ETH Rally Pushes Profitability To Nearly 70%: More To Come This Week?

30 September 2024 - 9:00AM

NEWSBTC

Ethereum’s movement last week was full of mixed signals as Spot

Ethereum ETFs started to witness good inflows. Notably, ETH has

been on a rally since the middle of September, reflecting a 25%

gain from the September 6 low of $2,171 as it crossed $2,715 on

September 27. Related Reading: XRP Set To Soar Nearly 900% To

$31, Analyst Highlights Key Resistance This rally and the

well-anticipated inflows in Spot Ethereum ETFs brought a

much-needed breather into the Ethereum ecosystem. According to

on-chain data, last week’s price action saw many Ethereum addresses

moving into the profitability zone. Particularly, last week’s rally

pushed Ethereum’s profitability from 59% of addresses to 69%.

Ethereum Addresses See Much-Needed Profitability After enduring

weeks of market consolidation and outflows from Spot Ethereum ETFs,

Ethereum’s price began an upward trajectory in the middle of

September that has reignited investor interest. According to data

shared by on-chain analytics platform IntoTheBlock (ITB), the rally

has led to more than two-thirds of Ethereum holders being in

profit. The key to understanding this development lies in

ITB’s “In/Out of the Money” metric, which plays a crucial role in

assessing the profitability of cryptocurrency holders. This metric

compares the current market price of Ethereum to the purchase

prices recorded for addresses that hold the asset. By doing so, it

calculates which holders are in profit, in loss, or at the

break-even point (known as “at the money”). According to this

measure, Ethereum has reached its highest profitability levels in

nearly two months, a significant indicator of growing bullish

sentiment. The graph below shows that the number of Ethereum

addresses in profit reached 85.03 million last week, representing

69.38% of the total Ethereum addresses. At this time, Ethereum was

trading at $2,693. Furthermore, the data highlights that at this

time, 2.61 million ETH addresses were at the money (neither in loss

nor profit), while 34.94 million ETH addresses were in losses. ETH

Profitability To Keep Rising? Looking ahead, it is only natural to

wonder if the profitability will continue to increase in October.

Fortunately, the crypto industry is now reveling in bullish

sentiment, especially in light of the recent Fed rate cuts and

weakening currencies in some parts of the world. Related

Reading: Stacks: New Network Upgrades Push STX Price Up By 18% –

Details According to IntoTheBlock’s social media handle on X, over

80% of ETH volume is now profitable, indicating strong buying

support at critical levels. With bullish projections now falling in

place, we could see many more addresses and ETH easily crossing

into profitability next week. As Ethereum pushes toward

higher price levels, the focus will also turn to key psychological

barriers, such as the $3,000 mark. The first step for ETH bulls is

to make a clean break above $2,700 next week. This would set the

stage for a successful run to $3,000, bringing even more addresses

back into profit. Featured image from Stormgain, chart from

TradingView

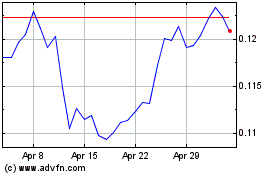

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024