LINK Price Action Turns Cautious As Bearish Pennant Shapes Up

22 February 2025 - 3:30AM

NEWSBTC

Chainlink (LINK) is flashing bearish signals as it forms a pennant

pattern, hinting at a potential continuation of its downward

trajectory. After struggling to gain bullish momentum, the price

remains in consolidation, with sellers keeping a tight grip on the

market. If this pattern plays out, LINK could be at risk of a steep

drop, with key support levels facing increased pressure. Market

sentiment appears cautious, as bulls attempt to hold the line

against growing bearish momentum. A breakdown from this structure

might accelerate losses, pushing LINK toward lower price zones.

However, if buyers manage to invalidate the pattern, a relief rally

may be in play. Analyzing Price Action: Bearish Pennant Signals

Breakdown Currently, Chainlink continues to trade within the

confines of the bearish pennant pattern, indicating a state of

indecision in the market. Neither the bulls nor the bears have

established firm control, as the price remains constrained within

converging trendlines. Related Reading: Chainlink Weekly

Chart Looks Promising – If Bulls Reclaim $30 ‘ATH Are Next’

Typically, this consolidation phase suggests that market

participants are in a wait-and-see mode, anticipating a technical

or fundamental catalyst for a decisive breakout in either

direction. While the structure of a bearish pennant typically

signals a continuation of the previous downtrend, LINK’s hesitation

indicates that bulls are still attempting to defend key support

levels. Nevertheless, without a strong surge in buying pressure,

the risk of a breakdown remains high. If LINK breaches the

lower boundary of the pennant with strong volume, an accelerated

decline is likely, reinforcing the bearish outlook and increasing

selling pressure. This breakdown could attract bearish momentum,

pushing the price toward key support levels. Additionally, the

asset is currently trading below the 100-day Simple Moving Average

(SMA), further strengthening the negative trend in the market. This

positioning suggests that LINK’s ongoing attempts to regain upward

momentum may face significant resistance. Potential Breakdown

Targets: How Low Can LINK Go? The formation of a bearish pennant in

Chainlink’s price action raises the possibility of further

downside, with the measured move target and key support levels

providing a roadmap for potential price movement. Related Reading:

Chainlink Witnesses Highest Whale Activity Since 2023, Price

Reversal Coming? Should the bears seize control and a breakdown

occur below the lower trendline, LINK’s downward trend could

accelerate, pushing the price below the critical $17.96 support

level. This drop eyes a deeper decline toward the $15 mark, where

buyers may attempt to regain momentum and prevent additional

losses. However, if bulls manage to defend these key levels and

initiate a strong rebound, LINK might invalidate the bearish setup

and shift toward a recovery, possibly targeting the $19.87

resistance level. A decisive move above this threshold would

reaffirm bullish momentum and pave the way for more gains. Featured

image from Medium, chart from Tradingview.com

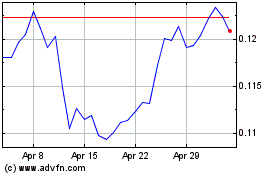

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025