentum for the past two

weeks. This momentum, which took many by surprise, saw Bitcoin

breaking above the psychological $65,000 price level again.

According to price data, Bitcoin traded as low as $52,820 on

September 6. Related Reading: Bitcoin Breaks $65K With $365 Million

In Spot ETF Inflows Fueling The Rally Its recent rebound to $66,300

indicates that the king of cryptocurrencies has recovered

substantially by 25.5% in two weeks. According to Coinglass data,

this marks the biggest gains recorded by Bitcoin in September since

2013. Yet, despite this impressive rally, a significant number of

traders continue to bet against BTC. This ongoing trend has set the

stage for a potential short squeeze, which could send the coin’s

price soaring to new all-time highs in October. Here’s a closer

look at how this is happening and what could unfold next. Short

Positions Dominate Exchange According to crypto analyst Ali

Martinez, who shared his insights on social media platform X, a

surprising 57.77% of Binance users with open positions are shorting

Bitcoin. This means that many traders are betting on the price of

Bitcoin to decline, even as it maintains a strong upward momentum.

57.77% of @binance users with open positions are shorting #Bitcoin!

pic.twitter.com/bWQ4d5n6MJ — Ali (@ali_charts) September 27, 2024

However, considering the institutional and whale inflow into

Bitcoin, especially through Spot Bitcoin ETFs, Bitcoin is still

largely in the position to keep trending upwards in the coming

week. The combination of such inflows and the significant volume of

short positions creates the potential for a short squeeze as we

move into October. As September comes to an end, many traders are

keeping an eye on October, which is historically a bullish month

for BTC (Uptober). Bitcoin has often performed well in the fourth

quarter, which is when the industry typically sees increased buying

pressure and institutional inflows. Such a short squeeze could

further push the crypto’s price beyond its previous all-time high

of $73,737 and into new price territories. Bitcoin: Short-Term

Correction On The Horizon? While the outlook for BTC is generally

bullish, there is also the possibility of a short-term correction

in the price over the coming days. The TD Sequential indicator, a

popular tool used by traders to identify potential price reversals,

has flashed a sell signal on the 4-hour chart. This phenomenon was

noted by Ali Martinez, suggesting that Bitcoin could experience a

brief pullback before resuming its upward trajectory. Related

Reading: Stacks: New Network Upgrades Push STX Price Up By 18% –

Details Such a correction would serve as a consolidation phase

after two weeks of bullish price action, giving the market time to

reset before the next big move. Following this trend, it could also

potentially trigger more traders to go short, further fueling the

potential for a bigger short squeeze when BTC rebounds. At

the time of writing, Bitcoin is trading at $65,658. Featured

image from CNBC, chart from TradingView

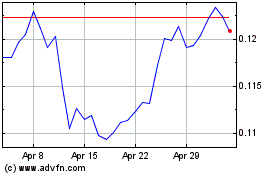

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024