Web3 devs, gamers, investors thrive despite India’s crypto policy hurdles

11 March 2025 - 3:30PM

Cointelegraph

India’s contribution to the global Web3 ecosystem — primarily in

software development, gaming, investments and startup funding —

increased year-on-year despite an absence of locally tailored

crypto regulations.

India’s share of global Web3 developers grew from 5% to 12% in

the last 10 years, second only to the United States as of 2024,

according to the India Web3 Landscape Report 2024 by Hashed

Emergent, shared with Cointelegraph.

Developer growth in India since 2015. Source: Hashed

Emergent

Speaking to Cointelegraph, Tak Lee, CEO and Managing Partner at

Hashed Emergent, pointed out four key factors driving India to the

top of global crypto adoption: retail crypto transactions on

centralized services, highest trading volumes, institutional

adoption and retail DeFi transactions.

Gen Z dominates the Web3 developer landscape in India

The growth is driven by the younger generation, as roughly 80%

of all blockchain developers in India are between 18 and 27 years

of age. The Indian developers in DeFi, Payments, AI and SocialFi

prefer Solana as the go-to blockchain.

Ton, Aptos and Base are steadily gaining momentum across other

key sectors, driven by the expanding presence of layer-1 and

layer-2 ecosystems, the report noted.

Web3 sector and ecosystem trends in India. Source: Hashed

Emergent

While funding opportunities and builder initiatives like hackathons

support initial growth, Indian developers have pointed out

employers’ lack of willingness to pay salaries that match global

industry standards.

The challenges faced by Web3 gaming projects are the extremely

high cost of customer acquisition (CAC) to onboard Web3 users and

the lack of quality gameplay beyond financial incentives to retain

Web2 gamers. “Therefore, several of these games are now focusing on

having great quality games before integrating blockchain mechanics

or tapping into Indian gamers’ craze for RMG,” Lee explained.

Related: Indian town adopts Avalanche blockchain for

tamper-proof land records

In contrast, investments into the Indian Web3 landscape saw a

224% increase in 2024 compared to the previous year — sourced from

various avenues such as local funds, ecosystem funds and corporate

venture arms of leading exchanges.

Lee told Cointelegraph that the lack of growth capital in the

Web3 world, along with the absence of traditional

venture/growth/private equity funds, makes it difficult for Indian

firms to raise capital, adding:

“Therefore, entrepreneurs explore crowd sales as a way

to fund their future growth. Some renowned projects may also

explore crowd sales due to higher valuations offered but this is

extremely rare and done by the extremely blue chip founders who can

raise money from retail with ample certainty and high

volumes.”

Funding in India’s Web3 finance sector. Source: Hashed

Emergent

Compared to the previous years, the substantial growth in Web3

investments in 2024 “signals a gradual recovery, with investors

focusing on emerging areas of decentralized finance,” the report

said.

India is a global hub for founders and developers, currently

home to the second-largest developer market and third-largest

founder base globally.

Some of the main barriers preventing large-scale investments,

according to Tak, have to do with the “slower than anticipated

growth of some of these startups .“ Unclear regulations and

compliances also hinder Web3 investments in India.

Growing Web3 against all odds

Despite an active high-tax environment on cryptocurrency,

small-scale crypto investments saw an uptick in India. Traders

generally preferred small, frequent trades, with 96% maintaining

positions less than $12 with an average of 11x-20x leverage.

Females represented 1 in 10 futures traders in India, highlighting

the scope for greater participation.

The report called for reforms in crypto tax deductions and

reporting in addition to the need for federal guidance and tax

implications:

“India must overcome its negative policy perception

that stifles innovation and instead focus on identifying and

addressing the pain points faced by stakeholders with effective

regulation that will incentivize the Web3 sector to grow and

thrive.”

Indian Web3 firms call for progressive regulation for all

stakeholders. Source: Hashed Emergent

The policy wish list for the Indian Web3 includes the regulatory

framework for virtual asset service providers (VASP), tax

rationalization, streamlined banking and payment access for Web3

companies, exemptions from VASP regulations and clarity on existing

regulations.

Recent regulatory initiatives like URL blocking of locally

unlicensed crypto exchanges have resulted in the influx of funds to

self-custodial solutions (decentralized exchanges) or domestic

exchanges, which are regulated under Indian law.

Magazine: Mystery celeb memecoin scam factory, HK firm

dumps Bitcoin: Asia Express

...

Continue reading Web3 devs, gamers, investors thrive

despite India’s crypto policy hurdles

The post

Web3 devs, gamers, investors thrive despite India’s

crypto policy hurdles appeared first on

CoinTelegraph.

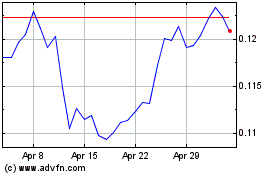

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025